AngloGold Ashanti (ticker: AU) is one of the world’s largest and most geographically diversified gold mining companies. Unlike Gold ETFs that track gold prices directly, AngloGold represents ownership in a global mining business with assets spread across multiple continents and regulatory environments.

For investors considering gold-related equities, AngloGold Ashanti often appears alongside peers like Barrick Gold. However, the company’s operational footprint, risk profile, and strategic focus create a distinct investment proposition that deserves careful examination.

What AngloGold Ashanti Is and How the Business Operates

AngloGold Ashanti is a multinational gold mining company engaged in exploration, development, and production. Its operations span Africa, the Americas, and Australia, giving it one of the broadest geographic footprints in the gold mining industry.

Revenue is generated through the sale of gold produced at its mines. Profitability depends on gold prices, production volumes, and cost management, particularly all-in sustaining costs.

Unlike Gold ETFs, AngloGold does not provide pure gold price exposure. Instead, AU stock reflects business execution layered on top of gold price movements, making it a commodity-linked equity investment.

If you want to understand how global gold miners behave differently from gold prices, comparing AU stock with spot gold across multiple market cycles can provide valuable perspective. Explore and learn more about gold mining company stocks on Gotrade App.

AngloGold Ashanti’s Position in the Global Gold Sector

AngloGold Ashanti is considered a senior gold producer, operating large-scale assets with established production histories. This positions the company differently from junior miners that rely heavily on exploration success or capital market access.

One defining feature of AngloGold is its geographic diversification. Operating across several regions helps spread operational risk, but it also introduces exposure to varying political, regulatory, and currency environments.

The company has increasingly focused on improving asset quality and simplifying its portfolio. This strategic direction prioritizes operational efficiency and risk management over aggressive expansion.

Prospects for AngloGold Ashanti Stock

AngloGold Ashanti’s prospects are closely tied to gold market conditions and internal execution. Rising gold prices can improve margins and cash flow, especially if cost discipline is maintained.

The company’s diversified asset base provides resilience during localized disruptions, but it can also limit upside compared with more concentrated, high-growth miners.

AngloGold’s strategy emphasizes sustainability, balance sheet strength, and long-life assets. As a result, AU stock is often viewed as a cyclical value and stability-oriented gold equity, rather than a high-growth opportunity.

Investors should frame expectations around steady exposure to gold cycles rather than rapid earnings expansion.

Risks of Investing in AngloGold Ashanti

Gold price exposure

AngloGold’s revenue and cash flow remain sensitive to gold prices. Prolonged declines in gold prices can compress margins despite operational improvements.

This risk is inherent to all gold mining equities.

Geopolitical and regulatory risk

AngloGold operates in multiple jurisdictions, some of which present higher political or regulatory uncertainty. Changes in taxation, mining regulations, or labor conditions can affect profitability.

Geographic diversification reduces single-country risk but increases overall complexity.

Operational risk

Mining is capital-intensive and operationally complex. Cost inflation, energy prices, and production challenges can impact results.

Operational setbacks at major assets can influence overall performance.

