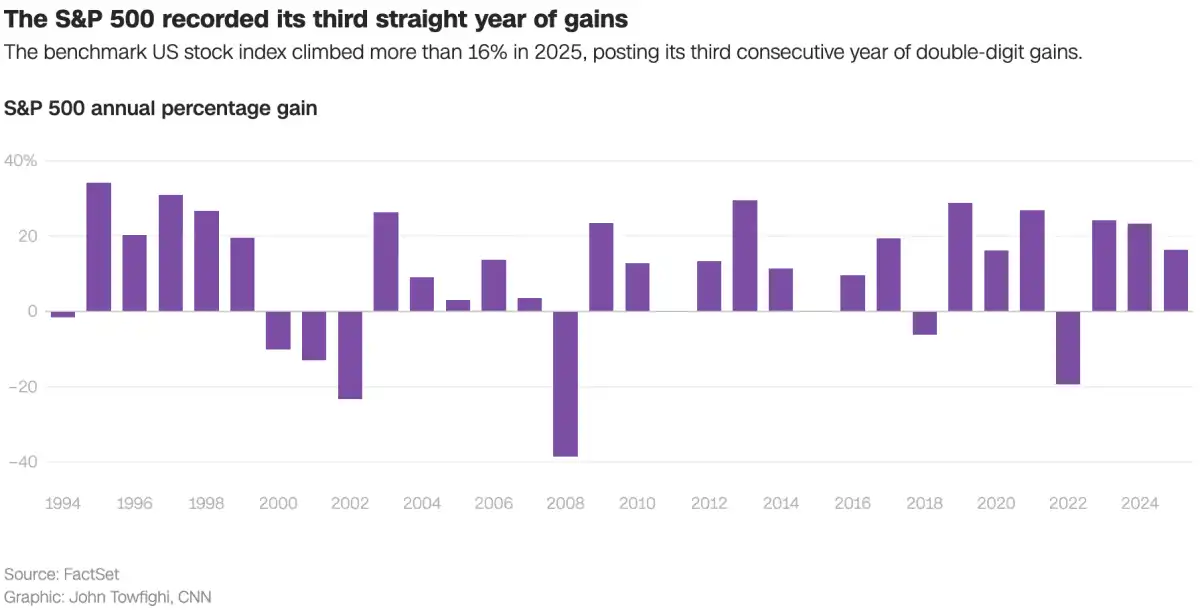

Jakarta, Gotrade News - After pulling off double-digit gains for three straight years, the S&P 500 wrapped up 2025 at the 6,845.50 level.

Wall Street is now placing its bets on whether this green streak can hit a "four-peat" in 2026. For investors, getting the lowdown on the diverging price targets from big institutions is key to setting strategy and managing return expectations this year.

