In fast-moving markets, investors often feel pressure to act quickly. Prices rise, stories spread, and social feeds fill with success narratives. This emotional pressure is commonly described as FOMO, or fear of missing out.

Understanding FOMO investing is critical because it rarely feels irrational in the moment. FOMO does not arise from ignorance. It arises from comparison, urgency, and the discomfort of watching others appear to benefit while you remain on the sidelines.

FOMO is not a strategy failure. It is a behavioral response that can quietly override discipline.

What Is FOMO?

FOMO in investing refers to the emotional urge to enter a trade or investment primarily because others appear to be profiting, rather than because it aligns with a clear strategy.

The fear is not just missing profits. It is missing validation, participation, and belonging.

FOMO often intensifies when:

-

Prices rise rapidly

-

Success stories dominate narratives

-

Entry feels “now or never”

FOMO compresses decision time. It replaces analysis with urgency.

Importantly, FOMO is not about optimism. It is about anxiety-driven action.

Signs of FOMO in Investing

FOMO reveals itself through behavioral patterns rather than explicit thoughts.

Entering trades late in extended moves

One of the most common signs of FOMO is buying after a large price increase.

Instead of participating early, investors enter when evidence feels obvious but risk is already elevated.

Late entries often coincide with reduced upside and increased downside.

Ignoring risk management

FOMO-driven trades often lack clear risk parameters.

Stops are undefined, position size is excessive, and exits are based on hope rather than structure.

Risk management feels secondary to participation.

Overreliance on social validation

FOMO increases attention to what others are doing.

Investment decisions become influenced by social media, forums, or anecdotal success rather than personal analysis.

Consensus replaces conviction.

Frequent strategy switching

FOMO-driven investors jump from one opportunity to another.

As soon as one asset stalls, attention shifts to the next trending idea. This behavior fragments focus and prevents consistency.

Emotional urgency

FOMO creates a sense that waiting equals losing.

Patience feels like inaction rather than discipline. Decisions are rushed, not reasoned.

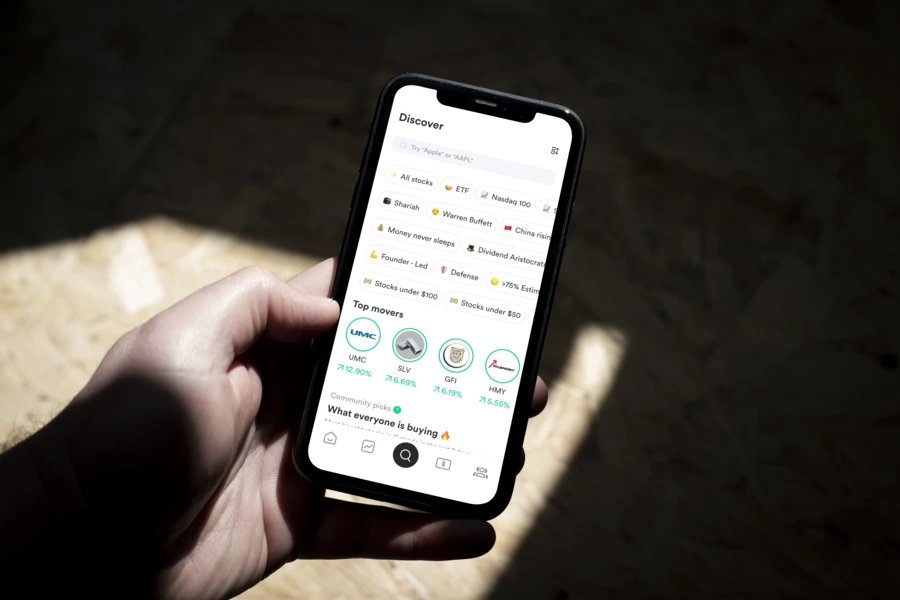

If you want to observe how hype-driven moves develop before acting, you can trade on Gotrade and watch price behavior unfold in real time rather than reacting to noise.

Examples of FOMO in Investing

FOMO appears across different market environments.

In bull markets, investors often chase fast-rising stocks or sectors after strong rallies, assuming momentum will continue indefinitely.

In speculative phases, new themes attract attention quickly. Early gains are amplified through narratives, pulling late entrants into crowded trades.

Even in declining markets, FOMO can appear as fear of missing “the bottom,” leading to premature entries without confirmation.

In each case, the pattern is the same: action driven by urgency rather than alignment.

FOMO does not require ignorance. Experienced investors experience it too.

How to Avoid FOMO in Investing

Avoiding FOMO does not mean avoiding opportunity. It means structuring decisions to reduce emotional pressure.

One effective approach is predefined criteria. Knowing in advance what conditions justify entry removes the need to decide under stress.

Another approach is time separation. Allowing time between idea discovery and execution reduces impulsivity.

Position sizing also matters. Smaller initial exposure reduces emotional attachment and regret.

Finally, focusing on process over outcome helps. Missing one trade is inconsequential compared to damaging discipline.

Avoiding FOMO is about protecting consistency, not capturing every move.

How Professionals Manage FOMO

Professional investors acknowledge FOMO but design systems to limit its influence.

They rely on rules, checklists, and review processes rather than emotion.

Professionals also accept that missing opportunities is inevitable. Capital preservation and clarity matter more than participation.

This mindset transforms FOMO from a trigger into a signal to slow down.

Conclusion

FOMO in investing is the fear-driven urge to act because others appear to be winning. It compresses decision time and replaces strategy with urgency.

Understanding fear of missing out helps investors recognize when emotions, not evidence, are driving decisions. FOMO does not disappear. It is managed.

Successful investing requires the ability to let opportunities pass without regret.

If you want to build investing discipline without reacting to hype, you can trade on Gotrade and practice making decisions based on structure and risk rather than urgency.

FAQ

What is FOMO in investing?

It is the fear of missing potential profits that leads to rushed or emotional investment decisions.

Is FOMO always bad?

FOMO itself is natural, but acting on it without structure increases risk.

How can investors reduce FOMO?

By using predefined rules, managing position size, and separating emotion from execution.

Does FOMO affect experienced investors?

Yes. Experience reduces frequency, not vulnerability.

References

-

Investopedia, Fear of Missing Out (FOMO) in Investing, 2026.

-

Golden Ratio Journal, The Effects of FOMO on Investment Behavior in the Stock Market, 2026.