Chip strength lifts sentiment while investors parse policy signals.

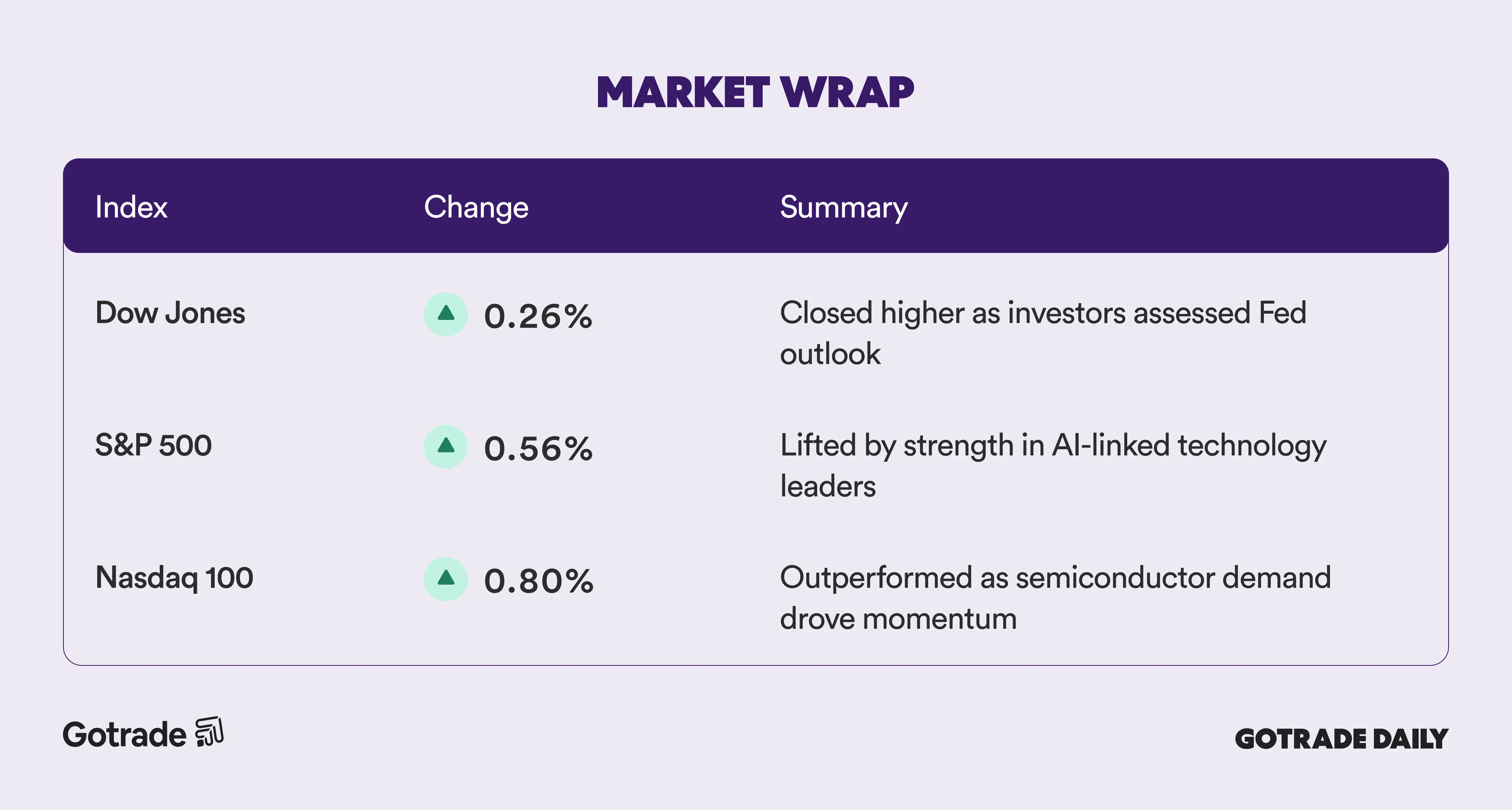

U.S. equities closed higher Wednesday, supported by gains in major technology stocks as investors digested minutes from the Federal Reserve’s latest policy meeting. The S&P 500 rose 0.56%, the Nasdaq Composite added 0.78%, and the Dow Jones Industrial Average advanced 0.26%, reflecting cautious optimism despite ongoing uncertainty around the interest-rate path.

Technology leadership again played a central role in index direction. Nvidia (NVDA) gained 1.6% after confirmation of large-scale chip deployment tied to hyperscale data-center expansion, reinforcing its position as a key beneficiary of enterprise AI spending cycles. Institutional positioning continued to favor companies with visible demand pipelines, suggesting capital is rotating toward firms tied directly to infrastructure rather than speculative AI themes.

Mega-cap sentiment also strengthened. Amazon (AMZN) rose nearly 2% after regulatory filings showed Pershing Square increased its stake by 65% in the fourth quarter, making it the fund’s third-largest holding. The move signaled renewed conviction that recent weakness in dominant platform companies may have been overdone and that earnings durability remains intact among market leaders with diversified revenue streams.

