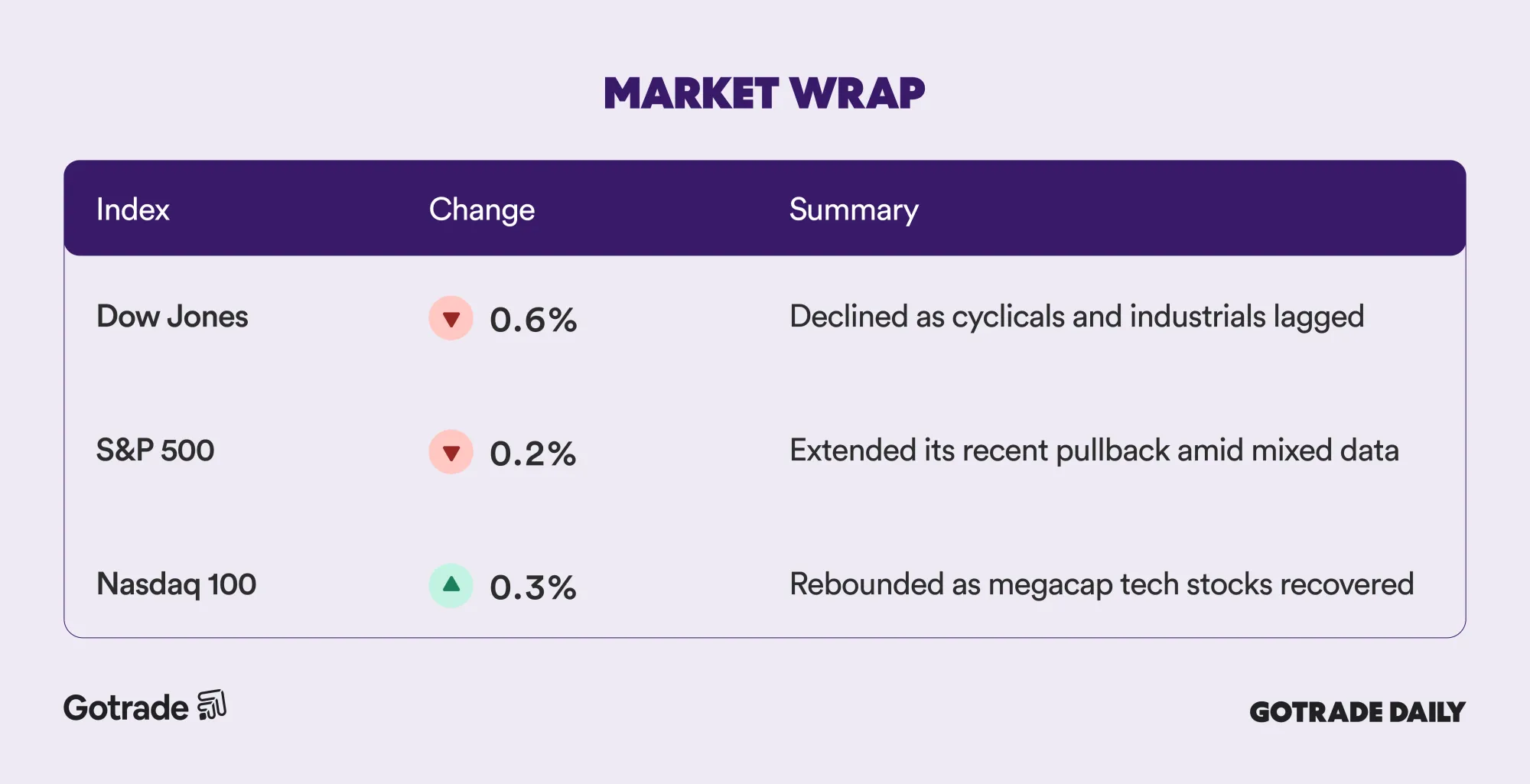

Dow and S&P 500 slip following delayed labor data.

U.S. stocks were mixed on Tuesday, with the Nasdaq Composite rebounding to snap a three day losing streak. The tech heavy index rose about 0.2%, while the Dow Jones Industrial Average fell roughly 300 points and the S&P 500 declined 0.2%.

The Nasdaq’s recovery was led by Tesla (TSLA), which closed at a new all time high, supported by optimism around recent robotaxi developments. Gains in other large technology names including Nvidia (NVDA), Microsoft (MSFT), and Meta Platforms (META) also helped stabilize the index after recent weakness.

Markets also digested the delayed November nonfarm payrolls report, which showed stronger than expected job growth but an uptick in the unemployment rate to 4.6%, the highest level since 2021. Revisions to October data, affected by the government shutdown, added further noise to the labor picture.

