Timeframe is one of the first choices every trader makes, often without realizing how important it is. The timeframe you trade on affects how often you enter the market, how much noise you see, and how you manage risk.

Understanding what is timeframe in trading and how trading timeframe selection works helps traders avoid mismatched strategies, emotional mistakes, and unrealistic expectations.

What Is Timeframe in Trading

A timeframe defines the period each price bar or candlestick represents.

In trading, timeframe refers to how much time a single candle, bar, or data point covers on a chart. This can range from seconds to months.

Your chosen timeframe determines how you see price movement, trends, and volatility. It shapes the entire trading experience.

Types of Trading Timeframes

Different timeframes suit different trading styles.

Short-term timeframes

Short-term timeframes include seconds, 1-minute, 5-minute, and 15-minute charts.

They show detailed price movement but contain more noise and false signals. These timeframes are commonly used by scalpers and day traders.

Medium-term timeframes

Medium-term timeframes include 30-minute, 1-hour, and 4-hour charts.

They balance detail and clarity, reducing noise while still offering regular opportunities. Swing traders often prefer these timeframes.

Long-term timeframes

Long-term timeframes include daily, weekly, and monthly charts.

They focus on broader trends and long-term market direction. Position traders and investors rely on these timeframes for decision-making.

How to Choose the Right Trading Timeframe

There is no universally correct timeframe.

Match timeframe with trading style

- Scalping requires very short timeframes.

- Swing trading works best on medium timeframes.

- Long-term investing relies on higher timeframes.

Your strategy should dictate your timeframe, not the other way around.

Consider time availability

Shorter timeframes demand constant attention.

Higher timeframes allow more flexibility and less screen time. Choose a timeframe that fits your lifestyle.

Align with risk tolerance

Lower timeframes experience rapid price swings.

Higher timeframes move more slowly but with larger overall swings. Risk tolerance should guide timeframe selection.

Avoid forcing signals

A good setup on the wrong timeframe often fails. Consistency matters more than chasing frequent trades.

Trading Strategies Across Timeframes

Timeframe affects how strategies behave.

Single-timeframe strategies

Some traders use only one timeframe for entries and exits. This approach is simpler but may miss broader context.

Multi-timeframe analysis

Many traders combine timeframes.

- Higher timeframes define trend direction.

- Lower timeframes refine entries and exits.

This improves alignment and reduces false signals.

Strategy sensitivity

Indicators and patterns behave differently across timeframes. A strategy that works on daily charts may fail on 5-minute charts. Always test strategies on the timeframe you plan to trade.

Common Mistakes with Trading Timeframes

Timeframe errors are common among beginners.

Switching timeframes mid-trade

Changing timeframes during a trade creates confusion. It often leads to emotional decisions.

Using a timeframe that does not match personality

Fast charts increase stress and overtrading. Slow charts require patience and discipline. Mismatch leads to burnout or impulsive behavior.

Ignoring higher timeframe context

Trading against higher timeframe trends reduces probability.

Context matters more than individual signals.

Practical Example of Timeframe Choice

An example highlights the difference:

A trader enters a stock on a 5-minute chart. Price pulls back sharply, triggering fear.

On the daily chart, the move looks insignificant. The issue was not the trade, but the timeframe mismatch.

Timeframe in Trading and Long-Term Consistency

Timeframe consistency supports discipline. Using the same timeframe reduces second-guessing. It helps traders evaluate performance accurately. Over time, clarity improves execution and confidence.

Conclusion

Timeframe in trading defines how you see the market and how you interact with it. By understanding what a trading timeframe is, the different types available, how to choose the right one, and how strategies change across timeframes, traders can align their approach with reality rather than emotion.

There is no perfect timeframe, only the one that fits your strategy, personality, and goals. Consistency matters more than speed.

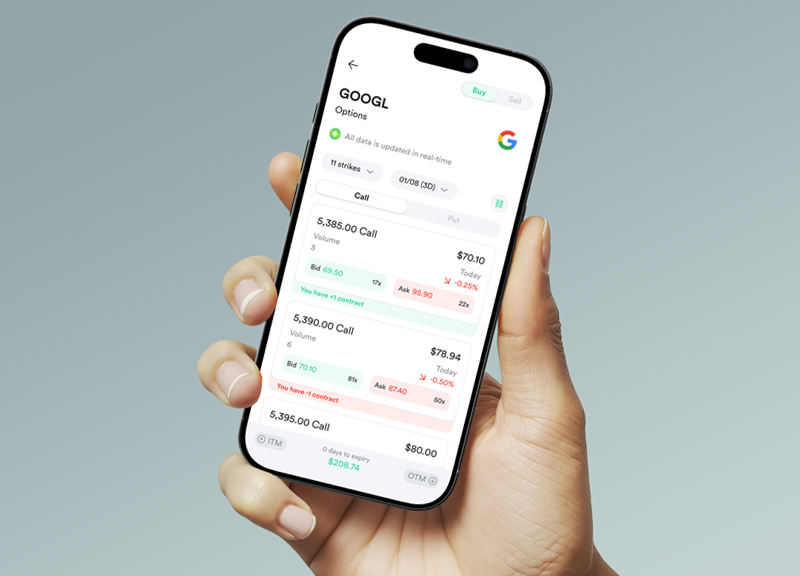

When trading stocks or ETFs through the Gotrade app, choosing a timeframe that matches your strategy can help you stay disciplined, manage risk better, and make clearer decisions.

FAQ

What is timeframe in trading?

A timeframe is the period each chart candle or bar represents.

Is lower timeframe better for beginners?

Not always. Lower timeframes are faster but noisier and more stressful.

Can I trade multiple timeframes?

Yes. Many traders use higher timeframes for direction and lower ones for entries.

Does timeframe affect profitability?

Yes. Using the wrong timeframe for a strategy often leads to poor results.

Reference:

-

Investopedia, Understanding Multi Time Frames, 2026.

-

IG Group, Trading Timeframes Explained, 2026.