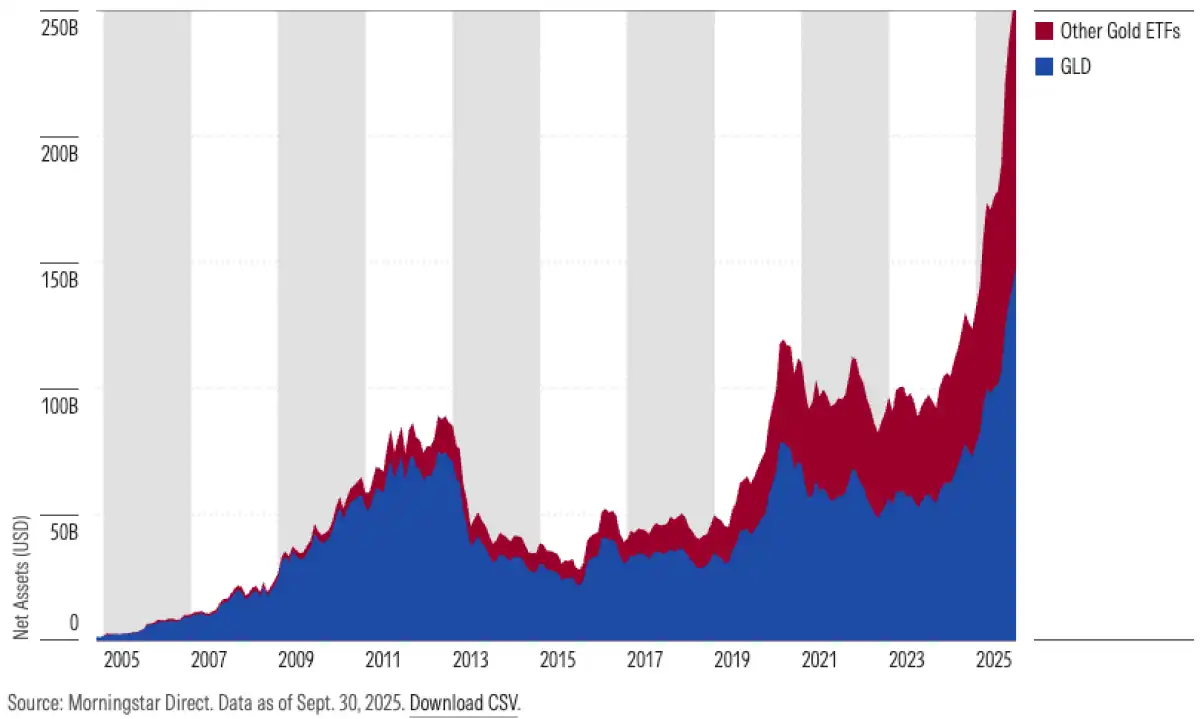

Gotrade News - Global investor interest in gold ETFs continues to show a massive surge. Total assets across all gold ETFs have successfully breached $309 billion.

This happens because gold proves resilient against various country-specific risks. A Morningstar report on Thursday (12/02) noted gold remains a reliable hedge.

Key Takeaways:

Total gold ETF assets soared to hit $309 billion globally.

Choosing a gold product depends heavily on your trading frequency.

SPDR Gold Shares stands out as the cheapest option for active day traders.

Gold often becomes the safest haven when global markets get highly volatile.

Inflows into gold ETFs usually skyrocket during peak market uncertainty. Retail investors frequently add these instruments for diversification and inflation hedging.

Crucial Factors for Picking Winners

Investors might feel confused when comparing various available gold ETF products. All these exchange-traded funds basically just hold physical gold.

| Name | Ticker | Inception Date | Fee (%) | Net Assets (USD Million) | 1-Year Net Flow (USD Million) | 3 Yr Net Flow (USD Million) |

|---|---|---|---|---|---|---|

| SPDR Gold Shares | GLD | 11/18/2004 | 0.40 | 174,069 | 26,513 | 24,334 |

| iShares Gold Trust | IAU | 1/21/2005 | 0.25 | 79,747 | 11,398 | 8,140 |

| SPDR Gold MiniShares | GLDM | 6/25/2018 | 0.10 | 31,125 | 9,672 | 10,972 |

| abrdn Physical Gold Shares ETF | SGOL | 9/9/2009 | 0.17 | 8,602 | 1,042 | 1,349 |

| iShares Gold Trust Micro | IAUM | 6/15/2021 | 0.09 | 7,565 | 3,548 | 3,375 |

| Goldman Sachs Physical Gold ETF | AAAU | 7/24/2018 | 0.18 | 3,049 | 930 | 1,200 |

