AI momentum steadies sentiment after a four-day tech slump.

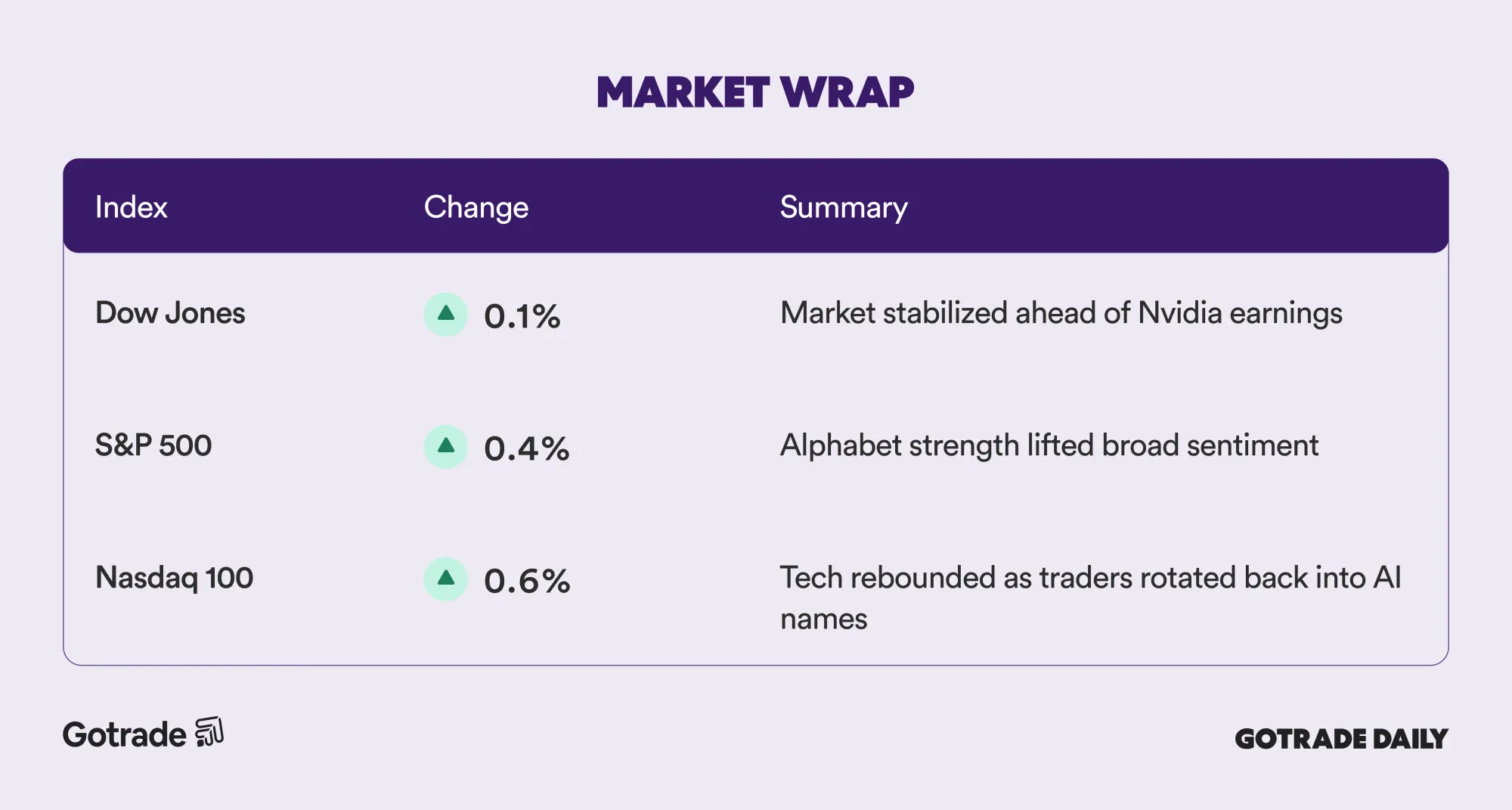

U.S. markets recovered on Wednesday after a four-day slide led by technology shares, with investors positioning ahead of one of the most anticipated earnings events of the year. The S&P 500 and Nasdaq 100 both advanced as traders reassessed the broader AI landscape and rotated back into large-cap names. Alphabet supported the rebound after its new Gemini 3 model rollout lifted sentiment around mega-cap AI names.

Attention then shifted firmly to Nvidia, which reported results after the closing bell. Expectations were unusually high given the company’s outsized role in the AI supply chain, and traders were bracing for meaningful volatility. Nvidia beat forecasts on revenue and earnings, raised guidance, and reported strong demand for Blackwell systems across cloud and enterprise customers. Early reactions were positive, helping lift other AI related stocks in after-hours trading.

CEO Jensen Huang addressed concerns about an AI “bubble,” stressing that adoption continues to broaden across industries and regions. He highlighted accelerating demand across training and inference workloads, noting that spending is rising simultaneously among model developers, enterprises, and startups. The remarks helped stabilize sentiment following several weeks of worry that AI valuations may be running ahead of fundamentals.

