Jakarta, Gotrade News - The US economy closed 2025 with growth stats that look solid on the surface. However, the latest data reveals some serious fundamental cracks beneath those positive numbers.

You need to pay attention to this because the quality of growth right now is incredibly uneven. Investors must realize that the market is being propped up by just a handful of sectors.

Key Takeaways

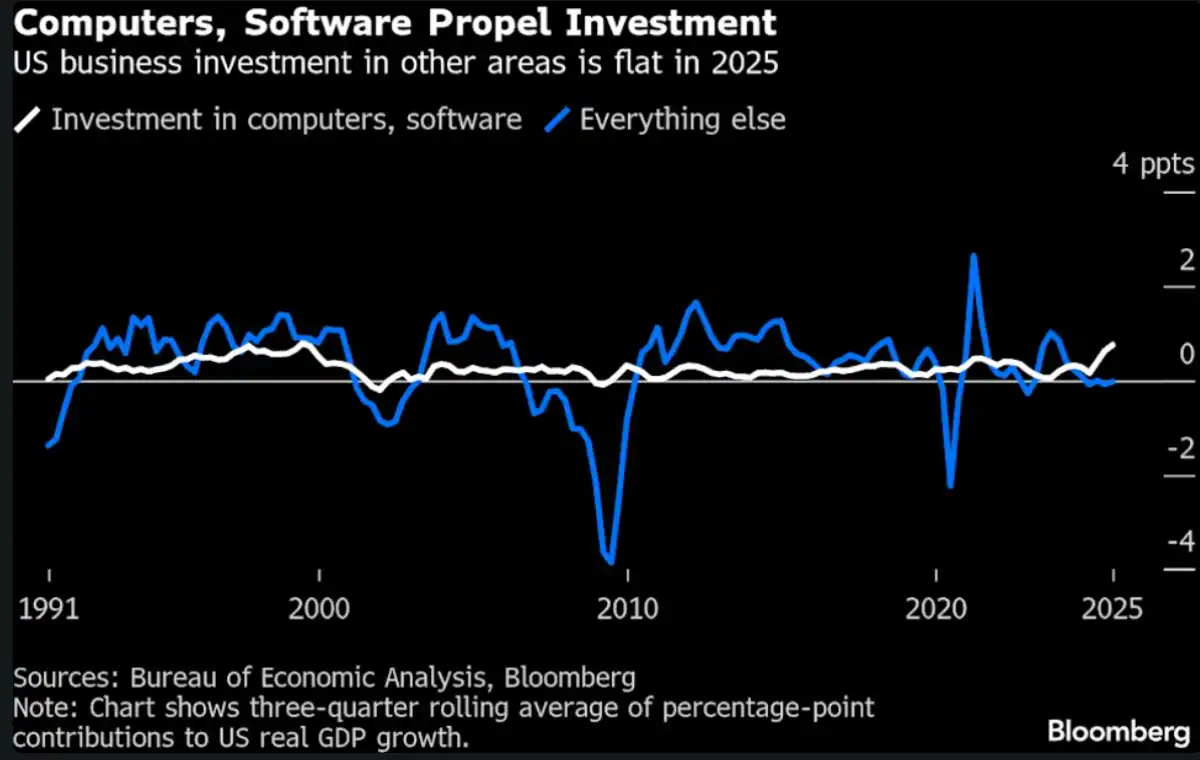

- Business investment is totally dominated by software and computer sectors, while other areas have flatlined.

