Decision fatigue is a hidden enemy in trading. Even experienced traders can make poor decisions after long periods of analysis, screen time, and repeated choices. In fast-moving markets, the problem is often not lack of knowledge, but depleted mental energy.

Understanding decision fatigue trading helps traders recognize when psychology, not strategy, is driving mistakes. Managing decision fatigue is essential for maintaining consistency and protecting long-term performance.

Decision Fatigue in Trading

Decision fatigue refers to the decline in decision quality after making too many decisions over time. In trading, this happens when constant choices gradually wear down mental focus and discipline.

Each trade requires judgment, risk assessment, and emotional control. When mental energy is depleted, traders become more impulsive, avoidant, or inconsistent.

Why trading accelerates decision fatigue?

Markets demand continuous attention and rapid responses. Price changes, news updates, and signals compete for focus throughout the trading session.

This constant stimulation drains cognitive resources faster than most activities.

How decision fatigue differs from lack of discipline?

Lack of discipline is often blamed for poor trades. In reality, many mistakes occur because the trader is mentally exhausted. Decision fatigue weakens discipline even when rules are clear.

How Decision Fatigue Impacts Trading Performance

Decision fatigue directly affects execution quality and risk management. The damage often appears subtle at first.

Increased impulsive trades

Tired traders are more likely to chase price or break rules. Impulse replaces planning as mental filters weaken. These trades often feel justified in the moment but fail in hindsight.

Delayed or avoided decisions

Some traders freeze instead of acting. Entries, exits, or stop adjustments are postponed due to mental overload. This leads to missed opportunities or larger losses.

Poor risk management

Position sizing and stop placement require focus. Decision fatigue leads to inconsistent risk-taking.

Small errors compound quickly in volatile markets.

Emotional overreaction

Mental exhaustion amplifies emotional responses. Losses feel larger, and wins feel more urgent.

This increases revenge trading and overconfidence cycles.

Common Causes of Decision Fatigue in Trading

Decision fatigue is usually structural, not personal. Trading environments are designed to overload attention.

Overtrading and excessive monitoring

Watching every price tick increases stress. Continuous monitoring forces constant micro-decisions.

This drains energy without improving outcomes.

Too many strategies or rules

Complex systems require constant judgment calls. When rules are unclear or conflicting, decision load increases. Simpler systems reduce mental strain.

Information overload

News feeds, indicators, and opinions compete for attention. Treating all information as equally important accelerates fatigue. Filtering is essential.

Long trading sessions

Extended screen time reduces concentration. Mental sharpness declines even if motivation remains high. Fatigue accumulates quietly throughout the day.

How to Reduce Decision Fatigue in Trading

Managing decision fatigue requires structure and boundaries. Mental energy must be treated as a limited resource.

Define clear trading rules

Rules reduce decision load. When criteria are predefined, fewer choices are needed in real time. This preserves focus for execution.

Limit the number of trades

Not every movement deserves action. Fewer, higher-quality trades reduce cognitive strain. Quality matters more than frequency.

Use checklists

Checklists externalize decisions. They prevent emotional shortcuts during fatigue. This supports consistency under pressure.

Separate analysis from execution

Analysis should happen outside active trading hours. Execution should follow prepared plans. This reduces decision-making during peak stress.

Schedule breaks intentionally

Stepping away resets mental clarity. Short breaks can prevent cascading errors. Rest is part of risk management.

Accept missed trades

Not every opportunity must be taken. Letting go reduces psychological pressure. Preserving clarity is more important than catching every move.

Decision Fatigue and Trading Psychology

Decision fatigue is a core concept in trading psychology. It explains why traders break rules even when they know better.

Successful traders design systems that minimize decisions. The goal is not to be smarter, but to reduce unnecessary thinking.

Mental energy should be conserved for moments that matter most.

Conclusion

Decision fatigue in trading occurs when too many decisions erode judgment and discipline. By understanding decision fatigue trading and its psychological impact, traders can recognize that mistakes often stem from exhaustion, not incompetence.

Reducing decision load through clear rules, fewer trades, and structured routines helps protect performance. Trading success depends not only on strategy, but on managing the mind that executes it.

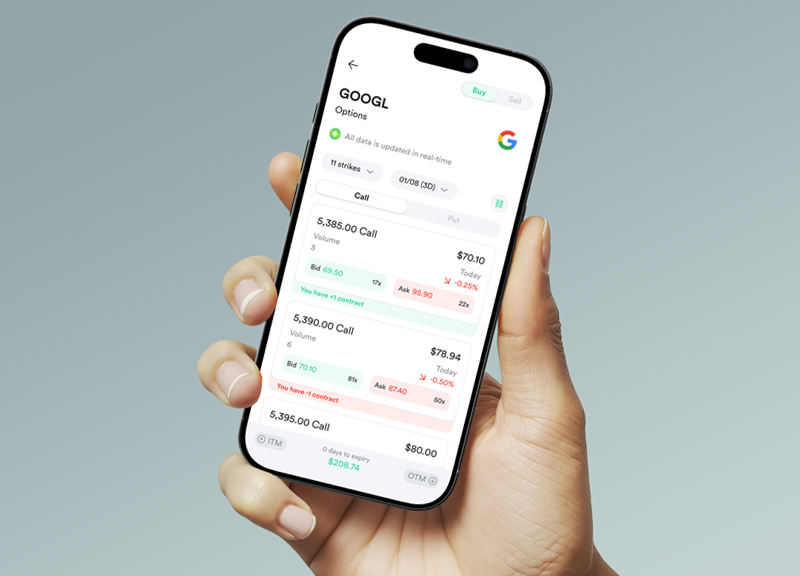

When trading through the Gotrade app, using predefined plans and avoiding constant screen monitoring can help reduce decision fatigue and support more consistent trading behavior.

FAQ

What is decision fatigue in trading?

It is the decline in decision quality caused by mental exhaustion from too many trading decisions.

Can decision fatigue affect experienced traders?

Yes. Experience does not eliminate mental limits.

How do traders reduce decision fatigue?

By simplifying strategies, limiting trades, and structuring routines.

Is decision fatigue the same as lack of discipline?

No. Fatigue weakens discipline even when rules exist.

Reference:

-

Cleveland Clinic, Signs of Decision Fatigue and How To Cope, 2026.

-

The Decision Lab, Decision Fatigue, 2026.