Retail sales soften as earnings drive rotation.

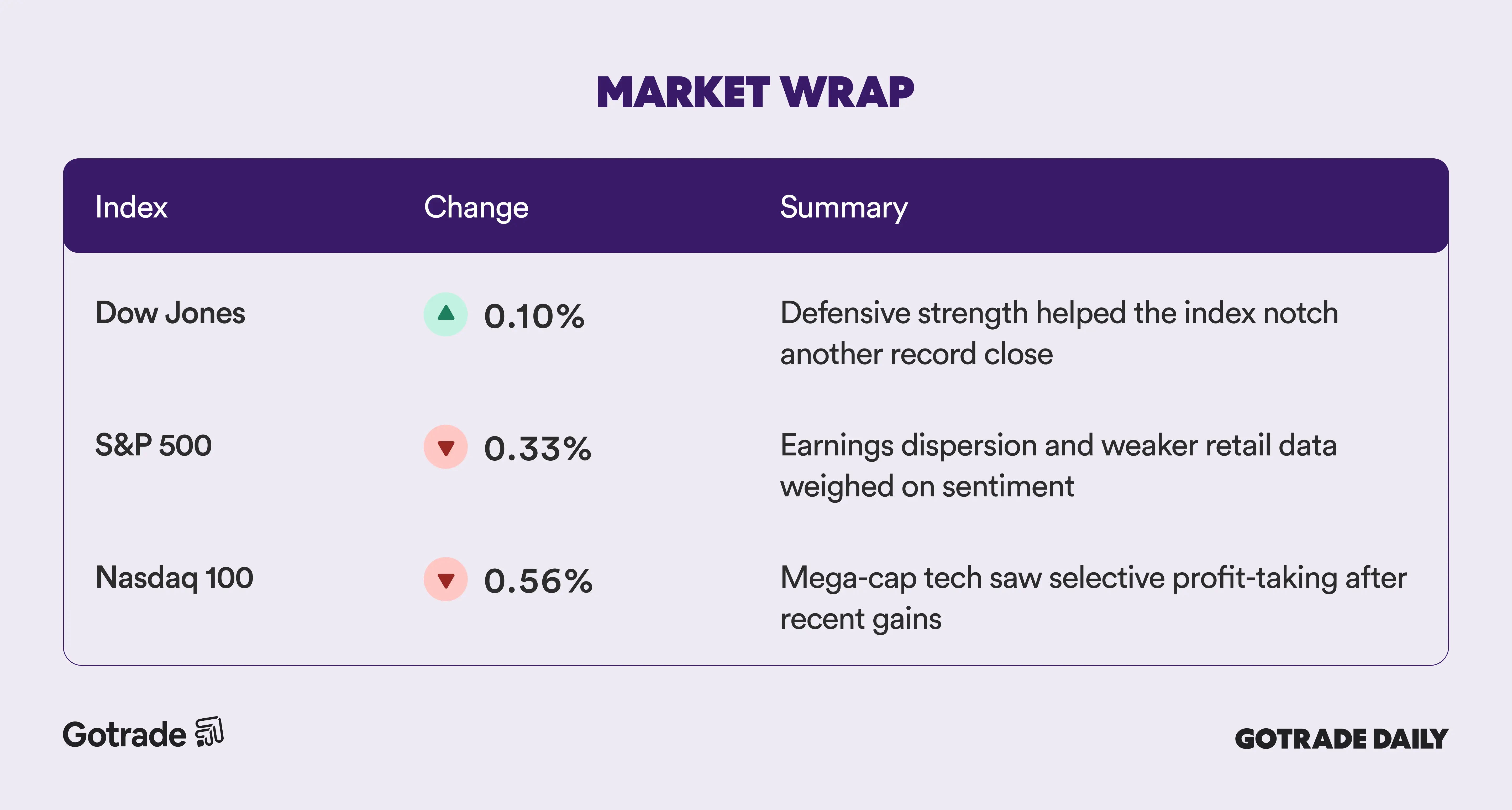

U.S. equities closed mixed on Tuesday as investors positioned ahead of a dense macro calendar, with the Dow Jones Industrial Average (DJI) securing a third consecutive record close while broader indexes edged lower. The Dow rose about 0.1%, while the S&P 500 (SPX) slipped roughly 0.3% and the Nasdaq Composite (IXIC) fell 0.6%, reflecting softer risk appetite outside select areas of strength.

