Key data this week will shape how traders position into year end and 2026.

US markets enter a holiday shortened week, but this is not a write off period. With thinner liquidity, macro data can carry outsized influence, especially as investors lock in final positioning for 2025 and start framing expectations for 2026.

The main focus is inflation. Monday’s Core PCE is the Fed’s preferred gauge and effectively the last clean inflation checkpoint of the year. After mixed CPI prints and shutdown related distortions, traders will be watching whether PCE confirms easing price pressure or keeps inflation sticky enough to limit rate cuts next year.

Growth and demand come into view on Tuesday with the Q3 GDP revision and consumer confidence. Together, these help answer a key question for traders: is the economy slowing enough to support easier policy, without slipping into something worse. Any surprise here can shift rate expectations quickly, especially in rate sensitive sectors.

Wednesday morning brings durable goods orders and jobless claims before an early close. With limited time to react, positioning often happens fast. In this environment, traders tend to lean on key technical levels, sector leadership, and momentum rather than chasing headlines.

The takeaway for traders

This is a week to trade selectively, respect liquidity, and stay aligned with macro direction. Inflation data sets the tone, growth data refines it, and year end flows can amplify moves. Discipline matters more than volume.

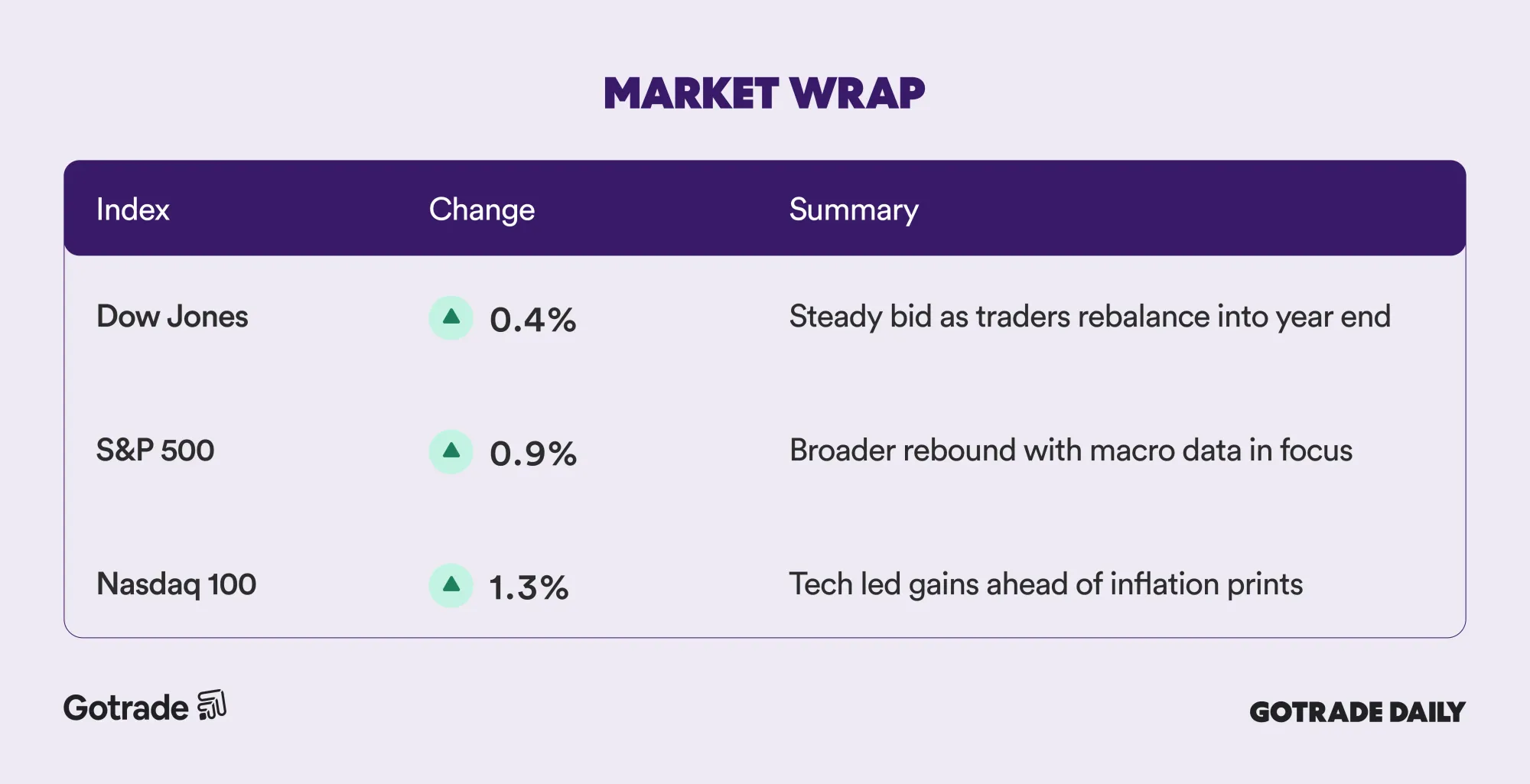

📊 Market Wrap Dec 22nd 2025

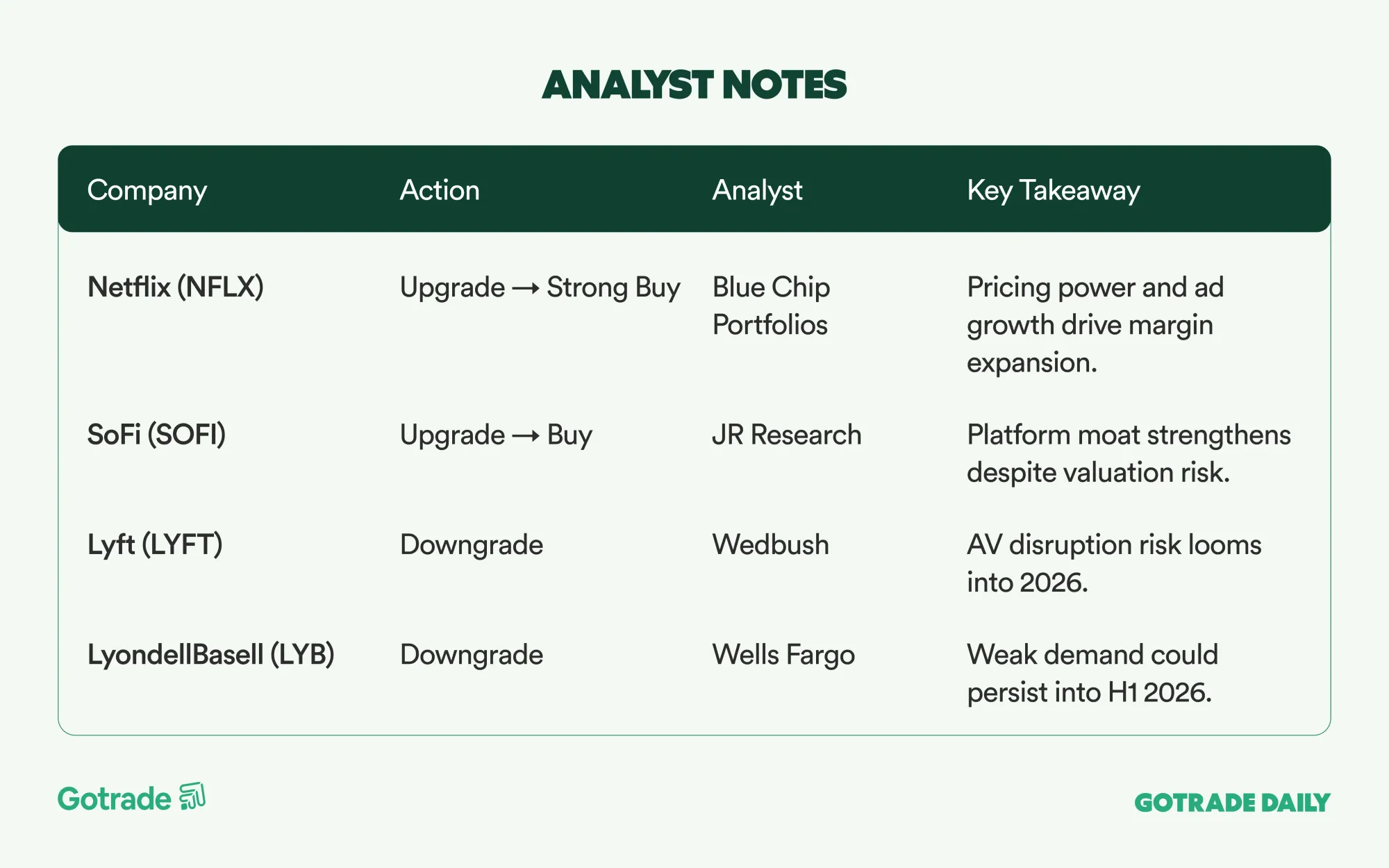

🧠 Analyst Notes

💬 Market Highlights

Waymo Temporarily Halts Robotaxi Service in San Francisco After Power Outage

