Jakarta, Gotrade News - Bank of America just updated their bullish stance on three semiconductor giants. According to analyst Vivek Arya (via TipRanks), AI infrastructure spending is predicted to stay strong all the way until 2026.

Keytakeaways:

- AI infrastructure spending is set to remain strong until 2026, says Bank of America.

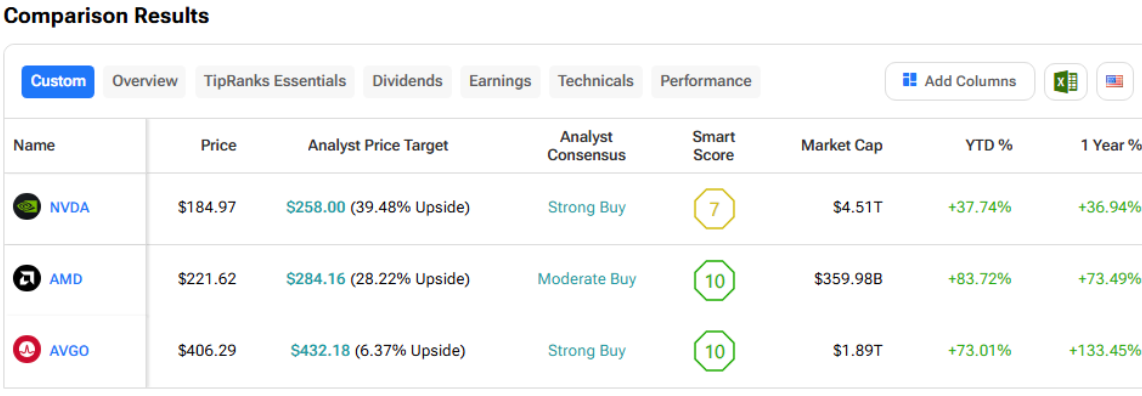

- Nvidia offers the highest potential upside of 39% compared to AMD and Broadcom.

- Broadcom is seen as having the most solid fundamentals ahead of its earnings report.

NVIDIA Corporation is rated as the top pick because demand is still outpacing supply. OpenAI's upcoming GPT-5.2 rollout is expected to be the major catalyst for a fresh wave of GPU orders.

Outlook for AMD and Broadcom

Advanced Micro Devices, Inc. is starting to get on investors' radar as a solid alternative to Nvidia. However, Arya warns about potential order instability from big clients like Oracle Corporation.

Meanwhile, the earnings report from Broadcom Inc. is the "main event" hitting the market today. They are in a very strong position thanks to their networking gear and custom chips used by Alphabet Inc..

Potential Upside

Wall Street analysis currently places Nvidia with the highest potential upside, reaching 39%. AMD follows in second place with a projected rise of around 28%, according to analyst consensus.

Broadcom shows the lowest potential upside at 6%, but it scores the highest on fundamentals compared to its competitors.

Referensi:

- TipRanks, Nvidia, AMD, and Broadcom (AVGO): Bank of America Stays Bullish on These 3 AI Chip Stocks. Accessed on December 11, 2025

- Featured Image: Shutterstock

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.