📊 Market Wrap Nov 20th 2025

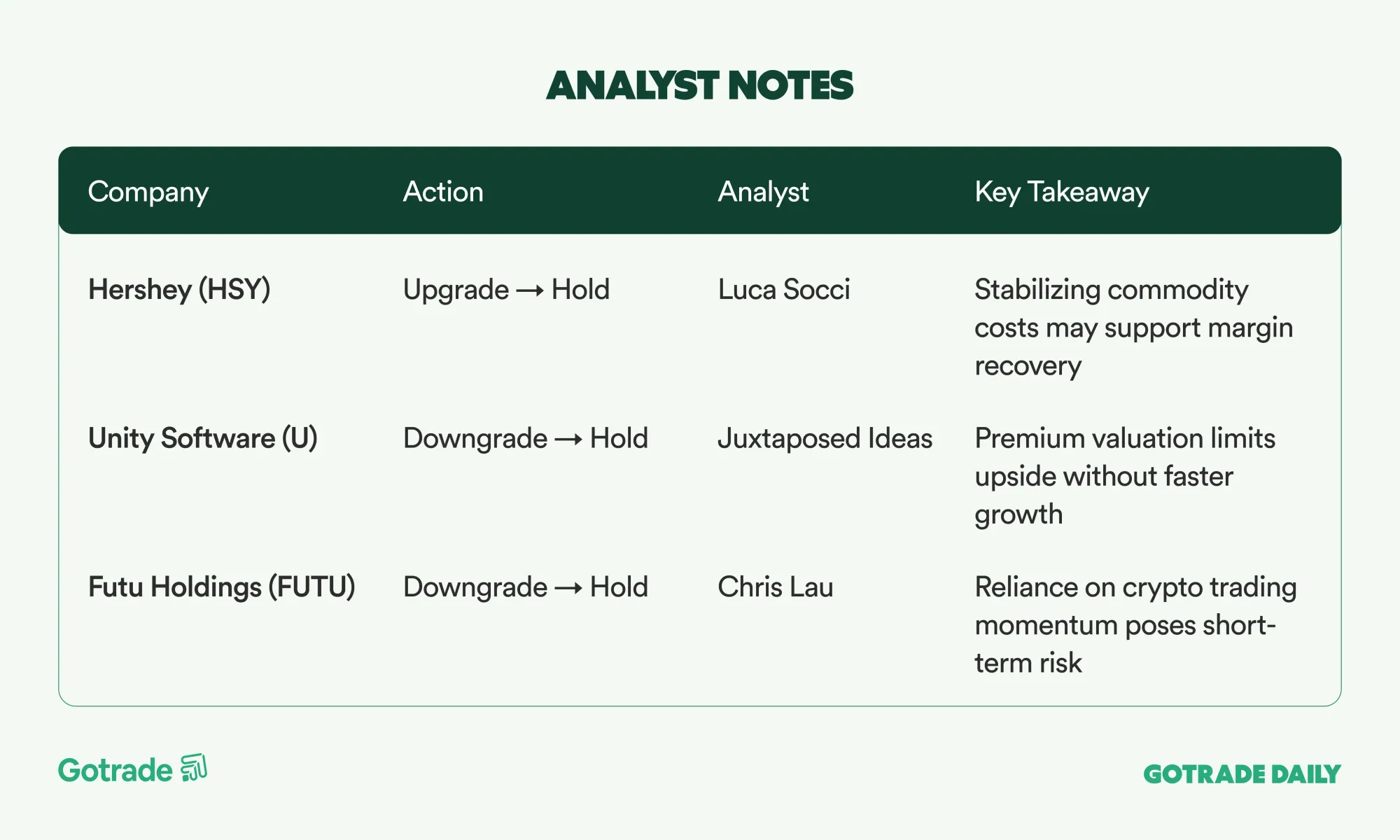

🧠 Analyst Notes

💬 Market Highlights

FirstEnergy Faces US$250 Million Penalty and Refund Over HB6 Bribery Case

Ohio regulators ordered FirstEnergy to pay more than US$250 million in fines and customer refunds linked to the HB6 nuclear bailout bribery scandal. The company, which has replaced management and tightened governance, continues to face legacy regulatory consequences despite earlier settlements.

Palo Alto Networks Targets US$20 Billion ARR by FY2030

Palo Alto raised its long-term ARR target to US$20 billion, driven by strong adoption of AI enabled cybersecurity platforms and acquisitions such as Chronosphere and CyberArk. Q1 2026 results showed 16 percent revenue growth, 29 percent NGS ARR expansion, and operating margins near 30 percent. Investors are watching integration risks as the company scales aggressively.

Target to Lift 2026 CapEx to US$5 Billion for Store and Tech Expansion

Target plans to increase capital spending to about US$5 billion next year to accelerate large-format store rollouts, technology upgrades, and improvements to digital and same-day services. Comparable sales in Q3 remained soft at minus 2.7 percent, but management views elevated investment as essential to rebuilding long-term performance.

📅 Earnings Watch

Markets continue to react closely to major catalysts, and traders are assessing how stronger earnings and improved AI sentiment may shape risk appetite across sectors. With more data and company updates ahead, conditions could shift quickly as the year end approaches.

Which stocks are you tracking now?

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.