Barrick Gold Corporation (ticker: GOLD) is one of the largest gold mining companies in the world. For investors looking beyond Gold ETFs and into individual gold-related equities, Barrick often stands out as a benchmark name due to its scale, geographic diversification, and long operating history.

Understanding Barrick Gold requires a different lens than analyzing gold prices alone. While gold prices matter, Barrick’s performance is also shaped by operational execution, cost discipline, and broader equity market conditions. This article breaks down what Barrick Gold is, how it generates value, its prospects, and the key risks investors should understand.

What Barrick Gold Is and How the Business Works

Barrick Gold is a global gold mining company engaged in the exploration, development, and production of gold and copper. Unlike a Gold ETF that tracks commodity prices directly, Barrick operates physical mining assets across multiple regions.

The company’s revenue primarily comes from selling gold produced at its mines. Profitability depends on:

-

Production volumes

-

Operating costs

-

Capital expenditure discipline

Barrick also produces copper, which adds diversification but introduces additional commodity exposure. This makes Barrick a commodity-linked operating business, not a pure gold proxy.

If you want to see how gold mining stocks behave differently from gold prices, comparing Barrick Gold’s share price with spot gold across market cycles can help highlight the distinction. Explore more with Gotrade App.

Barrick Gold’s Position in the Global Gold Industry

Barrick is considered a senior gold producer, meaning it operates large, long-life assets with established production profiles. This positions the company differently from junior miners that rely heavily on exploration success or external financing.

Barrick’s scale allows it to:

-

Spread risk across multiple mines and regions

-

Negotiate more efficiently with suppliers

-

Maintain stronger balance sheet resilience

However, size also limits explosive growth. Barrick’s prospects are tied more to operational efficiency and capital discipline than to discovery-driven upside.

Prospects for Barrick Gold Stock

Barrick’s prospects depend on both gold market conditions and internal execution.

When gold prices rise, Barrick benefits through higher revenue and improved margins, assuming costs remain controlled. The company’s focus on maintaining low all-in sustaining costs helps preserve profitability during volatile gold cycles.

Barrick’s copper exposure adds a second growth lever. In periods of global infrastructure investment or electrification trends, copper demand can support earnings even when gold prices are flat.

However, Barrick is not a growth stock in the traditional sense. Its return potential is more closely tied to:

-

Commodity price cycles

-

Cost control and margin stability

-

Shareholder return policies

Expectations should be framed around cyclical value and income stability, not rapid expansion.

Risks of Investing in Barrick Gold

Gold price dependency

Barrick’s revenue is highly sensitive to gold prices. Prolonged declines in gold prices can pressure margins even with strong cost management.

This makes GOLD stock vulnerable during unfavorable commodity cycles.

Operational and geopolitical risk

Mining operations face risks related to labor, energy costs, environmental regulation, and local political conditions. Barrick operates in multiple jurisdictions, which diversifies risk but also increases complexity.

Unexpected disruptions can affect production and profitability.

