U.S. equities edged higher into a holiday-shortened week as traders positioned ahead of a dense lineup of macro releases and earnings catalysts. With markets closed Monday for Presidents Day, attention shifts to inflation, growth, and consumer data that could shape rate expectations and sector leadership.

Corporate results will provide another layer of signals across sectors. Walmart (WMT) headlines the week with its first earnings report under new CEO John Furner, after recently surpassing US$1 trillion in market value and posting solid comparable-sales growth in its last quarter.

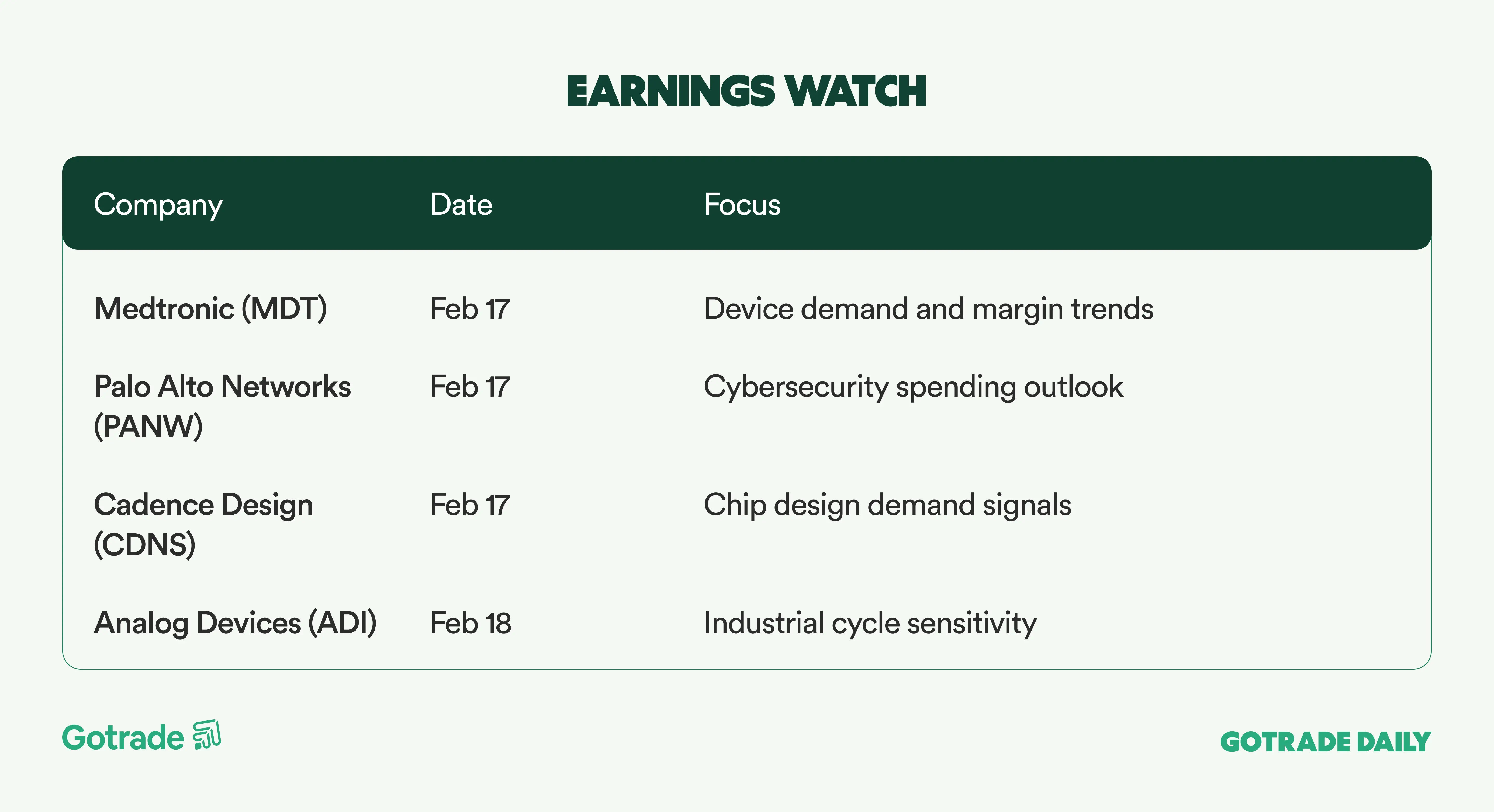

Industrial bellwether John Deere (DE) follows after warning annual profit could fall short due to tough conditions. Tech names reporting include Analog Devices (ADI), Palo Alto Networks (PANW), and Cadence Design (CDNS), offering insight into semiconductor demand, cybersecurity spending, and AI infrastructure trends.

Markets are entering a data-driven stretch, with Friday’s PCE inflation report expected to be the most closely watched release. Because the Federal Reserve tracks PCE more closely than CPI, the print could influence expectations for how long policy stays restrictive.

