Jakarta, Gotrade News - Picking the right investment vehicle when you're working with limited capital is the real game-changer for building long-term wealth.

Two Vanguard ETFs are currently stealing the spotlight due to their contrasting historical performance, yet they complement each other perfectly in a portfolio.

Key Takeaways

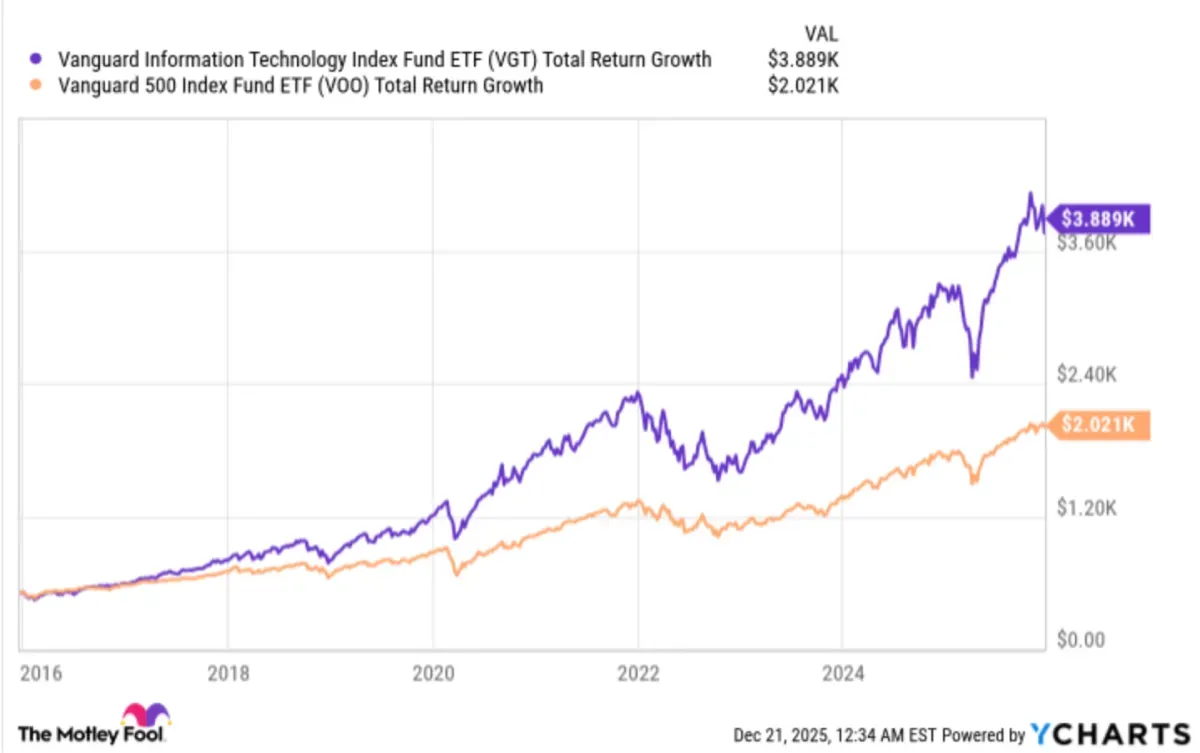

- Vanguard Information Technology ETF (VGT) scored an average annual return of 22 percent over the last decade.

- That performance leaves the S&P 500 in the dust, which grew by an average of 14.6 percent annually in the same period.

- Heavy concentration in the tech sector offers aggressive growth but comes with a higher vibe of volatility risk.

According to data released by The Motley Fool, tech-based ETFs have proven to bring in serious gains for disciplined investors.

The Vanguard Information Technology ETF (VGT) recorded an average annual return of 22 percent over the last ten years.

This growth figure consistently outperforms the broader market represented by the S&P 500 index.

For comparison, the Vanguard S&P 500 ETF (VOO) posted an average annual growth of 14.6 percent during the same timeframe.

VGT's edge is driven by its portfolio focus on 322 tech companies that are all about high growth and rapid innovation.

The biggest holdings in this fund include industry giants like NVIDIA Corporation, Apple Inc., and Microsoft Corporation.

Diversification is also boosted by stakes in Broadcom Inc. and Palantir Technologies Inc..

Exposure to chipmakers like Advanced Micro Devices, Inc. also helps drive performance when the market cycle is feeling bullish.

While offering simpler paths to bigger potential profits, this sector concentration definitely demands a higher risk tolerance from investors.

Reference:

- The Motley Fool, 2 Simple ETFs to Buy With $1,000 and Hold for a Lifetime. Accessed on December 26, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.