Jakarta, Gotrade News - Tesla, Inc. investors seem to care way more about Elon Musk's future promises than the actual car sales numbers right now. But you need to understand the real risks behind this autonomous driving euphoria that’s propping up the stock.

Key Takeaways

- Tesla is expected to report an 11% to 15% drop in vehicle deliveries for Q4.

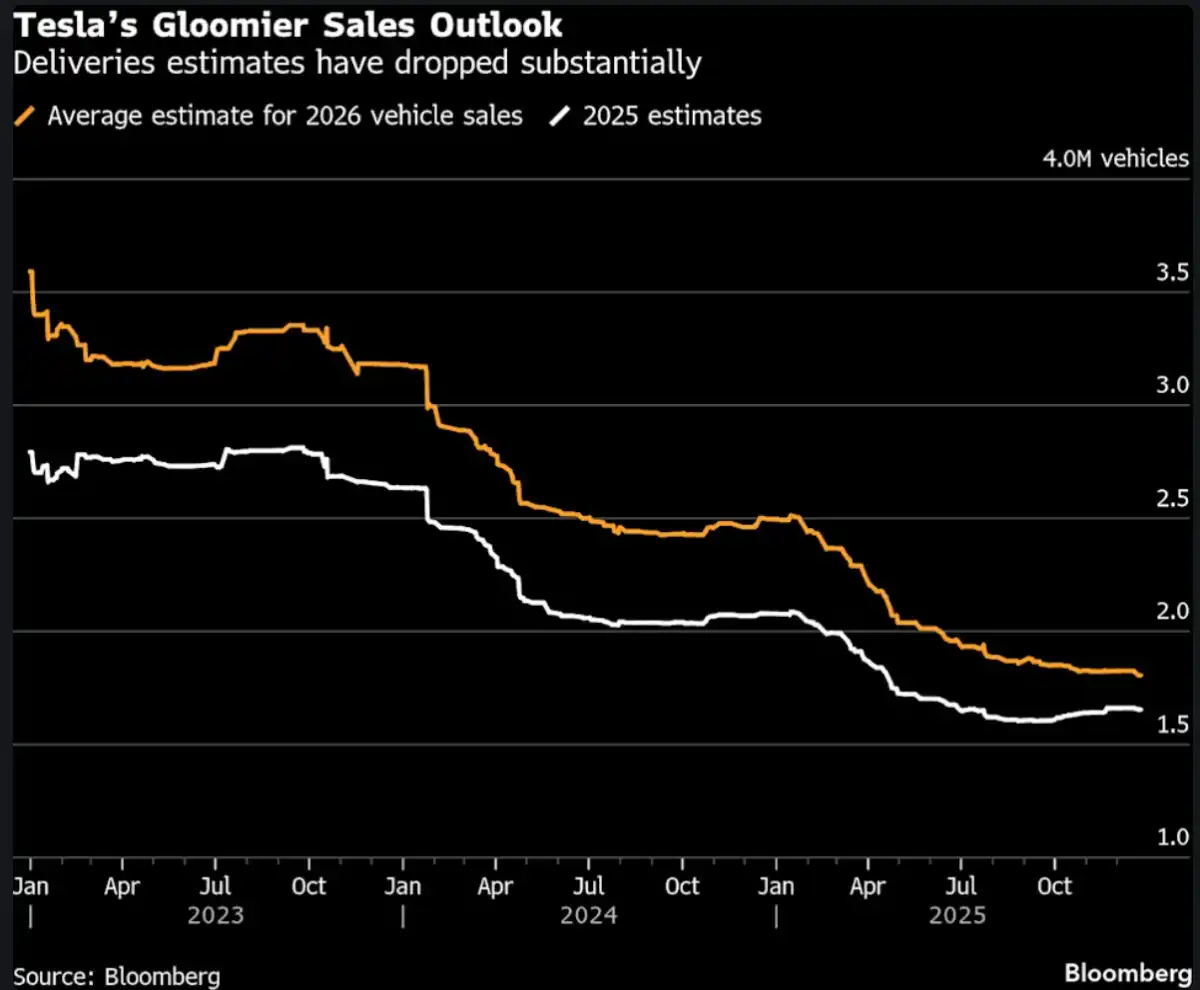

- 2026 sales estimates have been slashed by Wall Street from 3 million down to 1.8 million units.

- The stock valuation now relies heavily on the success of the Robotaxi vision, not retail car sales.

