November CPI revives rate-cut expectations for 2026.

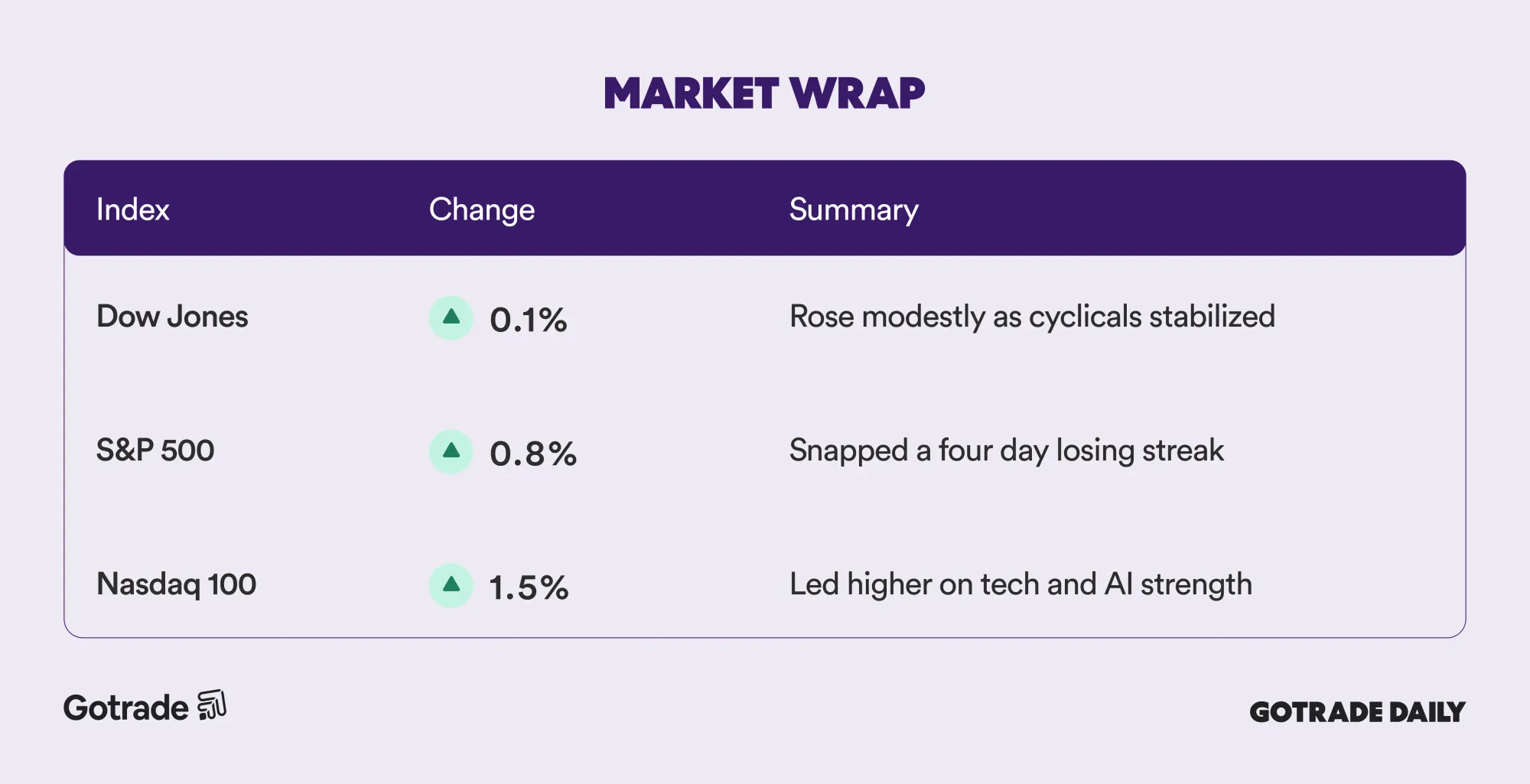

US stocks staged a broad rebound on Thursday after fresh inflation data showed price pressures easing faster than expected, offering relief to both equity and bond markets. The S&P 500 rose nearly 1%, snapping a four day losing streak, while Treasury yields fell as traders reassessed the outlook for Federal Reserve policy in 2026.

The catalyst was November’s consumer price index, which showed the slowest annual increase since early 2021. Despite distortions caused by the recent government shutdown, markets welcomed signs that inflation is moving in the right direction. The core CPI rose 2.6% year over year, below all estimates, helping ease concerns that sticky inflation would delay further rate cuts.

