Upstart Holdings, Inc. (NASDAQ: UPST) is back in focus after another sharp selloff, creating a compelling accumulation opportunity for growth-oriented investors.

Despite macro headwinds and cautious guidance, UPST continues to post solid revenue growth, expanding profitability, and a structurally improving business model driven by AI-powered lending automation.

- Q3 Revenue: $277M (+71% YoY), slightly below guidance ($280M).

- Contribution Margin: 57% (vs 58% guidance), still elevated historically.

- Adj. EBITDA: $71M (26% margin), beating guidance of $56M.

- Balance Sheet: $490M cash vs $1.9B debt, offset by $1.2B in held loans.

- Q4 Guidance: $288M revenue (+31.5% YoY), 53% contribution margin.

- Valuation: <3x forward sales, PEG ~0.5x (unusually cheap for a profitable AI fintech).

Rating: BUY. Using weakness to accumulate a high-volatility AI lending leader trading at deep value multiples.

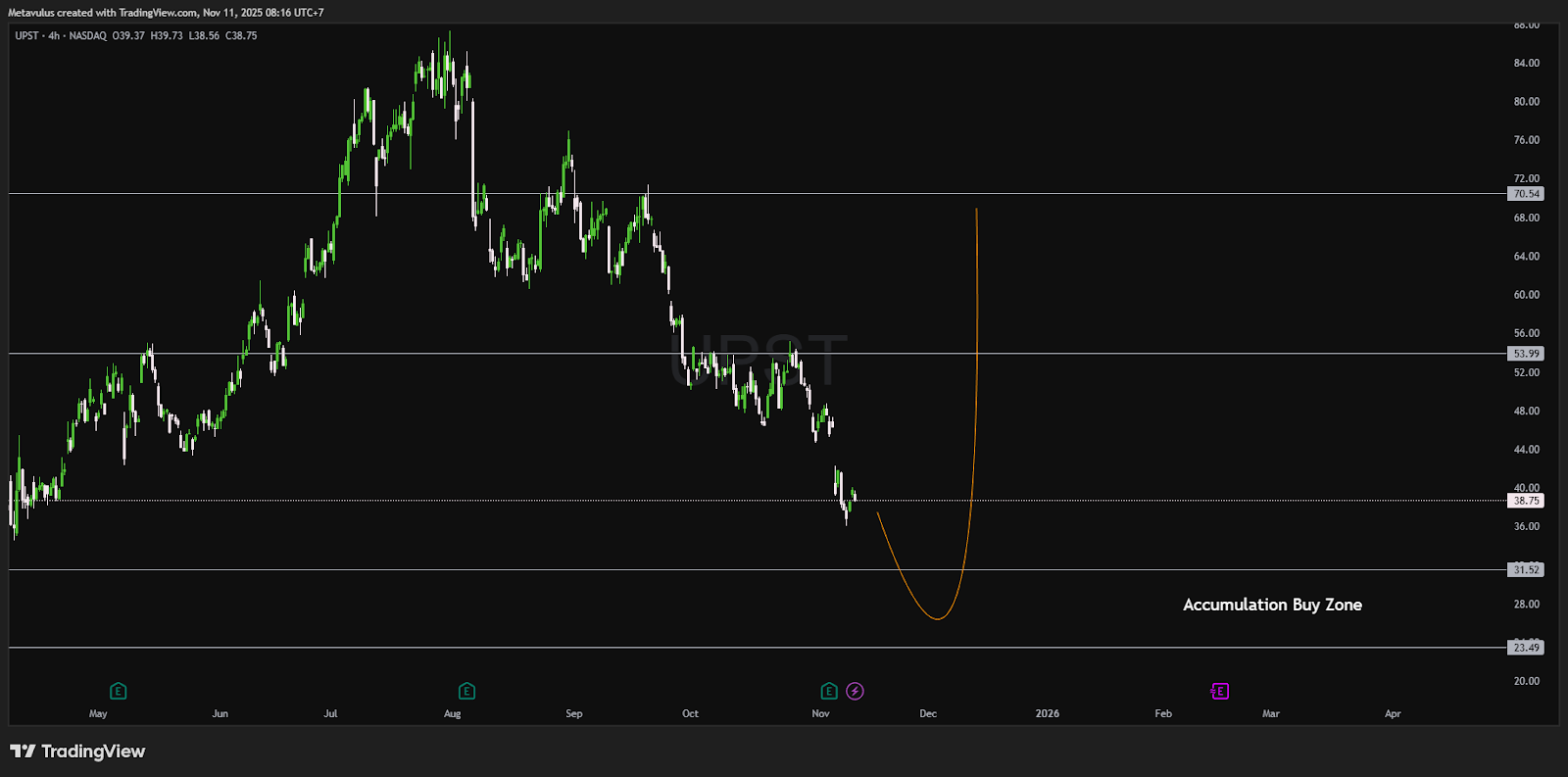

Technical Analysis

- Current Price: $38.75

- Accumulation Zone: $31.52 – $23.49

- Support: $31.52 (first layer) / $23.49 (final demand zone)

- Invalidation: Weekly close below $23.49

- Resistance / Targets: $53.99 → $70.54

UPST remains in a broad downtrend but is approaching a long-term demand area.

Scenario: capitulation flush into the $31–23 zone → base formation → rebound toward $54–70 as risk appetite returns.

Structure suggests a cyclical low forming, aligning with valuation reset levels.

Trading Setup

Accumulation Plan (DCA):

- 40% at $31.5–29

- 40% at $29–25

- 20% at $25–23.5 (final deep bids)

Stop Loss: Weekly close below $23.49

Take Profit (TP):

- TP1: $53.99

- TP2: $70.54–72.00

Risk/Reward Example: Entry ~$29, risk ~$6 (to $23), reward ~$24–41 → 4–6R setup.

Optional Income Play:

Sell cash-secured puts ($25–27.5, 30–45DTE) to enter at discount. Once assigned, sell covered calls at $55–70 for yield enhancement.

Growth Thesis: Why the Pullback = Opportunity

1. AI Lending Efficiency Edge

Upstart’s proprietary AI credit decisioning platform allows banks and partners to lend to a broader population beyond traditional FICO limits, with lower loss rates.

The platform continuously retrains on real-time credit data, giving UPST a long-term moat in credit risk modeling automation.

2. Solid Growth, Despite Macro Headwinds

