Buying power is a core concept in trading, yet it is often misunderstood by new traders. It determines how much you can trade at any given time and directly affects position sizing, risk, and strategy selection. Misunderstanding buying power can lead to overtrading, margin issues, or forced liquidations.

Understanding what is buying power in trading helps traders use capital efficiently while staying within risk limits.

What is Buying Power in Trading?

Buying power is the total amount of capital available in your trading account to open new positions.

It includes your own cash plus any additional funds you are allowed to use through margin, depending on account type and broker rules.

In short, buying power answers the question: how much can I trade right now?

Buying power vs account balance

Account balance shows how much money is in your account.

Buying power shows how much exposure you can take. These two numbers are often different, especially when margin is involved.

How Buying Power Works

Buying power changes dynamically.

Cash-based buying power

In a cash account, buying power is generally limited to available settled cash.

If you have USD 5,000 in cash, your buying power is typically USD 5,000. Once you use it, buying power decreases until positions are closed or cash settles.

Margin-based buying power

Margin accounts allow traders to borrow funds from the broker.

This increases buying power beyond the cash balance, but also increases risk and obligations.

Buying power and open positions

Open positions consume buying power.

As positions move in price, buying power can increase or decrease in real time depending on unrealized gains or losses.

Buying Power and Margin

Margin is the main factor that expands buying power.

How margin increases buying power

Margin allows traders to control larger positions with less capital.

For example, with 2:1 margin, USD 5,000 in cash may provide USD 10,000 in buying power.

This leverage magnifies both gains and losses.

Initial margin and maintenance margin

Initial margin is the amount required to open a position.

Maintenance margin is the minimum equity required to keep the position open. Falling below this level can trigger a margin call.

Margin calls and forced liquidation

If losses reduce account equity below maintenance requirements, brokers may issue a margin call.

If unmet, positions may be liquidated automatically to reduce risk.

Buying Power in Day Trading

Day traders often have different buying power rules.

Day trading buying power

Many brokers provide higher buying power for day trading.

This is because positions are opened and closed within the same trading day, reducing overnight risk.

Intraday vs overnight buying power

Intraday buying power applies only during market hours.

Overnight buying power is usually lower, as positions held overnight carry additional risk.

Traders must reduce positions before the market closes to avoid violations.

Pattern day trader considerations

Accounts classified under pattern day trading rules may face minimum equity requirements.

These rules affect how much buying power is available for frequent traders.

Examples of Buying Power in Practice

Examples help clarify how buying power works.

Example with a cash account

A trader deposits USD 3,000 into a cash account.

Buying power is USD 3,000. If the trader buys USD 1,500 worth of stock, remaining buying power is USD 1,500.

Example with a margin account

A trader has USD 5,000 in a margin account with 2:1 leverage.

Buying power becomes USD 10,000. If the trader opens a USD 8,000 position, USD 2,000 in buying power remains.

Losses reduce buying power quickly in leveraged accounts.

Day trading example

A trader receives USD 20,000 in intraday buying power.

If positions are not closed before market close, buying power reverts to overnight limits, potentially triggering margin issues.

Risks of Misusing Buying Power

Buying power can create hidden risk.

Overleveraging

High buying power can encourage oversized positions.

This increases drawdowns and emotional stress.

False sense of safety

More buying power does not reduce risk.

It simply allows larger exposure, which can amplify losses.

Liquidity and execution risk

Large positions relative to liquidity can increase slippage.

Buying power should always be considered alongside market conditions.

How Traders Use Buying Power Effectively

Buying power should support strategy, not dictate it.

Position sizing discipline

Professional traders size positions based on risk per trade, not maximum buying power.

Buying power sets the ceiling, not the target.

Matching buying power to strategy

Scalpers and day traders may use more buying power.

Swing traders and investors often use less to reduce volatility.

Monitoring buying power regularly

Buying power changes with market movement.

Monitoring it helps avoid accidental margin violations.

Buying Power vs Risk Management

Buying power and risk are not the same.

Buying power defines capacity

It tells you how much you can trade.

Risk management defines survival

Risk management determines how much you should trade.

Successful traders prioritize survival over maximizing buying power usage.

Conclusion

Buying power determines how much market exposure a trader can take, but it does not determine how much risk they should take. Understanding what is buying power in trading, how margin affects it, and how it differs for day trading helps traders avoid costly mistakes.

Used responsibly, buying power improves flexibility and capital efficiency. Used carelessly, it can magnify losses and lead to forced liquidations.

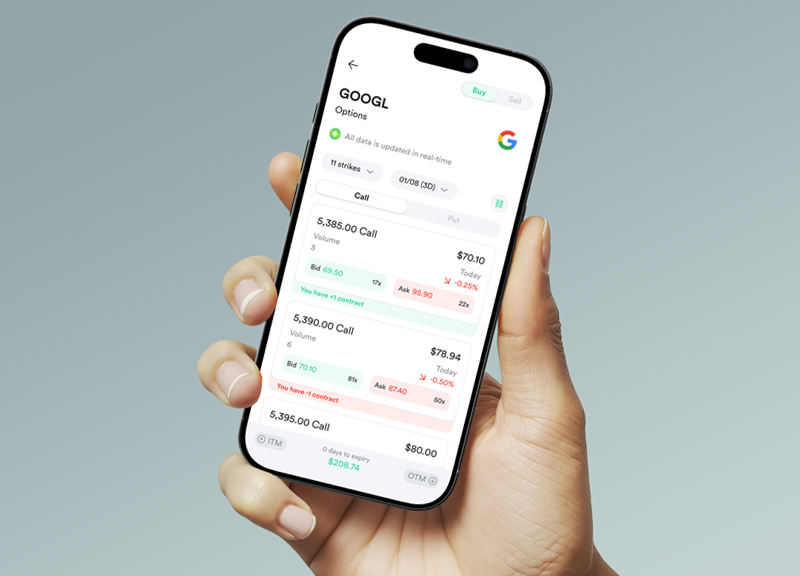

If you are actively trading stocks or ETFs, monitoring your buying power inside the Gotrade app can help you align position size with strategy and manage risk more effectively.

FAQ

What is buying power in trading?

Buying power is the amount of capital available to open new positions, including margin.

Does higher buying power mean higher profits?

No. It increases exposure, which can amplify both gains and losses.

Is buying power the same for cash and margin accounts?

No. Margin accounts typically have higher buying power.

Can buying power change during the day?

Yes. It changes based on open positions, price movement, and account equity.

Reference:

-

Investopedia, Understanding Buying Power, 2026.

-

Firstrade, Margin Buying Power Basics, 2026.