Traders assess how the Fed’s move shapes next year’s outlook.

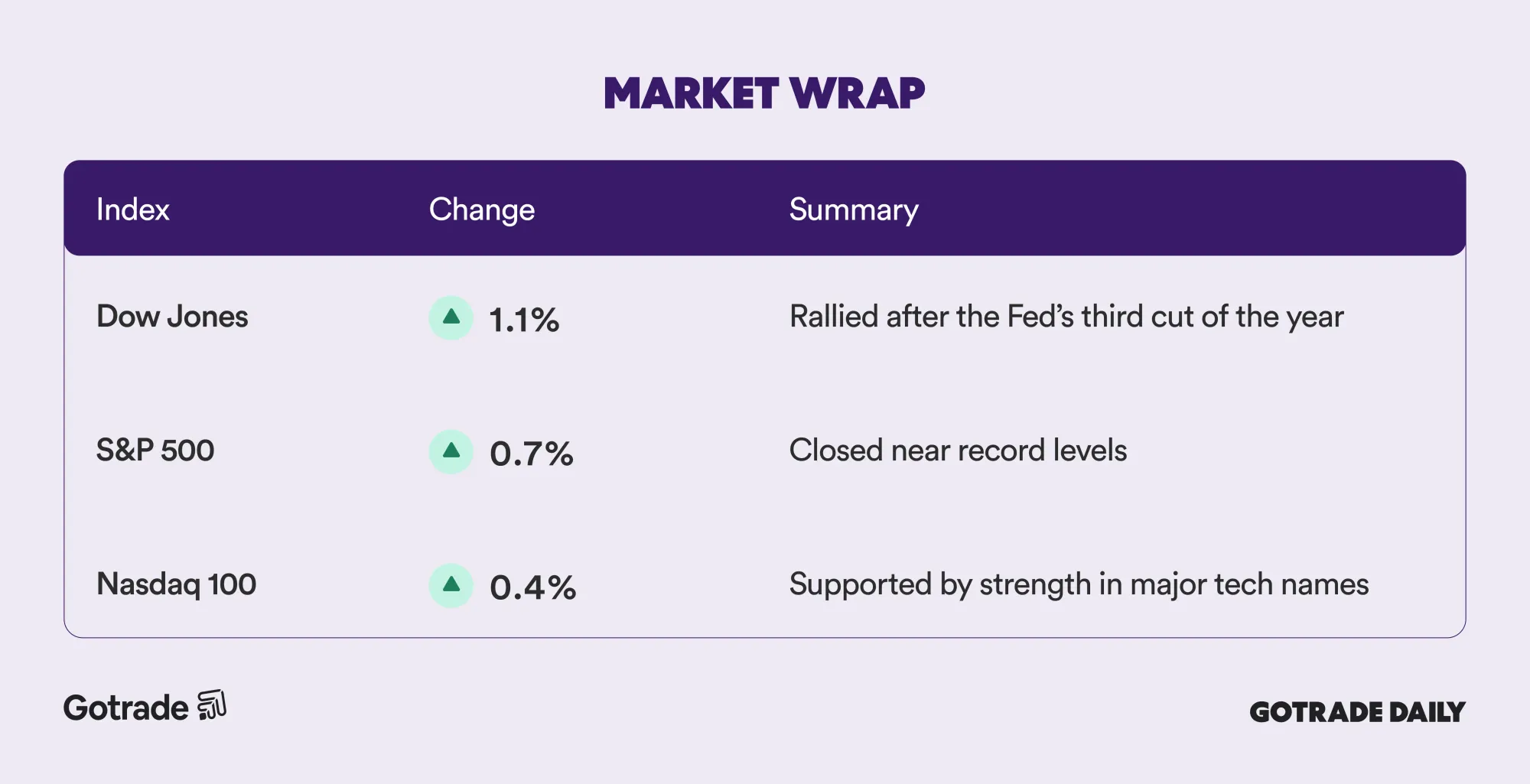

US stocks rallied on Wednesday after the Federal Reserve delivered a 25 basis point rate cut, lifting major indexes into the green and pushing the S&P 500 closer to record territory. The move marked the Fed’s third cut of the year, reinforcing expectations that inflation is continuing to cool.

The decision, however, came with clear signs of division inside the committee. Officials projected a slower path of easing for 2026, with only one cut penciled in. Two regional presidents preferred no cut at all, while Governor Stephen Miran pushed for a larger half point move.

In his press conference, Chair Jerome Powell acknowledged the “tension” in the Fed’s mandate but maintained confidence in the path of inflation, noting that recent price pressures tied to tariffs are likely to be one time in nature. Powell also highlighted continued underlying strength in the US economy, including activity tied to AI and productivity gains.

