Silver ETFs are often promoted as an accessible way to invest in silver without buying and storing physical metal. They offer liquidity, ease of trading, and integration into modern portfolios. As interest in precious metals grows, Silver ETFs frequently attract investors looking for inflation protection or diversification.

However, silver behaves very differently from gold. Understanding silver ETF risks is essential before treating Silver ETFs as defensive or stable assets. While they simplify access to silver prices, they also expose investors to unique volatility, structural, and behavioral risks that are often underestimated.

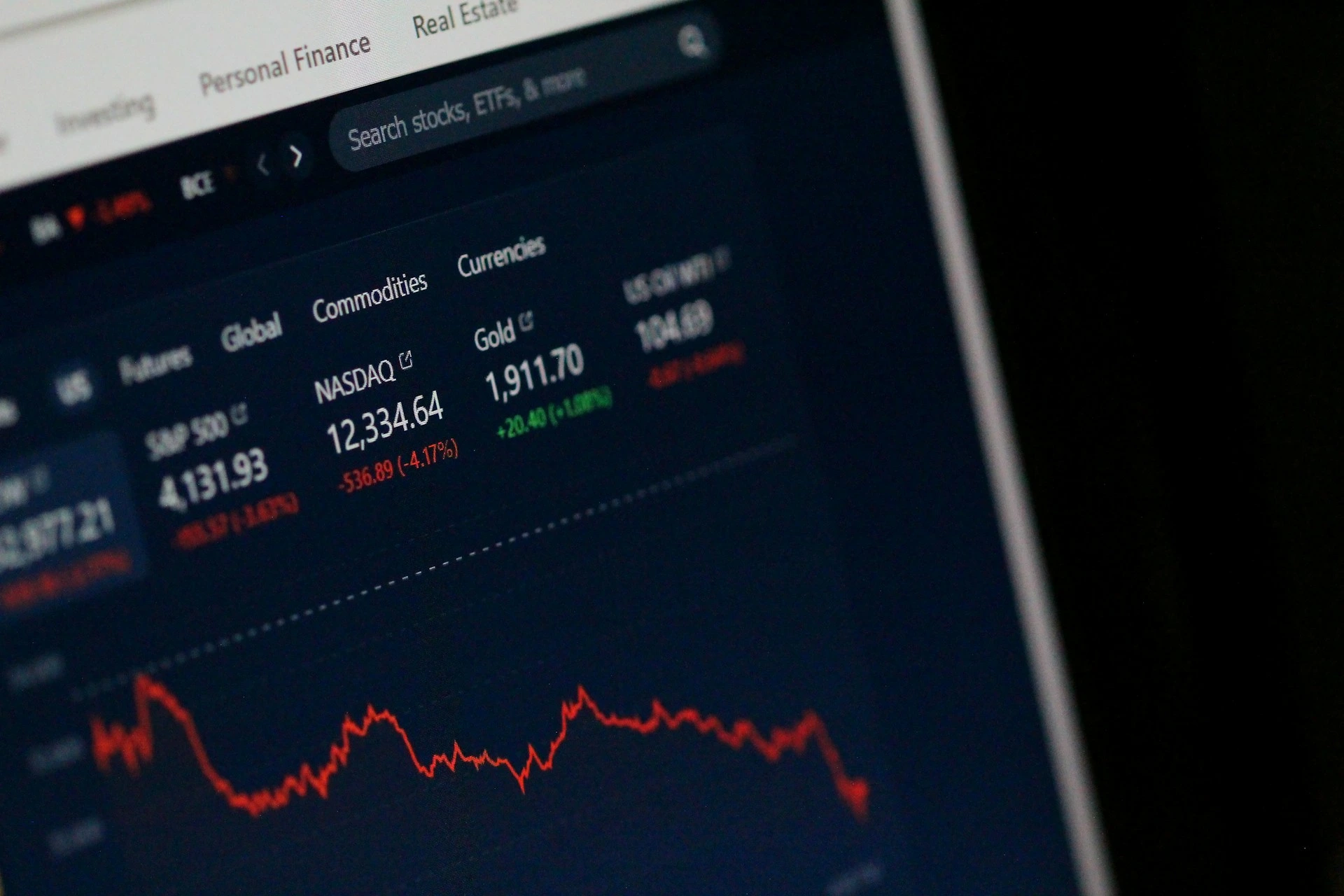

Silver Price Volatility Is Significantly Higher

Silver ETFs are directly exposed to silver price movements. Compared with gold, silver prices tend to fluctuate more aggressively due to their dual role as both a precious metal and an industrial commodity.

