Policy shock hits risk assets as markets reprice uncertainty.

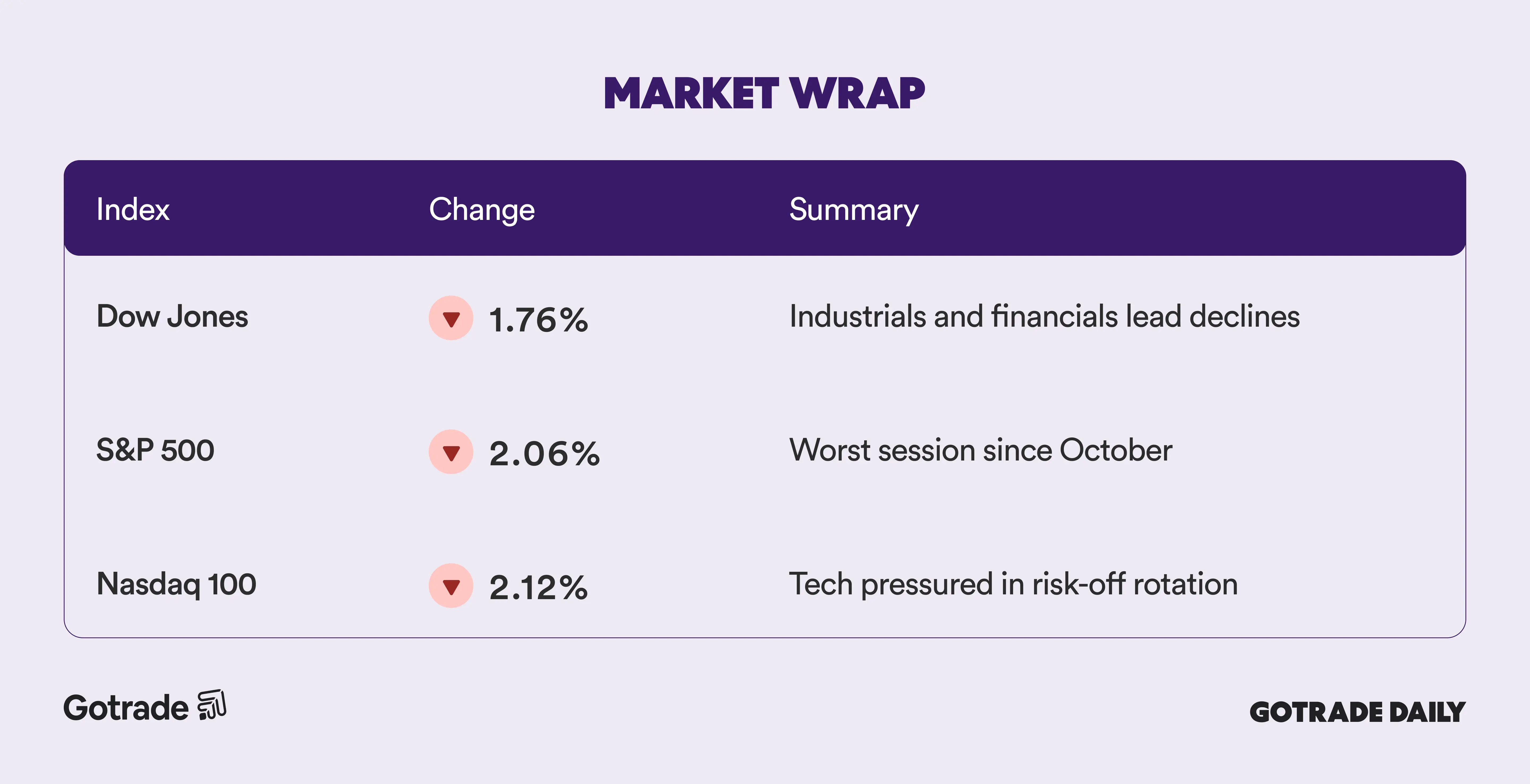

U.S. equities suffered their steepest decline since October as investors reacted to renewed tariff threats tied to Greenland, triggering a broad reassessment of geopolitical and policy risk. Markets entered the week near record highs, leaving little room to absorb sudden escalation without repricing.

President Donald Trump warned that countries opposing a U.S. acquisition of Greenland could face escalating tariffs, starting at 10% in February and rising to 25% by June. The move rattled global markets, pushing investors out of U.S. assets as Treasury yields spiked and the dollar weakened.

The selloff reflected how vulnerable markets remain to non-economic policy shocks. With valuations elevated and earnings expectations stretched, traders moved quickly to reduce exposure as uncertainty spread across trade, geopolitics, and capital flows.

European leaders signaled potential countermeasures, while prominent investors warned that trade disputes could spill into capital markets, raising concerns over U.S. debt demand and broader financial stability. With Trump set to speak in Davos, policy headlines remain a key overhang.

