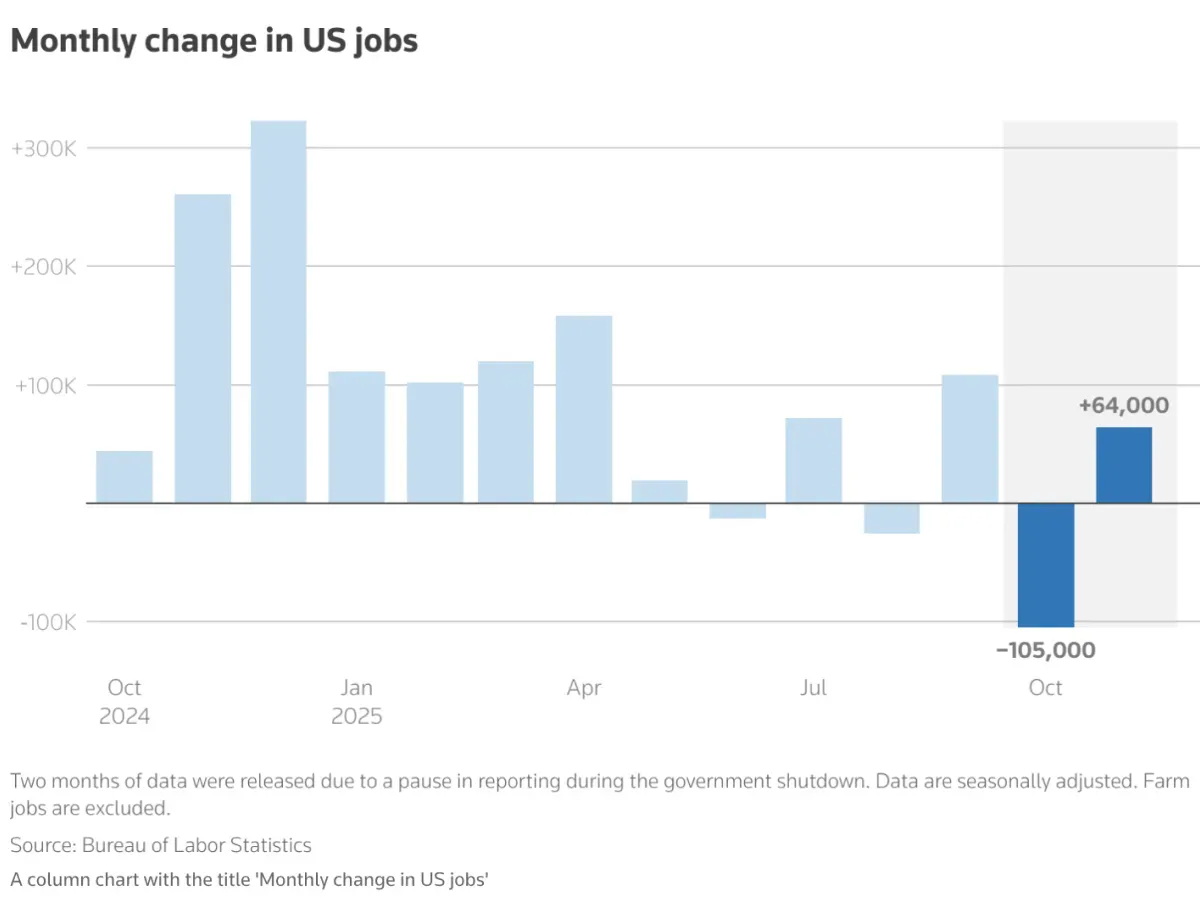

Jakarta, Gotrade News - US job growth bounced back in November 2025, adding 64,000 new positions—beating expectations. This rebound comes after a sharp drop last month caused by government spending cuts that sparked some economic uncertainty.

