Jakarta, Gotrade News - The global investment landscape is seeing a major shift toward fixed-income instruments—assets that were previously written off as "boring." Recent data shows massive inflows into bond ETFs while The Fed holds interest rates steady at the 4 percent level.

Key Takeaways

- Total inflows into bond funds hit $300 billion in the first nine months of 2025.

- Bond yields are now far more attractive compared to the zero-interest era of the 2010s.

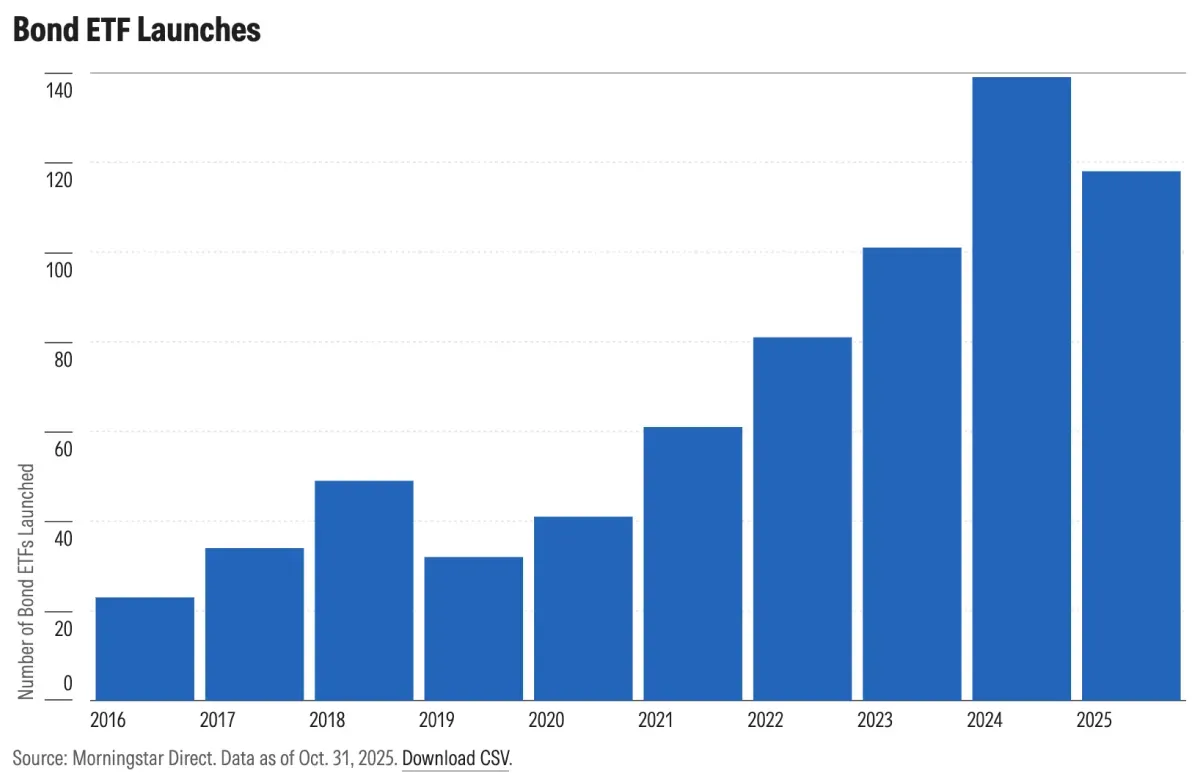

- About two-thirds of new bond ETFs launched since 2019 are actively managed to optimize return potential.

Read also: Nvidia’s Next Move: More Than Just Selling AI Chips

During the first nine months of 2025, investors moved nearly $300 billion into bond funds. According to a Morningstar report, this figure makes up about 30 percent of all ETF inflows this year.

The main appeal lies in yields that are significantly more competitive now compared to the last decade. With the Fed’s short-term rates hovering around 4 percent, these instruments offer returns that actually make sense historically.

This spike in interest is also pushing asset managers to issue more actively managed products. Approximately two-thirds of new bond ETFs launched between January 2019 and October 2025 utilize active management strategies.

