Many people delay financial decisions because investing feels complicated. Yet the earlier you start investing, the more time your money has to grow. Understanding why people invest can clarify whether this step aligns with your own goals.

Investing is not only about chasing returns. It is about building resilience, protecting purchasing power, and participating in economic growth over time.

Here are ten practical reasons people begin investing.

10 Reasons Why People Start Investing

Investing builds long-term wealth

Saving preserves money. Investing aims to grow it.

Over long periods, assets such as stocks have historically delivered returns above inflation. This growth helps individuals accumulate capital beyond what regular saving alone can achieve.

Compounding in investing multiplies growth

Compounding means earning returns on both your initial investment and previous gains.

Even small, consistent contributions can grow meaningfully when given enough time. The earlier you start investing, the stronger compounding becomes.

Investing helps beat inflation

Inflation reduces purchasing power over time. Money kept in cash may lose value in real terms.

Investing allows your capital to grow at a rate that may outpace inflation, preserving future spending ability.

Investing supports retirement planning

Many people invest to prepare for retirement. Relying solely on savings accounts may not provide sufficient growth. Investing in diversified assets can help create a larger retirement fund over decades.

Investing creates passive income opportunities

Certain investments generate income, such as:

-

Dividend-paying stocks

-

Bonds

-

Real estate investment trusts

This income can supplement salary or be reinvested for further growth.

Investing builds financial discipline

Regular investing encourages structured money management. When contributions are automated, investing becomes a habit rather than a sporadic decision.

Investing allows participation in business growth

Buying stocks means owning a portion of a company. When companies grow revenues and profits, shareholders may benefit through price appreciation or dividends.

Investing diversifies financial risk

Holding only cash exposes you to inflation risk. Diversified investments spread exposure across industries, sectors, or asset types, reducing dependence on a single income source.

Investing helps achieve long-term goals

People invest for specific objectives such as:

-

Buying a house

-

Funding education

-

Building generational wealth

Investing aligns current savings with future milestones.

Investing increases financial knowledge

Once people begin investing, they often become more engaged with markets and economic trends.

This awareness can improve overall financial decision-making.

Common Concerns Before Starting

Despite clear benefits, many hesitate to start investing due to uncertainty. Common concerns include:

-

Fear of losing money

-

Lack of knowledge

-

Belief that large capital is required

These concerns are valid. Investing involves risk, and prices fluctuate.

However, starting gradually and focusing on long-term strategies can reduce emotional decision-making. Many investors begin with small amounts and increase contributions as confidence grows.

Understanding risk tolerance and time horizon is more important than timing the market perfectly.

Getting Started With Investing

Starting does not require complex strategies. It requires clarity and consistency.

Define your financial goals

Are you investing for retirement, wealth growth, or a medium-term milestone? Clear goals determine your investment horizon and risk tolerance.

Build an emergency fund first

Before investing aggressively, ensure you have sufficient cash reserves to cover unexpected expenses. This prevents forced selling during market downturns.

Choose an investment approach

Common approaches include:

-

Long-term investing in diversified stocks

-

Index-based strategies

-

Gradual monthly contributions

Consistency often matters more than intensity.

Start small and scale gradually

Many beginners assume they need large capital. In reality, disciplined small contributions can build momentum over time.

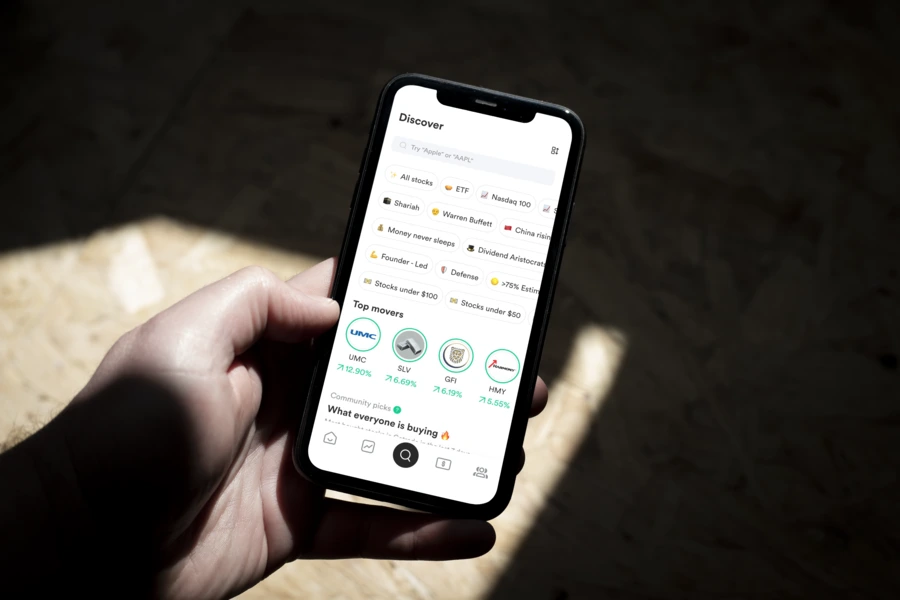

When you are ready to begin, you can get Gotrade App and start investing in global stocks step by step, aligned with your financial plan.

Conclusion

People start investing for different reasons, but the underlying goal is often the same: long-term financial growth.

Investing builds wealth through compounding, protects against inflation, and supports major life goals. It also strengthens financial discipline and market awareness.

Starting early provides time, and time supports growth.

If you are considering whether to start investing, the key question is not whether markets fluctuate. It is whether your money is positioned to grow over the long term.

FAQ

Why do people start investing instead of just saving?

People invest because savings alone may not generate enough growth to outpace inflation or meet long-term financial goals.

Is it risky to start investing as a beginner?

All investing involves risk, but starting gradually with diversified assets and a long-term perspective can reduce short-term pressure.

How much money do I need to start investing?

The required amount depends on the platform and strategy. Many investors begin with small, consistent contributions and increase over time.

References:

-

Dow Jones, Why Start Investing, 2026.

-

Willis Owen, Six reasons to start investing, 2026.