After three strong years, markets look ahead with optimism and higher selectivity.

US equities head into 2026 after an exceptional multi-year run. The S&P 500 finished 2025 at 6,845, marking a third straight year of double-digit gains as earnings growth, easing financial conditions, and improving risk appetite supported higher valuations.

Looking ahead, Wall Street broadly expects stocks to post further gains in 2026, though with more variation than in prior years. Strategists point to continued earnings growth, expectations for additional Federal Reserve rate cuts, and a resilient US economy, while also warning that returns may be less uniform and volatility more frequent after such strong performance.

Historically, years following gains of 15 percent or more tend to deliver positive but more moderate returns, often accompanied by meaningful pullbacks before markets move higher again. That backdrop suggests a market that remains constructive, but increasingly driven by positioning, stock selection, and earnings delivery.

While enthusiasm around technology and AI remains a key support, analysts note that leadership has begun to broaden. Financials, industrials, and selective consumer names have started to contribute more meaningfully, reinforcing confidence that the bull market is no longer reliant on a narrow group of stocks.

At the same time, risks remain on the radar. Elevated valuations, geopolitical uncertainty, trade policy questions, and confidence in future Fed policy could all shape market behavior as investors recalibrate expectations for 2026.

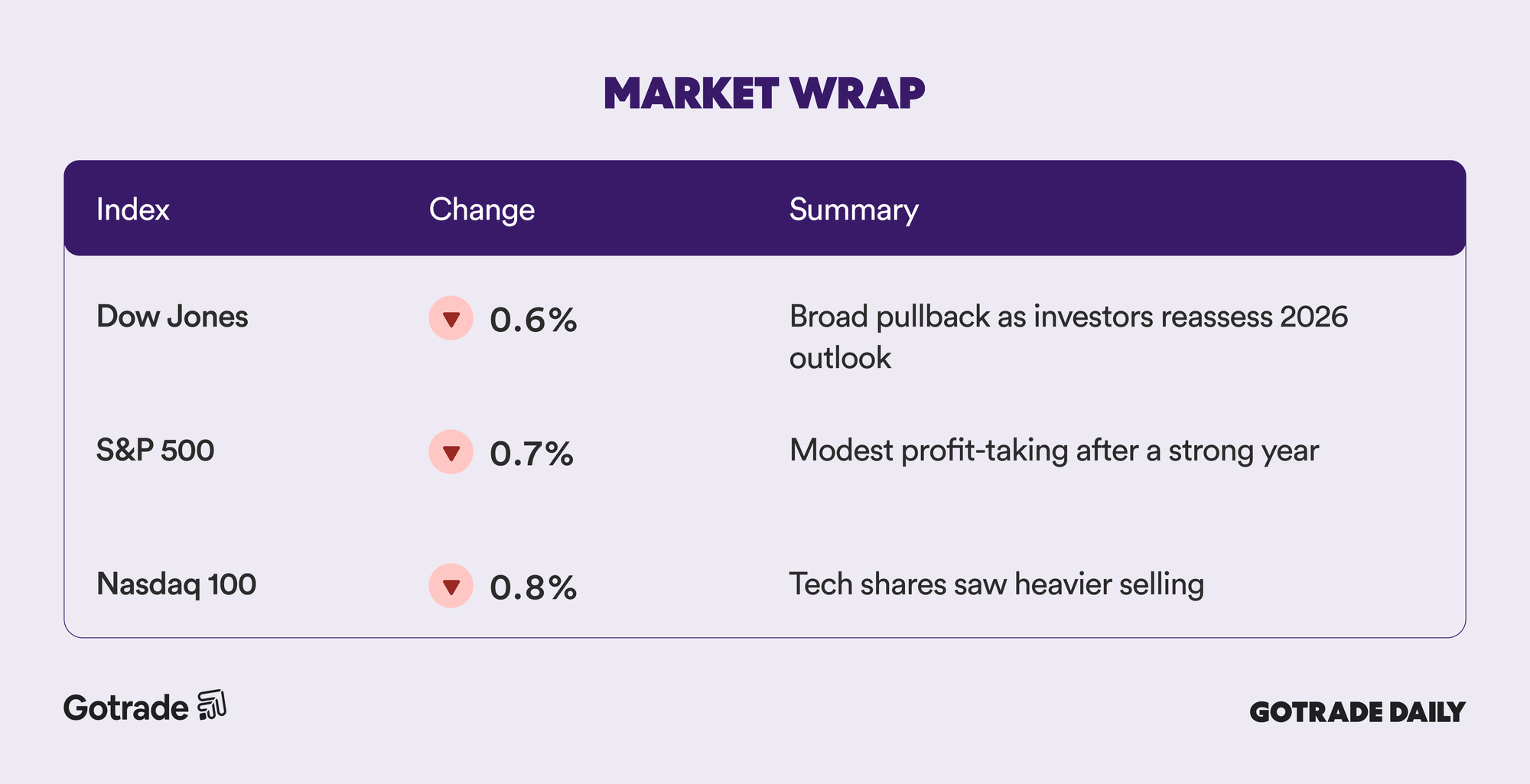

📊 Market Wrap Jan 2nd 2026

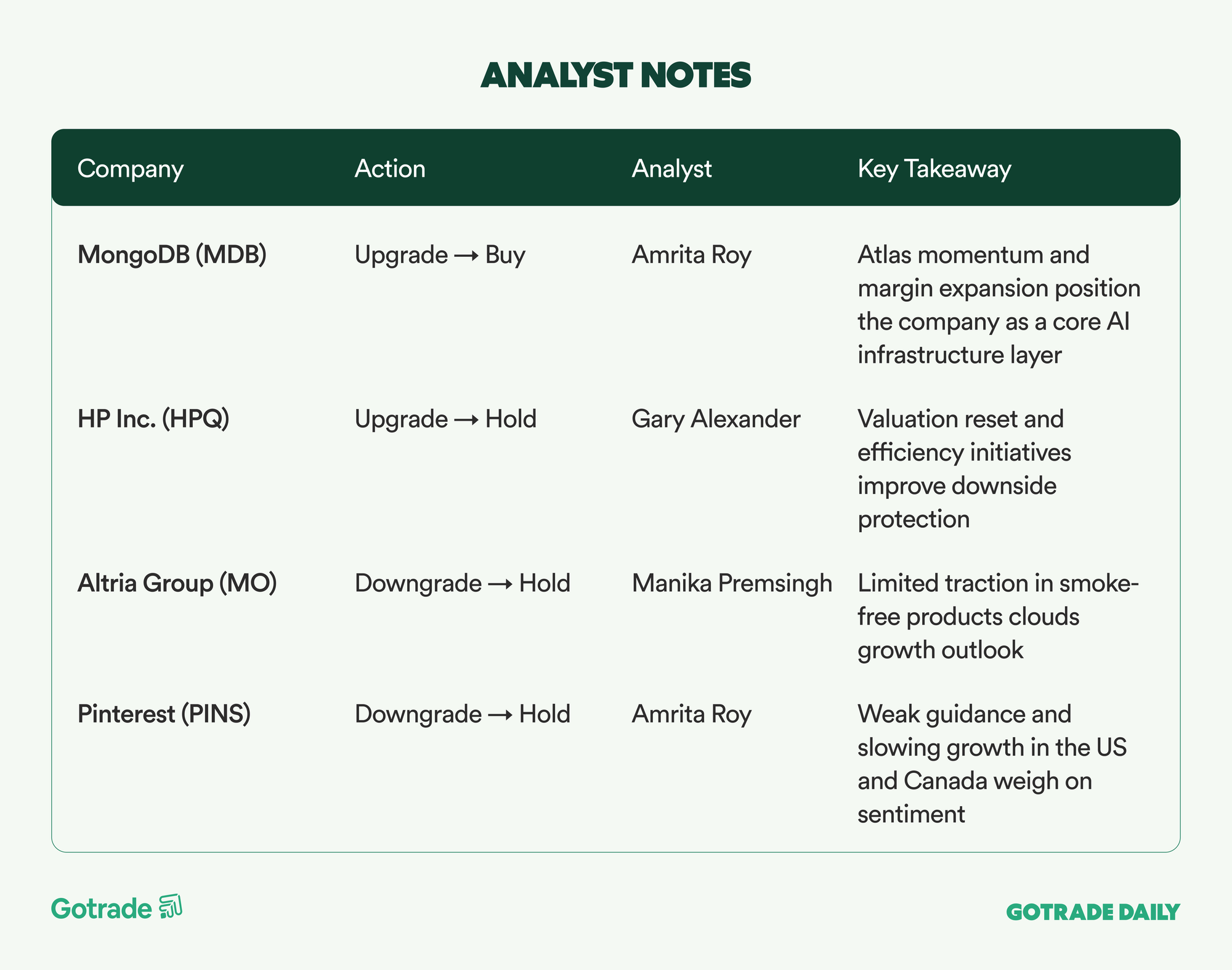

🧠 Analyst Notes

