Investors weigh earnings momentum against jobs and inflation signals.

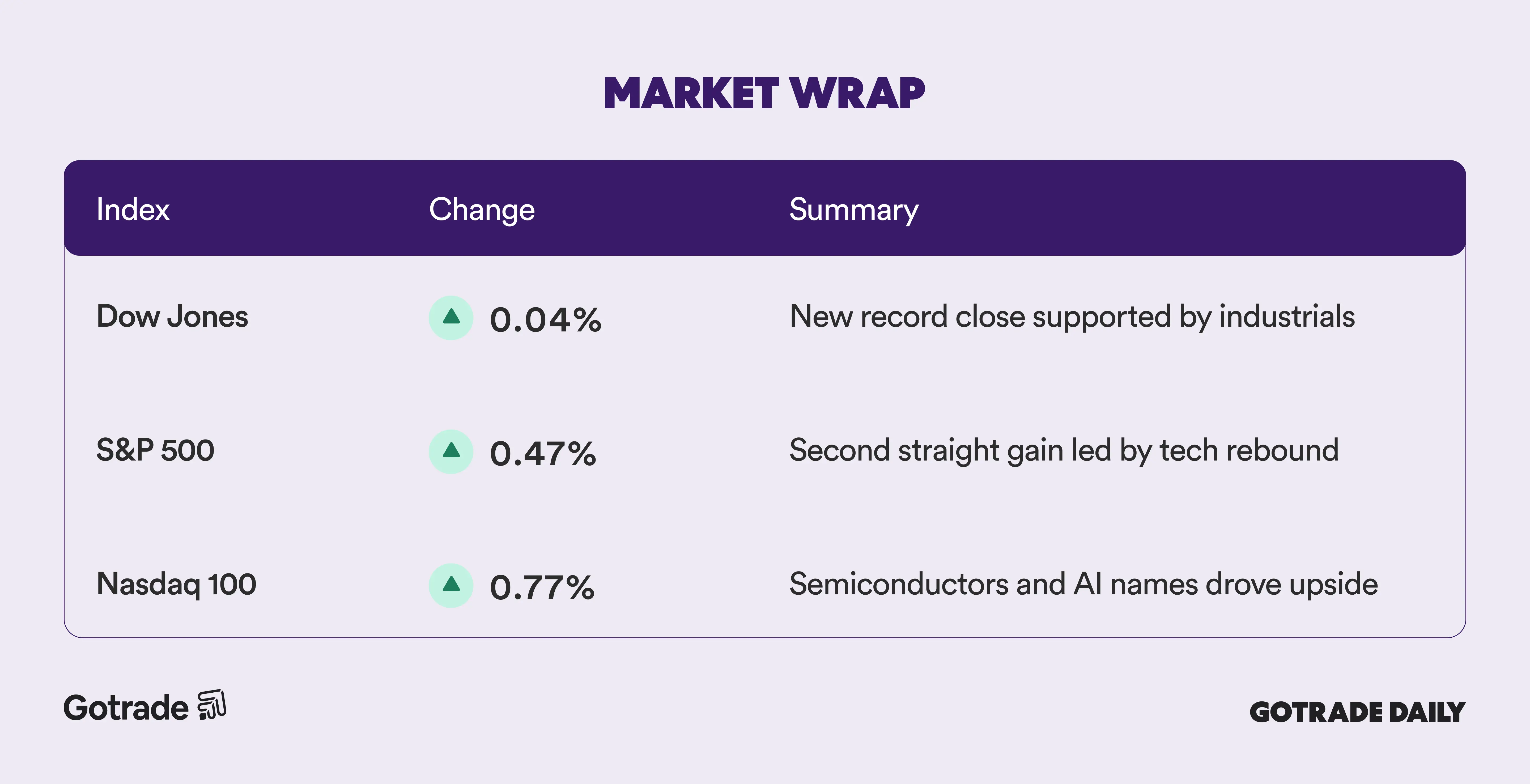

U.S. equities advanced on Monday as technology stocks led a rebound following last week’s sharp volatility, pushing the Dow Jones Industrial Average to a fresh record while the S&P 500 posted back to back gains. The S&P 500 rose 0.47% to close at 6,964.82, while the Dow added 20.20 points to finish at 50,135.87. The Nasdaq Composite outperformed, climbing 0.9% to 23,238.67.