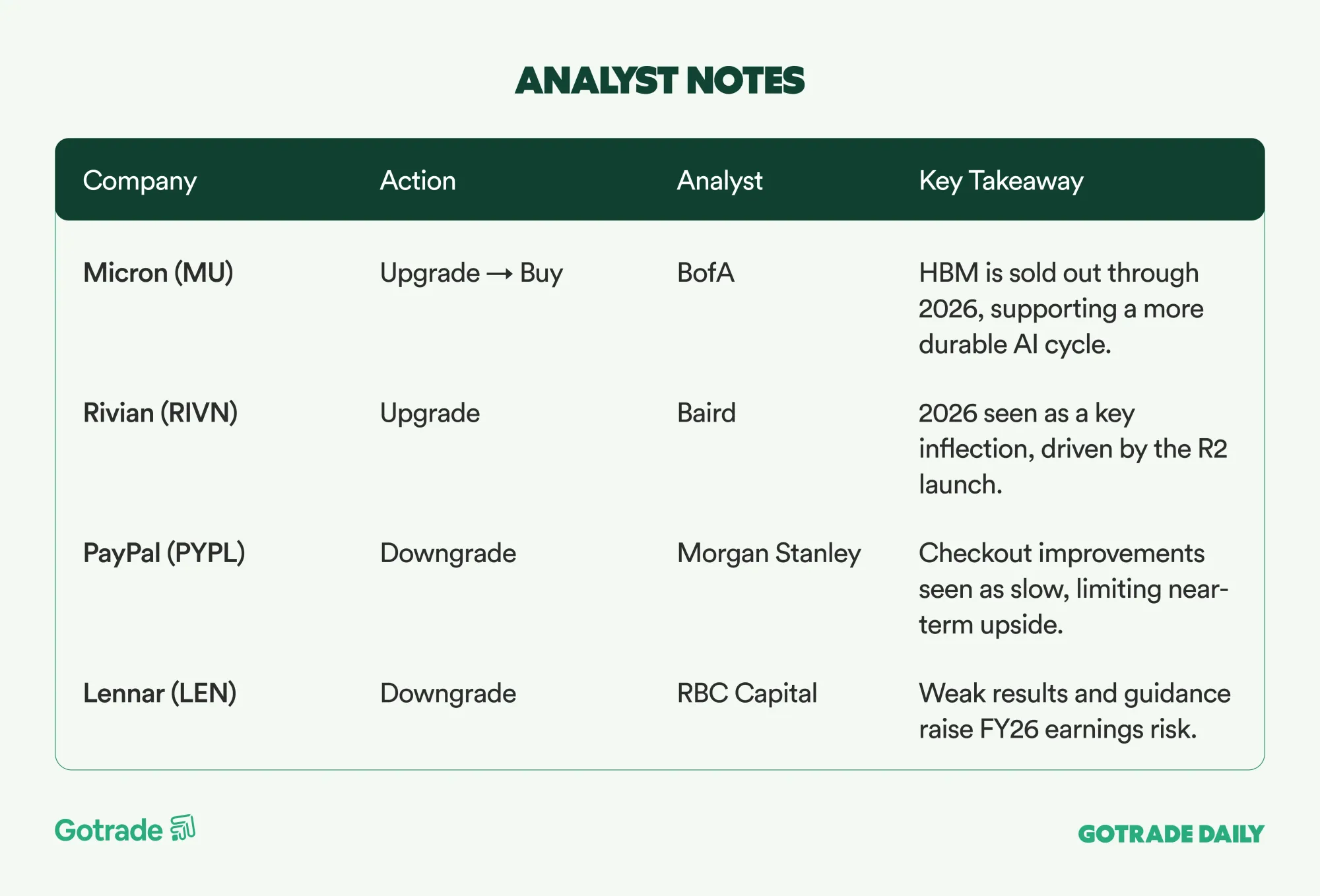

The rally was reinforced by strength in large cap technology. The Nasdaq 100 jumped 1.5%, led by a 10% surge in Micron (MU) after the company delivered a strong outlook tied to sustained AI driven demand. Gains in megacap tech helped restore risk appetite after a period of rotation away from crowded growth names.

In rates, the 10 year Treasury yield fell to around 4.11%, reflecting expectations that easing inflation could give the Fed more room to support a cooling labor market. While swaps still imply limited odds of a January rate cut, traders continue to price two rate cuts in 2026, with the first fully priced by mid year.

Globally, attention turned to Japan, where the Bank of Japan remains the only major central bank with potential rate-hike risk, highlighting a clear divergence in global monetary policy heading into 2026.

Analysts cautioned that the CPI report remains noisy due to incomplete October data collection, meaning policymakers are likely to place more weight on December’s inflation print. Still, the latest data helped validate the Fed’s wait and see stance and reopened the conversation around additional easing next year.

📊 Market Wrap Dec 19th 2025

🧠 Analyst Notes

💬 Market Highlights

Lockheed Martin Could Benefit From Turkey’s Potential Return to the F-35 Program

Turkey is reportedly exploring the option of returning its Russian-made S-400 air defense system as part of efforts to improve relations with the United States and reopen the door to the F-35 fighter jet program. If sanctions are lifted and the move materializes, Lockheed Martin (LMT), the primary contractor for the F-35, could see incremental orders and a broader international customer base. The development is viewed as a geopolitical catalyst that could support Lockheed Martin’s long term defense outlook.

