Strong Walmart results offset a broad tech pullback

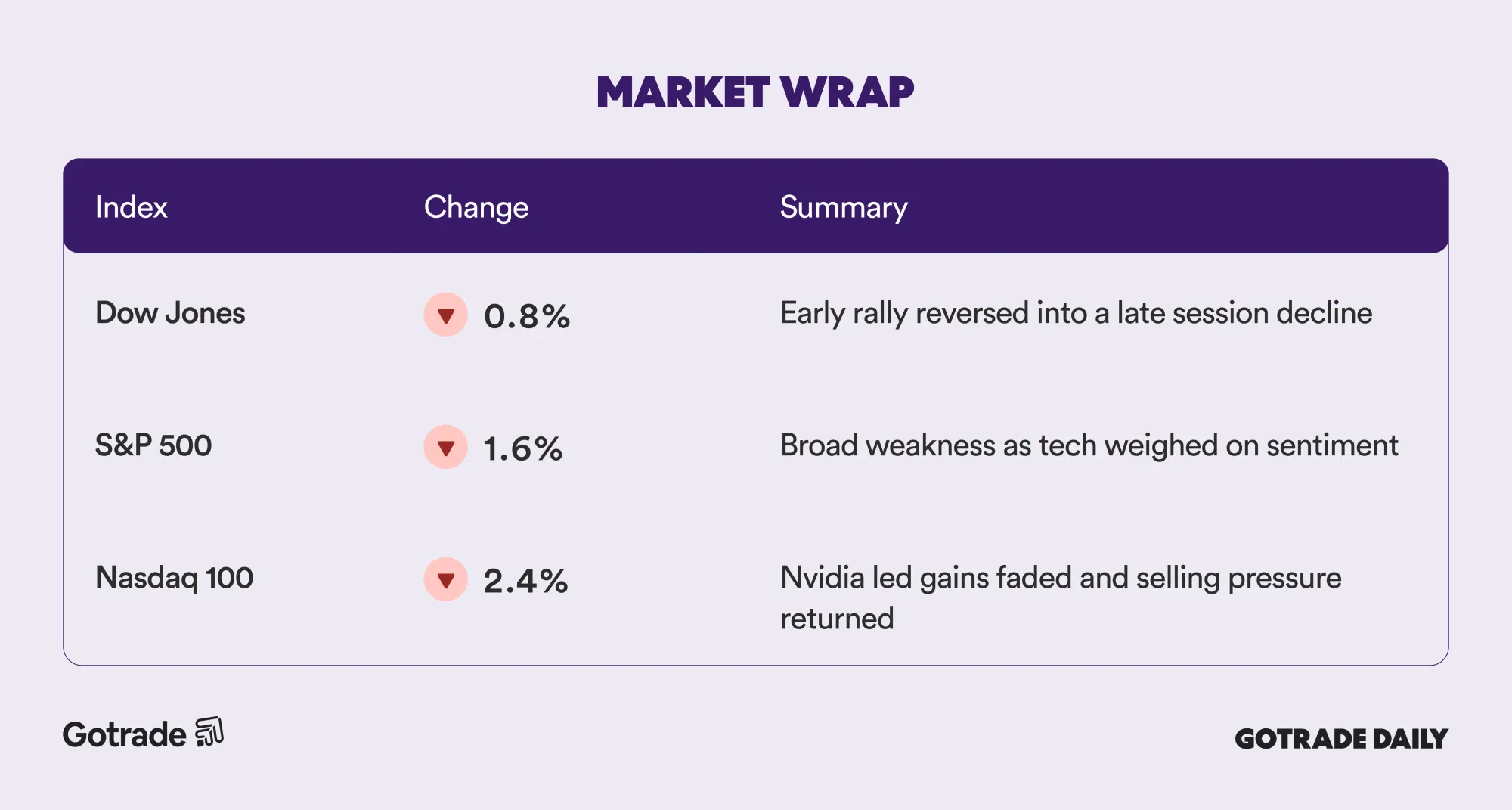

U.S. markets experienced a sharp reversal on Thursday after an early surge driven by Nvidia’s strong earnings lost momentum through the session. The Dow swung from a 700 point morning gain to close lower, while the S&P 500 and Nasdaq also finished in negative territory. The move came just one day after Nvidia reported better than expected quarterly results and upbeat guidance that initially lifted sentiment across AI and semiconductor names.

Traders also reacted to a delayed September jobs report showing employment rising at more than double expectations, adding complexity to the market’s expectations for the Federal Reserve. Although the unemployment rate unexpectedly ticked up to 4.4 percent and Treasury yields eased slightly, the mixed labor data provided little clarity for the next policy decision and contributed to intraday volatility.