Industrial demand from electronics, renewable energy, and manufacturing ties silver prices closely to economic cycles. During slowdowns, demand can weaken sharply, causing silver prices and Silver ETFs to fall even when inflation concerns remain elevated.

Silver also experiences sharper speculative swings. Rapid inflows and outflows can amplify price movements, making Silver ETFs more volatile than many investors expect when first entering the position.

Structural Risks Inside Silver ETFs

Expense ratios and long-term drag

Silver ETFs charge expense ratios to cover storage, insurance, and administration. While these fees are often modest, they accumulate over time.

For long-term investors, this creates a gradual performance drag relative to spot silver prices. The effect is subtle but persistent.

Tracking differences versus spot silver

Silver ETFs aim to track silver prices closely, but they do not match spot silver perfectly. Market hours, liquidity conditions, and operational frictions can cause short-term deviations.

During periods of heightened volatility, tracking differences can become more noticeable, especially for investors expecting precise price replication.

Custody and counterparty exposure

Physically backed Silver ETFs rely on custodians to store silver bullion. Although these arrangements are regulated and audited, they introduce counterparty and operational risk.

This risk is generally low, but it differs from owning physical silver directly.

Market Behavior Risks Often Misunderstood

Liquidity risk in stressed markets

Silver ETFs are usually liquid, but liquidity can deteriorate during periods of market stress. Bid-ask spreads may widen, increasing transaction costs.

Large or urgent trades may experience less favorable execution during volatile conditions.

Correlation risk during downturns

Silver is sometimes assumed to act as a safe haven. In reality, silver often behaves more like a cyclical asset than a defensive one.

During equity market selloffs driven by economic weakness, silver prices and Silver ETFs may decline alongside risk assets. This can surprise investors expecting protection.

Volatility clustering

Silver markets tend to experience volatility in clusters. Periods of calm can be followed by sudden, sharp moves.

Silver ETFs fully reflect this behavior, increasing the risk of emotional decision-making.

Understanding how Silver ETFs respond across different economic environments can help you size positions realistically and avoid relying on silver as a low-risk hedge. Access Silver ETF via Gotrade, now!

Behavioral and Allocation Risks

Overestimating silver’s defensive role

Many investors enter Silver ETFs expecting behavior similar to gold. This assumption often leads to disappointment during economic downturns.

Silver’s industrial exposure changes its risk profile significantly.

Chasing performance after sharp rallies

Silver prices can rise rapidly during speculative phases. Late entry driven by recent performance increases the risk of drawdowns once momentum fades.

Silver ETFs magnify this timing risk.

Ignoring opportunity cost

Capital allocated to Silver ETFs is capital not deployed elsewhere. During periods of strong equity or income asset performance, silver exposure may lag.

Opportunity cost matters, especially for long holding periods.

Additional Risks in Silver Mining ETFs

Equity market sensitivity

Silver mining ETFs do not track silver prices directly. They hold shares of mining companies, which are influenced by broader equity market conditions.

Even if silver prices rise, mining stocks may underperform due to operational or financial challenges.

Operational and cost risks

Mining companies face rising energy costs, labor expenses, and regulatory pressures. These factors can compress margins even during favorable silver price environments.

This adds layers of risk beyond metal prices.

Amplified downside exposure

Mining ETFs often exhibit leveraged behavior. Losses can accelerate quickly during market downturns.

This makes them unsuitable for conservative investors.

Conclusion

Silver ETFs provide convenient access to silver prices, but they come with meaningful risks. Silver price volatility, structural costs, market behavior, and investor psychology all shape the risks of investing in Silver ETFs.

Understanding silver ETF risks allows investors to move beyond assumptions and toward informed allocation decisions. When used intentionally and sized appropriately, Silver ETFs can add diversification, but they require realistic expectations and active risk awareness.

If you want to evaluate Silver ETFs alongside other assets and understand how silver price movements affect your portfolio, the Gotrade app allows you to compare exposures and build positions gradually based on your risk tolerance.

FAQ

Are Silver ETFs riskier than Gold ETFs?

Yes. Silver ETFs typically experience higher volatility than Gold ETFs.

Do Silver ETFs protect against inflation?

They can, but performance depends heavily on industrial demand and economic conditions.

What is the biggest risk of investing in Silver ETFs?

Silver price volatility driven by economic cycles and speculation.

Are silver mining ETFs riskier than physical Silver ETFs?

Yes. They add equity and operational risks on top of silver price exposure.

References

- The Royal Mint, Introduction to Silver Investment, 2026.

- Investopedia, Silver ETF, 2026.