In investing, few terms inspire as much trust as blue-chip stocks. They represent stability, steady growth, and consistent performance, qualities every investor values.

But what exactly are blue-chip stocks, and why are they such a cornerstone of long-term portfolios? Let’s break it down.

What Are Blue-Chip Stocks?

Blue-chip stocks are shares of large, financially strong, and well-established companies with long records of reliability and profitability.

The term comes from poker, where blue chips hold the highest value. In investing, it refers to market leaders known for resilience, brand strength, and steady returns.

These companies often operate globally and remain profitable through different market cycles. They’re trusted by institutional and individual investors alike for their consistency and financial strength.

Common Examples

Some of the most recognized U.S. blue-chip companies include:

- Apple (AAPL) – a global leader in technology and consumer electronics

- Microsoft (MSFT) – dominant in software and cloud computing

- Johnson & Johnson (JNJ) – a major healthcare and pharmaceutical brand

- Coca-Cola (KO) – a consumer goods icon with steady global demand

- Procter & Gamble (PG) – leader in household and personal care products

- JPMorgan Chase (JPM) – the largest U.S. bank with international reach

Key Traits of Blue-Chip Stocks

While each company differs, all blue-chip stocks share defining characteristics that make them reliable investments.

1. Strong Financials

Blue-chip companies consistently generate stable earnings, strong cash flow, and manageable debt. Their balance sheets allow them to expand during recoveries and endure recessions.

2. Long Operating History

Most have operated successfully for decades, often across multiple economic cycles. Their proven track record builds investor confidence.

3. Industry Leadership

They dominate their sectors. Whether in technology, finance, or consumer goods, blue chips often set industry standards rather than follow trends.

4. Reliable Dividends

Many blue-chip firms pay consistent dividends, and some, called Dividend Aristocrats, have raised payouts for over 25 consecutive years. This makes them attractive for both income and growth investors.

5. Large Market Capitalization

These companies typically have valuations in the tens or hundreds of billions of dollars, reflecting their market dominance and investor trust.

6. Lower Volatility

Because of their scale and stability, blue-chip stocks are generally less volatile than smaller companies, offering smoother performance during market turbulence.

Why Blue-Chip Stocks Are So Popular

Blue-chip stocks combine growth, income, and stability — a rare balance that keeps them popular among all types of investors.

1. Stability in Uncertain Times

During market downturns, investors often move funds to blue-chip companies. Their strong fundamentals make them more resilient when markets get rough.

2. Steady Dividends

Dividends provide a consistent stream of passive income, especially valuable during low-interest environments or retirement planning.

3. Compounding Growth

Blue-chip stocks may not skyrocket overnight, but their consistent returns compound over time, helping investors build wealth steadily.

4. Trust and Transparency

Their global presence, strong governance, and brand recognition make investors feel secure about long-term ownership.

5. Core of Diversified Portfolios

Blue chips form the foundation of diversified portfolios, reducing overall risk while maintaining exposure to economic growth.

Blue-Chip vs. Growth Stocks

While both can be profitable, they cater to different investor goals.

| Aspect | Blue-Chip Stocks | Growth Stocks |

|---|---|---|

| Size | Large, established companies | Smaller or mid-sized companies |

| Risk Level | Lower | Higher |

| Dividends | Often regular | Usually none |

| Volatility | Moderate | High |

| Investor Focus | Steady income and stability | Rapid growth potential |

How to Invest in Blue-Chip Stocks

There are several easy ways to gain exposure to blue-chip companies.

1. Buy Individual Stocks

Purchase shares directly through a trading platform. This gives full control but requires research and diversification on your own.

2. Invest Through ETFs

Exchange-Traded Funds (ETFs) like the SPDR S&P 500 ETF (SPY) or Vanguard Dividend Appreciation ETF (VIG) offer instant diversification across dozens of leading companies.

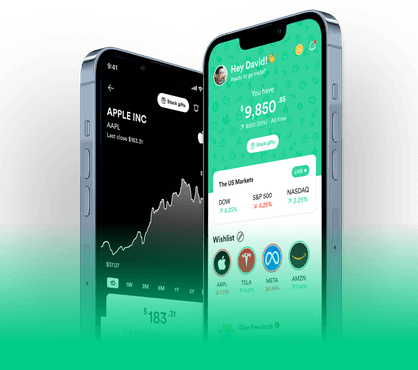

3. Use Fractional Shares

Platforms like Gotrade let you invest in blue-chip stocks from as little as $1, making global investing more accessible than ever.

Are Blue-Chip Stocks Risk-Free?

No investment is completely risk-free. Even established companies can face challenges such as market disruptions, regulatory changes, or competition.

However, blue-chip firms tend to recover faster from downturns due to their diversified operations, strong cash reserves, and loyal customer bases. Historically, they’ve provided more stability than smaller, speculative stocks.

Conclusion

Blue-chip stocks are the foundation of smart investing — combining proven performance, strong balance sheets, and consistent dividends.

They may not deliver overnight gains, but their strength lies in steady, compounding growth that builds real wealth over time.

Whether you’re a beginner or a seasoned investor, blue-chip companies belong in every diversified portfolio.

FAQ

1. What defines a blue-chip stock?

It’s a share of a large, established company known for financial strength, stability, and consistent returns.

2. Are blue-chip stocks good for beginners?

Yes. Their reliability and lower volatility make them perfect for new investors seeking steady growth.

3. Do all blue-chip stocks pay dividends?

Most do, but some choose to reinvest profits into innovation or expansion.

4. Are they completely safe?

No, but they’re generally safer than smaller or speculative stocks because of their strong fundamentals.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.