Earnings growth expectations support a constructive outlook.

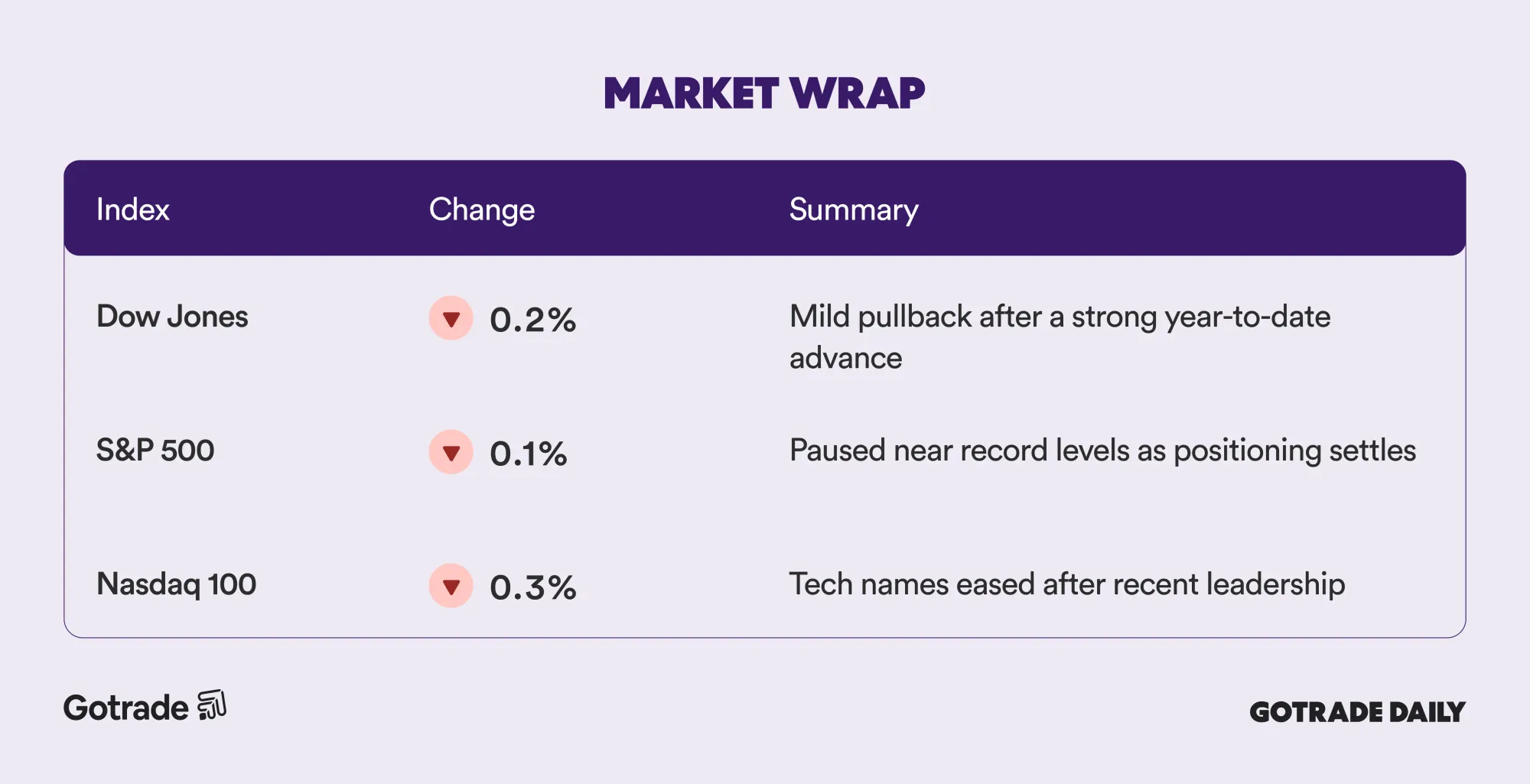

US stocks eased slightly at the start of the week after a strong multi-year run, as investors took stock of positioning into year end. The S&P 500 slipped 0.1%, the Dow Jones Industrial Average fell 0.2%, and the Nasdaq 100 declined 0.3%, reflecting light profit-taking rather than a shift in broader sentiment.

Despite the modest pullback, 2025 is shaping up as another strong year for equities. The S&P 500 is up more than 19% year to date, marking a third consecutive year of double-digit gains. With only a few sessions left, attention is increasingly turning toward what could sustain momentum into 2026.

Analysts remain broadly constructive on the outlook. Wall Street expects S&P 500 earnings to grow around 15% in 2026, supported by continued AI investment, stable economic growth, and a Federal Reserve that is expected to maintain an easing bias next year. While volatility is always possible after extended rallies, the absence of recession signals keeps the medium-term backdrop supportive.

Artificial intelligence remains a central pillar of this view. Continued spending on data centers, cloud infrastructure, and AI-enabled software is expected to drive productivity gains and earnings leverage across multiple sectors, even as expectations become more selective than during earlier phases of the AI rally.

