Seasonal strength holds as markets reassess momentum into year end.

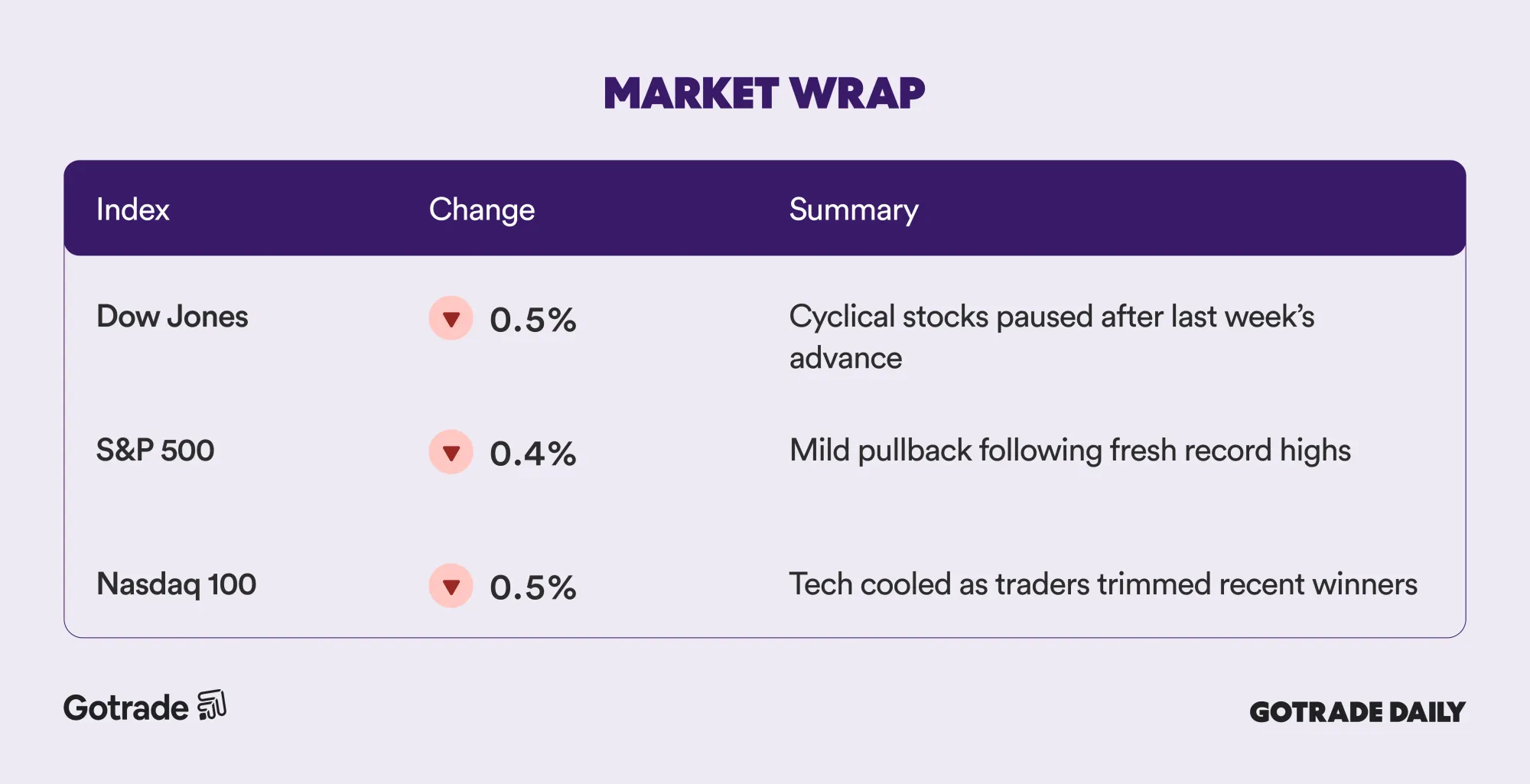

US stocks pulled back modestly on Monday after last week’s record-setting rally, a move that reflected consolidation rather than a shift in trend. The S&P 500 slipped 0.35%, while the Nasdaq 100 fell 0.5%, as traders locked in gains following a strong advance into the Christmas period.

Technology and AI-linked stocks led the pause. NVIDIA (NVDA) gave back more than 1% after rising over 5% last week, while Meta Platforms (META), Palantir (PLTR), and Oracle (ORCL) also traded lower. The pullback came amid a light economic calendar, suggesting positioning and short-term momentum, not fundamentals, drove the move.

Outside equities, crowded trades also reset. Silver pulled back sharply after briefly touching record levels, with the iShares Silver Trust (SLV) falling around 7%. The move followed a near 150% surge in silver prices this year, reinforcing how stretched positioning can unwind quickly without changing the broader macro narrative.

For traders, the setup remains constructive rather than defensive. Markets are still within the historically strong Santa Claus rally window, and year-to-date performance remains solid across major indices. With limited data this week, internal momentum, sector rotation, and how leadership responds to dips are likely to guide near-term trading decisions.