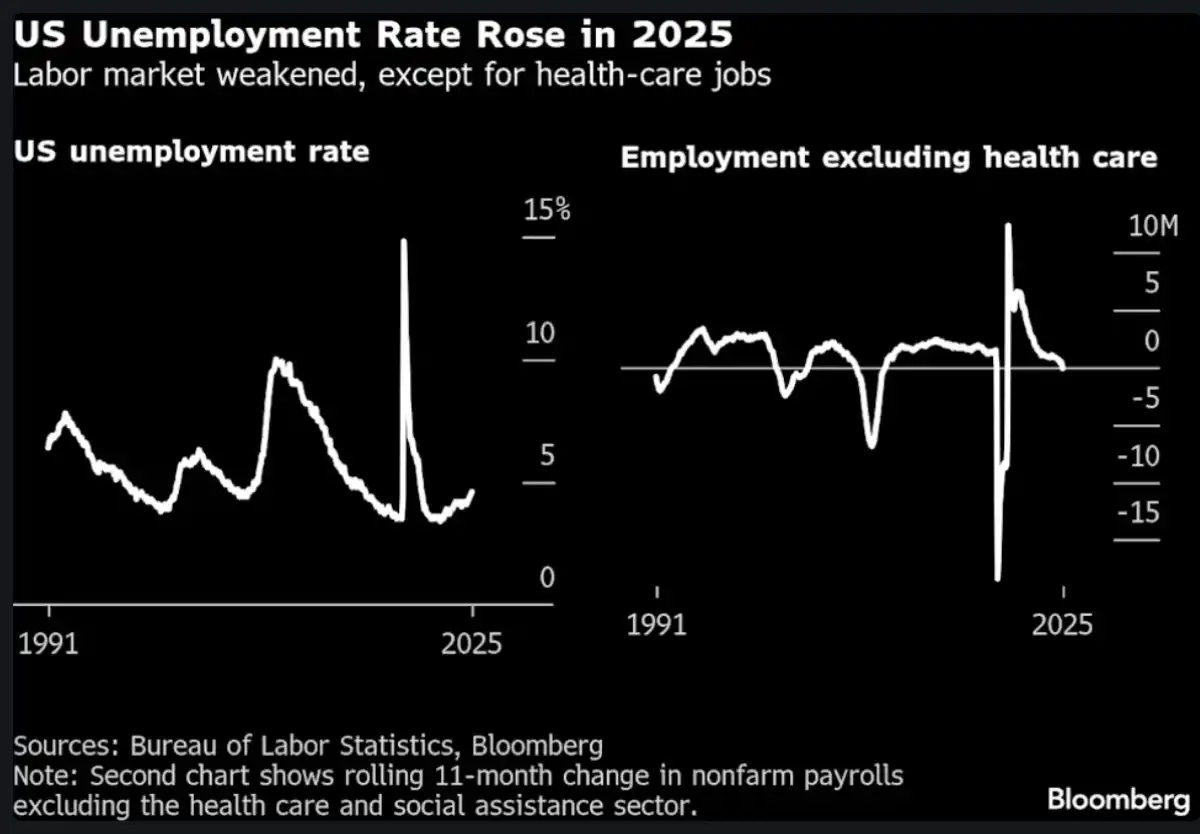

- Unemployment hit its highest level since 2021, with the manufacturing sector continuing to cut jobs.