- Revenue +71% YoY (Q3) even as loan approvals tightened.

- Management intentionally reduced approval rates and raised rates to protect portfolio quality.

- Conversion fell to 20.6%, but management emphasized this reflects discipline, not weakness.

3. Profitability Momentum

- Adj. EBITDA beat by 26% vs guidance.

- Contribution margin (57%) remains structurally high due to automation and efficiency in origination.

- Management continues prioritizing per-share FCF growth over volume.

4. Balance Sheet Expansion is Temporary

- Loan book rose to $1.2B as R&D loans for new products increased.

- Management reiterated this expansion is temporary during the transition to new funding channels.

- Continued focus on external capital partnerships (forward-flow, credit unions) to de-risk balance sheet.

5. Valuation Re-Compression Creates Upside

- <3x forward sales and PEG 0.5x = undervalued for 30–40% growth.

- Long-term profitability + scalability means even modest rerating to 4–5x sales could imply 50–70% upside.

Valuation & Risks

Attractive De-Rating:

| Metric | FY25E | FY26E |

|---|---|---|

| EV/Sales | <3x | ~2.5x |

| PEG Ratio | ~0.5x | <0.5x |

| Adj. EBITDA Margin | 26% | 30%+ (potential) |

Key Risks:

- Credit cycle deterioration: if delinquencies rise, lending partners may pull back.

- Macro slowdown: lower loan demand, higher defaults.

- Competitive AI lending models from banks and fintechs.

- Balance sheet exposure if held loans aren’t offloaded in time.

Risk Mitigation:

- Diversified funding (bank & institutional flow agreements).

- Dynamic AI model retraining and credit risk throttling.

- Cash cushion ($490M) provides runway for R&D and flexibility.

Conclusion

Upstart has weathered a difficult macro cycle, yet remains profitable, growing, and highly innovative.

The stock’s collapse to sub-3x sales levels represents deep value in an AI credit platform with long-term scalability.

This is not a “hypergrowth” trade, it’s a volatility-to-value transition, ideal for disciplined accumulation.

✅ BUY around $31–23 zone;

Target $54 → $70;

Cut if weekly closes below $23.5.

This setup offers multi-bagger potential once credit markets normalize and growth reaccelerates into 2026.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.