Post-earnings moves continued to drive sharp single-stock dispersion. Spotify (SPOT) surged 15% following its results, while Hasbro (HAS) added 7.5% and AstraZeneca (AZN) advanced nearly 3%. On the downside, Upwork (UPWK) plunged 19%, Coca-Cola (KO) declined 1.5%, and CVS Health (CVS) finished modestly lower, reinforcing how earnings outcomes remain the primary driver of near-term positioning.

Large-cap technology showed mixed signals. Oracle (ORCL) extended gains with another 2% advance after leading the S&P 500 in the prior session, while Microsoft (MSFT) and Nvidia (NVDA) both finished down less than 1% after strong gains earlier in the week. The pattern points to rotation within mega-cap tech rather than a broad pullback, as investors reassess leadership following last week’s volatility.

Macro data added to the cautious tone. December retail sales were essentially flat, signaling a slowdown in consumer momentum from November’s 0.6% increase and falling well short of expectations. The softer reading reinforced growing conviction that policy easing could arrive later this year, with futures markets assigning a rising probability to rate cuts by June.

Commodities remained volatile. Gold futures slipped 0.4% to around US$5,060 per ounce, while silver futures fell 1.7% to roughly US$80.80. iShares Silver Trust (SLV) stayed on investors’ radar after extreme recent swings, with positioning increasingly focused on managing short-term volatility, often through instruments such as options.

Attention now turns to Wednesday’s January employment report, following recent indicators pointing to a softening labor market. The January CPI report due Friday will provide an additional read on inflation pressures as the Federal Reserve continues to balance growth risks with price stability.