💬 Market Highlights

Neuralink, led by Tesla CEO Elon Musk, moves toward higher volume production

Neuralink, the brain computer interface company founded by Elon Musk, who also serves as CEO of Tesla (TSLA), said it plans to begin higher volume production of its implants in 2025, with a more automated surgical process expected in 2026.

While the clinical program remains limited, the update reinforces Musk’s push into frontier technologies beyond electric vehicles. For markets, it adds another long term optionality angle tied to the broader Tesla ecosystem.

NIO posts record deliveries, EV demand remains in focus

NIO (NIO) reported record monthly and quarterly deliveries, showing strong year over year growth and cumulative deliveries nearing one million vehicles. The data point suggests resilient demand for electric vehicles in China, even as competition and margin pressure remain key challenges. Investors are watching whether scale can translate into sustained profitability.

Nvidia and AMD expected to dominate CES headlines

Wedbush expects Nvidia (NVDA) and AMD (AMD) to lead headlines at the upcoming CES, with updates focused on data centers, industrial AI, AI PCs, robotics, and automotive computing. The event is viewed as an important checkpoint for enterprise spending trends and technology leadership heading into 2026, particularly across the semiconductor and AI ecosystem.

📅 Earnings Watch

No major earnings releases this week.

With earnings expectations still rising and economic conditions holding up, markets enter 2026 with a constructive backdrop, though investors may need to navigate wider swings and more selective leadership.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.