| VanEck Merk Gold Trust | OUNZ | 5/16/2014 | 0.25 | 2,903 | 438 | 745 |

| GraniteShares Gold Trust | BAR | 8/23/2017 | 0.17 | 1,725 | 80 | -304 |

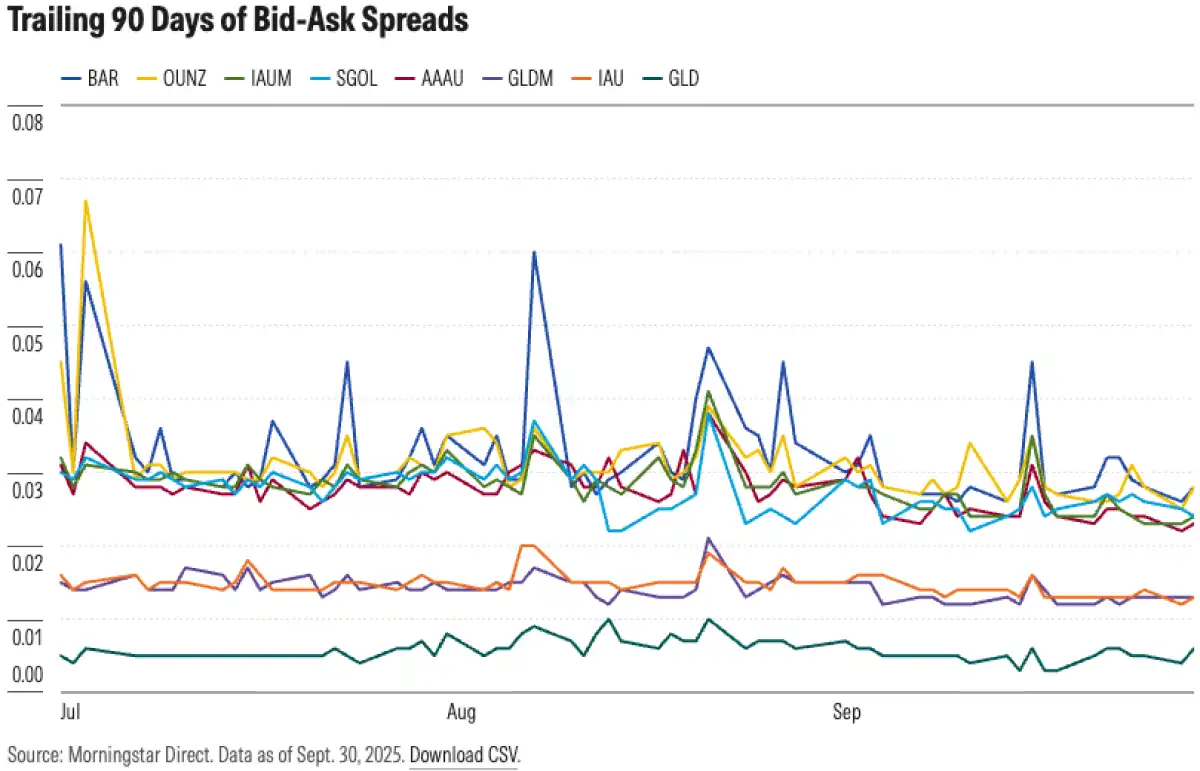

The main factor separating each product is the total cost of ownership. These costs generally split into annual fees and routine trading expenses.

Trading costs become the most crucial concern for high-frequency market players.

SPDR Gold Shares dominates the space with $174 billion in total assets. The annual fee for this pioneer product sits at 0.40% every year.

Morningstar data shows the bid-ask spread ratio for this product is nearly zero. This makes it highly ideal for active traders with substantial capital.

Impact on Investment Strategies

For passive long-term investors, a low annual fee remains an absolute priority. SPDR Gold MiniShares offers a low-cost combination that functions highly efficiently.

The best choice always depends on transaction frequency and initial investment capital. Understanding these fee structures will optimize your long-term portfolio return potential.

Gold always holds strong appeal as a balancing anchor for global portfolios. You can grab the opportunity from this rising hedge asset trend now.

Starting an investment in precious assets no longer requires massive upfront capital. Gotrade provides secure access to over 600 top tier Options and ETFs.

You can build a resilient portfolio and start investing with just $1. Please use the link below to secure your investment position immediately.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

Morning Star, How to Choose the Right Gold ETF. Accessed on February 19, 2026

Featured Image: Shutterstock