Chipmaker Micron (MU) surged more than 5% after Appaloosa Management boosted its position, while dispersion within the sector continued to improve as investors differentiated between companies based on execution visibility. Strategists noted that recent performance does not invalidate the “broadening” thesis but instead indicates a more selective phase of leadership within technology.

Outside equities, Treasury yields edged higher as traders evaluated the Fed minutes, which showed policymakers broadly supported holding rates steady but remained divided about future policy direction. Oil prices climbed amid geopolitical tensions involving Iran, while crypto slipped from recent highs, highlighting cross-asset volatility that continues to shape short-term positioning.

📊 Market Wrap Feb 19th 2026

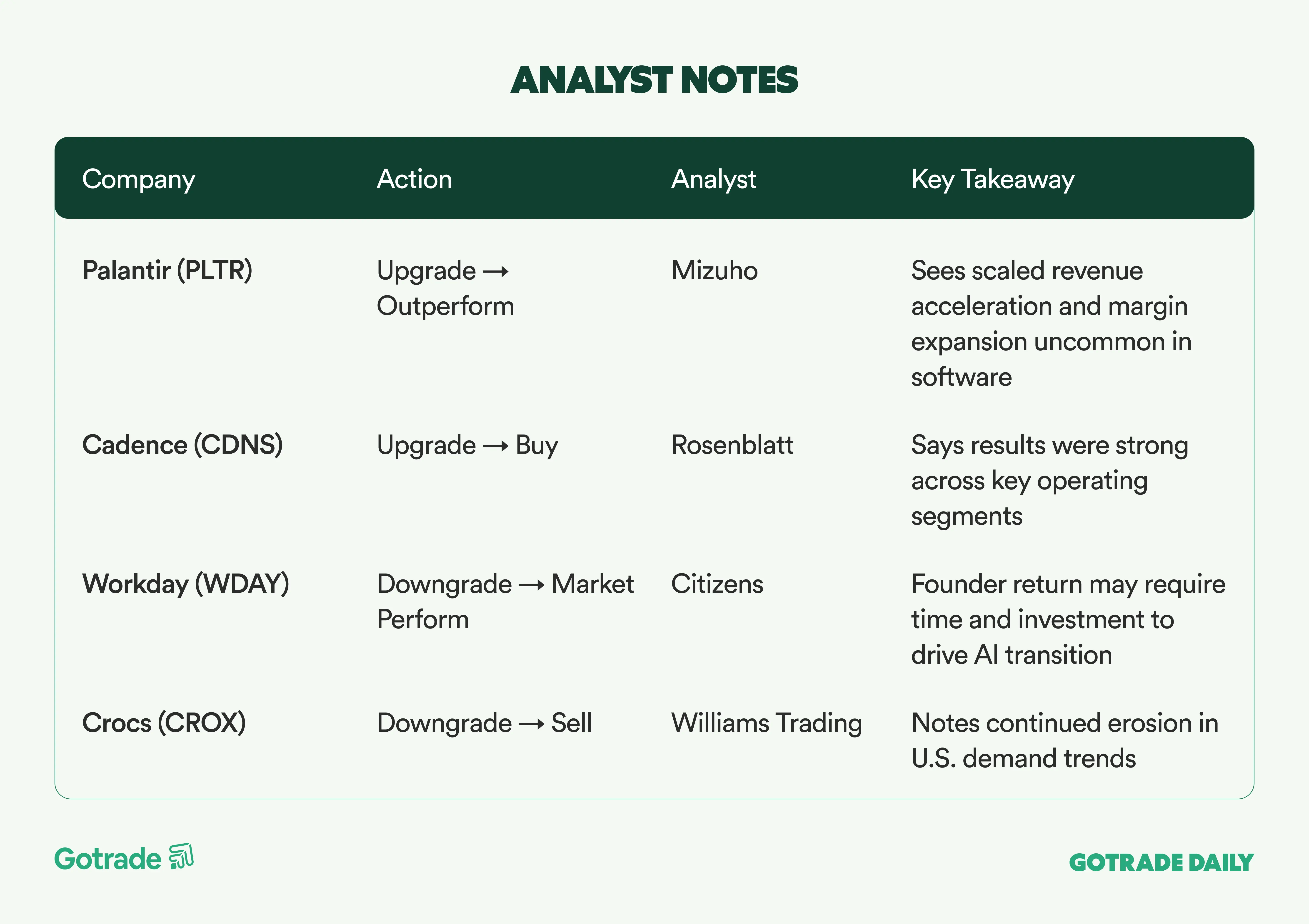

🧠 Analyst Notes

💬 Market Highlights

eBay Accelerates C2C Push with Depop Acquisition

eBay (EBAY) is guiding for 10%-12% GMV growth in Q1 after closing 2025 with strong momentum, including nearly $80 billion in global GMV and revenue growth outpacing transaction volume, supported by its expanding advertising business. The planned $1.2 billion acquisition of Depop is positioned as a strategic move to strengthen its consumer-to-consumer marketplace and expand its presence in circular fashion. Management expects the deal to add 1-2 percentage points to GMV growth while reinforcing engagement among younger buyers.

