When investors look at a stock, some focus on the company's financials. Others focus on the price chart. The second approach is called technical analysis.

Understanding technical analysis basics can help you read market behavior, identify potential entry and exit points, and make more informed trading decisions. Here is what it involves and how to use it effectively.

What Is Technical Analysis?

Technical analysis is a method of evaluating financial assets by studying historical price and volume data. Rather than analyzing a company's revenue or earnings, technical analysts look at how the price has moved over time and use that information to anticipate future price behavior.

The core assumption behind technical analysis is that all available information, including fundamentals, news, and market sentiment, is already reflected in the price. Because of this, studying price movement itself is considered sufficient for making trading decisions.

Technical analysis is used across all types of financial markets, including stocks, ETFs, commodities, and currencies. It is equally relevant for short-term traders looking for quick moves and longer-term investors identifying optimal entry points.

How Price Charts Work

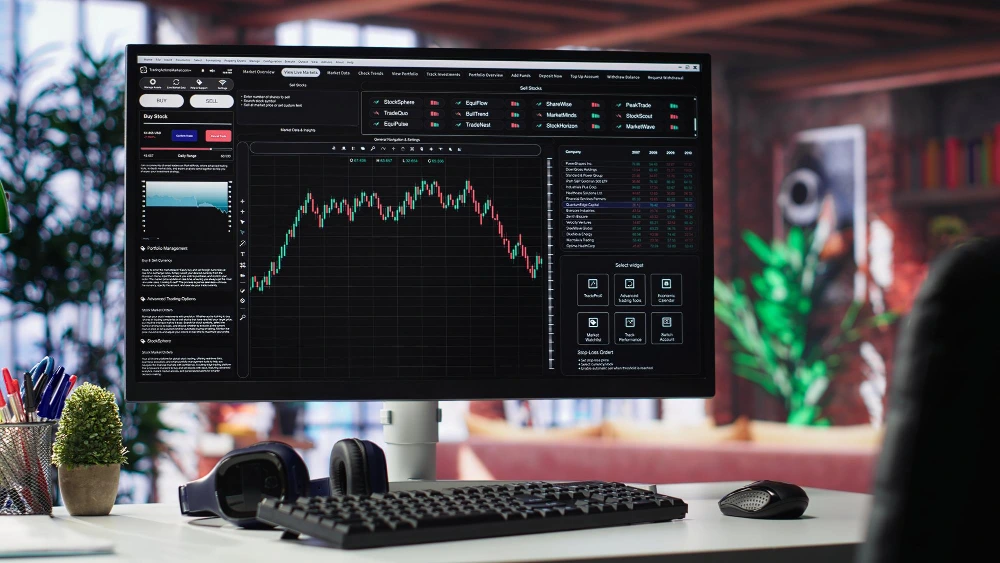

The foundation of chart analysis is the price chart. A price chart is a visual representation of how an asset's price has changed over time.

Candlestick charts

The most widely used chart type is the candlestick chart. Each candlestick represents a specific time period, such as one day, one hour, or one week, and shows four key pieces of information: the opening price, the closing price, the highest price reached, and the lowest price reached during that period.

A green or white candlestick means the price closed higher than it opened. A red or black candlestick means it closed lower. Reading a series of candlesticks together reveals patterns that traders use to anticipate future price movement.

Support and resistance

Two of the most fundamental concepts in chart analysis are support and resistance.

Support is a price level where buying interest has historically been strong enough to stop the price from falling further. Resistance is a price level where selling pressure has historically prevented the price from rising further.

When a price approaches a support or resistance level, traders pay close attention. A bounce from support can signal a buying opportunity. A break through resistance can signal further upside.

Trends

A trend describes the general direction in which a price is moving. An uptrend is characterized by higher highs and higher lows. A downtrend shows lower highs and lower lows. A sideways trend, also called consolidation, occurs when the price moves within a relatively flat range.

Identifying the trend is one of the first steps in technical analysis. Many traders follow the principle of trading in the direction of the trend rather than against it.

Common Technical Indicators

Technical indicators are mathematical calculations based on price and volume data. They are displayed on or below a price chart and help traders interpret market conditions more clearly.

