Tech momentum builds into Christmas as AI recovers.

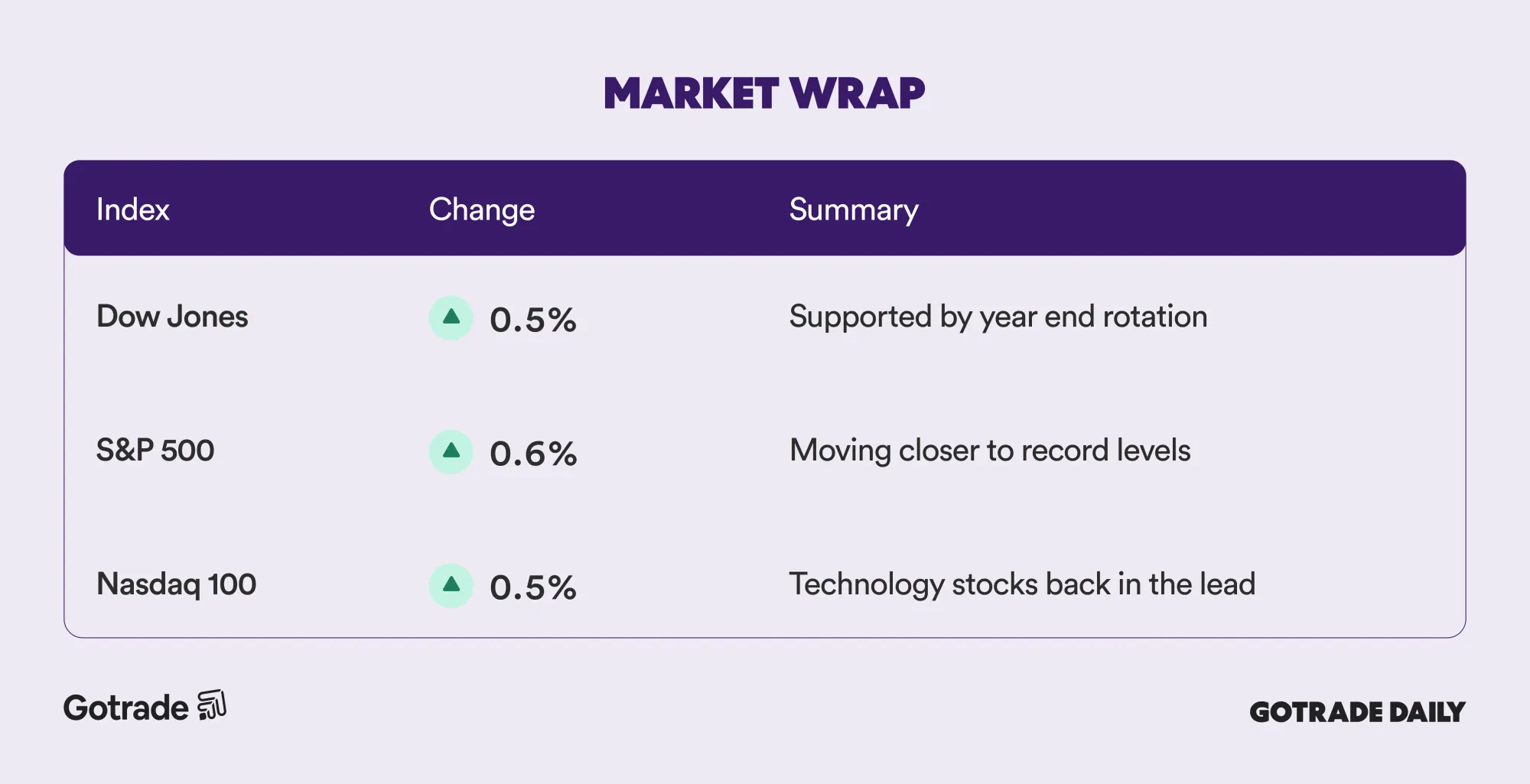

U.S. stocks advanced again as markets entered a holiday shortened week, extending gains for a third consecutive session. The Dow Jones, S&P 500, and Nasdaq 100 all closed higher, signaling that risk appetite is gradually returning as the year draws to a close.