📊 Market Wrap Feb 11th 2026

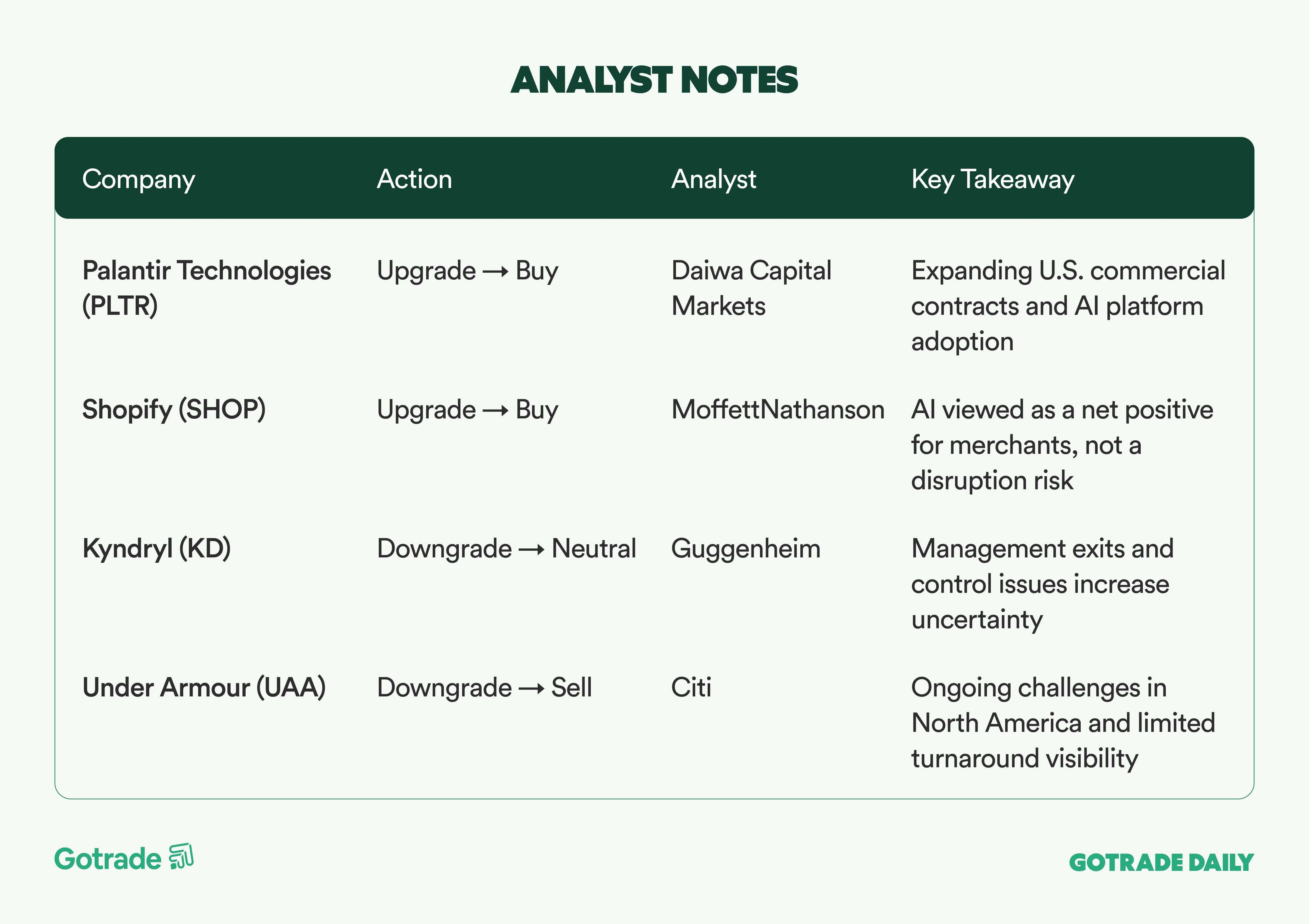

🧠 Analyst Notes

💬 Market Highlights

DuPont Delivers Solid Execution and Raises 2026 Outlook

DuPont (DD) reported fourth-quarter results that exceeded market expectations, supported by margin expansion and disciplined cost management despite largely flat year-over-year revenue. Modest volume declines were offset by favorable currency effects, improved product mix, and productivity initiatives, driving higher operating margins.

Strength in Healthcare and Water Technologies contrasted with continued softness in construction-related markets within Diversified Industrials. The upbeat 2026 guidance, with revenue and earnings forecasts above consensus, reinforces the view that DuPont is entering a more stable post-restructuring phase focused on profitability, execution, and cash flow generation.

Hasbro Accelerates Digital Shift as Wizards of the Coast Powers Earnings

Hasbro (HAS) delivered a sharp rebound in fourth-quarter profitability, fueled by exceptional performance at Wizards of the Coast, with Magic emerging as the company’s core growth engine. Strong results in tabletop gaming more than offset ongoing weakness in the entertainment segment, driving significant operating margin expansion.

The company’s positive 2026 outlook reflects management confidence that its evolution into a digital-first IP company is gaining traction. While revenue growth remains modest, higher margins and earnings quality position Hasbro more favorably, though its increasing reliance on Wizards remains a key concentration risk.

IBM Advances Autonomous Storage Strategy with AI-Powered Systems

IBM (IBM) introduced a new generation of FlashSystem storage products featuring AI agents for security and data management, signaling a strategic push toward fully autonomous storage infrastructure. The offering addresses rising data complexity and security demands driven by AI adoption, enabling continuous optimization without human intervention.

With the launch of FlashSystem.ai, IBM further strengthens its enterprise value proposition by integrating AI into core infrastructure. The move underscores IBM’s strategy to position storage not as passive hardware, but as an intelligent, strategic layer within enterprise IT architectures.