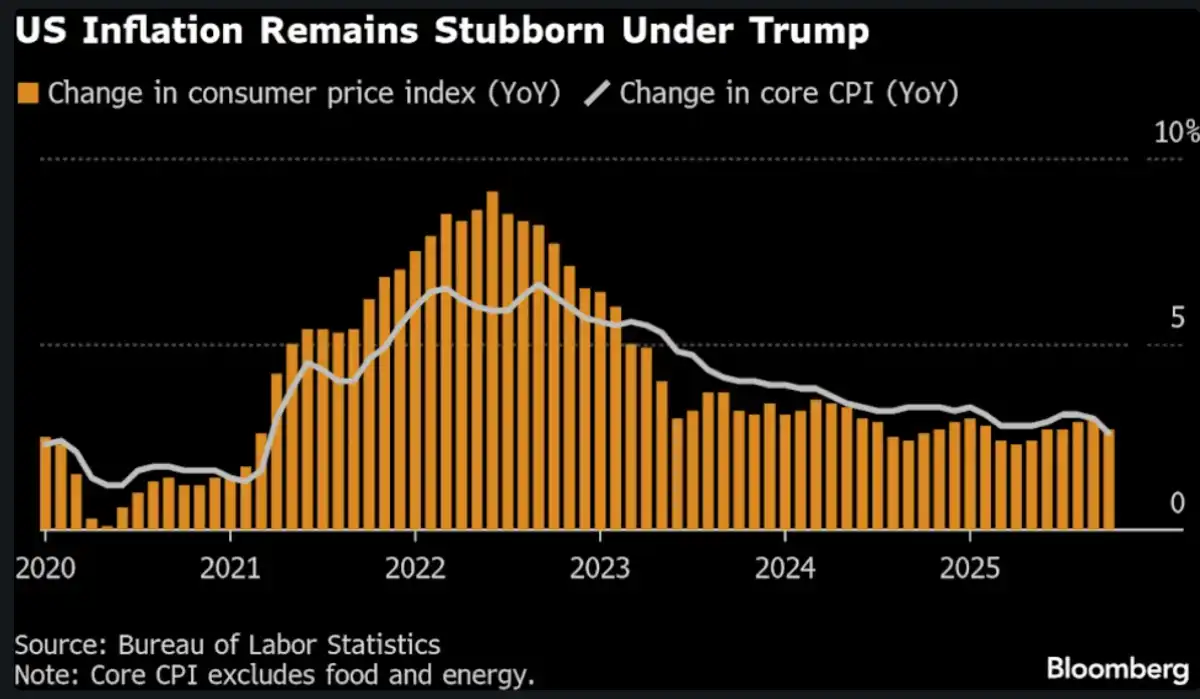

- Inflation remains sticky at 2.7 percent, even though import tariffs have hit record highs.

Read also: UBS: 10 Multibagger Stocks for 2026 Amid US Retail Momentum

Tech and AI Dominance

Q3 data shows the US economy expanded at its fastest pace in two years. According to a Bloomberg report, this surge was almost entirely driven by spending on computer equipment and software.

This trend confirms that AI-related CAPEX is basically carrying the economy right now. On the flip side, business investment in non-tech areas has been pretty much stagnant throughout 2025.

Labor Market Weakness

It’s a different story in the labor market, which had a pretty rough year. The unemployment rate climbed to 4.6 percent in November, the highest level since 2021.

Job growth was heavily concentrated in healthcare and social assistance. If you exclude that sector, US employment numbers actually dipped this year.

Inflation and Cost of Living

Price-wise, inflation proved to be stickier than many expected. The CPI stayed at 2.7 percent, not yet returning to the low levels seen pre-pandemic.