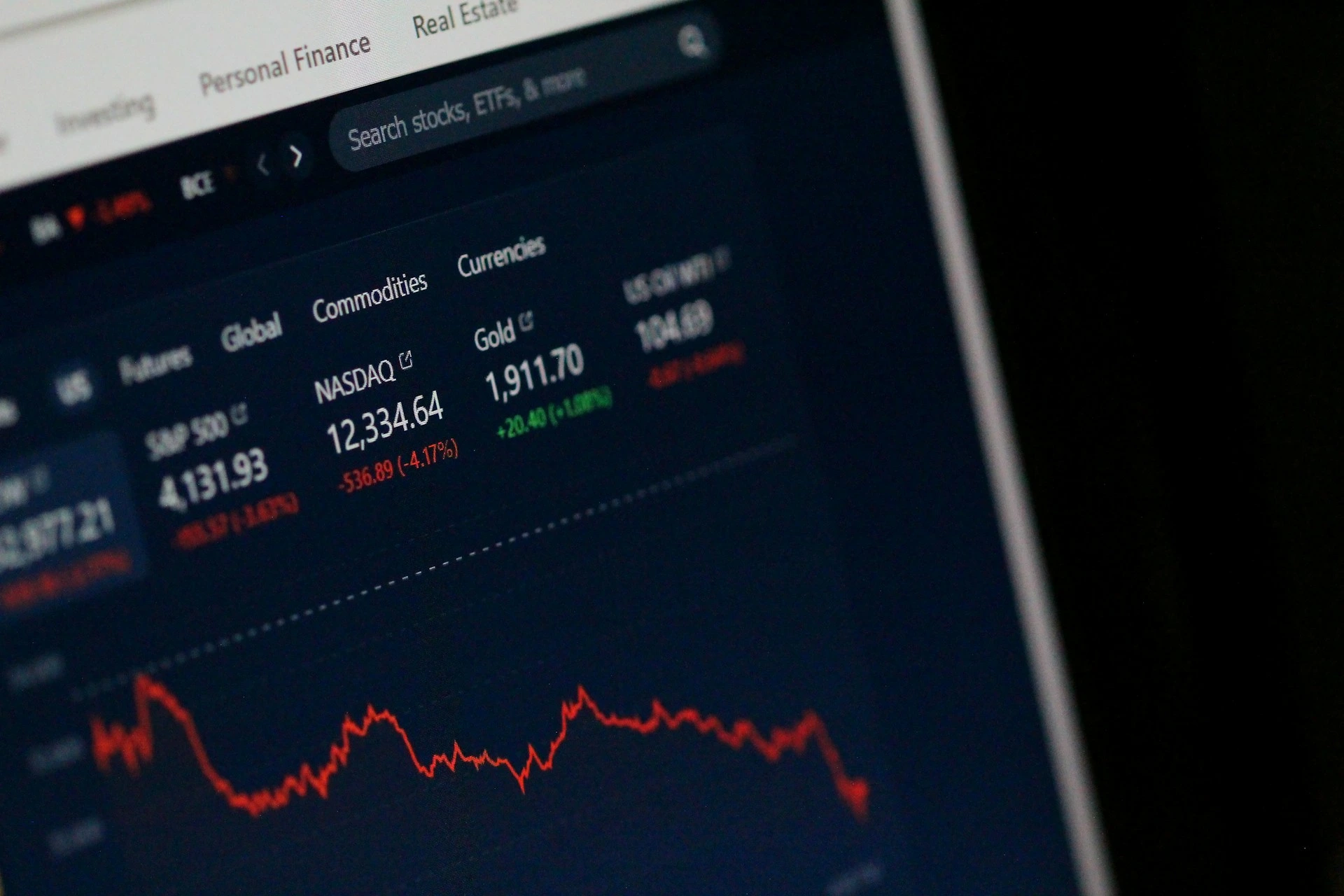

Equity market risk

Barrick Gold is a publicly traded stock and is therefore exposed to broader equity market sentiment. During market-wide selloffs, GOLD stock can decline even if gold prices are stable.

This risk does not exist in physically backed Gold ETFs.

Capital allocation risk

Large mining companies must balance reinvestment, debt management, and shareholder returns. Poor capital allocation decisions can hurt long-term value.

Execution discipline remains critical.

How Barrick Gold Fits Into Portfolio Strategy

Barrick Gold stock is often used as a gold-linked equity exposure rather than a gold substitute. It offers potential dividends and operational leverage to gold prices, but with higher volatility than Gold ETFs.

For many investors, Barrick works best when:

-

Used as a satellite position alongside Gold ETFs

-

Sized smaller than core equity holdings

-

Held with an understanding of commodity cyclicality

Barrick can complement gold exposure, but it should not replace direct gold price tracking tools.

Conclusion

Barrick Gold is a global gold mining company whose performance reflects a combination of gold prices, operational execution, and equity market conditions. Unlike Gold ETFs, GOLD stock represents ownership in a business rather than direct exposure to gold prices.

Understanding how Barrick Gold works, its prospects, and its risks helps investors set realistic expectations. When used intentionally within a diversified portfolio, Barrick can provide gold-linked equity exposure, but it requires comfort with commodity cycles and business-level risk.

If you want to compare Barrick Gold with Gold ETFs and other gold mining stocks, the Gotrade app allows you to explore these exposures side by side and build positions gradually based on your strategy.

FAQ

What is Barrick Gold stock?

Barrick Gold stock represents ownership in a global gold and copper mining company.

Is GOLD stock the same as investing in gold?

No. GOLD stock reflects company performance and gold prices, not direct gold ownership.

Does Barrick Gold pay dividends?

Barrick has paid dividends, but payouts depend on profitability and policy decisions.

Is Barrick Gold riskier than Gold ETFs?

Yes. It carries additional operational and equity market risks.

References

- Barrick Gold Corporation, Barrick Mining: Investor Overview, 2026.

- Nasdaq, Is Barrick Mining Stock Worth Buying, 2026.