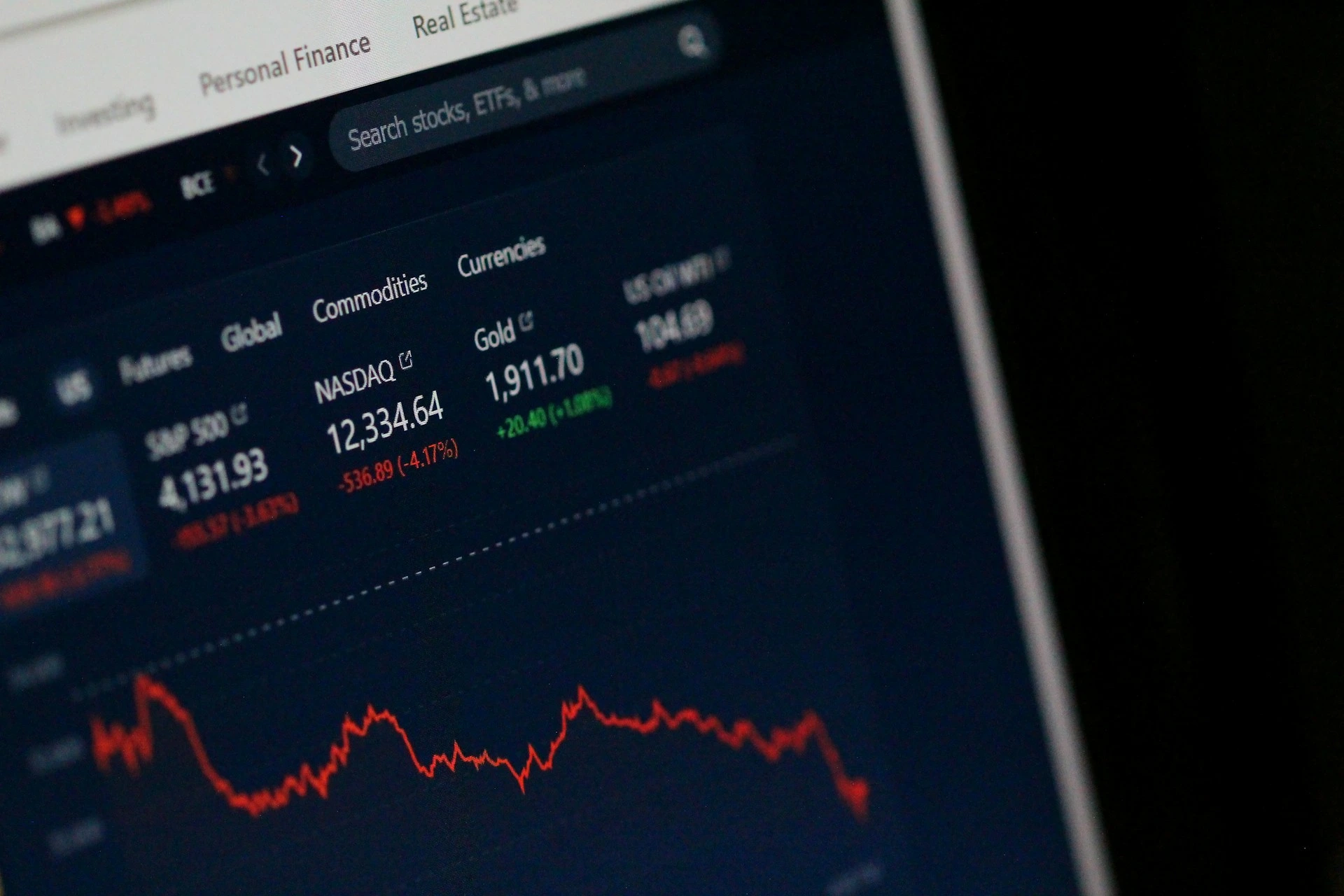

Equity market volatility

As a publicly traded stock, AU is exposed to broader equity market sentiment. During market-wide selloffs, AU stock may decline even if gold prices are stable.

This distinguishes it from physically backed Gold ETFs.

How AngloGold Ashanti Fits Into Portfolio Strategy

AngloGold Ashanti (AU) stock is typically used as a gold-linked equity allocation rather than a gold substitute. It offers operational leverage to gold prices, but with higher volatility and business risk.

For many investors, AU works best when:

-

Held as a satellite position alongside Gold ETFs

-

Sized appropriately relative to total equity exposure

-

Evaluated with a long-term, cycle-aware mindset

AU stock can complement gold exposure, but it should not replace direct gold price tracking tools.

Conclusion

AngloGold Ashanti is a globally diversified gold mining company whose performance reflects a combination of gold prices, operational execution, and geopolitical factors. Unlike Gold ETFs, AU stock represents ownership in a complex mining business rather than direct exposure to gold prices.

Understanding how AngloGold Ashanti operates, its prospects, and its risks allows investors to set realistic expectations. When used intentionally within a diversified portfolio, AU can provide gold-linked equity exposure, but it requires comfort with commodity cycles and business-level risk.

If you want to compare AngloGold Ashanti with other gold mining stocks and Gold ETFs, the Gotrade app allows you to explore these exposures side by side and build positions gradually based on your strategy.

FAQ

What is AngloGold Ashanti stock?

AngloGold Ashanti stock represents ownership in a global gold mining company.

Is AU stock the same as investing in gold?

No. AU stock reflects company performance and gold prices, not direct gold ownership.

Does AngloGold Ashanti pay dividends?

Dividend payments depend on profitability and company policy and may vary.

Is AU stock riskier than Gold ETFs?

Yes. It carries additional operational, geopolitical, and equity market risks.

References

- AngloGold Ashanti, Investor Overview, 2026.

- Seeking Alpha, AngloGold Ashanti Explained, 2026.