Key Takeaways

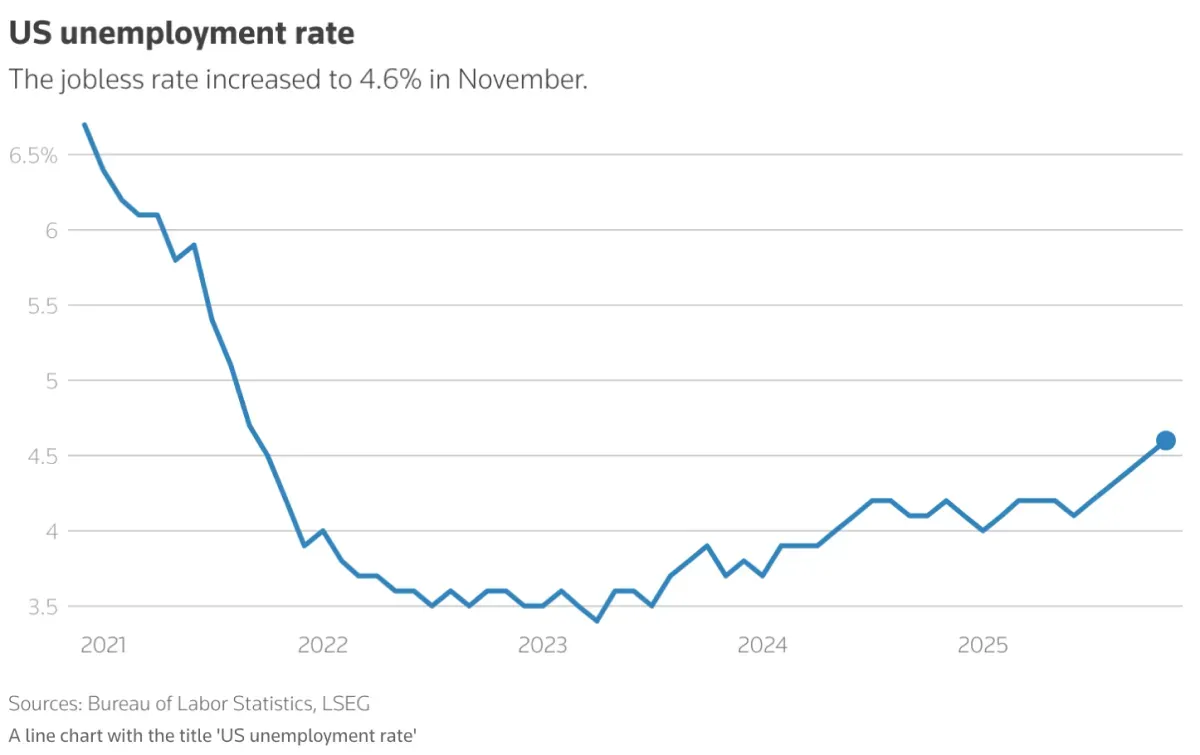

- US jobs grew by 64,000 positions in November, despite unemployment technically hitting 4.6%.

- The unemployment spike is skewed by data issues from the government shutdown, not just economic weakness.

- Wage growth cooled to 3.5%, sending mixed signals for inflation and the Fed's next move.

However, the unemployment rate actually touched its highest level in four years, hitting 4.6%.

You need to take this spike in unemployment with a grain of salt. It's largely due to a change in survey methodology after the government shutdown.

The Bureau of Labor Statistics had to tweak how they calculate things after a 43-day shutdown messed up their data collection. According to Reuters, the October unemployment rate wasn't even published for the first time since 1948.

The private sector is showing decent recovery, even though the healthcare sector is doing most of the heavy lifting. Here is how the main industries are moving:

- Healthcare added 46,000 new spots across various medical facilities.

- Construction saw positive growth with 28,000 added jobs.

- Transportation and warehousing actually lost 18,000 workers due to lower demand for couriers.

Economic Policy & Interest Rates Impact

The steady growth in private jobs is a strong signal for the Fed to hit pause on their rate-cutting cycle. Michael Feroli, chief US economist at JPMorgan Chase & Co. , noted that the rise in unemployment is actually just marginal when you look at the technicals. Fed officials had already cut the benchmark rate to the 3.50%-3.75% range last week.

The cooling labor market is also evident in wage growth, which only rose 3.5% year-on-year. Gisela Young from Citigroup Inc. mentioned that while consumer spending is resilient, this labor market weakness remains a key downside risk. This trend might help tame inflation, but it could squeeze purchasing power for folks down the line.

Market Outlook & What’s Next

Wall Street investors reacted to this mixed bag of data with lower trading. The economic uncertainty fueled by President Donald Trump’s aggressive trade policies is definitely influencing market sentiment right now.

The Bureau of Labor Statistics will drop the final data revision in February to give us a clearer picture of what's really going on.

Reference:

- Reuters, US job growth snaps back in November; shutdown distorts unemployment rate. Accessed on December 17, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.