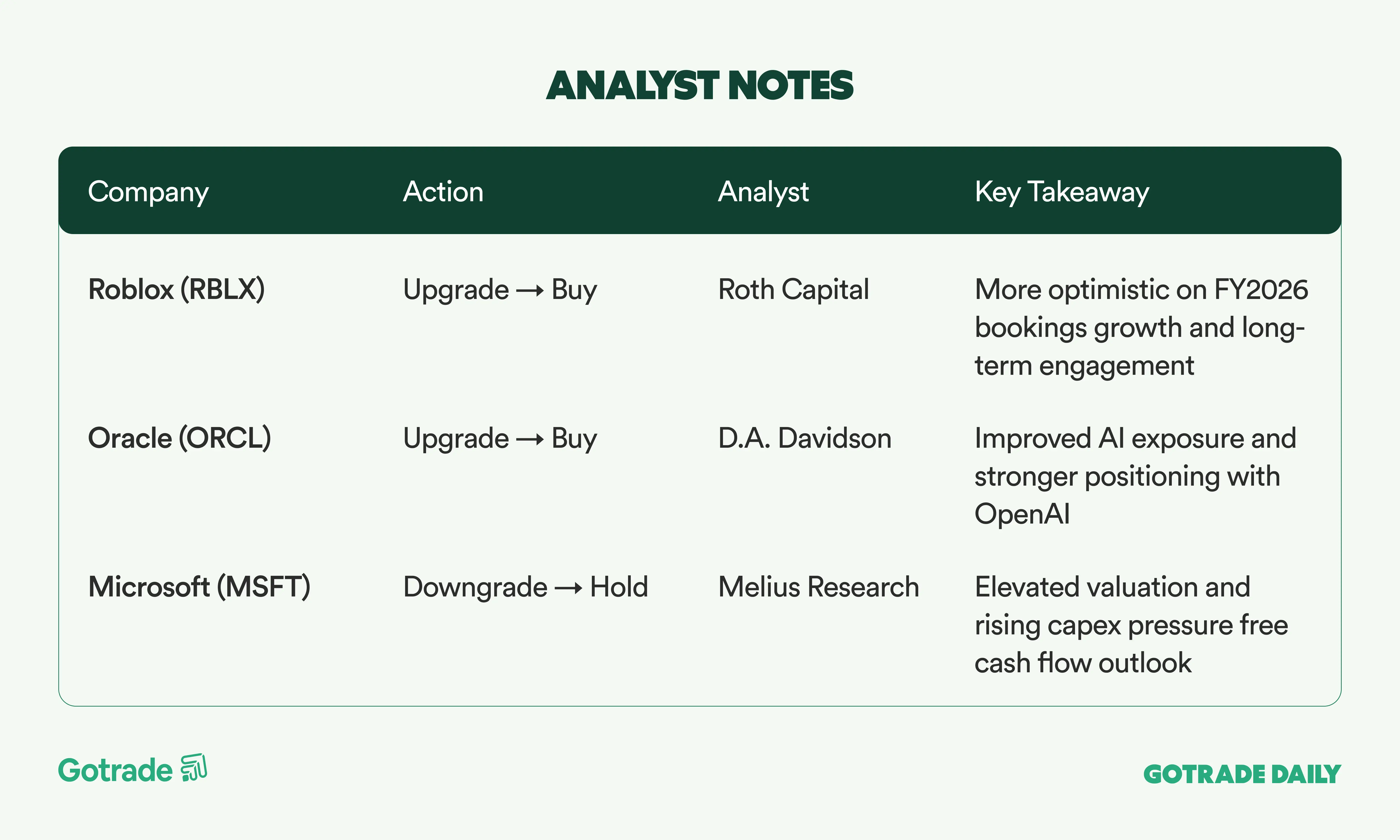

Strength in semiconductors anchored the move higher. Nvidia (NVDA) and Broadcom (AVGO) extended their recent gains, rising 2.5% and 3.3% respectively. Oracle (ORCL) surged 9.6% after being upgraded to Buy at D.A. Davidson, with analysts citing improved visibility tied to OpenAI and downstream AI beneficiaries.

The rebound followed a volatile stretch last week, when heavy selling in software and high growth stocks drove a broad risk-off move across markets. Investors remain cautious about whether the latest recovery has durability or represents a short-term bounce after positioning became stretched.

Looking ahead, attention turns to macro data and earnings. Coca-Cola (KO) and Ford Motor (F) are set to report, while investors also await delayed U.S. economic releases including the January jobs report on Wednesday and CPI inflation data on Friday. Economists expect payroll growth of around 55,000, alongside a 2.5% annual CPI reading.

Outside equities, precious metals remained in focus. Gold futures climbed back above US$5,000 per ounce after last week’s sharp pullback, while sentiment around gold-linked equities began to cool. The VanEck Gold Miners ETF (GDX), which had surged to record highs earlier this year on inflation and geopolitical concerns, has started to consolidate after an extended rally. Analysts point to elevated valuations, concentration risk, and technical overextension, with some market participants often using options to express more defined views as prices stabilize rather than adding outright exposure.

📊 Market Wrap Feb 10th 2026

🧠 Analyst Notes

💬 Market Highlights

Kyndryl Slides After Filing Delays and Executive Departures

Kyndryl (KD) shares plunged after the company announced delays in regulatory filings, including its Form 10-Q, amid an accounting and internal control review. Investor concerns intensified following the immediate departure of CFO David Wyshner and General Counsel Edward Sebold, alongside disclosures of voluntary document requests from the SEC related to cash management, free cash flow reporting, and internal controls.

