In options trading, price movement alone does not determine value. Two options with the same strike price and expiration can trade very differently depending on market expectations. This difference is driven by implied volatility (IV).

Understanding implied volatility in options is essential because it reflects what the market expects to happen, not what has already happened. Implied volatility is forward-looking, and it often moves independently from price.

Many traders misunderstand implied volatility as a prediction. In reality, it is a pricing input, shaped by demand, uncertainty, and risk perception.

How Implied Volatility Works

Implied volatility (IV) represents the level of future price movement that is implied by an option’s current price.

When option prices rise, implied volatility increases. When option prices fall, implied volatility decreases.

Implied volatility does not measure direction. It measures expected magnitude of movement, regardless of whether price moves up or down.

Relationship between option price and volatility

Option prices are influenced by several factors, including time to expiration, strike price, interest rates, and volatility.

When traders expect larger price swings, they are willing to pay more for options. This increased demand pushes option premiums higher, which results in higher implied volatility.

Conversely, when uncertainty declines, option demand falls and implied volatility compresses.

Supply, demand, and expectations

Implied volatility is not calculated from past price data alone.

It emerges from market behavior. If many traders seek protection or speculate aggressively, implied volatility rises even if price has not moved significantly.

This is why implied volatility often spikes ahead of earnings, economic data, or major events.

Implied volatility vs historical volatility

Historical volatility measures how much price has moved in the past.

Implied volatility measures how much the market expects price to move in the future.

The two can diverge significantly. High implied volatility does not require recent price movement. It reflects anticipated uncertainty, not realized movement.

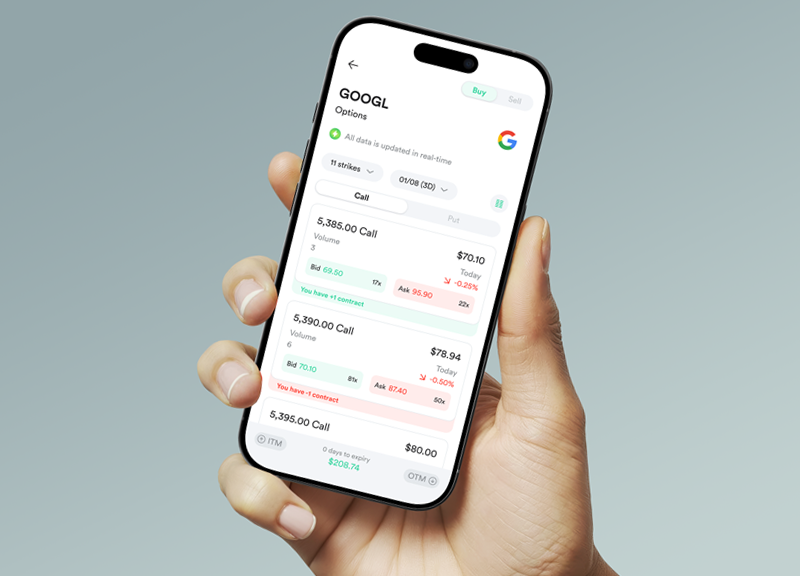

If you want to see how implied volatility changes around earnings, macro events, or market stress, you can trade on Gotrade and observe how option prices react before and after key events.

Why Implied Volatility Matters

Implied volatility matters because it directly affects option pricing and risk.

- Higher implied volatility increases option premiums, making options more expensive to buy and more rewarding to sell.

- Lower implied volatility reduces option premiums, limiting potential payout but also lowering cost.

- Implied volatility also influences strategy selection. Some strategies benefit from rising volatility, while others benefit from stability or volatility decline.

- Understanding implied volatility helps traders avoid a common mistake: buying options simply because they expect price movement, without considering whether volatility is already priced in.

- In many cases, traders lose money even when price moves in the expected direction because implied volatility collapses.

Implied volatility is the market’s way of pricing uncertainty, not direction.

Risks of High Implied Volatility

High implied volatility increases both opportunity and risk.

Overpaying

One major risk is overpaying for options. When volatility is elevated, option premiums may already reflect worst-case scenarios.

Volatility crush

If the expected event passes without surprise, implied volatility often drops sharply, causing option prices to fall even if price barely moves. This phenomenon is known as volatility crush.

Complexity and uncertainty

High implied volatility also increases strategy complexity. Directional trades become harder to manage because volatility changes can overwhelm price effects.

For sellers, high implied volatility can be attractive, but risk is asymmetric. Large unexpected moves can produce losses quickly.

High implied volatility does not mean opportunity by default. It means uncertainty is expensive.

How Professionals Use Implied Volatility

Professional traders treat implied volatility as a context signal, not a trade trigger.

They compare implied volatility to historical levels to assess whether options are relatively expensive or cheap.

They align strategies with volatility expectations rather than price opinions alone.

Professionals also monitor volatility skew and term structure to understand where risk is concentrated.

Implied volatility informs risk positioning more than direction bias.

Conclusion

Implied volatility (IV) reflects the market’s expectation of future price movement and directly influences option pricing. It is not a forecast, but a consensus measure of uncertainty.

Understanding implied volatility in options helps traders choose strategies more deliberately and avoid paying too much for risk that is already priced in.

Volatility is a cost. Knowing when it is cheap or expensive matters as much as knowing where price may go.

If you want to apply implied volatility concepts in real trading scenarios, you can trade on Gotrade and analyze how option prices respond to changing market expectations.

FAQ

What is implied volatility in options?

It is the market’s expectation of future price movement implied by option prices.

Does high implied volatility predict big moves?

No. It reflects expectation, not certainty.

Is implied volatility directional?

No. It measures magnitude of movement, not direction.

Why do options lose value after earnings?

Because implied volatility often collapses once uncertainty is resolved.

References

-

Investopedia, How Implied Volatility Works, 2026.

-

IncomeShares, How Volatility Affects Options Premium, 2026.