📊 Market Wrap Jan 21st 2026

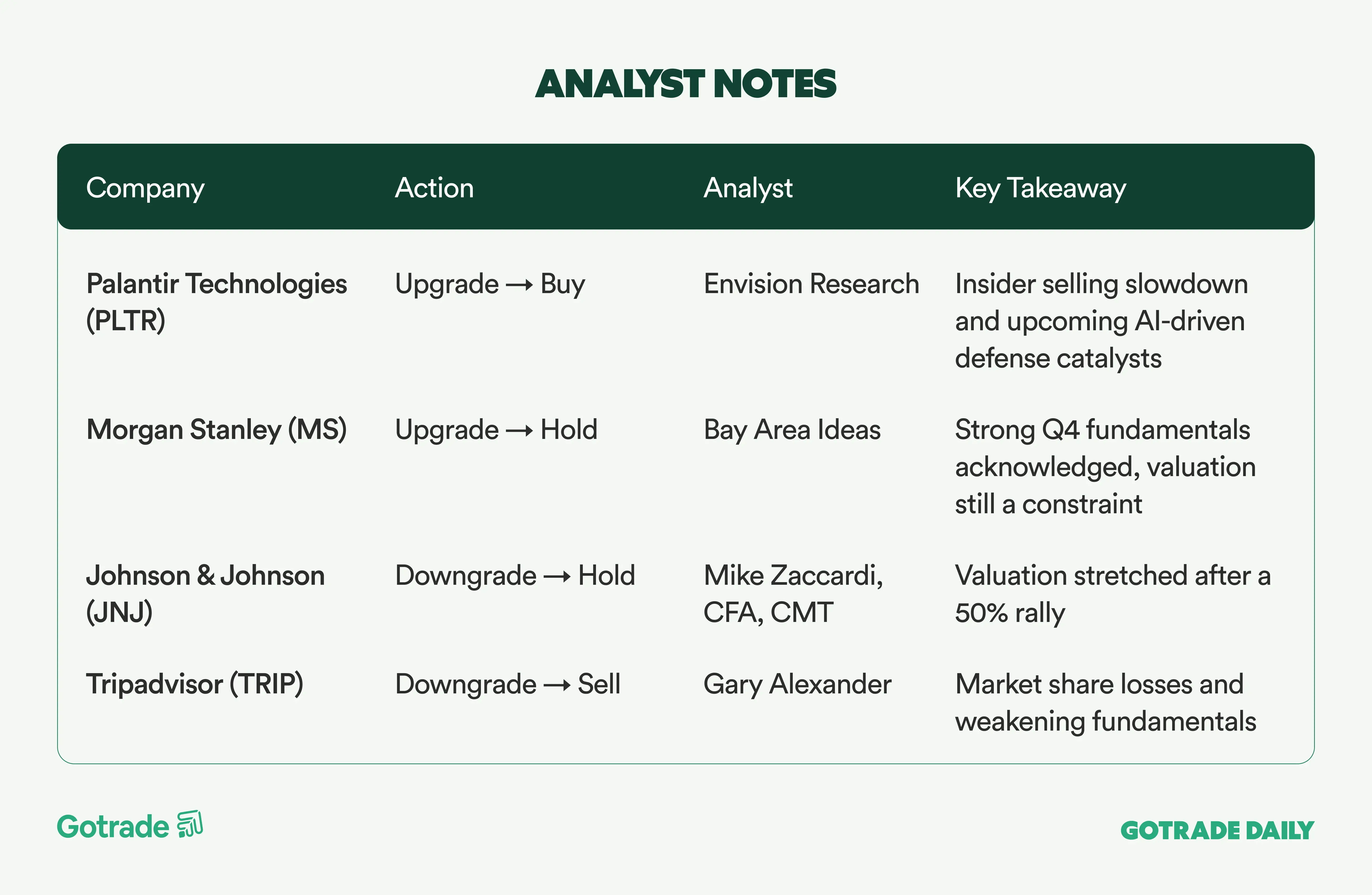

🧠 Analyst Notes

💬 Market Highlights

Netflix Targets $51B Revenue in 2026, Aims for 31.5% Operating Margin

Netflix (NFLX) projects 2026 revenue of $51 billion, representing roughly 14% year-over-year growth, while targeting an operating margin of 31.5%. Growth is expected to be driven by subscriber expansion, pricing, and a sharp acceleration in advertising revenue, which management expects to nearly double to around $3 billion. The pending acquisition of Warner Bros. Studios and HBO is positioned as a strategic accelerator rather than a shift away from organic growth, though it is expected to create modest near-term margin pressure.