📊 Market Wrap Dec 11 2025

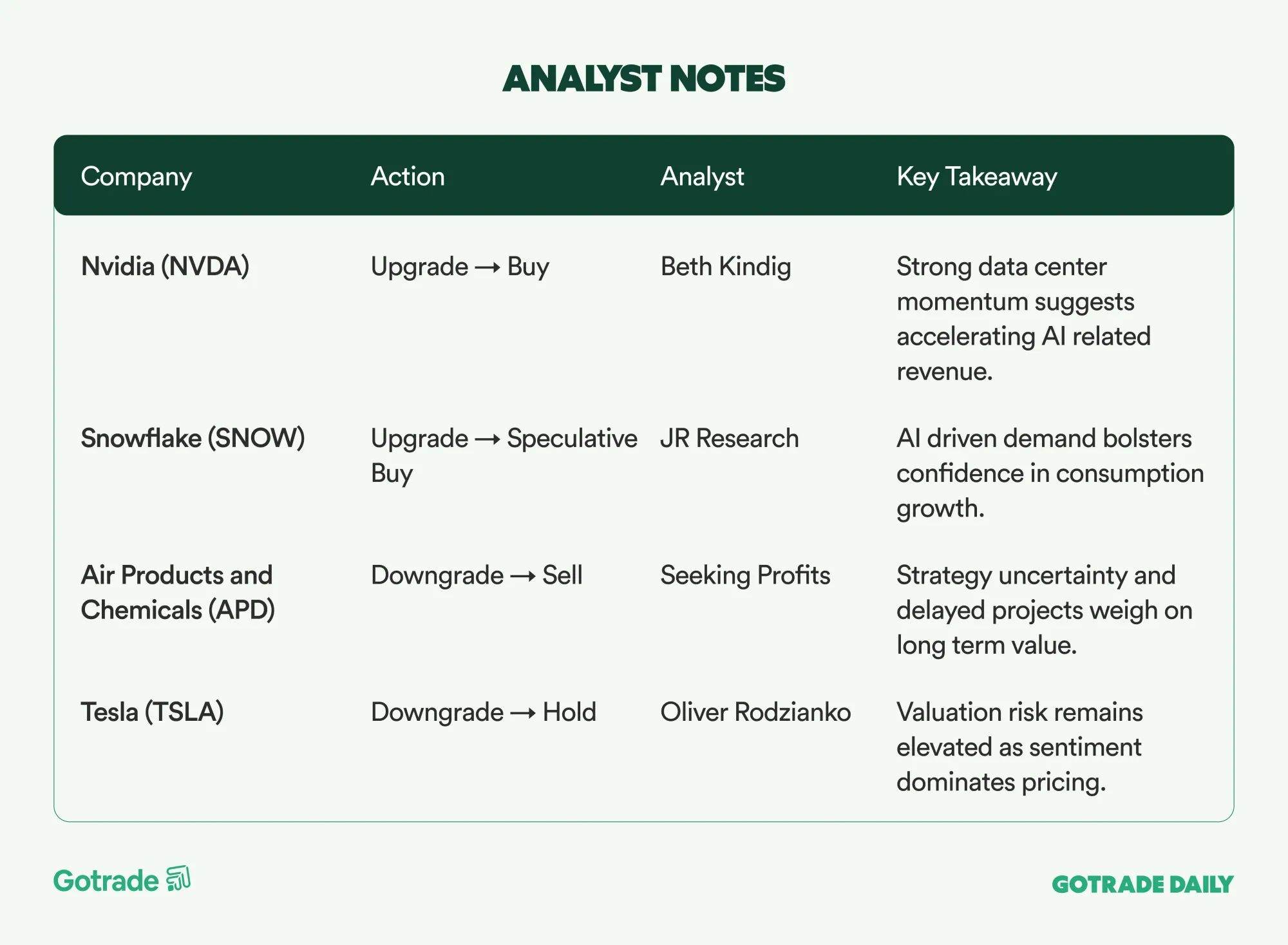

🧠 Analyst Notes

💬 Market Highlights

Adobe targets double digit ARR growth supported by AI and Semrush

Adobe (ADBE) closed FY25 with a record 23.77 billion dollars in revenue and strong margins, and now aims for ARR growth above ten percent in 2026. Management highlighted accelerating demand for Firefly, Acrobat AI Assistant, and Express, with AI credit consumption rising sharply. The Semrush acquisition is positioned to strengthen Adobe’s marketing and brand visibility suite on top of Creative Cloud and Experience Cloud, expanding cross sell potential into its large enterprise base.

Synopsys lifts 2026 revenue outlook on Ansys integration and AI momentum

Synopsys (SNPS) is targeting about 9.6 billion dollars in revenue for 2026 after consolidating Ansys and reporting a backlog above 11 billion dollars. The company emphasized a unified engineering workflow from chips to systems, deeper integration of Ansys RnD, and strategic collaboration with Nvidia for AI driven design and accelerated computing. While management noted that IP growth may be more muted and China demand remains a headwind, the company expects margin expansion toward the low 40 percent range through cost synergies and a shift toward AI and HPC workloads.

Regulatory pressure builds on AI as US attorneys general scrutinize Microsoft and Meta

A letter from 42 US state attorneys general raised concerns about chatbot outputs becoming “sycophantic” or “delusional,” especially for children. Microsoft (MSFT) and Meta (META) were among the companies asked to tighten safety features across Windows, Office, and social platforms. From a market standpoint, the development heightens regulatory risk and may increase compliance costs for large tech companies, while potentially delaying broader AI feature rollouts aimed at younger users.

📅 Earnings Watch

Markets ended the day firmly higher as investors digested the Fed’s slower easing path for next year. With the final policy meeting out of the way, attention now shifts back to broader macro trends and sector specific catalysts.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.