Key Takeaways

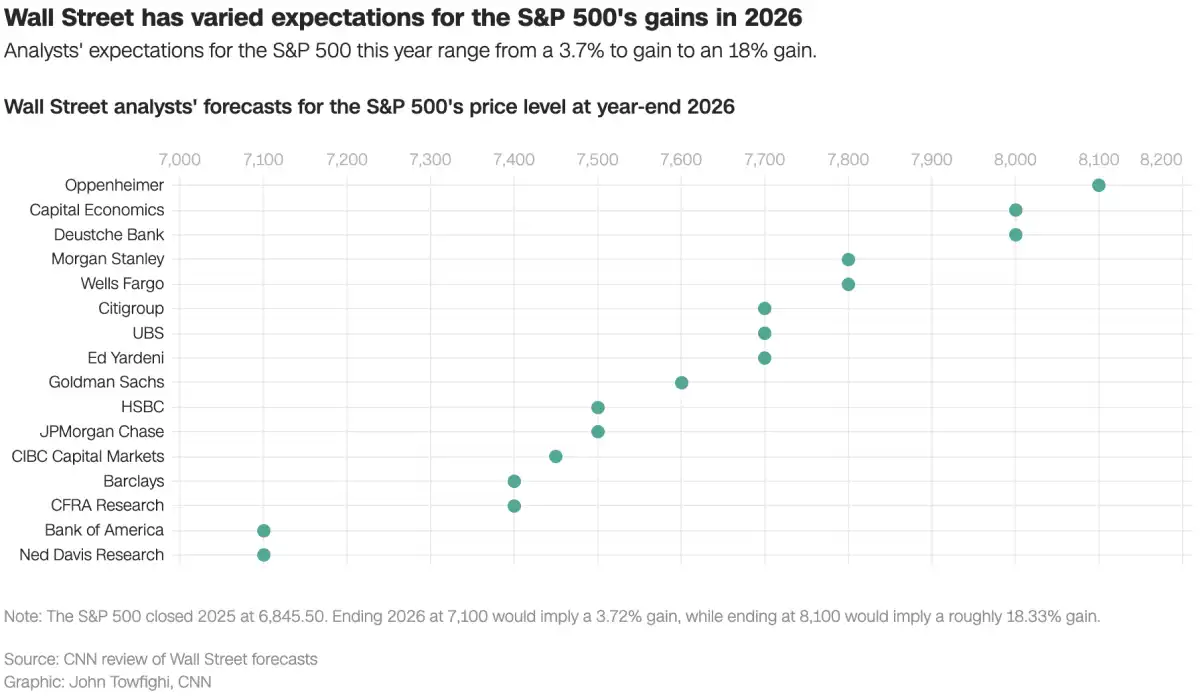

- Analysts project the S&P 500 to keep growing in 2026, with targets ranging from a conservative 3.7% to an 18% upside.

- The AI sector and potential Fed rate cuts remain the main fuel for market optimism.

- High valuations demand extra caution, even though strategists view the probability of a recession as low.

Read also: Are EVs Losing the Hype? Hybrids Are Stealing the Spotlight

Most financial heavyweights predict the US market will stay in the green, but the levels of optimism vary wildly. Based on data reviewed by CNN, year-end 2026 targets stretch from a conservative 7,100 prediction by Bank of America to the 8,000 level forecast by more aggressive analysts.

Market history shows an interesting pattern when the benchmark index gains at least 15% in a calendar year. LPL Financial's chief technical strategist, Adam Turnquist, notes that the following year usually sees average returns of about 8%, though it's often a bumpy ride with average mid-year drawdowns of roughly 14%.

Main Drivers

The bullish narrative this year is still dominated by the AI boom, which is seen as unlocking a new era of profitability for US Inc. Dan Ives from Wedbush Securities specifically highlights big tech names like NVIDIA, Microsoft, Apple, Tesla, and Palantir as his top picks for 2026.

Beyond tech, expectations of further rate cuts by the Fed are giving equity valuations some breathing room. Strategists at JPMorgan Chase noted that the US economy is set to remain a global growth engine, backed by record-breaking corporate capital expenditure (capex).

Market participation is also looking healthier, with the Dow Jones starting to keep pace with the Nasdaq since late last year. Peter Oppenheimer fromGoldman Sachsstated they remain constructive on equities as earnings grow, though index returns might be more modest compared to the 2025 run.

Risks to Watch

However, investors shouldn't sleep on geopolitical risks and tariff uncertainties that could trigger volatility at any moment. Deutsche Bank and other analysts highlight that if inflation proves stubborn in the new year, it could complicate the central bank's rate-cutting path and put pressure on stock prices.

US stock valuations, which are looking pricey relative to earnings, are under the microscope. Ed Yardeni of Yardeni Research targets the S&P 500 at 7,700, but he reminds us that while the probability of a market correction triggered by recession fears remains low at 20 percent, the risk isn't zero.

Read also: Disney’s $10M Fine: Data Privacy Issues Resurface

Reference:

- CNN, What to expect from stocks in 2026. Diakses pada 2 Januari 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.