Before you can buy or sell any financial asset, you need a place to do it. That place is called a trading account.

Understanding the trading account meaning is one of the most practical first steps for anyone who wants to participate in financial markets. Here is how trading accounts work, what they cost, and how to choose the right one for your needs.

What Is a Trading Account?

A trading account is a type of financial account that allows you to buy and sell assets such as stocks, ETFs, bonds, and other securities through a licensed broker or platform.

When you open a trading account, you deposit funds into it. Those funds are then used to execute trades in the financial markets. Any gains, losses, dividends, or cash from sales are reflected in the account balance.

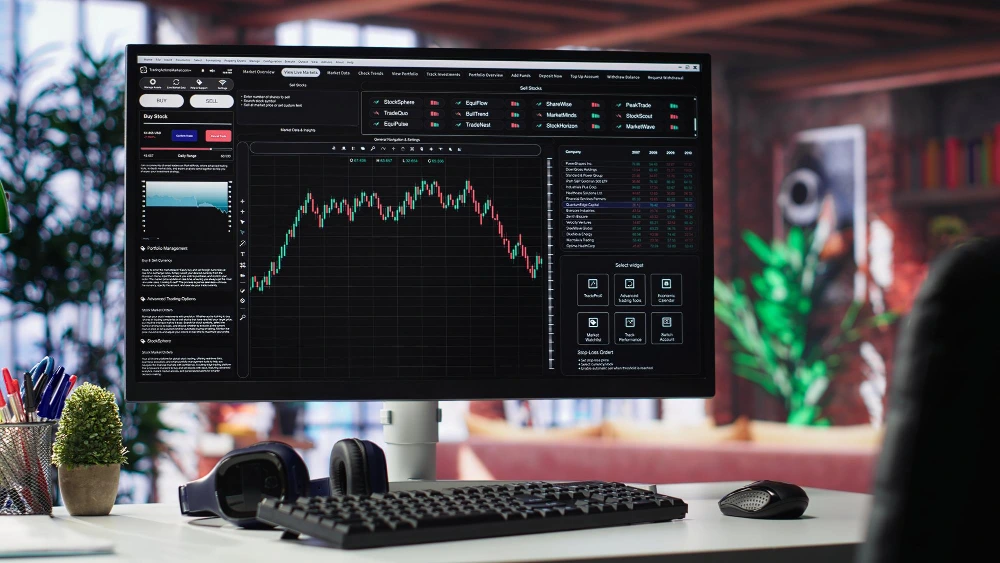

Most trading accounts are accessible online or through a mobile app, making it straightforward for anyone to start investing from anywhere in the world.

How Trading Accounts Work

Understanding how a trading account works involves knowing the basic steps from opening an account to placing your first trade.

Opening an account

To open a trading account, you apply with a licensed brokerage or investment platform. The process typically requires:

- A valid form of identification.

- Proof of address.

- Basic personal and financial information.

Most platforms complete verification within a few hours to a couple of days. Some platforms offer instant verification through digital ID checks.

Funding the account

Once verified, you transfer money from your bank account into your trading account. This is your available capital for investing. Most platforms support bank transfers, and some accept additional deposit methods.

Placing trades

With funds in your account, you can search for stocks, ETFs, or other assets and place buy or sell orders. You select the asset, the number of shares or dollar amount, and choose your order type before confirming the trade.

Holding and monitoring

After a trade is executed, the asset is held in your account. You can monitor its performance, receive dividends if applicable, and decide when to sell.

Withdrawing funds

When you sell an asset, the proceeds return to your account balance. You can reinvest them into other assets or withdraw them back to your bank account. Withdrawal timelines vary by platform.

Trading Account vs Investment Account

The terms trading account and investment account are often used interchangeably, but there are subtle differences worth understanding. The distinction comes down to how you use the account rather than the account itself.

| Aspect | Trading Account | Investment Account |

|---|---|---|

| Typical holding period | Short to medium term | Long term |

| Primary goal | Profit from price movements | Wealth building over time |

| Activity level | More frequent trades | Buy and hold |

| Account type | Usually the same platform | Usually the same platform |

Costs and Fees

Understanding the cost structure of a trading account is essential. Fees reduce your overall returns, and small differences in cost can add up significantly over time.

Commission fees

Some brokerages charge a flat fee or percentage each time you buy or sell an asset. Many modern platforms have moved to zero-commission trading for stocks and ETFs, but always confirm before signing up.

Spread

Even on zero-commission platforms, brokerages may earn through the spread, which is the difference between the buy price and the sell price. A wider spread adds an indirect cost to each trade.

Currency conversion fees

If you are based outside the United States and investing in US-listed assets, your platform may charge a fee to convert your local currency into US dollars. This can be a significant cost for frequent traders.

Inactivity fees

Some platforms charge a fee if your account sits unused for an extended period. Check the fee schedule before opening an account.

Withdrawal fees

Transferring money from your trading account back to your bank may come with a fee on certain platforms.

Being clear on all associated costs before you start helps you choose a platform that keeps more of your returns in your pocket.

Choosing the Right Account

With so many platforms available, choosing the right trading account comes down to a few key factors.

Regulation and licensing

Only open an account with a platform that is licensed and regulated by a recognized financial authority. This protects your funds and ensures the platform meets minimum standards of transparency and security.

Access to markets

Check whether the platform gives you access to the markets and assets you want to invest in. If you want to invest in US stocks from Southeast Asia, for example, make sure the platform supports that specifically.

Fee structure

Compare the full cost of using each platform, including spreads, conversion fees, and withdrawal charges, not just whether commission is zero.

Minimum deposit

Some platforms require a minimum deposit to open an account. Others allow you to start with any amount. Look for a platform that fits your starting capital.

Fractional shares

If you want to invest in high-priced stocks without committing large sums, look for a platform that offers fractional share investing. This allows you to buy a portion of a share rather than needing to purchase a whole one.

User experience

A clear, intuitive interface makes a real difference, especially for beginners. Look for platforms that make it easy to search for assets, review performance, and place orders without confusion.

Conclusion

A trading account is the foundation of your investing journey. It connects you to financial markets and gives you the tools to buy, hold, and sell assets over time.

Understanding the trading account meaning, how it differs from a long-term investment account, and what costs to watch for puts you in a much stronger position when choosing where to invest.

The right account depends on your goals, your starting capital, and the markets you want to access. Start with a regulated platform, keep fees low, and focus on building consistent habits over time.

FAQ

What is the trading account meaning?

A trading account is a financial account that allows you to buy and sell assets such as stocks and ETFs through a licensed broker or investment platform.

How does a trading account work?

You open an account, deposit funds, and use those funds to buy and sell financial assets. Gains, losses, and dividends are reflected in your account balance. You can withdraw cash back to your bank at any time.

What is the difference between a trading account and an investment account?

The terms are often used interchangeably. A trading account is typically associated with more frequent activity, while an investment account implies a longer-term, buy-and-hold approach.

References

- Investopedia, Brokerage Account: Definition, How to Choose, Types, 2026.

- SEC, Introduction to Investing: Brokerage Accounts, 2026.