Nike Targets Double Digit EBIT Margins Through Efficiency and Product Innovation

Nike (NKE) reiterated its focus on restoring profitability, targeting double digit EBIT margins through operational efficiency and a stronger sports focused product portfolio. Momentum has improved in North America, although margin pressure persists from tariffs and weaker demand in China. Management sees restructuring efforts, new product innovation, and organizational adjustments as key pillars for a healthier growth trajectory.

SoFi Enters the Stablecoin Market With the Launch of SoFiUSD

SoFi (SOFI) officially launched SoFiUSD, a US dollar stablecoin fully backed by cash and issued directly by SoFi Bank. The move makes SoFi the first US national bank to issue a stablecoin on a public blockchain. The initiative expands SoFi’s presence in the digital payments ecosystem and opens new growth opportunities tied to fast, secure, and low cost transaction infrastructure.

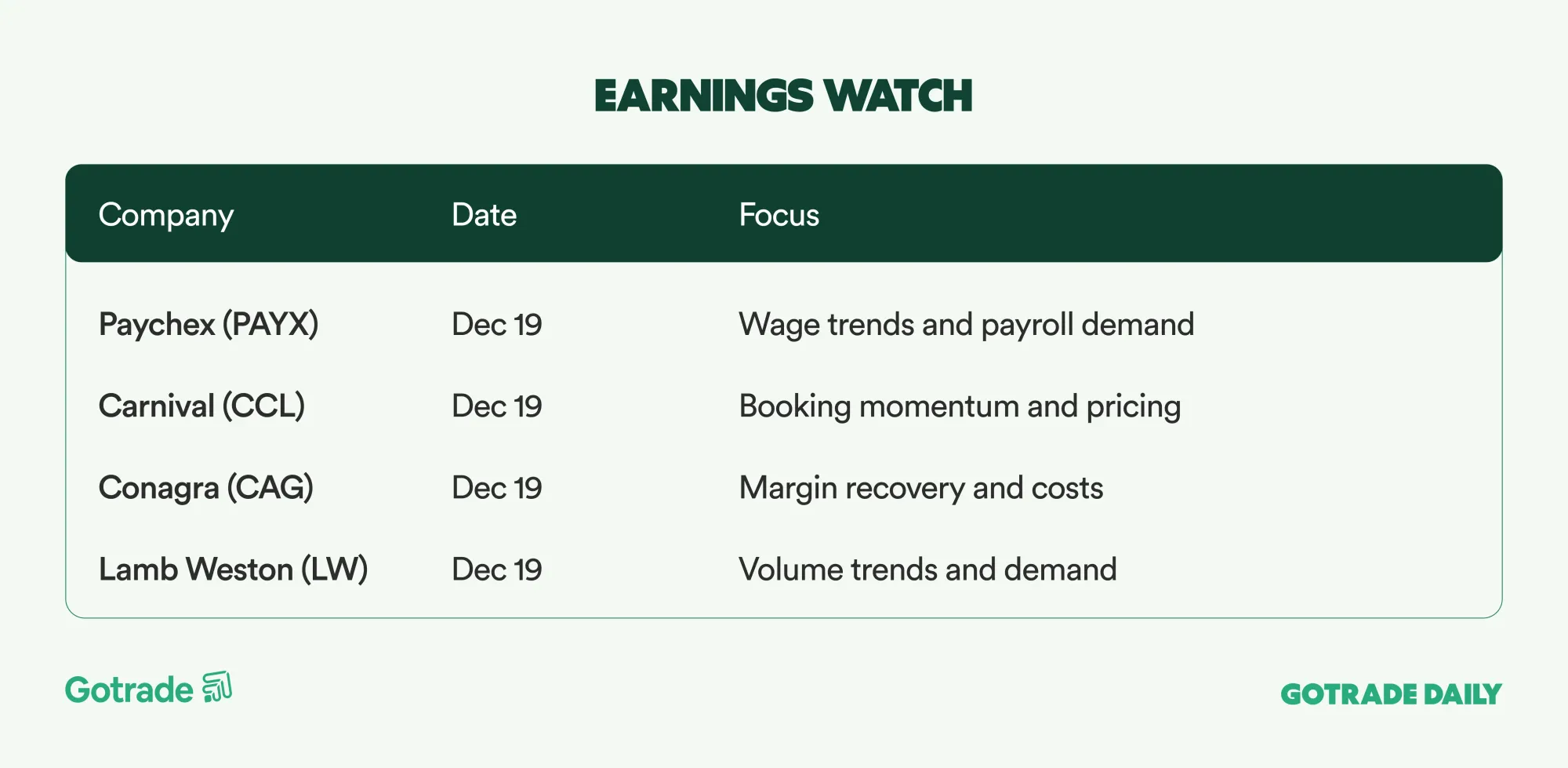

📅 Earnings Watch

Markets found breathing room after inflation data eased near term concerns, but attention now shifts to whether upcoming data can confirm this trend. December CPI and forward guidance into 2026 will be key in determining whether this rebound has staying power.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.