While third-quarter results showed modest year-over-year growth in revenue and earnings, both missed expectations. Management’s statement that prior filings should no longer be relied upon and the likelihood of material weaknesses in internal controls have raised governance and reporting risk concerns, weighing heavily on near-term confidence despite underlying operational activity.

Alphabet Plans Bond Sale to Fund Accelerating AI Investments

Alphabet (GOOG, GOOGL) announced plans to raise funds through a bond offering, reportedly targeting around $15 billion, to support its expanding AI infrastructure investments. The move follows guidance for $175 billion to $185 billion in capital expenditures for 2026, underscoring the company’s aggressive push to scale AI capabilities across its ecosystem.

The decision to tap debt markets highlights Alphabet’s balance sheet strength and confidence in long-term cash flow generation, while signaling a more capital-intensive phase of AI competition. Markets generally view the bond issuance as a strategic step to preserve financial flexibility amid escalating AI spending.

Strategy Adds to Bitcoin Holdings Despite Ongoing Price Volatility

Strategy (MSTR) continued its bitcoin accumulation, purchasing 1,142 BTC worth approximately $90 million over the past week at an average price near $79,000 per coin. The purchases were funded through equity issuance, bringing total holdings to more than 714,000 BTC with an aggregate cost of about $54.35 billion.

The move reinforces management’s long-term conviction in bitcoin as a core treasury asset, even as market prices remain below the company’s average purchase cost and crypto volatility persists. For investors, MSTR increasingly functions as a leveraged bitcoin exposure, with equity performance closely tied to movements in digital asset prices.

📅 Earnings Watch

Markets are entering a phase where leadership is being tested across assets, with investors balancing strong earnings signals against tighter macro data and valuation discipline. As volatility lingers, attention remains on whether recent rebounds can broaden or give way to more selective positioning in the weeks ahead.

What stocks are you watching today?