Breakouts are exciting. When price moves beyond a key level, it often feels like the start of a strong trend. But not every breakout follows through. In many cases, price quickly reverses, trapping traders who entered too early. This is known as a false breakout.

False breakouts are one of the most common reasons breakout trades fail. Understanding why they happen helps traders manage risk, avoid emotional mistakes, and improve execution.

This guide explains what a false breakout is, why false breakouts occur, and how they affect breakout trading strategies.

What Is a False Breakout?

A false breakout occurs when price moves beyond a support or resistance level but fails to continue in that direction and quickly reverses.

In simple terms, it is a breakout that does not hold.

False breakouts often lure traders into positions before the market moves the other way. They can occur in both bullish and bearish scenarios.

How False Breakouts Happen

False breakouts are usually caused by a combination of market behavior and trader positioning.

1. Lack of real buying or selling pressure

Price may move beyond a level due to short term orders, but there is not enough demand or supply to support continuation.

2. Stop hunting and liquidity grabs

Markets often move slightly beyond obvious levels to trigger stop loss orders. Once those stops are filled, price reverses.

3. Low volume conditions

Breakouts during low volume periods are more likely to fail because fewer participants are involved.

4. News driven spikes

Sudden headlines can push price beyond levels briefly before the market reassesses and reverses.

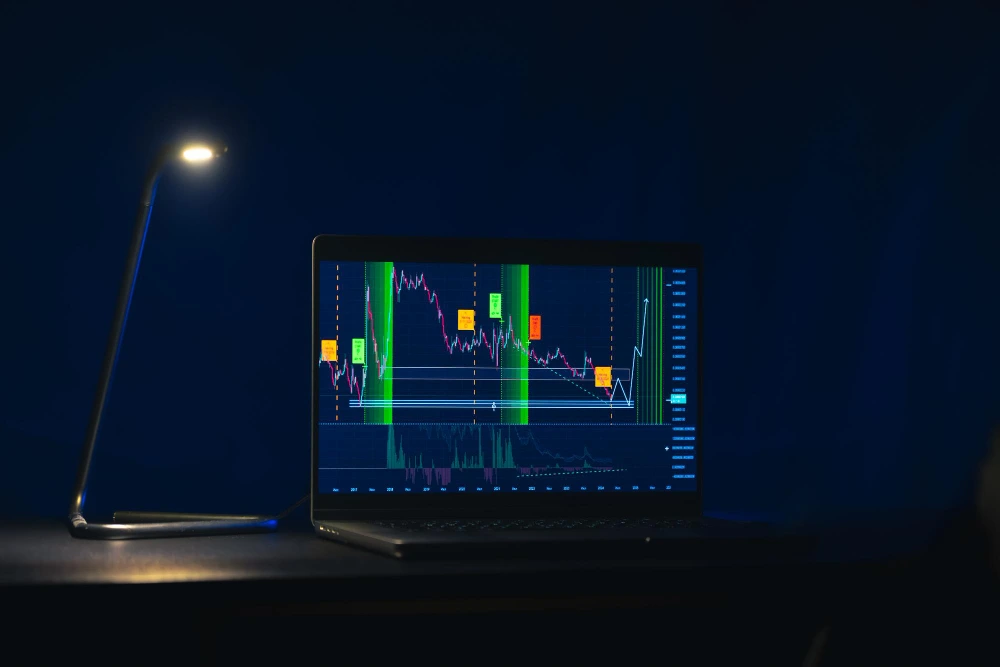

False Breakout Example

Imagine a stock trading below resistance at 100 dollars.

Price briefly moves to 102, triggering breakout entries. Volume remains weak, and buyers do not follow through.

Soon after, price falls back below 100 and continues lower. Traders who bought the breakout are now trapped, often forced to sell at a loss.

This sequence is a classic false breakout.

Why False Breakouts Cause Trades to Fail

They trigger emotional entries

Fear of missing out pushes traders to enter without confirmation or planning.

They lead to poor risk reward

Entering late in a move often leaves little room for error.

They expose weak discipline

Traders without clear exit rules hesitate to cut losses when breakouts fail.

They amplify losses in volatile markets

False breakouts are common during choppy or uncertain market conditions.

How Traders Manage False Breakout Risk

False breakouts cannot be avoided completely, but they can be managed.

Wait for confirmation

Using volume, closing prices, or higher timeframe confirmation can filter weaker breakouts.

Avoid obvious levels

Highly visible levels attract crowded trades and stop hunts.

Use defined stop loss rules

Stops placed too close to breakout levels are easier to trigger. Stops placed with context offer better protection.

Trade fewer, better setups

Not every breakout is worth trading. Selectivity matters.

Accept small losses

Small losses are part of breakout trading. Avoiding large losses is the real goal.

False Breakouts vs Failed Trades

A false breakout does not mean the strategy is broken.

Breakout trading naturally includes failed attempts. The key is managing losses so that successful trades outweigh failed ones over time.

Understanding false breakouts improves execution, not prediction.

Conclusion

False breakouts occur when price moves beyond key levels without follow through. They are a common reason breakout trades fail, especially in low volume or choppy markets.

By understanding why false breakouts happen and applying risk controls, traders can reduce their impact and improve consistency.

If you want to observe breakout behavior and false breakouts in real markets, you can explore US stocks through the Gotrade app. Fractional shares make it easier to practice execution and manage risk while learning.

FAQ

What is a false breakout in simple terms?

A false breakout is when price breaks a level but quickly reverses instead of continuing.

Why are false breakouts common?

They happen due to low volume, stop hunts, news spikes, and crowded trades.

Can false breakouts be avoided?

No, but their impact can be reduced through confirmation and risk management.

Do false breakouts mean breakout trading does not work?

No. Failed trades are part of breakout trading. Managing risk is what matters.

Reference:

-

PriceAction, False Breakout Trading Strategy, 2026.

-

Investopedia, Mastering Technical Analysis, 2026.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., which is registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.