📊 Market Wrap Dec 31st 2025

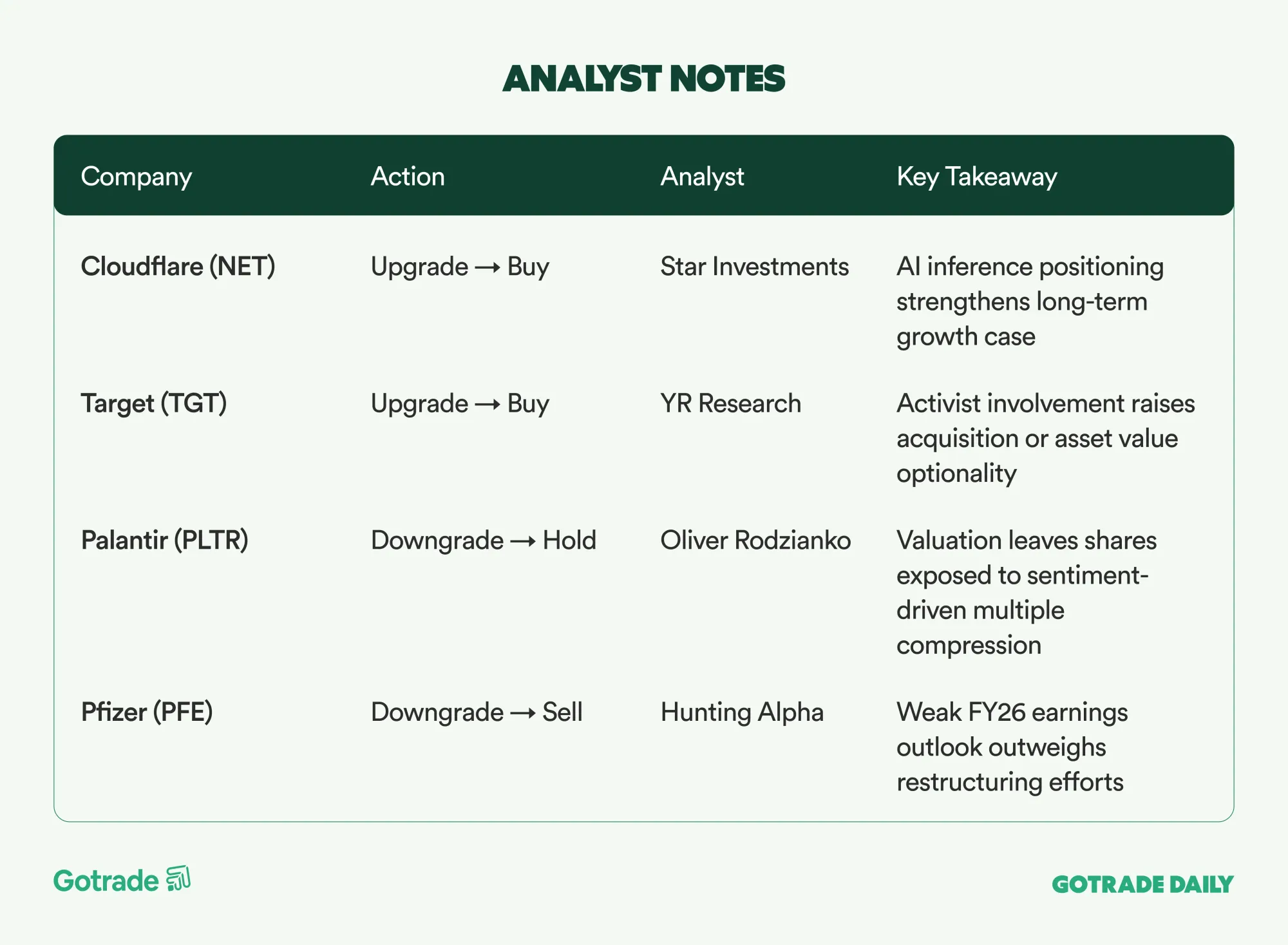

🧠 Analyst Notes

💬 Market Highlights

Boeing Wins $8.6B Contract to Supply F-15 Jets to Israeli Air Force

Long-term value investor Fairfax Financial increased its ownership in Under Armour (UAA) (UA) to 16.1% of outstanding shares, up from around 9% in mid-December. The move extends Under Armour’s recent rally, with shares rising in nine of the past ten sessions, despite being down nearly 40% year-to-date.

Fairfax is known for its conservative, value-oriented approach, and the higher stake is seen as a vote of confidence in Under Armour’s medium-term recovery as the company executes its brand repositioning and profitability initiatives.

Starbucks Sharpens Focus on Profitability After U.S. Store Closures

Starbucks (SBUX) closed roughly 400 U.S. stores earlier this year as part of its “Back to Starbucks” strategy, aimed at improving profitability and customer experience. The closures primarily targeted underperforming locations in dense, high-cost urban markets.

Despite the smaller store base, Starbucks plans to open new locations in 2026 in some affected cities. The move reflects an adjustment to changing work patterns, higher operating costs, and intensifying competition from specialty coffee chains.

Chinese EV Stocks Supported by 2026 Trade-In Subsidies

China’s government is set to roll out RMB 62.5 billion in trade-in subsidies for 2026 to stimulate consumption and support the domestic auto manufacturing sector.

Funded through ultra-long-term special treasury bonds, the program is part of Beijing’s efforts to counter economic slowdown and deflationary pressures. The policy is viewed as a positive tailwind for Chinese electric vehicle makers such as NIO (NIO), Li Auto (LI), XPeng (XPEV), and BYD, amid fierce competition and uneven domestic demand.

📅 Earnings Watch

No major earnings releases this week.

As markets move toward 2026, the focus remains on earnings delivery, AI investment trends, and how positioning evolves after a strong multi-year run. Selectivity and discipline are likely to matter more than broad risk-on exposure in the months ahead.

Which stocks are you watching today?

Note: U.S. stock markets are closed on January 1 for the New Year holiday, so Gotrade Daily will not be published that day.

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.