Alphabet’s autonomous vehicle unit, Waymo, temporarily suspended its robotaxi operations in San Francisco after a major power outage caused several vehicles to stop and disrupt traffic. The incident highlighted the dependence of autonomous fleets on external infrastructure such as electricity and city traffic systems. For Alphabet, the event serves as a reminder that while Waymo remains a long term strategic asset in AI and transportation, operational reliability and public perception continue to be key risks to large scale adoption.

Cisco and Arista Seen as Potential 2026 Outperformers on AI Infrastructure Demand

Morgan Stanley sees Cisco (CSCO) and Arista Networks (ANET) as well positioned to outperform in 2026 as global AI infrastructure buildout continues. Cisco is viewed as having upside from sovereign demand, optics, and hyperscale data centers, with AI related revenue becoming a more meaningful contributor. Arista is seen as a potential rebound candidate as negative sentiment fades and AI deployments move into activation phases. Ongoing investment in networking, optics, and Ethernet for AI supports the sector’s role as a key beneficiary of the next AI capex cycle.

FedEx Delivers Margin Expansion on Operational Efficiency Gains

FedEx (FDX) reported fiscal second quarter results that exceeded expectations, with operating margin rising to 6.9 percent on the back of successful efficiency initiatives and business transformation. Revenue growth was supported by higher domestic and international shipping yields in the US, continued cost savings, and increased package volumes. Management also raised its full-year outlook and reaffirmed plans to spin off FedEx Freight in 2026, reinforcing the shareholder value narrative amid a challenging operating environment.

📅 Earnings Watch

No major earnings releases this week.

Holiday weeks are quieter, but they are not irrelevant. Inflation direction, growth signals, and positioning into 2026 are all being set right now.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.