Jakarta, Gotrade News - Chevron Corporation (CVX) is now the main highlight for global investors following strong signals of a regime change in Venezuela. The company is the only US oil major still actively operating in the country.

Key Takeaways

- Chevron has active infrastructure while competitors have to start from scratch.

- President Trump stated US oil companies will invest big in Venezuela.

- Wall Street analysts target Chevron's stock price upside of 10 percent.

President Donald Trump just stated that major oil companies will be spending billions of dollars.

Media reports call this a strategic move to revive Venezuela's damaged energy infrastructure.

This condition gives a massive competitive advantage to Chevron compared to its main rivals who bailed years ago.

Companies like Exxon Mobil Corporation and ConocoPhillips are known to have left the Venezuelan market way back.

According to Seeking Alpha analysis, Chevron survived because of a special agreement to get paid via oil production.

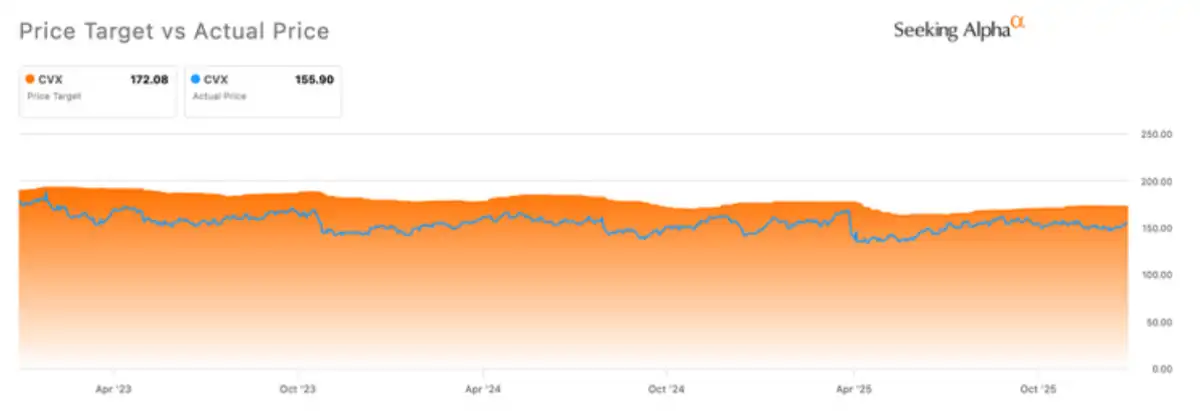

This unique position is predicted to drive positive sentiment for Chevron's stock price movement.

Market data from Wall Street analysts shows an average price target at the $172.08 level.

However, Venezuela's political stability remains a major risk factor that investors need to watch out for.

Analysts warn that the country's history of coups could limit potential long-term gains.

Reference:

- Seeking Alpha, Chevron stock: What the Ratings say. Accessed on January 5, 2026

- Seeking Alpha, Chevron: Tight Spot In Venezuela. Accessed on January 5, 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.