Market Strategy Options

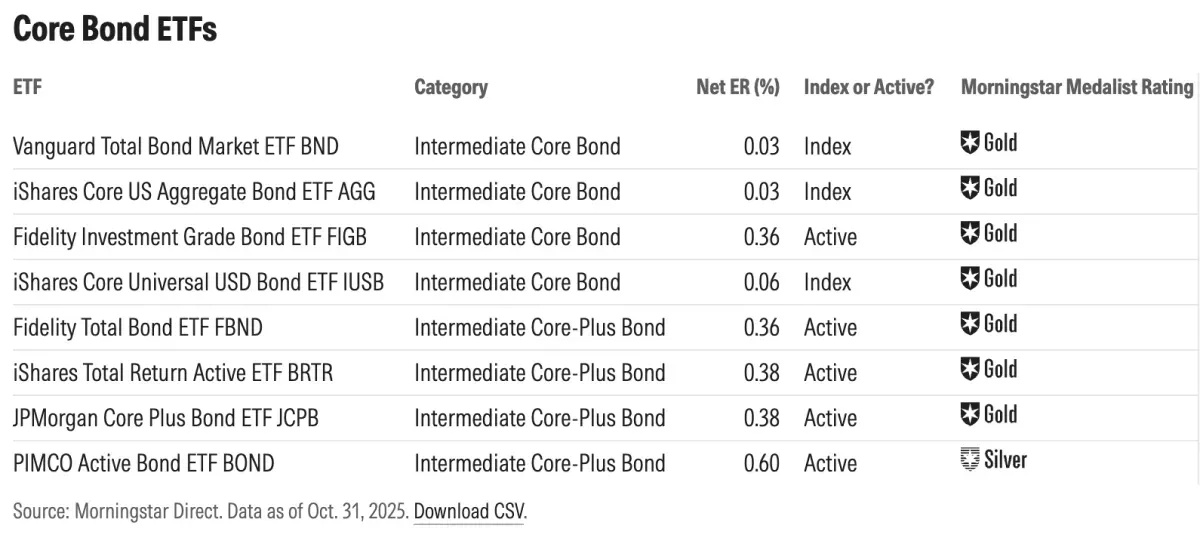

For a low-risk core strategy, investors generally opt for index-based products like theVanguard Total Bond Market ETF. This type of ETF provides low-cost access to the stable investment-grade bond market.

However, index-based products are often heavy on government Treasuries, which typically have lower yields. Consequently, active investment managers have started offering broader portfolios that cover corporate or high-yield bonds to boost potential returns.

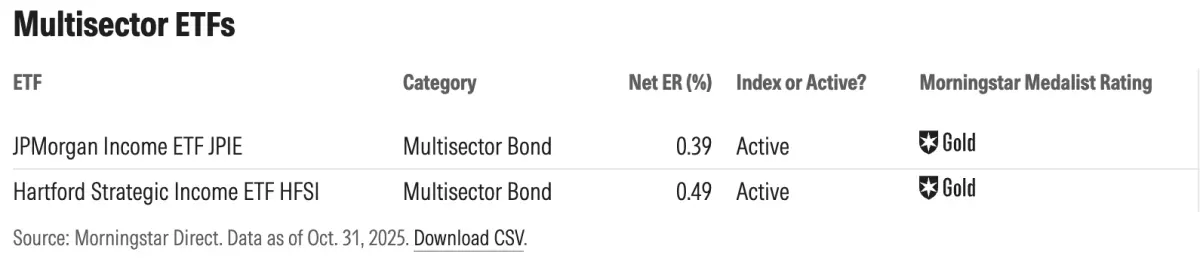

Investors bold enough to take on more risk for better income are starting to eye the multisector ETF category. This strategy allows investment managers to use a variety of tools to control risk while chasing yield.

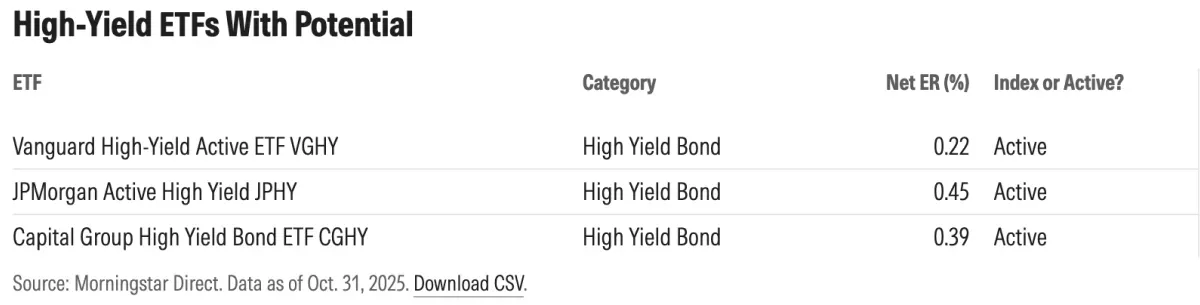

Meanwhile, high-yield bond ETFs offer the biggest potential gains but come with a fairly high correlation to the stock market. Instruments in this category require extra caution as their volatility is higher compared to standard core bonds.

Choosing the right instrument depends heavily on your risk tolerance and specific portfolio goals. However, the primary role of bonds—acting as a stabilizer against stock volatility—remains the most critical factor to consider right now.

Read also: Wells Fargo Unchained: Ready to Make Big Moves in 2026

Reference:

- Morning Star, Bond ETFs Are Having a Moment. Here’s How They Can Benefit Your Portfolio in 2026. Accessed on December 31, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.