Despite the broad pullback, Walmart stood out as one of the strongest performers in the market, surging nearly 7 percent after reporting solid earnings and raising its outlook for the year ahead. Its gains were helped by strength in e commerce and advertising, offering a contrast to the weakness seen in large tech names and helping balance the market narrative on consumer health heading into the holiday period.

📊 Market Wrap Nov 21th 2025

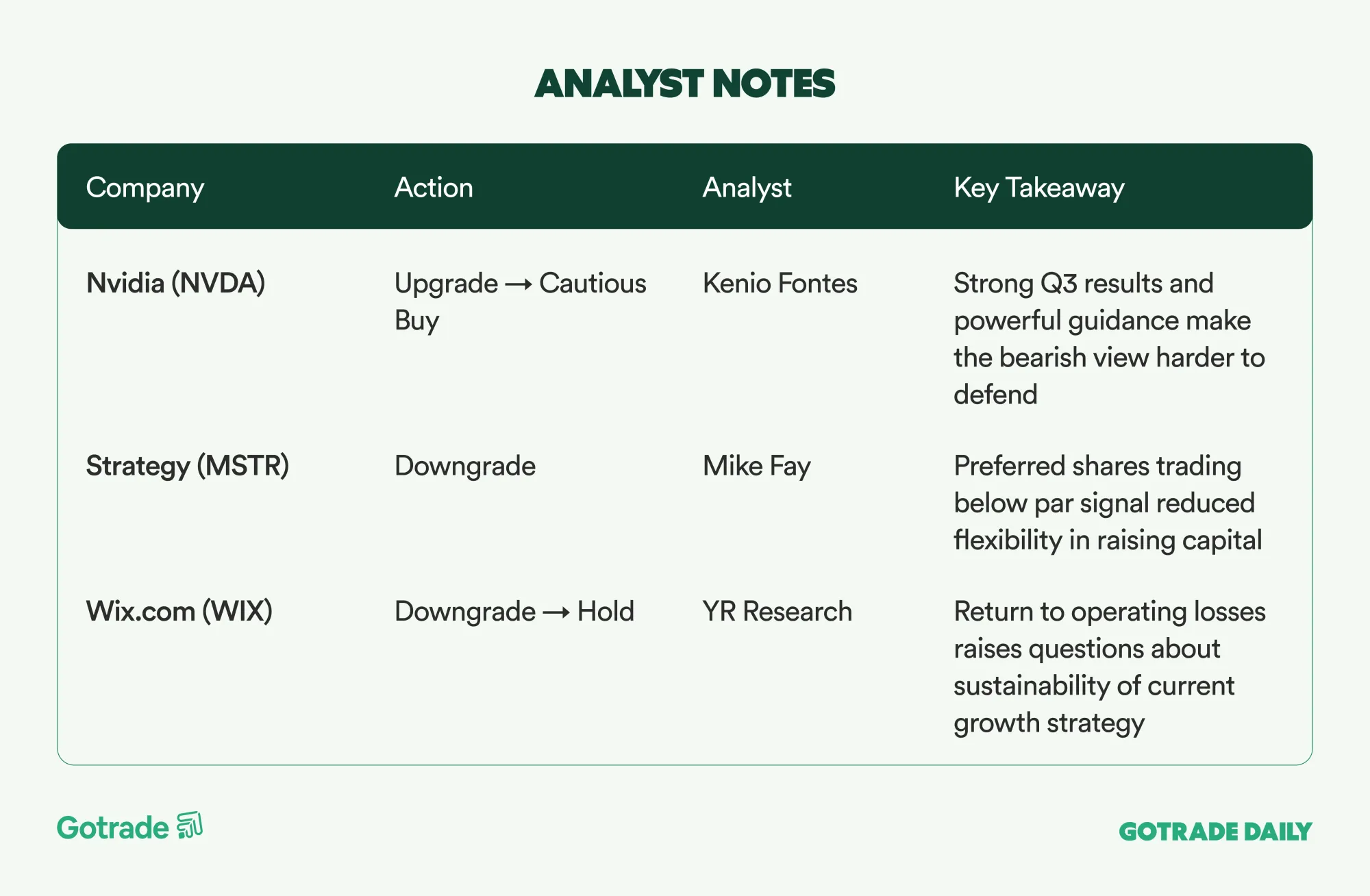

🧠 Analyst Notes

💬 Market Highlights

Home Depot and Nike Confirm Quarterly Dividends

Home Depot maintained its dividend at US$2.30 per share with a yield near 2.77 percent, and Nike increased its payout to US$0.41 per share with a yield of roughly 2.67 percent. Both companies emphasized consistency in shareholder returns, even as broader market conditions remain uncertain and consumer trends show signs of unevenness.

Citi Appoints New CFO and Announces Major Restructuring in U.S. Banking Unit (C)

Citigroup named Gonzalo Luchetti as its next CFO beginning March 2026 and unveiled a significant restructuring aimed at simplifying its U.S. operations. Retail Bank and Wealth units will be combined, while Branded Cards and Retail Services will merge into a single division. The move reflects Citi’s push for operational efficiency as it prepares for its next investor day. Shares slipped 0.1 percent after hours.

