The most anticipated update of the season arrives with high expectations.

A lot is at stake as Nvidia prepares to report earnings. The company’s quarterly update is widely viewed as the most important event of this earnings season, with the potential to sway not only AI related names but the broader U.S. market. Expectations are extremely high for the world’s most valuable public company. Any result that falls short could trigger sharp price swings across indexes and funds heavily exposed to AI.

Nvidia’s influence is unusually large. With a market value near 4.4 trillion dollars and an eight percent weight in the S&P 500, a big move in its stock can ripple across retirement accounts, index funds, and nearly every AI linked stock. Options pricing suggests traders expect Nvidia to swing around seven percent this week, while the S&P 500 could move close to two percent as markets react.

The setup is challenging. Nvidia’s earnings have often been strong, but the stock has finished the week lower in three of the past four earnings cycles even when results beat expectations. At the same time, shares have still climbed more than one third this year and most analysts still see long term upside.

From Our Analyst Desk

Nvidia Earnings Preview: Key Things to Watch

Nvidia will report earnings tonight at 4:00 PM EST. Demand for Blackwell systems, strong data center momentum, and multi-year partnerships like OpenAI continue to support its long term outlook. But expectations are extremely high, and valuations already reflect strong execution.With the stock carrying significant index weight and options implying wide swings, even small surprises in data center growth, supply commentary, or export restrictions could move the broader market.