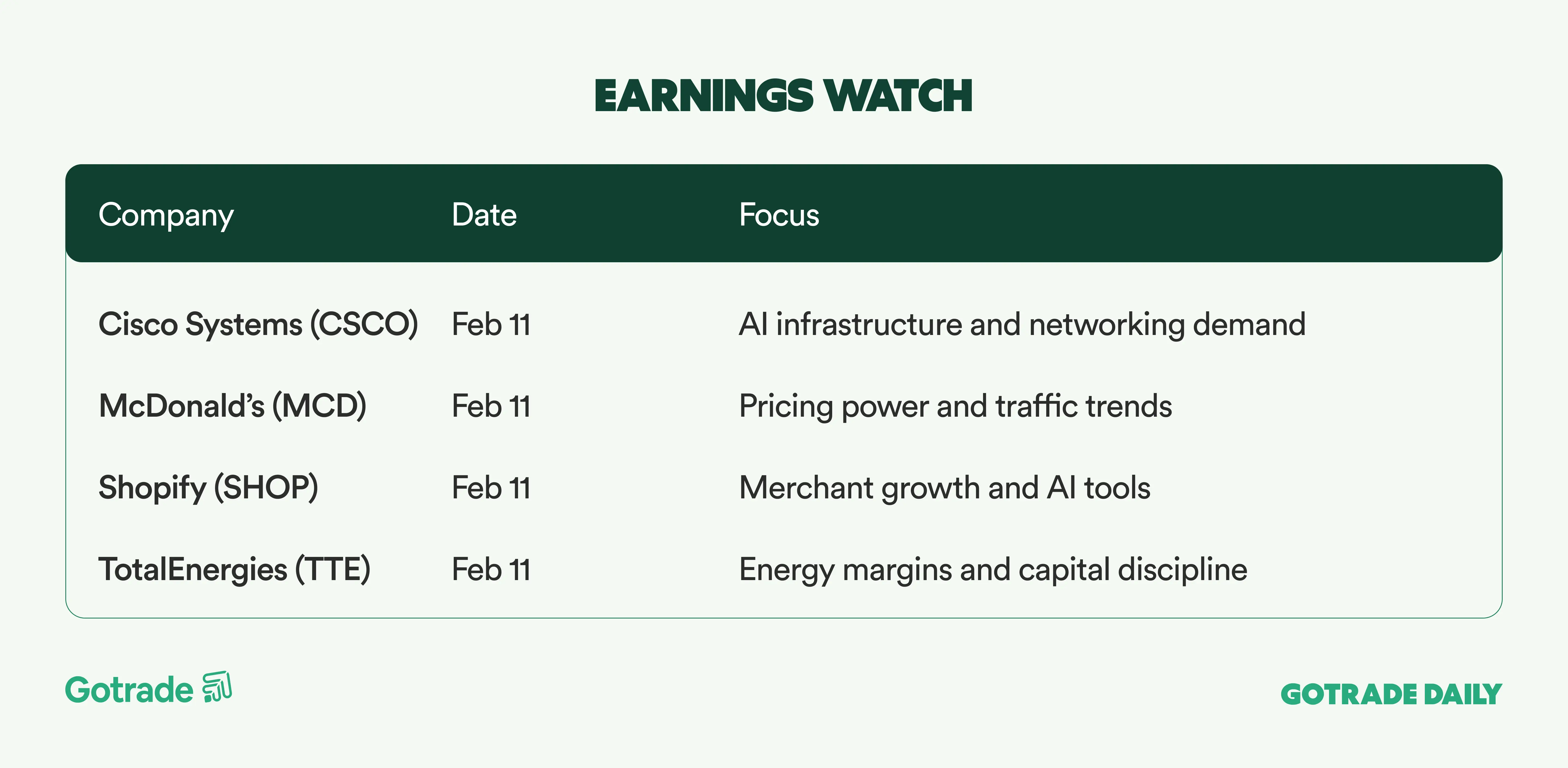

📅 Earnings Watch

With retail data, jobs, and inflation all converging this week, markets appear increasingly selective rather than broadly risk-on or risk-off. The labor report will be a key test for whether recent optimism around rate cuts can hold.

What stocks are you watching today?