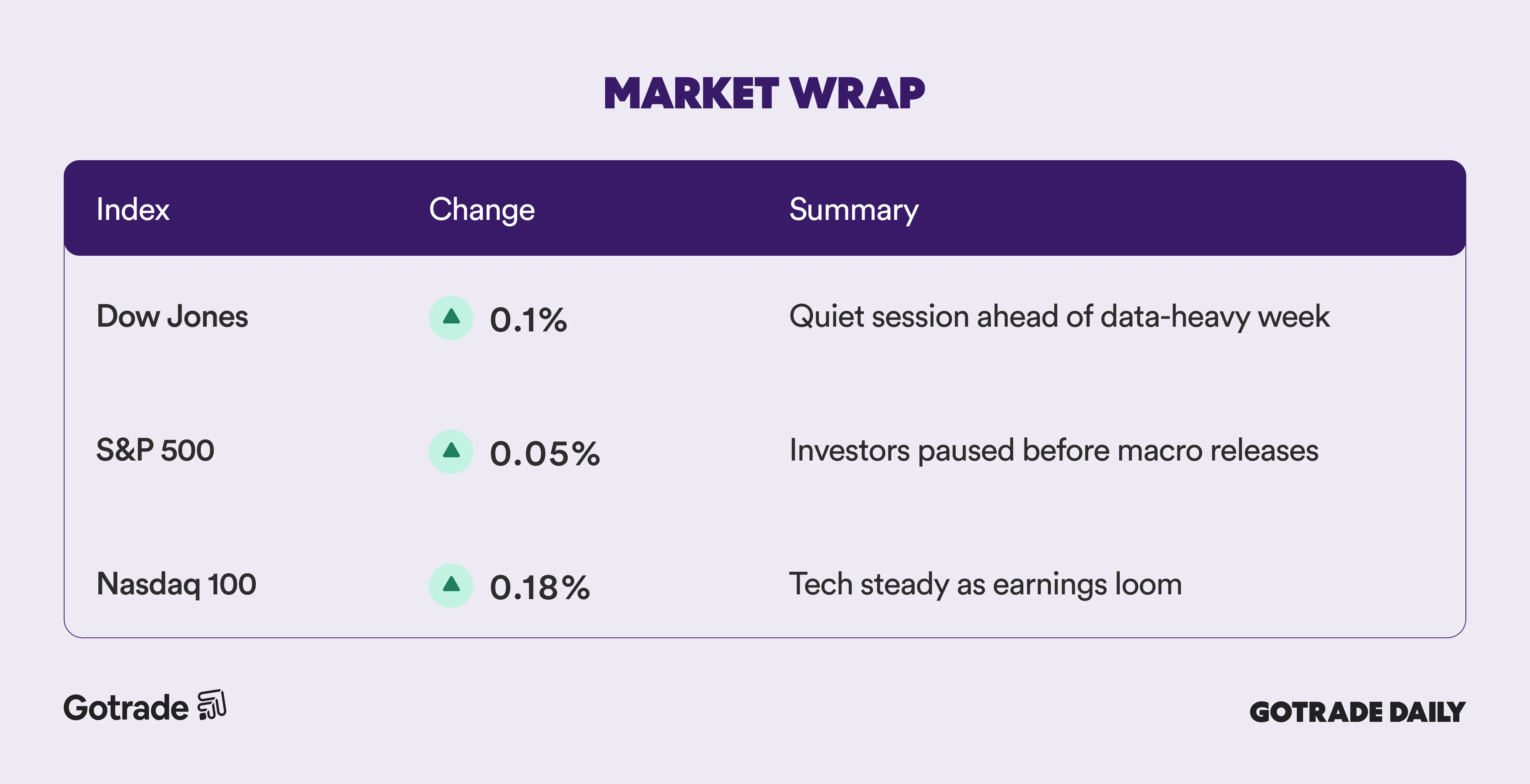

📊 Market Wrap Feb 17th 2026

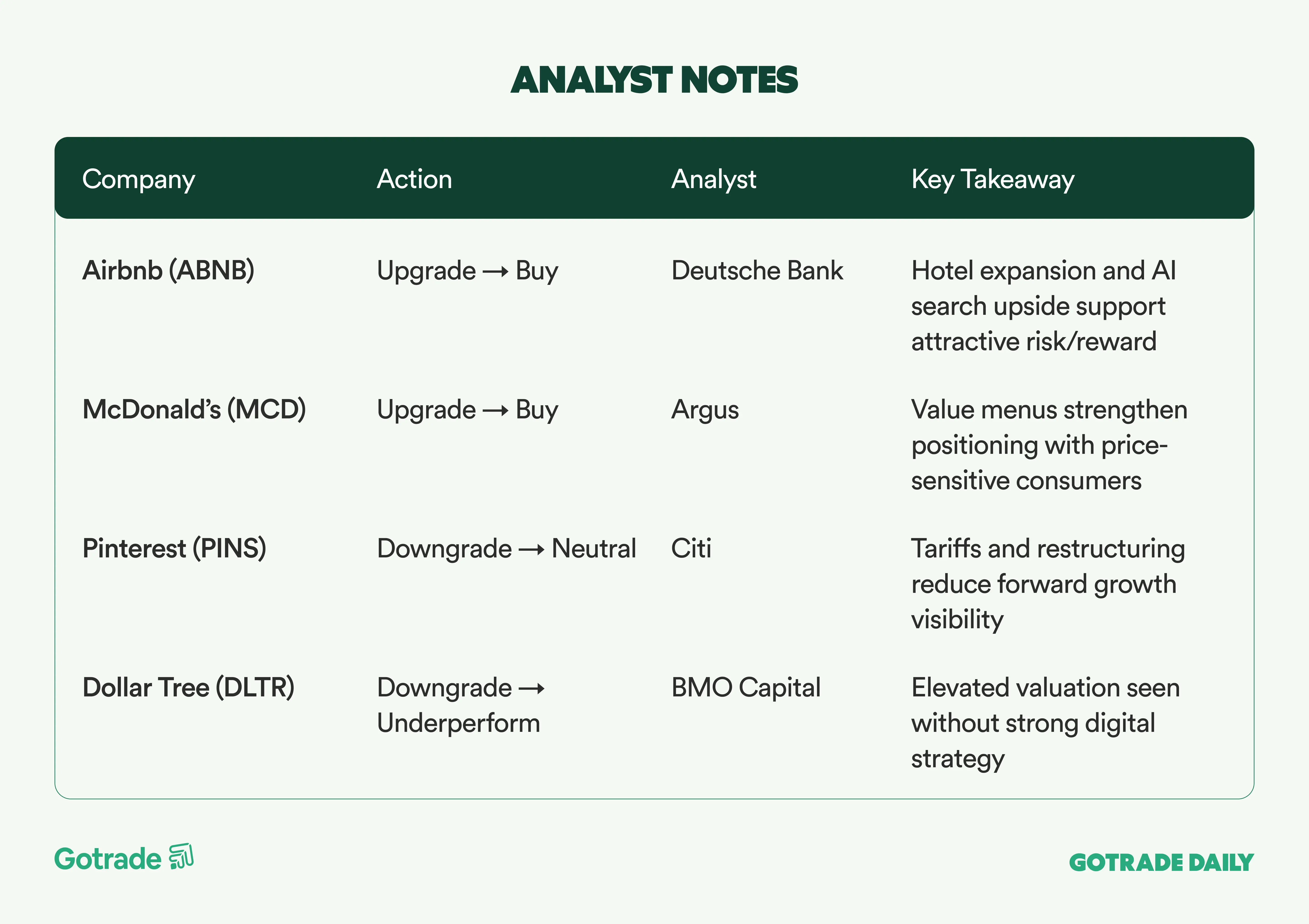

🧠 Analyst Notes

💬 Market Highlights

China Tightens Oversight on Internet Platforms

China’s market regulator summoned major platform companies including Alibaba (BABA), Baidu (BIDU), and JD.com (JD), ordering them to strictly comply with competition, pricing, consumer protection, and e-commerce regulations. Authorities also urged firms to eliminate what they described as “involution-style competition,” a term used domestically to describe destructive price wars and excessive rivalry that can weaken profitability across entire industries.

The move signals that regulatory scrutiny remains an embedded risk premium in Chinese tech valuations. Investors are interpreting the directive less as an isolated intervention and more as a reminder that platform companies must balance growth ambitions with policy alignment. While not an outright crackdown, the message reinforces expectations that future expansion strategies may need to prioritize sustainability and compliance over aggressive market share tactics.

Kraft Heinz Strategic Reset Draws Mixed Investor Response

Shares of Kraft Heinz (KHC) rose after management chose to abandon plans to split the company and instead commit roughly US$600 million toward operational reinvestment. The decision reflects a strategic pivot away from structural breakup toward rebuilding brand strength, innovation pipelines, and pricing power after years of underinvestment. Investors viewed the reinvestment as a constructive sign that leadership is prioritizing long-term competitiveness rather than short-term financial engineering.

However, skepticism remains. Analysts note that Kraft Heinz still faces structural headwinds including shifting consumer preferences toward private labels and fresh foods, pressure from government benefit program volatility, and lingering balance sheet constraints. The key question for markets is whether 2026 could represent a trough earnings year that establishes a stable base for recovery, or whether the company risks remaining stuck in a prolonged transition phase without a clear catalyst.

Nvidia CEO Absence Highlights Global AI Narrative Sensitivity

Nvidia (NVDA) said CEO Jensen Huang will not attend the upcoming India AI Impact Summit, one of the largest international gatherings of policymakers and technology leaders focused on artificial intelligence. Although the company reaffirmed its commitment to India’s fast-growing AI ecosystem, the announcement drew attention because Huang was expected to be one of the event’s most closely watched speakers.

The reaction highlights how sensitive markets have become to signals surrounding AI leadership, visibility, and geopolitical positioning. Major AI conferences increasingly function as sentiment catalysts, shaping expectations around infrastructure spending, partnerships, and national technology strategies. Even minor changes to executive participation can influence short-term narratives, underscoring how central AI positioning has become to investor perception of tech sector leadership.

📅 Earnings Watch

What stocks are you watching today?