Analyst Stance

- Rating: Neutral

- Preferred Action: Accumulate on dips

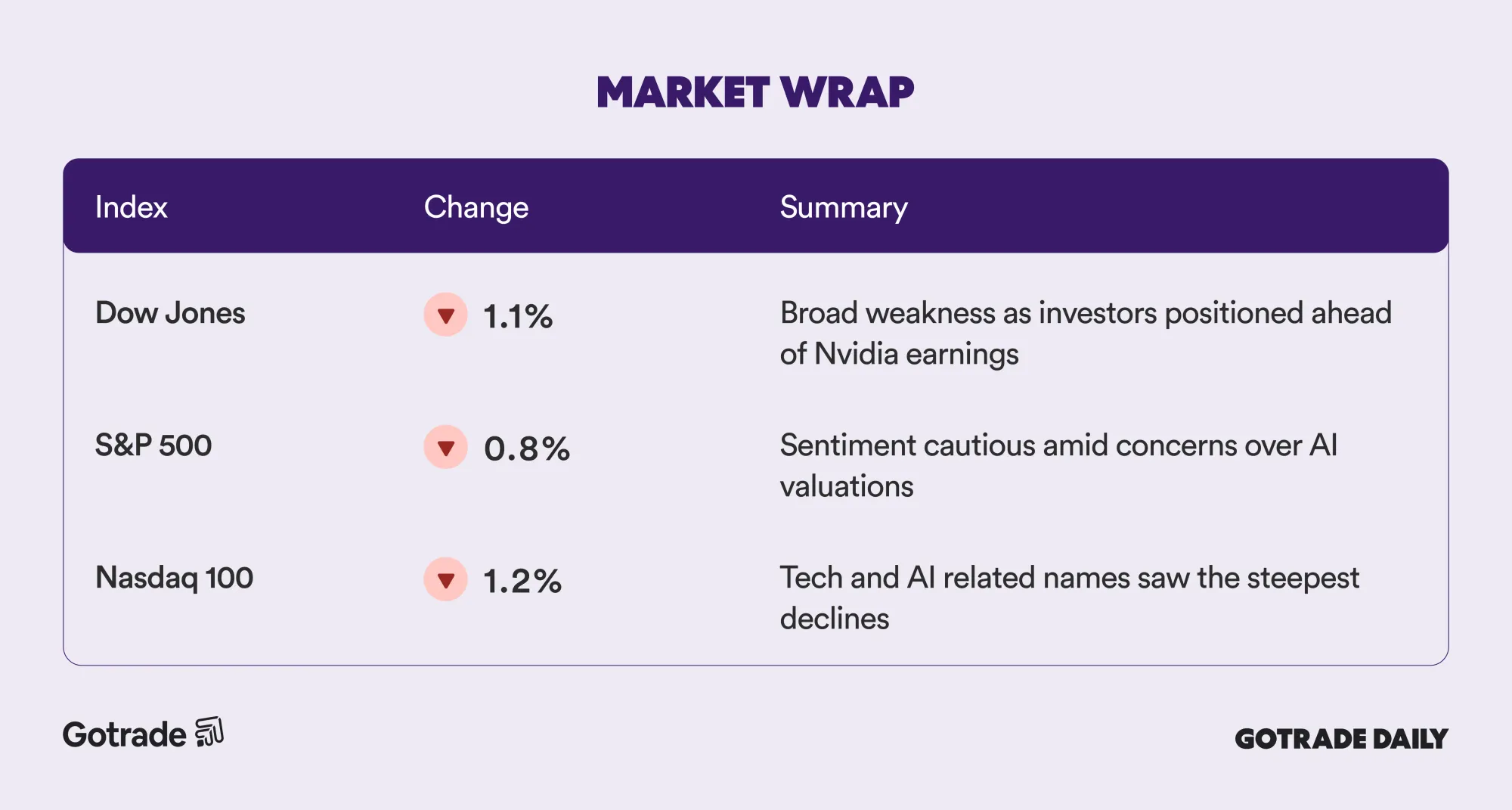

📊 Market Wrap Nov 19th 2025

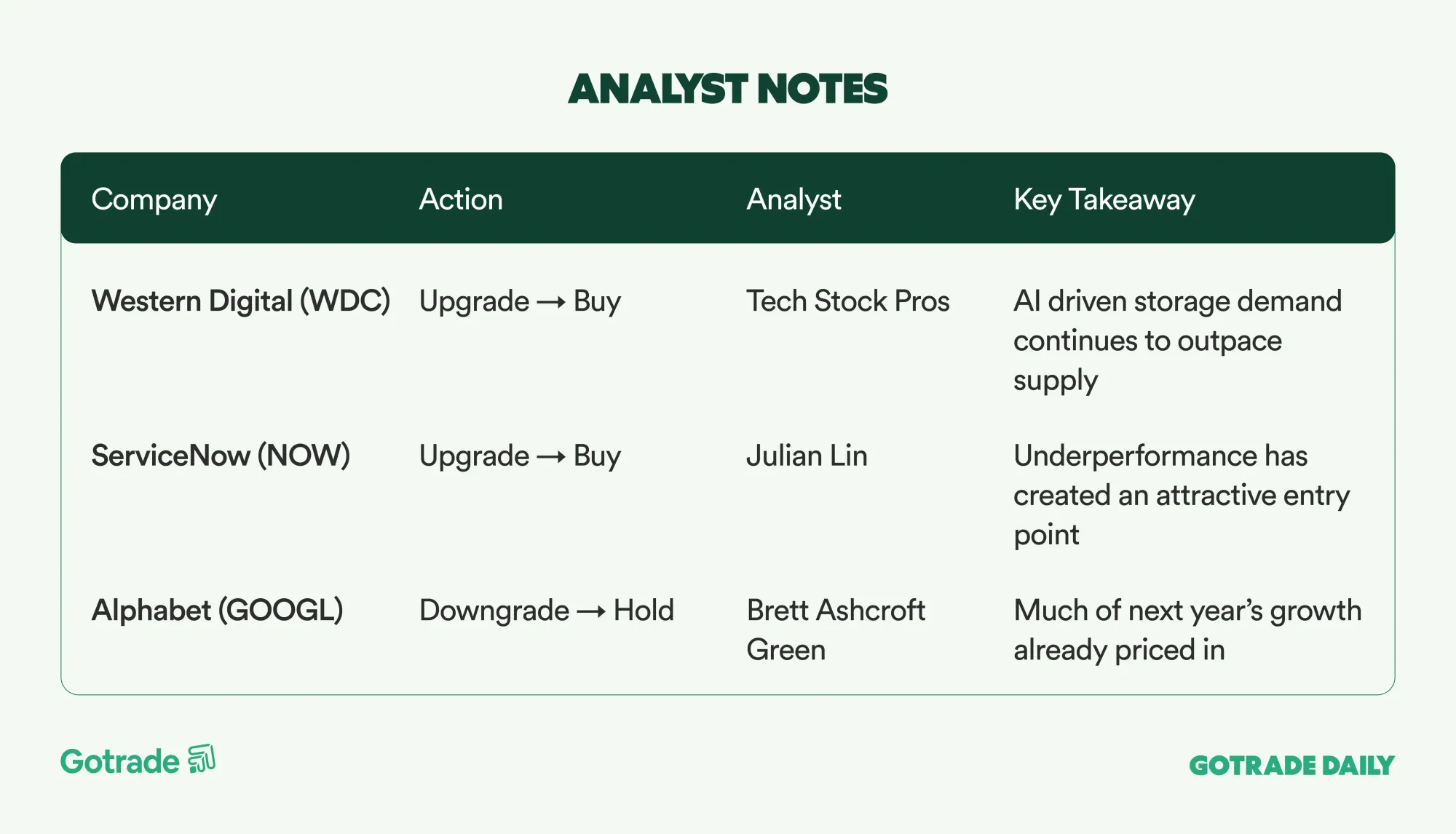

🧠 Analyst Notes

💬 Market Highlights

Dolby Targets 15 to 20 Percent Growth in Atmos and Vision Consumption Model

Dolby Laboratories is targeting annual growth of 15 to 20 percent for Dolby Atmos, Dolby Vision, and its imaging patents as it expands consumption based revenue. Revenue for 2025 rose six percent, supported by GE Licensing and early adoption of Dolby Vision 2 by Hisense, TCL, Instagram, and Douyin. Management projects 2026 revenue of 1.39 to 1.44 billion dollars driven by service based growth.

Barrick Restructures Operations After Activist Investor Pressure

Barrick Mining implemented a major operational overhaul after Elliott Investment Management built a significant position. Changes include shifting Pueblo Viejo to the North America division and combining Latin America and Asia Pacific operations. Shares rose 2.1 percent after management said the restructuring aligns the company with its strategic priorities.

Oil Prices Rise on Distillate Concerns and Russian Sanctions Impact

Global energy prices moved higher as the market reacted to rising diesel prices and new risks to Russian supply. Strong European export demand and refinery disruptions from Ukrainian attacks lifted United States Oil Fund (USO) and broader energy sentiment.

📅 Earnings Watch

With Nvidia’s earnings and market sensitivity converging, traders are preparing for wider swings in the days ahead. The results will help determine whether sentiment stabilizes or remains fragile as the year end approaches.

Which stocks are you watching next?

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.