Booking Targets Faster Growth with $700M Reinvestment Plan

Booking Holdings (BKNG) aims to deliver 2026 revenue growth roughly 100 basis points above its long-term trend after reporting double-digit gains in bookings and EBITDA in Q4. The strategy includes an additional $700 million in reinvestment toward generative AI, its Connected Trip ecosystem, Asia expansion, and loyalty and fintech initiatives. The company also raised its dividend by 9.4% and approved a 25-for-1 stock split, signaling management confidence in sustained earnings strength and cash-flow generation.

DoorDash Rallies on Order Growth and Strong Outlook

DoorDash (DASH) surged more than 10% as investors focused on strong operating metrics despite modest misses on revenue and EPS. Total orders rose 32% and gross order value climbed 39%, both topping expectations, while first-quarter guidance points to continued expansion in GOV and EBITDA. Management reiterated plans for elevated investment in international markets, new verticals, and platform technology to support long-term growth momentum.

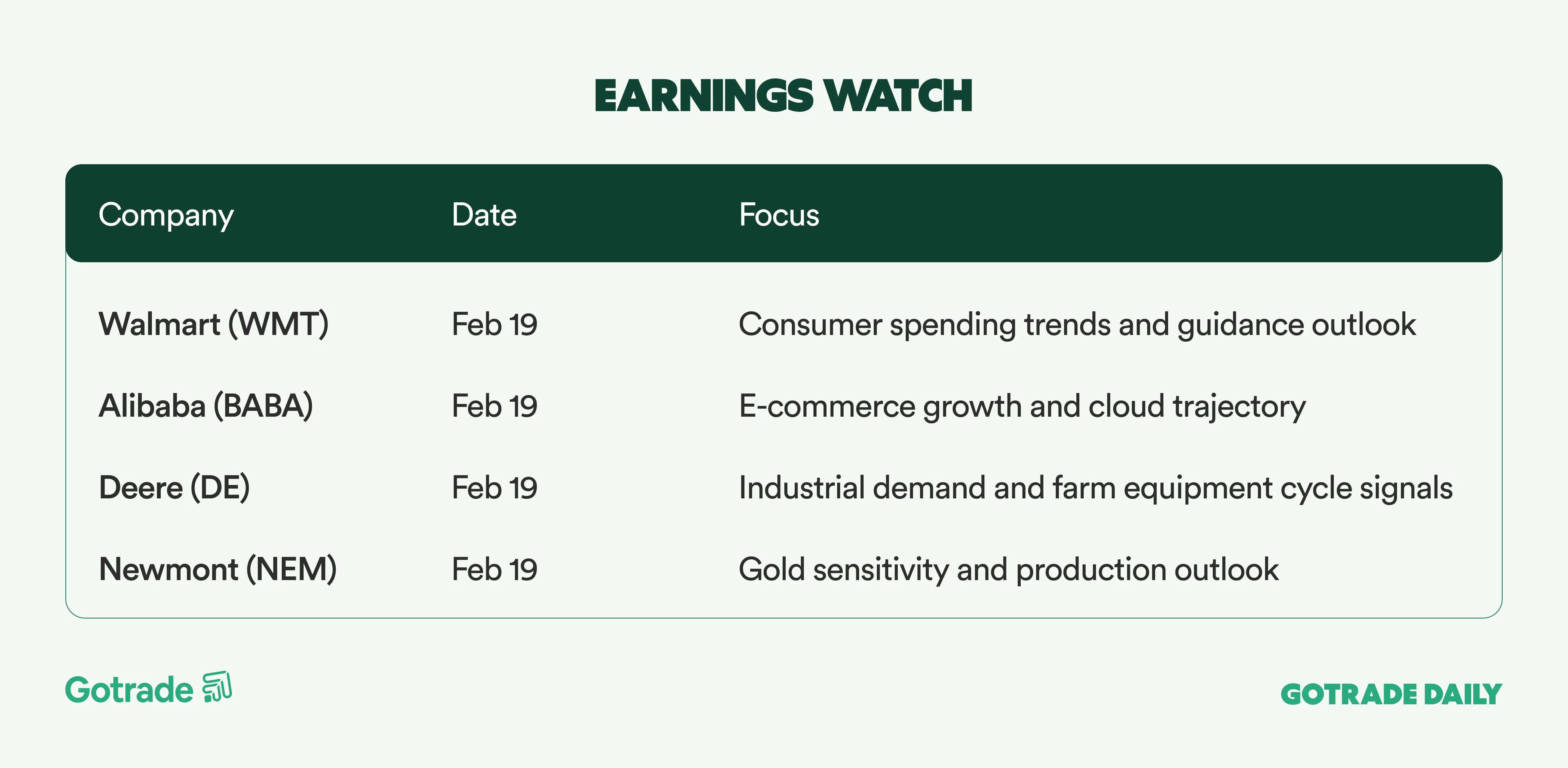

📅 Earnings Watch

Attention now shifts to upcoming data releases and earnings catalysts for confirmation of whether current leadership trends can persist. Investors will be monitoring if institutional flows continue favoring AI infrastructure and mega-cap platforms, or if participation broadens across sectors.

What stocks are you watching today?