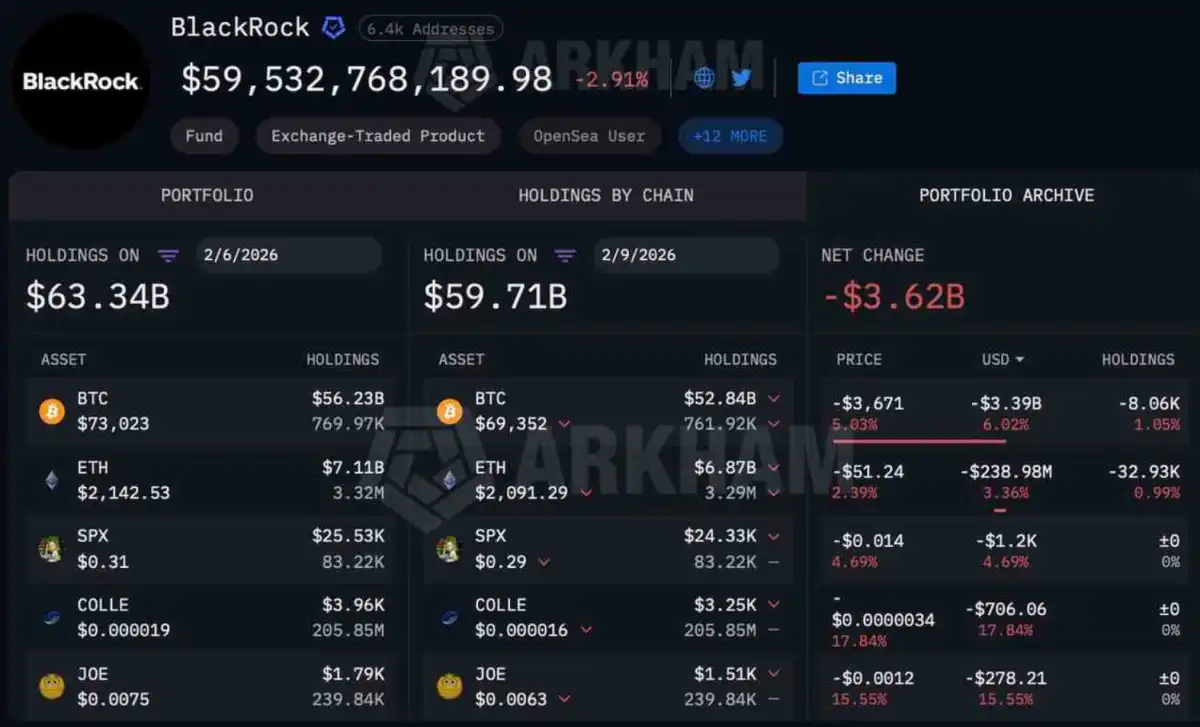

Gotrade News - BlackRock-linked crypto wallets just recorded a massive net outflow of $3.6 billion over a three-day span. This sharp movement between Friday (Feb 6) and Monday (Feb 9) has sparked fresh anxiety in an already fragile market.

With digital assets testing critical support levels, you need to look under the hood of these numbers. It is crucial to distinguish between institutional custody shifts and actual panic selling before making your next move.

Key Takeaways:

Crypto assets linked to BlackRock saw $3.6 billion in outflows driven by investor redemptions and price corrections.

Withdrawals were heavily concentrated in Bitcoin ($3.39 billion) and Ethereum ($238.98 million).

Market sentiment has hit "Extreme Fear" as Bitcoin retests the vital $60,000 support zone.

Real-time wallet tracking data reveals the fund's total holdings dropped significantly from $63.34 billion to $59.71 billion. According to Finbold, this outflow was largely focused on Bitcoin and Ethereum, which have both faced heavy selling pressure recently.

Crucially, this decline reflects custody flows related to ETFs rather than direct proprietary trading or "dumping" by BlackRock management. However, retail investors often misread these massive institutional movements as a broader bearish signal, fueling unnecessary FUD (Fear, Uncertainty, and Doubt).

This selling pressure coincides with heightened market volatility, where Bitcoin dipped 2.39% and Ethereum slid 4.69%. AInvest reports that market sentiment has now plunged into "extreme fear," with the index scoring a lowly 9.

In a move to manage liquidity, BlackRock deposited 2,268 BTC and 45,324 ETH into Coinbase Prime early this week. Such transfers are standard practice for asset managers ensuring they have enough liquidity to meet investor redemption requests.

The situation is further complicated by Ethereum exchange balances hitting their lowest levels in a decade. This tightening supply on exchanges could act as a double-edged sword, potentially amplifying price swings if selling pressure persists.

What to Watch Next

With Bitcoin hovering near $60,000 and Ethereum at $2,000, these technical support levels are the key battlegrounds to watch. Analysts at Crypto Economy warn that the mix of thin liquidity and extreme fear could trigger sharper downside moves if support breaks.

Short-term liquidity risk remains a real threat if stressed holders decide to head for the exits simultaneously. You should keep a close eye on on-chain data to spot potential volatility spikes before they hit the headlines.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

Finbold, BlackRock-linked crypto wallets see $3.6 billion in outflows in three days. Accessed on February 10, 2026

AInvest, BlackRock's $3.6B Crypto Outflows: A Signal of Institutional Stress or Strategic Rebalancing?. Accessed on February 10, 2026

Crypto Economy, Crypto Wallets Tied to BlackRock See $3.6 Billion Exit in 72 Hours. Accessed on February 10, 2026

Featured Image: Shutterstock