US stocks end the week higher as tech leads gains into key data and earnings

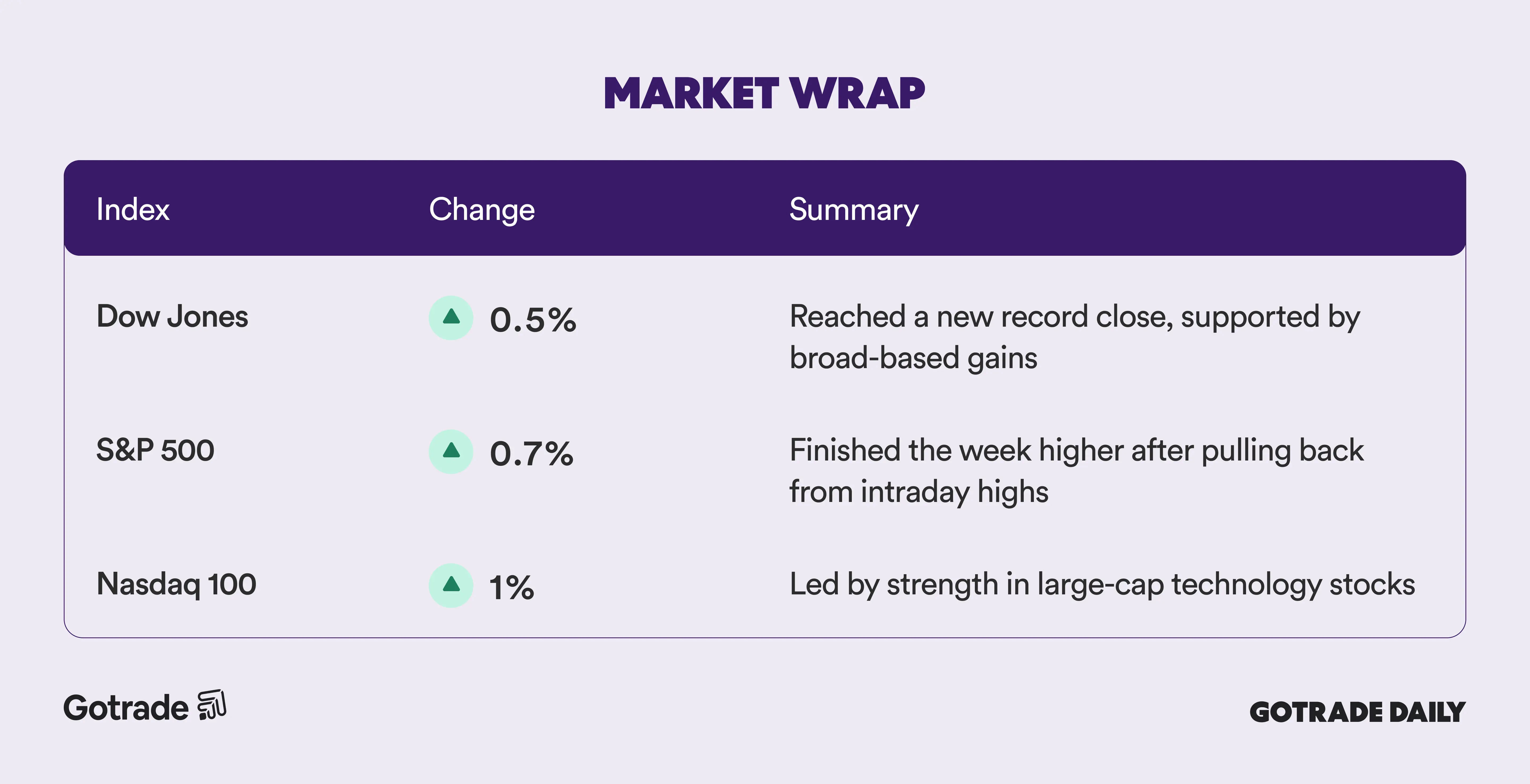

US stocks closed out the first full week of trading in 2026 on a positive note, with technology stocks leading gains and helping major indexes finish higher. The Dow Jones Industrial Average (DJI) and the S&P 500 (SP500) both ended Friday at fresh record highs, while the Nasdaq 100 (NDX) capped the week with solid momentum.

For the week, the Dow outperformed with gains of more than 2%, while the S&P 500 added around 1.6% and the Nasdaq 100 rose close to 2%. Large-cap technology names provided much of the support, reinforcing investor confidence as markets transitioned from holiday trading into a more active January session.

Oil prices also moved higher over the week as markets continued to assess developments in Venezuela and broader US energy policy. Brent crude rose more than 3% on the week, while West Texas Intermediate gained over 2%, reflecting tighter control over supply rather than immediate disruption concerns.

Looking ahead, attention turns to a busy macro and earnings calendar. Inflation data will take center stage with consumer price data due Tuesday (Jan 13th), followed by producer prices and retail sales on Wednesday (Jan 14th). Traders are currently pricing in a high probability that the Federal Reserve will keep interest rates unchanged at its January meeting, making this week’s data critical for confirming that outlook.

