Written by Aries Yuangga

Lululemon Athletica (NASDAQ: LULU) has had a brutal 2025, but the business quality is far better than the share price suggests:

- Q2 2025:

- Revenue $2.5B (slight miss vs Street by ~0.5%)

- EPS $3.10, solid beat

- Guidance cut: FY growth from 5–7% → 2–4%, driven by stale assortments + tariff headwinds.

- Stock crashed ~18% post-earnings, from ~$205 → mid-$150s, and has only partially recovered to ~$169, making it one of 2025’s worst performers.

- Yet the moat remains intact:

- ROE has sat in the 20–30%+ range since 2010.

- Premium pricing + high gross margins reflect strong brand power.

- Moat is built on innovation, niche ambassador marketing, and DTC-centric distribution.

- U.S. now guided to be -1% to -2% in 2025, but international still growing double-digits and is far from saturated.

- Valuation: ~12–13x forward P/E, a discount vs peers despite stronger long-term growth + brand equity comparable to Nike/Adidas.

Rating: STRONG BUY. High-quality compounder temporarily punished for fixable issues, not structural damage.

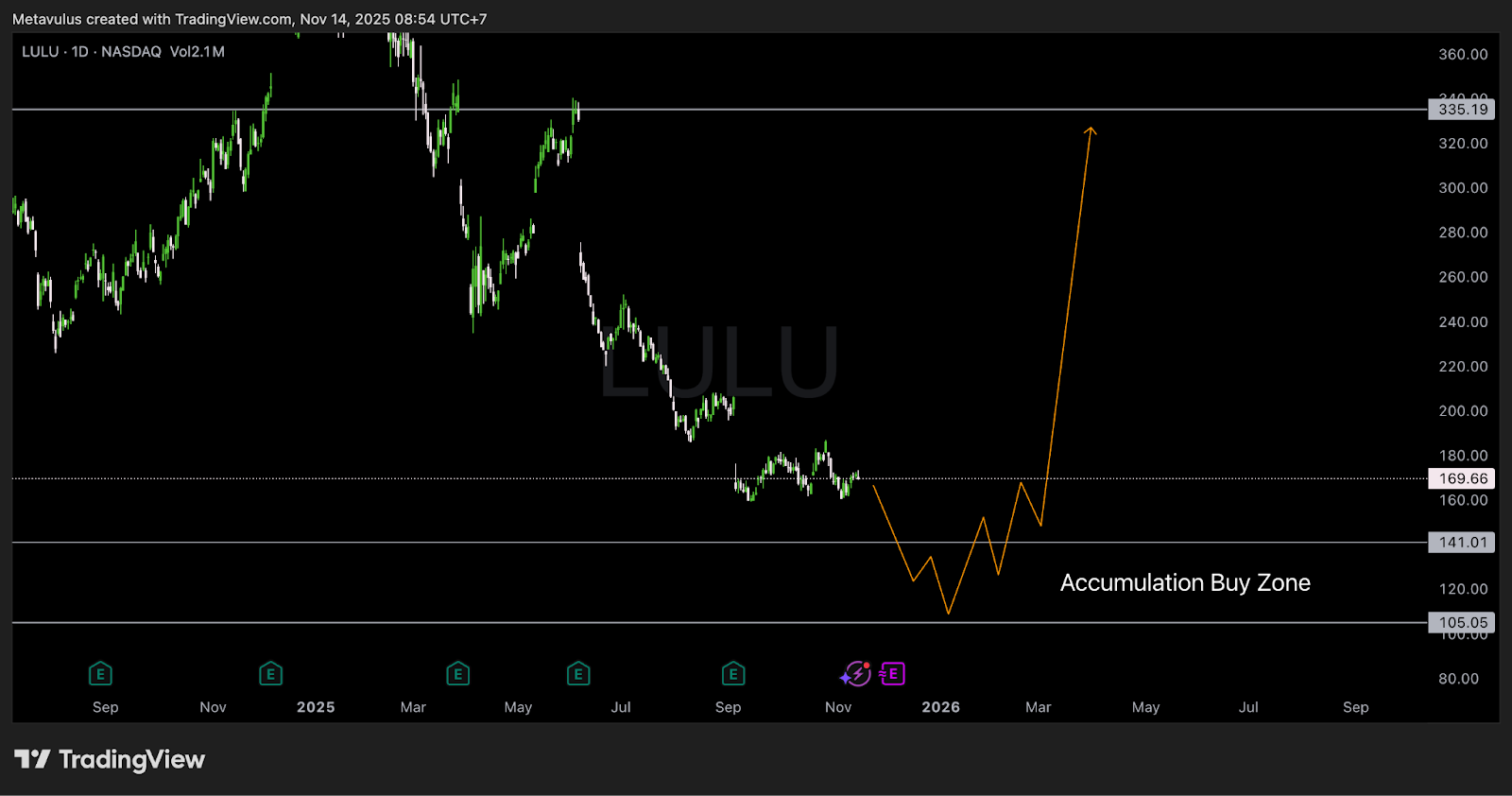

Technical Analysis

- Current Price: ~$169.66

- Primary Accumulation Buy Zone:

- $141.01 – $105.05 (major horizontal demand band; prior structural base)

- Upper Support / First Reaction Level:

- $141.01

- Deeper Value Support:

- $105.05 (Covid-style panic level / “max fear” discount)

- Upside Target:

- TP Macro: $335.19 (prior ATH / measured move)

- Invalidation:

- Weekly close < $105.05 (macro-uptrend thesis broken; reassess)

Read:

LULU has been grinding sideways after the earnings gap-down, forming a base around the high-160s. The healthiest path would be one more washout into $141–120, possibly a spike toward $110–105, to shake out weak hands and build a new higher low. From there, a multi-quarter mean-reversion toward $280–335 is very realistic if fundamentals normalize.