For traders, the session highlighted a market balancing renewed momentum in select technology leaders against uncertainty around the labor outlook. Attention now shifts to upcoming inflation data, which could further shape expectations for interest rate policy in 2026.

📊 Market Wrap Dec 17th 2025

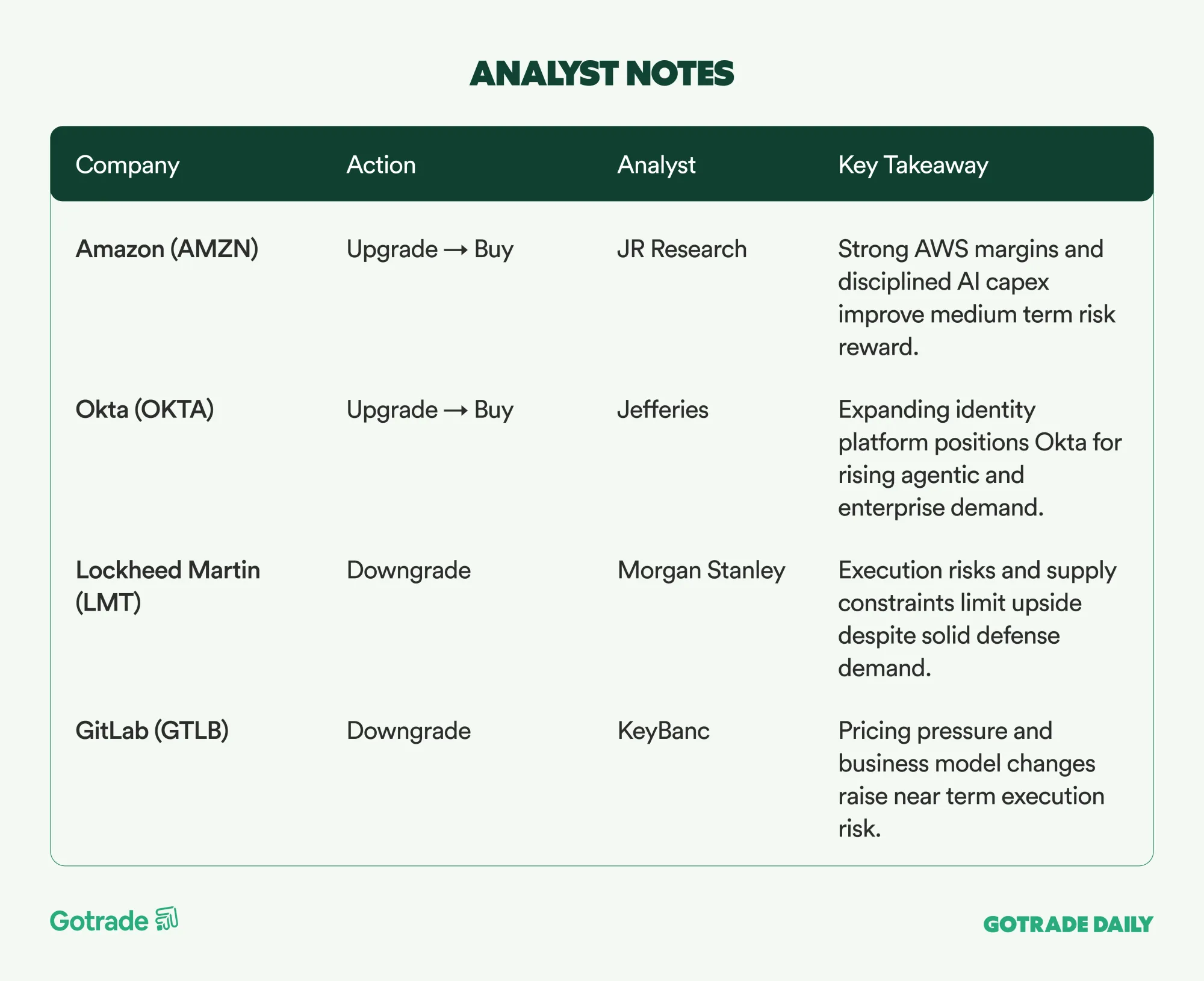

🧠 Analyst Notes

💬 Market Highlights

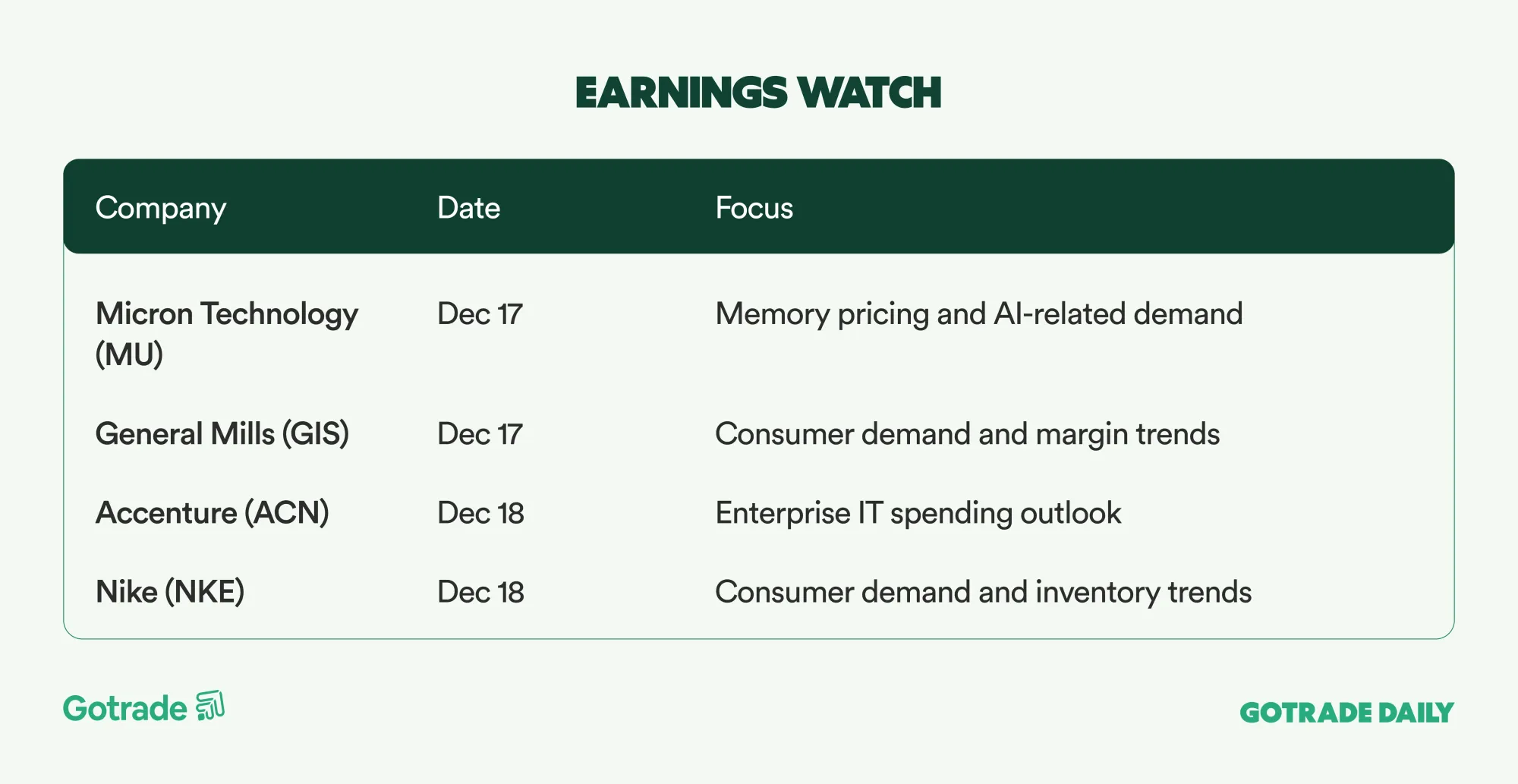

Accenture Expands AI Data Center Capabilities Through DLB Associates Acquisition

Accenture (ACN) agreed to acquire a 65% stake in DLB Associates, an AI focused data center engineering and construction firm. The deal broadens Accenture’s capabilities across design, build, and operations as global demand for AI data center capacity accelerates. The move reinforces Accenture’s push toward end to end infrastructure solutions for clients facing capacity constraints.

Robinhood Earns Buy Rating on Product Momentum and User Growth

Robinhood (HOOD) received a Buy rating from Truist Securities, driven by faster product launches and expansion into higher balance user segments. Analysts see this strategy supporting key growth metrics while creating room for margin expansion. While the stock has already rallied sharply this year, the growth and profitability mix remains attractive over the medium term.

ServiceNow Upgraded by Guggenheim Despite Ongoing AI Monetization Challenges

ServiceNow (NOW) was upgraded by Guggenheim, even as analysts flagged continued challenges around AI monetization. The firm noted that the stock has significantly underperformed major indices since mid 2024, despite consistently solid operational execution. ServiceNow is still viewed as a high quality software franchise, with premium valuation likely to persist, though it may narrow over time.

📅 Earnings Watch

Markets showed selective resilience, with technology shares stabilizing even as broader indices softened. Attention now turns to upcoming inflation data and what it could signal for policy expectations into 2026.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.