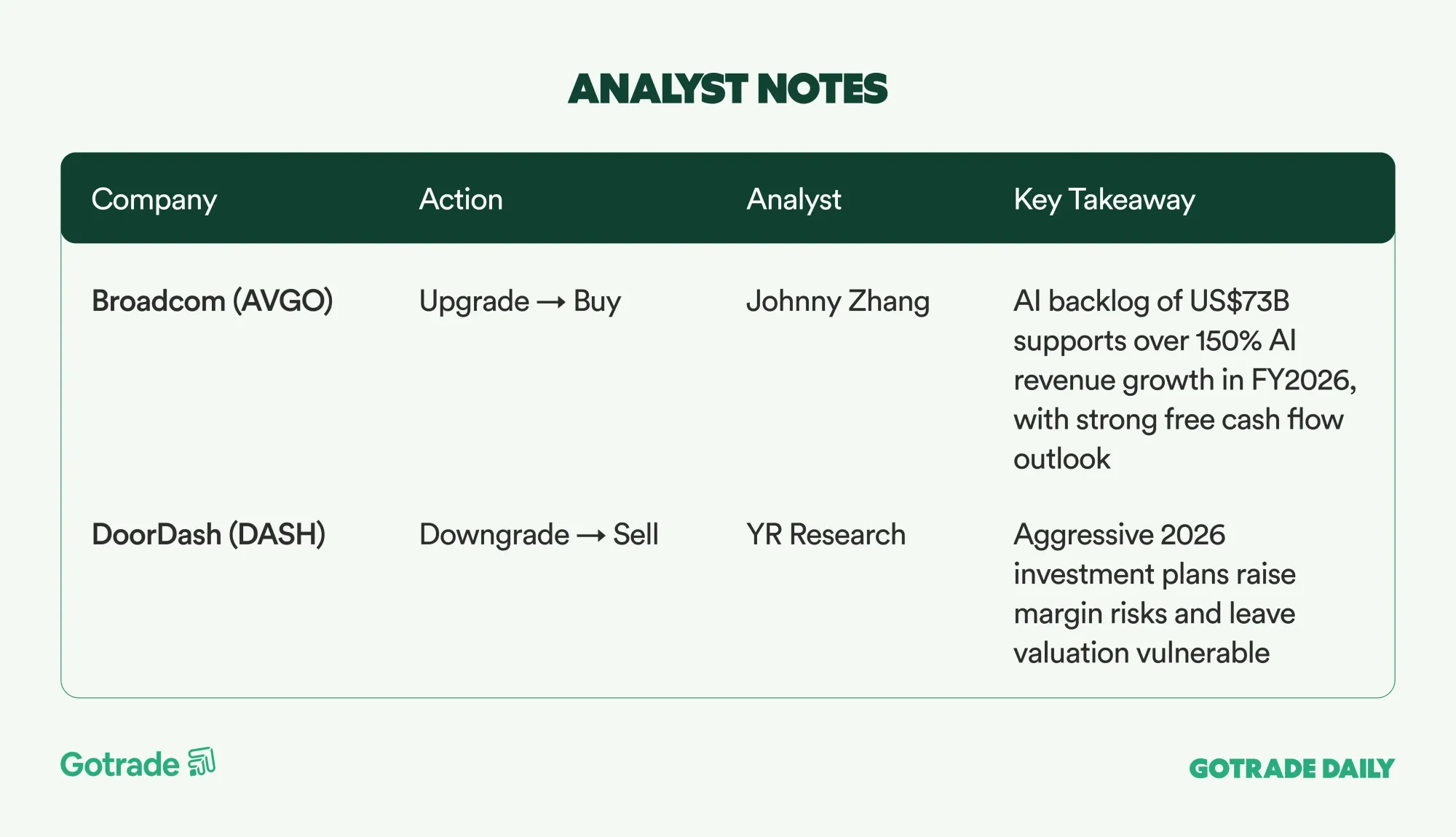

The rally was led by technology stocks. After a volatile stretch, large cap tech names were back in demand as short term concerns around AI valuations eased. Oracle (ORCL) extended its recent rebound, while Nvidia (NVDA) continued to anchor optimism around AI infrastructure. Tesla (TSLA) also moved higher and traded near its record territory.

Technology strength came amid expectations that cooling inflation and relatively soft labor data still leave room for potential rate cuts in 2026. While policymakers have not confirmed a new easing path, markets are increasingly pricing in a more accommodative backdrop next year.

Outside equities, geopolitical tensions lifted safe haven assets. Gold and silver hit fresh record highs, while oil prices climbed after the U.S. increased pressure on Venezuela. The mix of equity risk taking and rising commodity prices highlights how investors are reassessing risk as year end approaches.

For traders, the key question is whether tech momentum can hold in a low liquidity environment, and how delayed U.S. economic data due to the government shutdown could shape market direction in the final days of 2025.

📊 Market Wrap Dec 23rd 2025

🧠 Analyst Notes

💬 Market Highlights

Lockheed Martin Faces Scrutiny Over Capital Allocation

The Trump administration is reportedly considering measures to pressure major defense contractors, including Lockheed Martin (LMT), to prioritize faster weapons production over dividends, share buybacks, and executive compensation. The White House is said to be exploring policies that would link management incentives more closely to delivery performance on key weapons systems. While details remain uncertain, the move signals potential increased government involvement in defense sector governance.

Novo Nordisk Jumps After FDA Approves Oral Wegovy

Shares of Novo Nordisk (NVO) surged after the FDA approved an oral version of Wegovy, making it the first GLP-1 obesity treatment available in pill form. Clinical data from the OASIS 4 trial showed an average weight loss of 16.6%. The oral Wegovy launch is scheduled for January 2026, expanding access to obesity treatments and reinforcing Novo Nordisk’s leadership in the GLP-1 space.

Wells Fargo Expands Into Options Clearing

Wells Fargo (WFC) is reportedly entering the options clearing business to meet rising demand from institutional clients, following the removal of its long standing asset cap. The expansion is part of the bank’s broader effort to rebuild its global markets franchise and strengthen its competitiveness in trading and derivatives services.

📅 Earnings Watch

No major earnings releases this week.

Holiday trading tends to be quieter, but it is not irrelevant. Thin liquidity, sector rotation, and delayed economic data can still amplify moves, especially as markets head into the final stretch of the year.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.