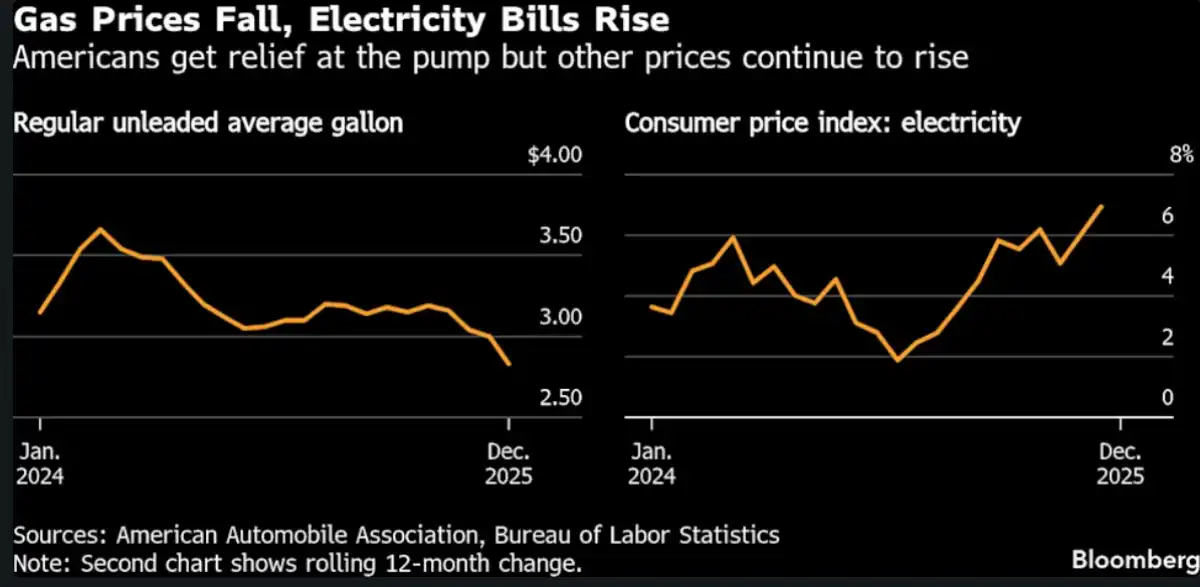

The good news is, the aggressive import tariffs applied by President Trump haven't triggered an extreme price spike just yet. Consumers also got a bit of relief from falling gas prices, though electricity bills are creeping up.

Import Tariff Surge

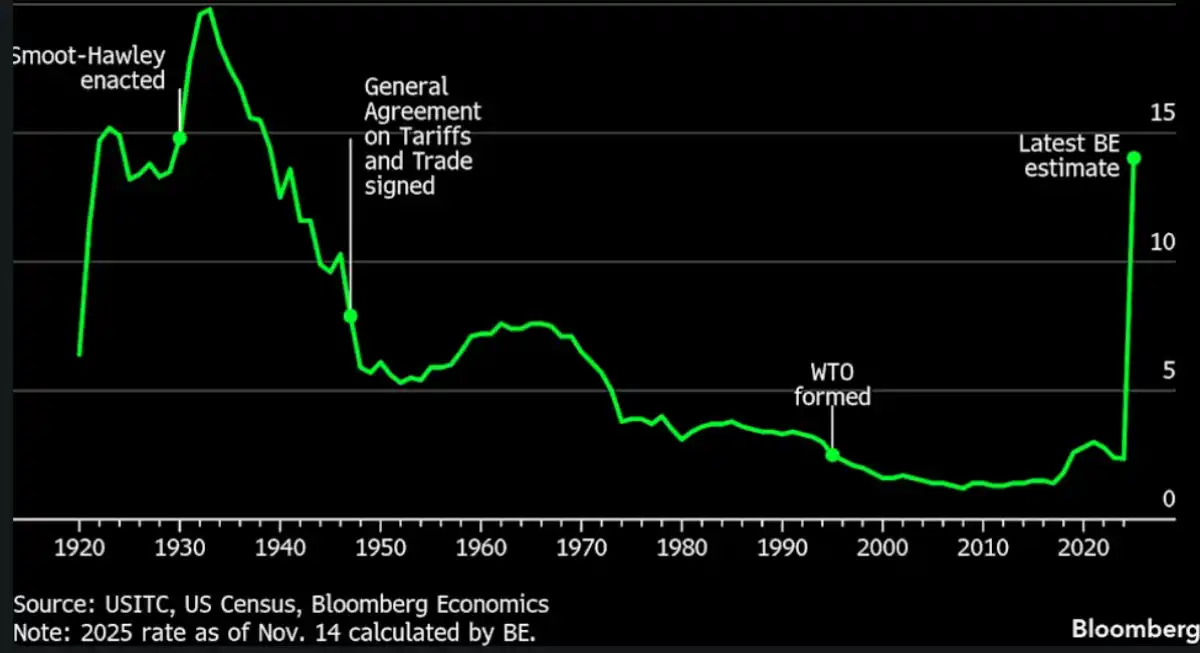

Trade protectionism was the most dramatic policy shift in 2025. US import tariffs are now at their highest level in nearly a century.

This move managed to add about US$30 billion a month to state revenue by late 2025. However, its impact on narrowing the trade deficit is still super volatile and shaky.

Read also: Don't Just Auto-Reinvest Dividends, Know the Tax Risks First

Reference:

- Bloomberg, Here’s How the US Economy Fared Under Trump in 2025. Diakses pada 2 Januari 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.