Read also: AI Trend Shift: Data Infrastructure Takes the Spotlight in S&P 500 2025

According to Bloomberg data, Tesla is expected to deliver around 440,900 vehicles in Q4, down 11% from last year. Tesla even took the unusual step of releasing their own internal numbers that are even more bearish, predicting a 15% drop.

Wall Street has also slashed growth expectations for 2026 significantly. Two years ago, analysts predicted Tesla would deliver 3 million units this year, but that average estimate has now plunged to just 1.8 million.

Garrett Nelson, an equity analyst at CFRA Research, says investors are fully focused on the company's outlook 5 to 10 years down the road. The market is basically discounting short-term financials to bet on Musk’s autonomous vision.

Competition & Regulation Factors

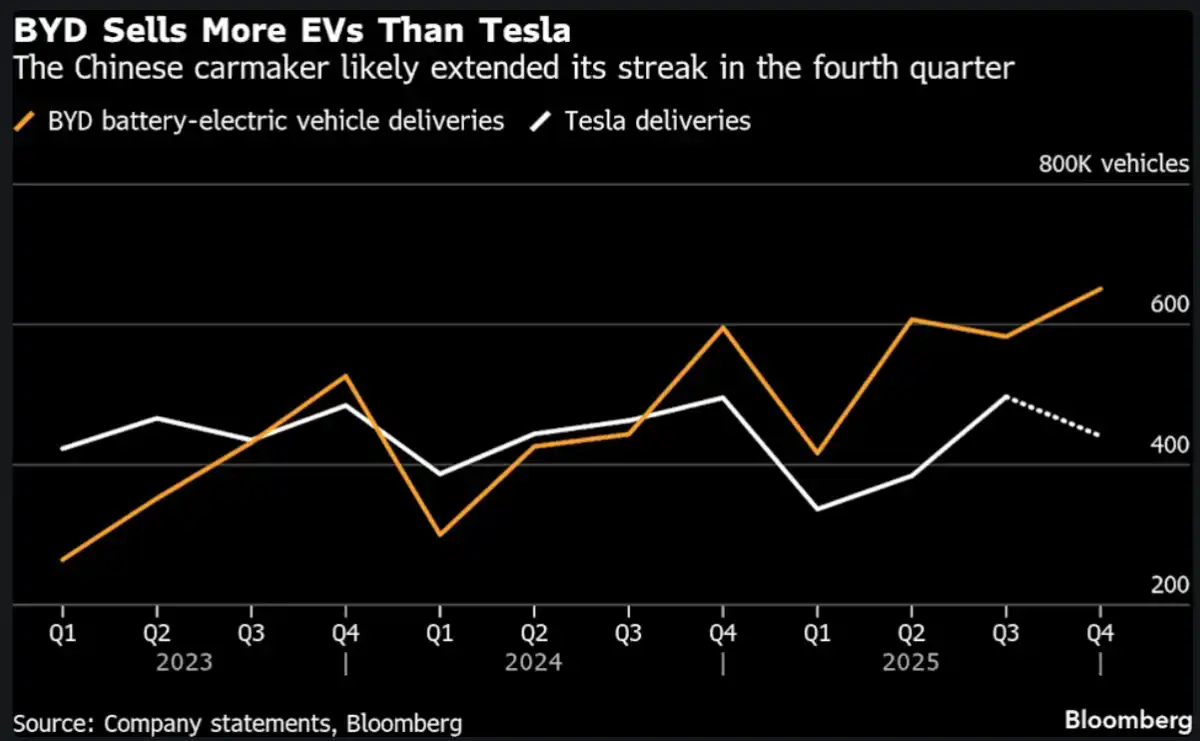

On the global stage, Tesla, Inc. dominance is getting chipped away by Chinese competitors. BYD is likely to beat Tesla’s battery-electric vehicle sales for the fifth quarter in a row.

The challenge for 2026 gets tougher as the US has stopped federal tax credits for EV purchases. Musk himself warned this policy shift could trigger "a few rough quarters" for the company.

This policy impact is also hitting other manufacturers like Ford Motor Company. Ford just announced about $19.5 billion in charges from cancelling EV and battery projects that were seen as no longer profitable.

Gene Munster from Deepwater Asset Management thinks investors have fully bought into the autonomous vision as a trade-off for the stagnant EV business. In his view, Elon just needs to stabilize the car business next year to keep market confidence high.

Read also: These Two 2026 IPO Candidates Have Massive Valuations

Reference:

- Bloomberg, Tesla Sales Outlook Darkens Despite Musk’s Self-Driving Euphoria. Diakses pada 2 Januari 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.