Cenovus Weighs Sale of C$3B Alberta Oil and Gas Assets

Cenovus Energy (CVE) is considering the sale of conventional oil and gas assets in Alberta’s Deep Basin, with potential proceeds of approximately C$3 billion. The move would support balance sheet deleveraging following its C$8.5 billion acquisition of MEG Energy, which significantly increased net debt. Strategically, Cenovus is sharpening its focus on its core oil sands business, including the recently added Christina Lake asset.

Micron’s Taiwan Fab Acquisition Seen as Accelerating DRAM Expansion

Micron’s (MU) planned $1.8 billion all-cash acquisition of a chip fabrication facility in Taiwan from Powerchip is viewed as a strategic move to accelerate DRAM production amid a global supply shortage. The facility is expected to meaningfully contribute to wafer output in the second half of 2027 and provides operational and geographic synergies with Micron’s existing Taiwan footprint. Analysts believe the deal positions Micron to move faster than competitors in addressing AI- and data center-driven memory demand.

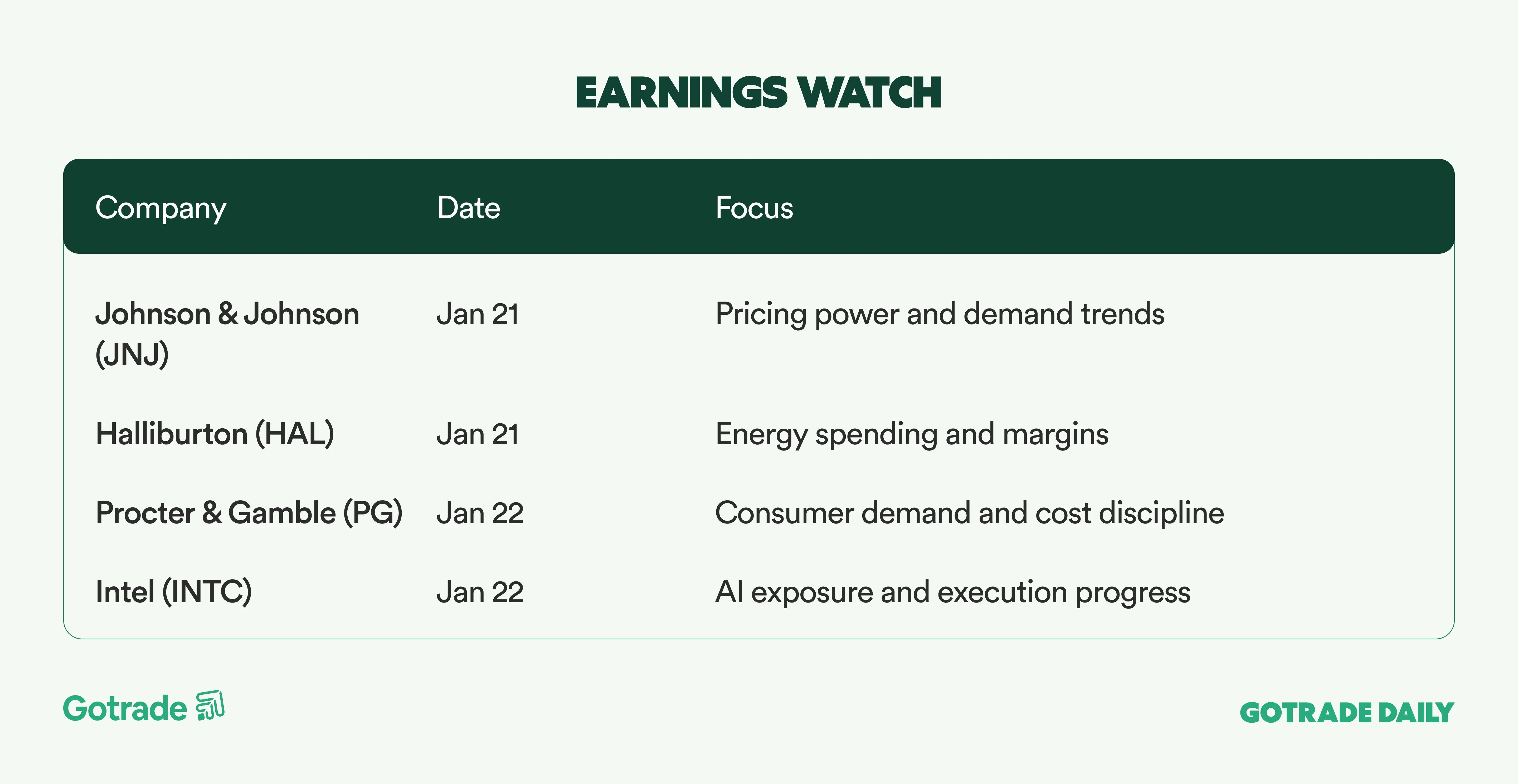

📅 Earnings Watch

Markets are not breaking, they are rotating. With geopolitics, trade policy, and earnings converging, leadership will be decided by results and execution, not narratives.

What stocks are you watching today?