PayPal Extends Seven Day Slide Amid Branded Checkout Concerns (PYPL)

PayPal shares continued their downward streak, pressured by worries that branded checkout growth is slowing at a time when discretionary spending is weakening in both the U.S. and Europe. Despite raising full year guidance after a solid Q3, softer expectations for Q4 and slower active user growth weighed on sentiment. The stock has now fallen more than 11 percent in six sessions, prompting renewed debate about its medium term trajectory and valuation.

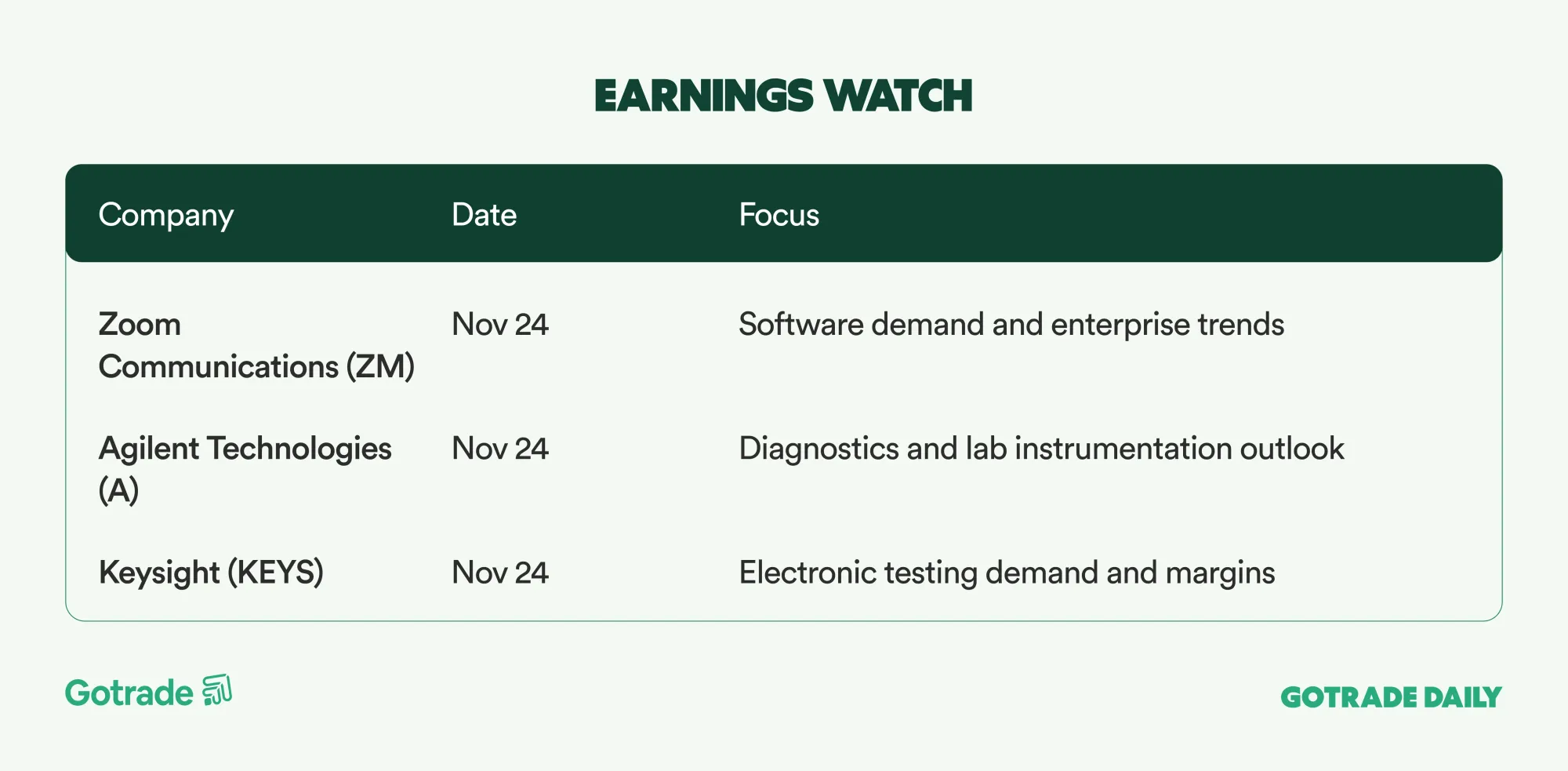

📅 Earnings Watch

Markets remain sensitive to earnings, macro data and shifts in expectations around the Federal Reserve, and traders are watching how sentiment develops as new information comes in.

Which stocks are you following today?

Disclaimer: Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.