Gotrade News - Google is planning to sell 100-year bonds in British pounds as part of a massive debt sale. It is a rare move not seen from a tech firm since the late 90s dot-com era.

This century-long debt issuance comes as the company faces massive capital needs. They are raising cash to win the expensive race for artificial intelligence infrastructure dominance.

Key Takeaways:

Alphabet becomes the first tech firm since 1997 to issue a 100-year bond.

Demand for the company's US dollar bonds hit $140 billion from global investors.

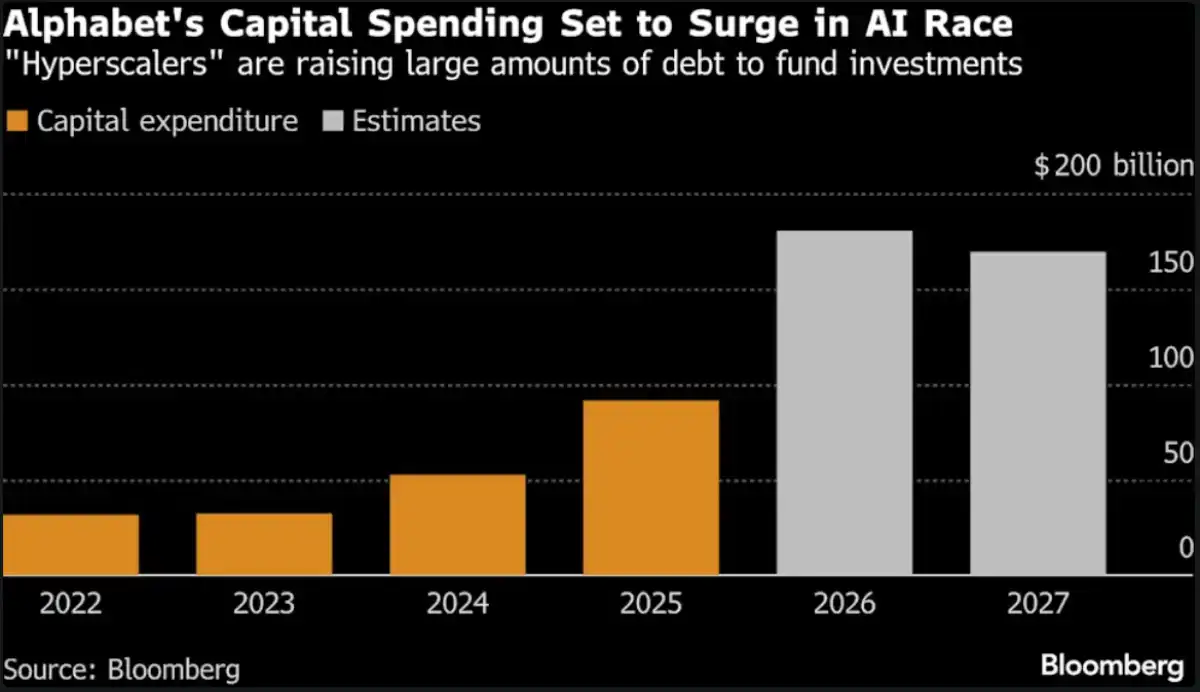

The funds will support a projected $185 billion in AI capital expenditure this year.

The move coincides with a US dollar bond sale that saw insane demand. The Australian Financial Review reports orders topping $140 billion from eager institutional investors.

This marks the first time a tech major has sold such long-dated debt since Motorola in 1997. The 100-year market is usually the playground of governments and universities, not corporates.

But the urgent need to build AI capabilities is bringing these ultra-rare deals back to life. Bloomberg reports Alphabet's capital expenditure could hit $185 billion this year alone.

This borrowing spree isn't unique to Google, with peers like Microsoft also spending big. Morgan Stanley expects hyperscalers to borrow a combined $400 billion this year.

That figure is a massive jump from the $165 billion borrowed in 2025. The scale of investment suggests the AI infrastructure build-out is nowhere near finished.

These 100-year notes target a very specific crowd, primarily pension funds and insurers. These buyers need super long-duration assets to match their decades-long liabilities.

The deal taps into strong demand from UK pension funds in the Sterling market. While successful, issuing century bonds will likely remain a market anomaly rather than a new standard.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

Bloomberg, Alphabet Plans Tech’s First 100-Year Bond Since Dot-Com Era. Accessed on February 10, 2026

The Australian Financial Review, Alphabet’s dollar bond sale draws over $140b of demand. Accessed on February 10, 2026

Featured Image: Shutterstock