Money management refers to how you earn, spend, save, and invest your income in a structured way. At its core, money management is about making intentional financial decisions rather than reacting to expenses as they arise.

Strong money management does not require high income. It requires clarity, consistency, and discipline. Whether you are just starting your financial journey or refining existing habits, understanding how money management works is essential.

Here is a structured breakdown.

Money Management Definitions

Money management is the process of planning and controlling personal finances to achieve short-term stability and long-term goals.

It includes:

Budgeting income and expenses

Saving regularly

Managing debt

Investing strategically

Protecting assets

Money management is not just about cutting costs. It is about directing money toward priorities.

For example, two people earning the same income can experience very different financial outcomes depending on how they allocate and manage their resources.

Money management determines whether income translates into lasting financial progress.

How Money Management Works

Money management operates through a structured cycle.

1. Income allocation

Every financial plan begins with understanding net income. From there, funds are distributed across essential categories such as:

Living expenses

Savings

Debt payments

Investments

Intentional allocation prevents overspending.

2. Expense monitoring

Tracking spending patterns ensures that expenses align with income. Monitoring can be done through:

Budgeting apps

Bank statements

Monthly reviews

The objective is awareness, not perfection.

3. Saving and investing

Money management emphasizes paying yourself first. Consistent contributions to savings and investment accounts support long-term goals and reduce reliance on debt during emergencies.

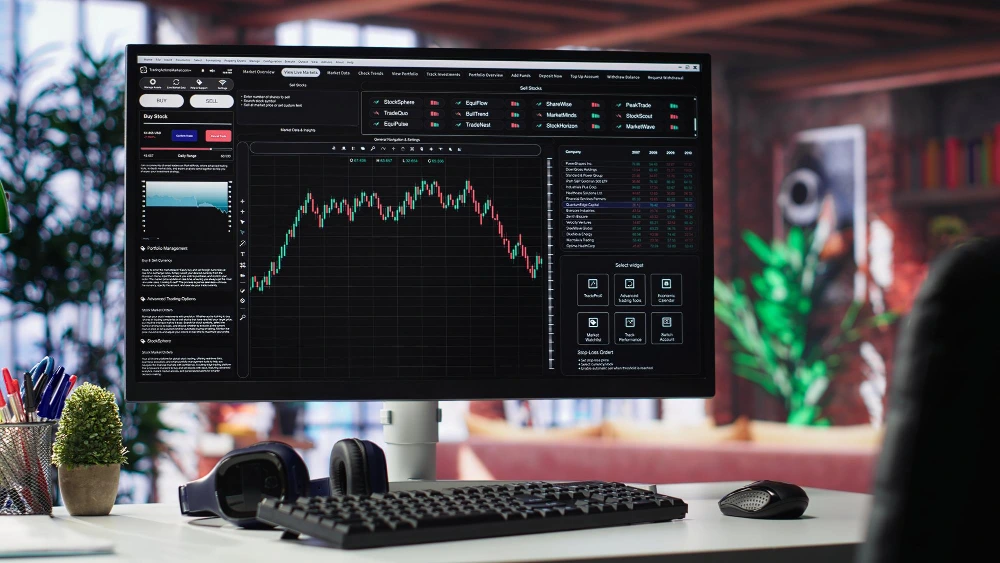

Once you have established consistent savings, you can invest using Gotrade App and begin allocating capital into diversified global stocks as part of your financial plan.

4. Review and adjustment

Financial circumstances change. Effective money management includes periodic reassessment.

Adjustments may be necessary due to:

Income changes

Life events

Shifting goals

Flexibility supports sustainability.

Why Money Management Matters

Money management directly influences financial stability. Without structure, income can disappear through unplanned expenses. With structure, income becomes a tool for growth.

Effective money management:

Reduces financial stress

Prevents excessive debt

Builds emergency reserves

Supports long-term investing

It also improves decision-making. When you understand your financial position clearly, you can evaluate opportunities with confidence. Poor money management, on the other hand, often results in:

High-interest debt

Lack of savings

Limited financial flexibility

Over time, small decisions accumulate. Managing money consistently often matters more than earning more.

Core Money Management Practices

Strong money management relies on practical habits.

Budget consistently

A budget provides visibility. Whether you use envelope budgeting, reverse budgeting, or percentage-based systems, the key is assigning income intentionally.

Build an emergency fund

Unexpected expenses are inevitable. Maintaining three to six months of essential expenses in liquid savings reduces financial vulnerability.

Control debt

Understanding interest rates and repayment terms is critical. Prioritize high-interest debt and avoid unnecessary borrowing.

Automate savings

Automation reduces reliance on willpower. Scheduled transfers to savings or investment accounts improve consistency.

Invest for long-term growth

Savings alone may not generate sufficient growth. Investing supports wealth accumulation and protects purchasing power over time.

Practical Money Management Example

Consider a person earning $3,500 per month after taxes.

A structured money management plan might allocate:

Rent and utilities: $1,400

Groceries and transport: $600

Insurance: $200

Debt repayment: $300

Emergency savings: $400

Investments: $300

Lifestyle spending: $300

Total: $3,500

This plan balances current living costs with future planning.

If income increases, additional funds can be directed toward savings or investments rather than lifestyle inflation. The key principle is intentional allocation. Money is assigned purpose before it is spent. Over time, consistent saving and investing support financial resilience and growth.

Conclusion

Money management is the structured control of income, expenses, savings, and investments. It transforms financial decisions from reactive to intentional.

Strong money management reduces stress, builds security, and supports long-term goals. It does not depend on high earnings but on disciplined allocation and consistent review.

By developing clear financial habits and aligning spending with priorities, you create a stable foundation for wealth building.

FAQ

Is money management only about budgeting?

No. Budgeting is one component. Money management also includes saving, investing, debt control, and financial planning.

How can beginners improve money management quickly?

Start by tracking expenses, creating a simple budget, and automating savings. Small structured steps produce steady progress.

Why is money management important before investing?

Without stable cash flow and emergency savings, investing can create unnecessary risk and financial pressure.

References:

Ascend Bank, 5 Fundamental Principle of Money Management, 2026.

Money Helper, Managing Your Money, 2026.