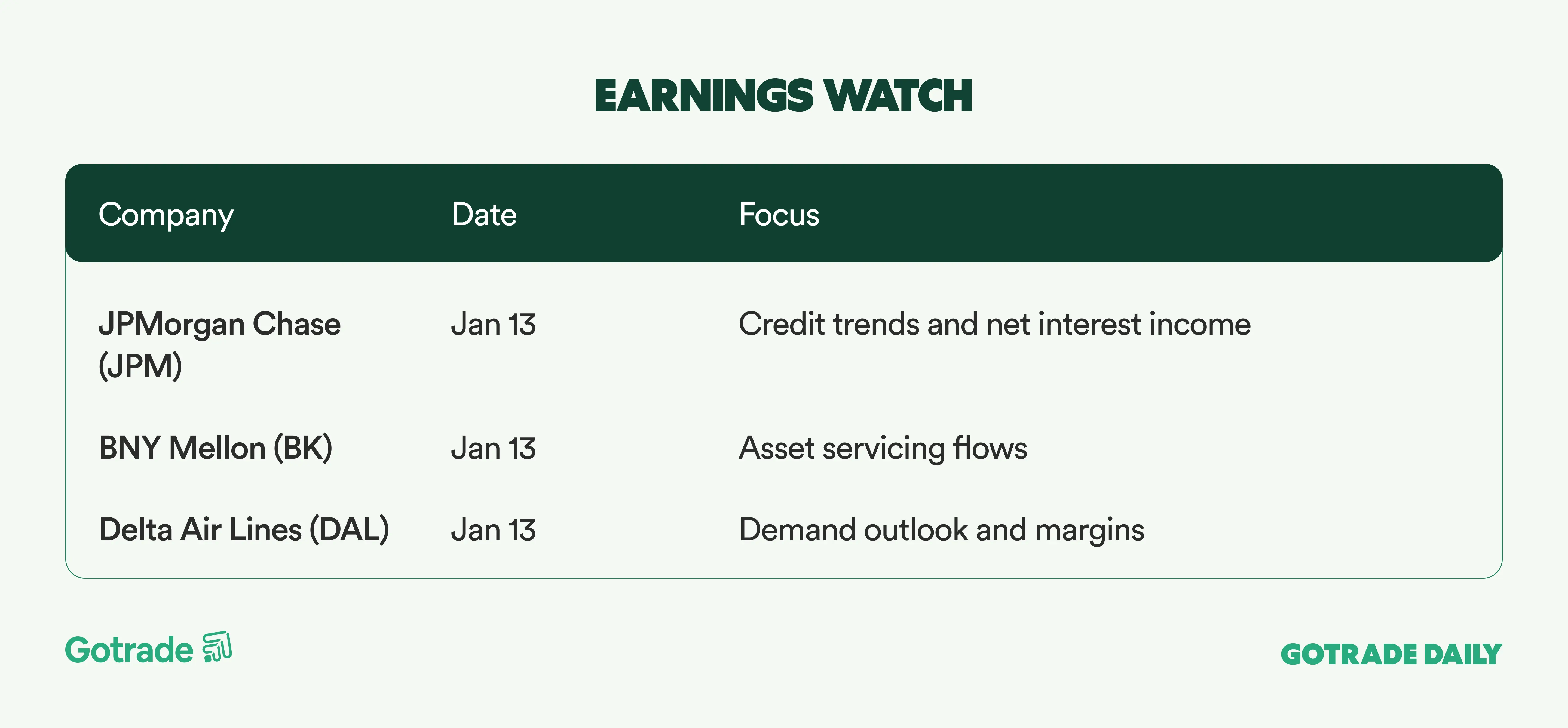

Earnings season also begins in earnest as major US banks report results. JPMorgan Chase (JPM) and BNY Mellon (BK) are scheduled to report on Tuesday, followed by Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) on Wednesday. Additional reports later in the week include Goldman Sachs (GS), Morgan Stanley (MS), and Taiwan Semiconductor (TSM), offering early signals on financial conditions, deal activity, and global chip demand.

📊 Market Wrap Jan 12th 2026

🧠 Analyst Notes

💬 Market Highlights

Trump Signals Potential Block on Exxon Venezuela Operations

President Trump said he may block Exxon Mobil (XOM) from operating in Venezuela after criticizing comments made by CEO Darren Woods, who described the country as currently “uninvestable.”

Trump said the remarks undermined efforts to rebuild Venezuela’s oil sector and suggested Exxon was being overly cautious. Exxon previously exited Venezuela following nationalization of the oil industry, while Chevron remains the only major U.S. producer still operating in the country.

Walmart Accelerates Drone Delivery Expansion With Alphabet’s Wing

Walmart (WMT) announced a major expansion of its drone delivery program through a deeper partnership with Alphabet (GOOG) (GOOGL) subsidiary Wing. The retailer plans to add drone services at 150 additional U.S. stores, potentially reaching over 40 million customers by 2027. The service targets small, time-sensitive orders and reflects improving regulatory conditions that could support broader adoption of aerial delivery.

Michael Burry Takes Bearish Position on Oracle

Investor Michael Burry disclosed that he holds put options on Oracle (ORCL), citing concerns over the company’s cloud strategy and rising debt levels amid the AI boom. The move marks another high-profile bearish bet by the “Big Short” investor, following similar positions previously taken against Nvidia (NVDA) and Palantir (PLTR). Burry’s stance highlights growing investor scrutiny over valuation and execution risks among large enterprise software and AI-linked names.

📅 Earnings Watch

With earnings season beginning and key inflation data ahead, markets enter the week with solid momentum but heightened sensitivity to surprises. Bank results and price data are likely to shape near-term positioning across sectors.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.