📊 Market Wrap Dec 30th 2025

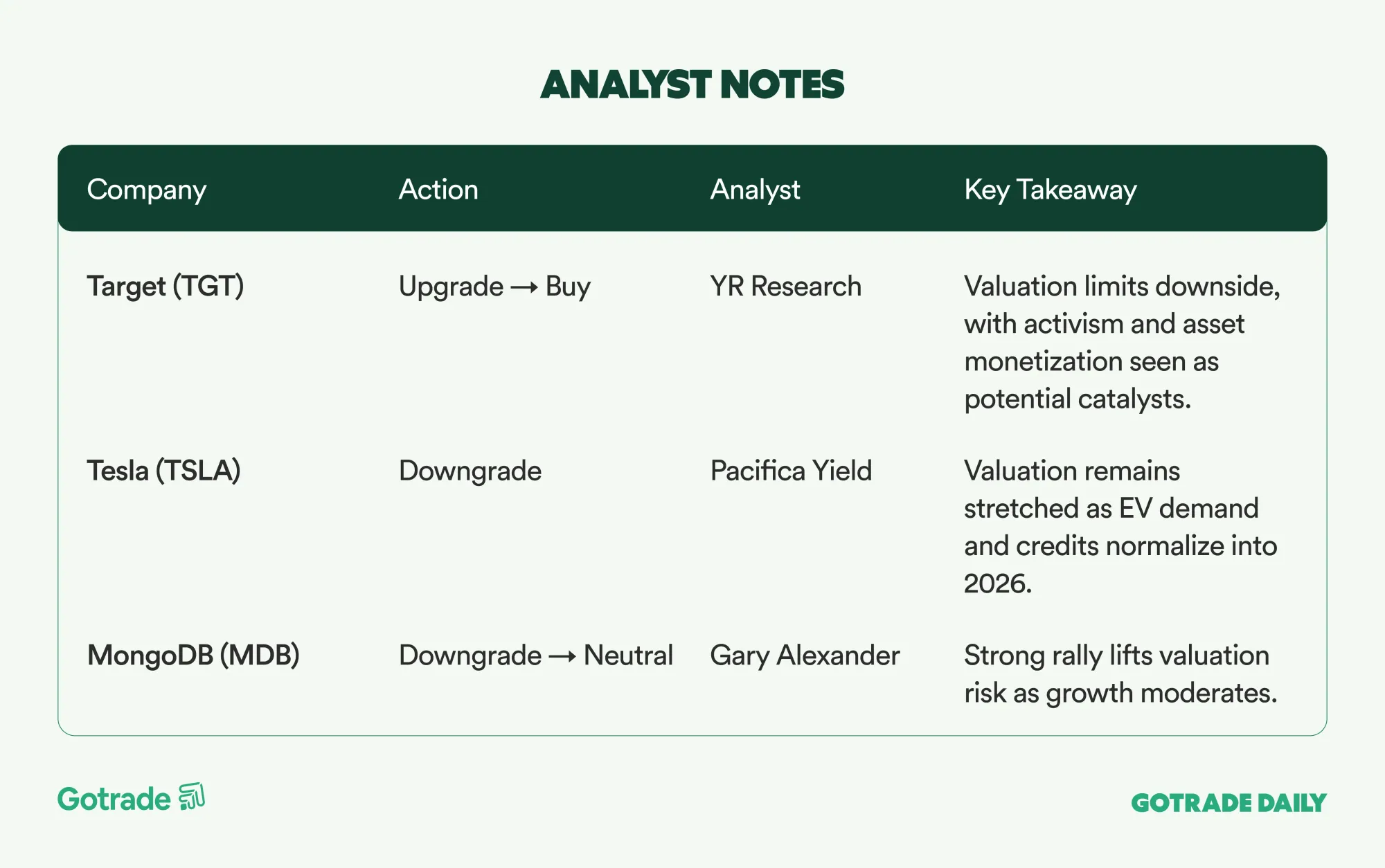

🧠 Analyst Notes

💬 Market Highlights

Boeing Wins $8.6B Contract to Supply F-15 Jets to Israeli Air Force

Boeing (BA) has secured a contract worth up to $8.6 billion from the U.S. Air Force to design and manufacture F-15 fighter jets for the Israeli Air Force. The agreement covers 25 new F-15IA aircraft with an option for 25 additional units, with production scheduled through 2035. The award strengthens Boeing’s defense backlog and reinforces long-term demand visibility for its combat aircraft business.

Strategy Adds $109M in Bitcoin Holdings During Holiday Week

Strategy (MSTR) purchased 1,229 bitcoin for approximately $109 million during the Dec. 22–28 period, funded through a common stock offering. Total bitcoin holdings now stand at nearly 672,500 tokens, valued at over $50 billion. Despite recent volatility in crypto prices, the company remains profitable on its bitcoin position, reinforcing its aggressive balance-sheet strategy tied to digital assets.

Nvidia Completes $5B Equity Investment in Intel

Nvidia (NVDA) has finalized its $5 billion purchase of Intel (INTC) shares, acquiring more than 214 million shares at $23.28 per share. The investment formalizes a strategic partnership between the two companies to co-develop PC and data center chips, combining Nvidia’s AI and accelerated computing platform with Intel’s x86 ecosystem. The deal adds to Intel’s significant equity fundraising efforts in 2025 and underscores Nvidia’s long-term commitment to shaping next-generation computing infrastructure.

📅 Earnings Watch

No major earnings releases this week.

Rather than signaling weakness, this pullback is being read as digestion after a strong run. As liquidity thins into year end, traders are watching whether leadership stabilizes and rotation creates fresh opportunities.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.