Price alone does not tell the full story of market activity. A move that happens on heavy volume carries different meaning than the same move on light volume. This is where VWAP comes in.

VWAP, or Volume Weighted Average Price, is widely used by professional traders and institutions to understand where most trading activity has occurred during the day. It provides context for price, execution quality, and intraday bias.

This guide explains what VWAP is, how VWAP trading works, and why volume weighted price matters in real market conditions.

Understanding VWAP and Volume-Weighted Price

VWAP, stands for Volume Weighted Average Price, is the average price of an asset during the trading day, weighted by volume.

Instead of treating every price equally, VWAP gives more importance to prices where more shares were traded. This makes it a more realistic representation of where the market has actually done business.

What VWAP measures

VWAP combines two key elements:

-

Price

It answers a simple question: At what price did most trading activity occur today?

Because of this, VWAP is often viewed as a benchmark rather than a prediction tool.

How VWAP is calculated conceptually

VWAP is calculated by multiplying price by volume for each trade, adding those values together, and dividing by total volume.

While traders do not need to calculate it manually, understanding the logic helps interpret its behavior.

VWAP resets at the start of each trading day and updates continuously during market hours.

How Traders Use VWAP in Practice

VWAP is primarily an intraday tool.

VWAP as a benchmark for execution

Institutional traders often use VWAP to evaluate execution quality.

Buying below VWAP or selling above VWAP is generally considered favorable execution. This is why VWAP is commonly referenced by large funds and algorithmic traders.

VWAP as dynamic support and resistance

Many traders observe how price behaves around VWAP.

-

Above VWAP, market bias is often considered bullish

-

Below VWAP, market bias is often considered bearish

VWAP can act as a dynamic level where price reacts, especially in liquid stocks.

VWAP in trend vs range conditions

VWAP behaves differently depending on market conditions.

In trending markets:

-

Price may stay above or below VWAP for long periods

-

Pullbacks toward VWAP can act as continuation zones

In ranging markets:

-

Price may oscillate around VWAP

-

Mean reversion setups become more common

Understanding context is critical.

VWAP Trading Strategies and Use Cases

VWAP trading is not a single strategy, but a framework.

Trend confirmation with VWAP

Traders may use VWAP to confirm intraday trend direction.

- Long setups are favored when price holds above VWAP.

- Short setups are favored when price stays below VWAP.

VWAP helps align trades with dominant intraday flow.

Mean reversion around VWAP

In sideways markets, traders may look for price to revert back toward VWAP after extended moves away from it.

This approach assumes temporary imbalance rather than sustained trend.

VWAP and market open behavior

VWAP is especially useful after the market open.

Early price action can be volatile. As volume accumulates, VWAP becomes more stable and informative.

Many traders wait for VWAP to develop before making decisions.

Anchored VWAP variations

Some traders use anchored VWAP, which starts calculation from a specific event such as earnings or major highs and lows.

This variation helps analyze longer term volume weighted levels, though it goes beyond classic intraday VWAP.

Strengths and Limitations of VWAP

VWAP is powerful, but not universal.

Strengths of VWAP

VWAP:

-

Incorporates volume, not just price

-

Reflects where real trading occurred

-

Adapts dynamically during the day

-

Is widely watched by institutions

Because many participants monitor VWAP, reactions around it can be self reinforcing.

Limitations of VWAP

VWAP:

-

Is intraday only and resets daily

-

Lags during fast moving markets

-

Loses relevance late in the session if volume drops

-

Does not predict direction

VWAP should be used as context, not as a standalone signal.

VWAP vs Moving Averages

VWAP and moving averages are often compared.

Moving averages treat all prices equally, while VWAP weights prices by volume.

As a result, VWAP often reflects fair value more accurately during active trading periods, while moving averages are better suited for multi day trend analysis.

They serve different purposes and can complement each other.

Conclusion

VWAP, or Volume Weighted Average Price, shows where most trading activity has taken place during the day. It helps traders understand fair value, execution quality, and intraday bias.

By understanding how VWAP trading works and its limitations, traders can use volume weighted price as a contextual tool rather than a rigid signal.

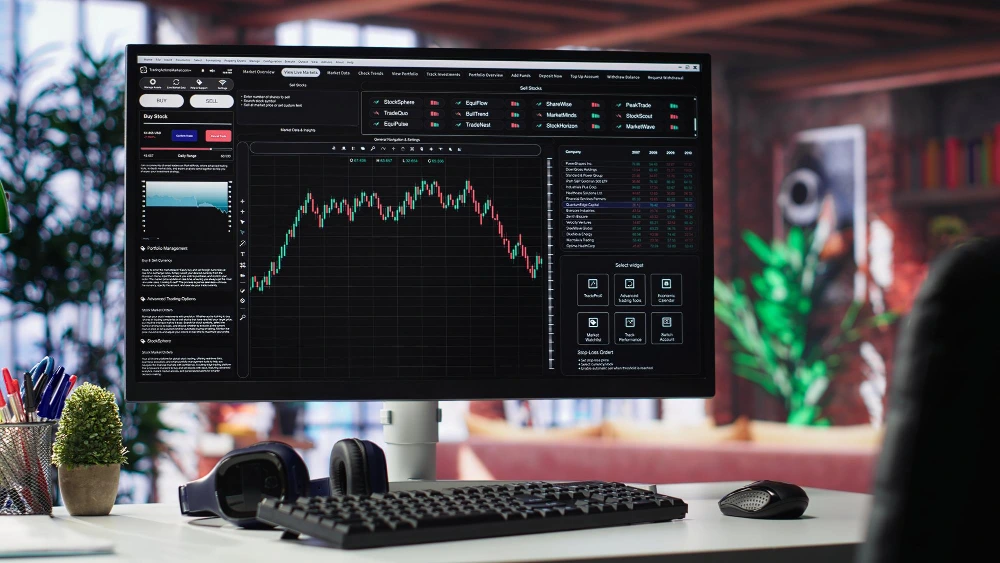

If you want to observe VWAP behavior across US stocks in live markets, you can use the Gotrade app. Charting tools make it easier to see how price interacts with volume throughout the trading day. You can also trade for 24 hours on 5 days!

FAQ

What is VWAP used for?

VWAP is used to measure the average price weighted by volume during the trading day.

Is VWAP good for long term investing?

No. VWAP is primarily an intraday tool.

Does price always respect VWAP?

No. VWAP provides context, not guarantees.

Is VWAP better than moving averages?

They serve different purposes and are often used together.

Reference:

-

Investopedia, Volume Weighted Average Price (VWAP), 2026.

-

Corporate Finance Institute, Volume Weighted Average Price (VWAP), 2026.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., which is registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.