1. Moving averages

A moving average smooths out price data by calculating the average price over a set number of periods. The 50-day and 200-day moving averages are among the most commonly watched.

When the price is above its moving average, it is generally considered to be in an uptrend. When the price crosses below its moving average, it may signal a shift in momentum. A crossover between a short-term and long-term moving average is often used as a buy or sell signal.

2. Relative Strength Index (RSI)

The RSI measures the speed and magnitude of recent price changes to assess whether an asset is overbought or oversold. It is displayed as a number between 0 and 100.

A reading above 70 is generally considered overbought, meaning the price may be due for a pullback. A reading below 30 is considered oversold, suggesting a potential bounce. RSI is most useful when combined with other indicators rather than used in isolation.

3. MACD

The Moving Average Convergence Divergence indicator, commonly known as MACD, tracks the relationship between two moving averages of a price. It consists of a MACD line, a signal line, and a histogram.

When the MACD line crosses above the signal line, it is often interpreted as a bullish signal. When it crosses below, it may suggest bearish momentum. MACD is widely used to identify changes in trend direction and momentum.

4. Volume

Volume refers to the number of shares or contracts traded during a given period. It is one of the most important supporting tools in technical analysis.

A price move accompanied by high volume is generally considered more significant than the same move on low volume. Rising prices on increasing volume suggests strong buying interest. A price rally on declining volume may indicate weakening momentum.

Strengths and Limitations

Technical analysis is a widely used tool, but it works best when you understand both what it can and cannot do.

Strengths

- Applicable to any market. Technical analysis can be applied to stocks, ETFs, currencies, and commodities. The same principles and indicators work across different asset classes.

- Useful for timing entries and exits. Even investors who focus primarily on fundamentals often use technical analysis to identify better entry and exit points rather than buying or selling at random prices.

- Objective and visual. Price charts make market behavior visible. Patterns, trends, and levels can be identified consistently across different assets and time frames.

Limitations

- Not predictive with certainty. Technical analysis identifies probabilities, not guarantees. Patterns that have worked historically can and do fail. No indicator is right 100% of the time.

- Susceptible to interpretation. Two traders looking at the same chart can reach different conclusions. Technical analysis involves judgment, and that judgment is influenced by experience and bias.

- Less useful for long-term investing. For investors holding positions over many years, short-term price patterns are largely irrelevant. Fundamentals tend to drive prices over the long run.

- Can generate false signals. Indicators sometimes suggest a move that does not materialize. This is why most experienced technical traders use multiple indicators together rather than relying on any single one.

Technical vs Fundamental Analysis

Technical and fundamental analysis are the two main approaches to evaluating investments, and they work in very different ways.

| Aspects | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price and volume | Financial data and valuation |

| Time horizon | Short to medium term | Medium to long term |

| Key tools | Charts, indicators | Financial statements, ratios |

| Core belief | Price reflects all information | Price reflects intrinsic value over time |

Many investors use both approaches together. Fundamental analysis helps identify what to buy. Technical analysis helps identify when to buy it.

Conclusion

Technical analysis basics come down to reading price charts, identifying trends and key levels, and applying indicators to better understand market momentum. It is a practical toolkit for investors who want to make more informed decisions about timing their entries and exits.

Like all analytical tools, technical analysis works best when combined with other approaches and applied with discipline. Understanding its strengths and limitations helps you use it effectively as part of a broader investment strategy.

FAQ

What is technical analysis?

Technical analysis is the study of historical price and volume data to anticipate future price movement. It uses charts and indicators rather than financial statements to evaluate assets.

What is the most common chart type in technical analysis?

The candlestick chart is the most widely used. Each candlestick shows the open, close, high, and low price for a specific time period, and patterns in the candlesticks are used to identify potential price moves.

What is the difference between technical and fundamental analysis?

Technical analysis focuses on price charts and market data. Fundamental analysis focuses on a company's financials and valuation. Many investors use both together for a more complete picture.

References

- Investopedia, Technical Analysis for Stocks: Beginers Overview, 2026.

- Wealthsimple, Technical vs Fundamental Analysis, 2026.