Trading Setup

DCA Plan

- 40% at $145–140

- 40% at $125–115

- 20% at $110–105 (“final bid” if panic hits)

Stop Loss

- Swing traders: Weekly close < $105.05

- Long-term investors: use fundamental stop (e.g., multi-year ROE/margin erosion + brand momentum clearly broken).

Take Profit

- TP1: Revisit old range $230–250 (take partials, de-risk).

- TP2: $335.19 (prior ATH; trail stop below new higher lows).

Income Strategy

- While waiting for a flush:

- Sell cash-secured puts at $140–120 (30–60 DTE).

- If assigned, run covered calls at $260–340 to monetize volatility.

Growth Thesis: Why Lululemon’s Moat Still Matters

1️⃣ ROE & Margins Prove a Real Moat, Not a Fashion Fad

- ROE has held in the 20–30%+ band for 15+ years.

- Gross margins are consistently high, well above most peers, signaling pricing power + brand loyalty.

- Economic theory: such high returns should attract competition and revert to the cost of capital; the fact they haven’t is strong evidence of a durable moat.

Key idea: This is not a random athleisure label; it is a category-defining brand for women’s performance apparel.

2️⃣ Premium Product + Innovation Engine

- LULU built its edge by:

- Targeting female athletes first, an area Nike/Adidas historically under-served.

- Selling $100+ pieces that customers accept as premium because:

- Quality & fit are top-tier.

- Continuous fabric & design innovation supports the price point.

- Management openly admitted they leaned too hard on core franchises → offerings felt “stale.”

- But innovation has always been the company’s DNA, turning that engine back on is a process, not a reinvention.

If they simply return to their historic pace of product innovation, the pricing power + margins are likely to remain intact.

3️⃣ Ambassador + Influencer Playbook = Hyper-Efficient Marketing

- Instead of burning billions on superstar athletes only, LULU:

- Partners with yoga teachers, runners, trainers, local community figures.

- Leverages niche authority: when your yoga coach wears Lululemon, it becomes the “default” choice.

- This strategy:

- Creates trust + social proof.

- Keeps marketing spend highly efficient (high sales per marketing dollar vs big-brand peers).

The result is a flywheel of organic demand with lower spend intensity than traditional mass-sport brands.

4️⃣ DTC-Heavy Distribution Protects Brand & Margins

- LULU leans on:

- Company-operated stores + e-commerce, not wholesale.

- Benefits:

- Tighter control over pricing, promos, and in-store experience.

- Avoids the heavy discounting cycles that often erode brand equity in wholesale channels.

- Higher average margins → more cash to reinvest + buy back stock.

For a premium brand, DTC dominance is a structural advantage, not a bug.

5️⃣ International Is the Next Chapter

- Management now expects:

- U.S. revenue -1% to -2% in 2025.

- International segment still growing double digits.

- Outside North America, LULU’s penetration is still low vs Nike/Adidas.

- The same consumer psychology, premium pricing as quality signal, community/ambassador marketing, athleisure lifestyle, exists in Europe & Asia.

- Tactics may need local tweaking, but the core playbook is portable.

Long term, international growth can offset a slower, more mature U.S. business and re-accelerate consolidated revenue back toward high-single / low-double digits.

Valuation & Return Scenarios

- Market Cap: ~$20B

- Forward P/E: ~12–13x

- Rev growth (YoY): ~9% currently, guided 2–4% for 2025 due to tariffs + stale assortment.

For a brand with:

- ROE 20–30%,

- High margins,

- A global runway,

…a low-teens P/E looks more like “distress pricing” than fair value.

Base Case (3–5 Years)

- US returns to mid-single-digit growth, international stays double digit → blended high-single-digit topline.

- Margins remain strong, modest buybacks continue.

👉 Fair multiple 18–20x on higher EPS → share price $250–280.

Bull Case

- Innovation cycle hits, tariffs moderate, and international scaling works.

- Revenue back to low-double-digit growth, margins expand a bit.

👉 Market re-rates LULU closer to Nike/Adidas multiples (20–22x) → Price range $300–340+ (retests/clears prior ATH at $335).

Bear Case

- Fashion cycle turns, competition (Nike, fast fashion, knockoffs) erodes growth.

- International fails to offset a structurally flat U.S.

- Market holds P/E at 10–11x on sluggish earnings.

👉 Stock trades $130–150, still supported by brand value but with limited upside.

Risk/reward from ~$170 with a buy plan closer to $140–120 remains skewed to the upside.

Key Risks

- Competition: Nike, Adidas, UA, fast fashion, warehouse clubs (Costco knockoffs) all chasing the same wallet.

- Innovation Risk: If LULU fails to re-ignite “newness,” premium pricing could come under pressure.

- Tariffs / Macro: External shocks (tariffs, weak consumer spending) can drag US results longer than expected.

- International Execution: Cultural misreads or poor localization could blunt growth outside North America.

Conclusion

Lululemon is:

- A category-defining premium brand,

- With decade-plus of elite ROE and margins,

- Strong, repeatable marketing + distribution playbook,

- And a long runway internationally.

2025’s drawdown is driven by fixable issues (product refresh + tariffs), not a broken business model.

Verdict: STRONG BUY.

Look to accumulate in the $141–105 zone, manage risk below $105, and aim for $250–335 over the next cycle once innovation and international growth reassert the story.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.