Written by Aries Yuangga

Summary

Amplitude (NASDAQ: AMPL) is a classic “growth at a reasonable price” setup: fundamentals are quietly improving, but the market is still pricing it like a broken IPO story.

- Since IPO highs above US$80 in 2021, AMPL has been crushed, but Q3’25 marked a clear fundamental inflection:

- Revenue +18% YoY (acceleration vs Q2’s +14%).

- Net-new ARR US$12M, ARR +16% YoY to US$347M.

- RPO (backlog) +37% YoY, with contract duration rising from 19 → ~22 months.

- FY25 revenue guide raised to US$340.8–342.8M (+13.9–14.5% YoY) with pro-forma operating margin ~breakeven to slightly positive.

- FY26 Street revenue ~US$390.7M (+14% YoY). At today’s price just above US$10:

- EV/FY25 sales ≈ 3.3x

- EV/FY26 sales ≈ 2.9x → Well below many 13–15% growth SaaS peers trading at 4.5–6x.

- Balance sheet is bulletproof: ~US$267M cash, zero debt, positive FCF (~US$13.3M, 4.9% margin 9M’25).

- AI is accelerating app creation and experimentation → more product teams need deep analytics on user journeys, where AMPL is a top pure-play.

Thesis: you’re paying a “broken IPO” multiple for a business that is quietly re-accelerating, lengthening contracts, and sitting in the slipstream of the AI app wave.

Rating: BUY. Accumulate in the current range as a 2026 re-rating candidate rather than a short-term trade.

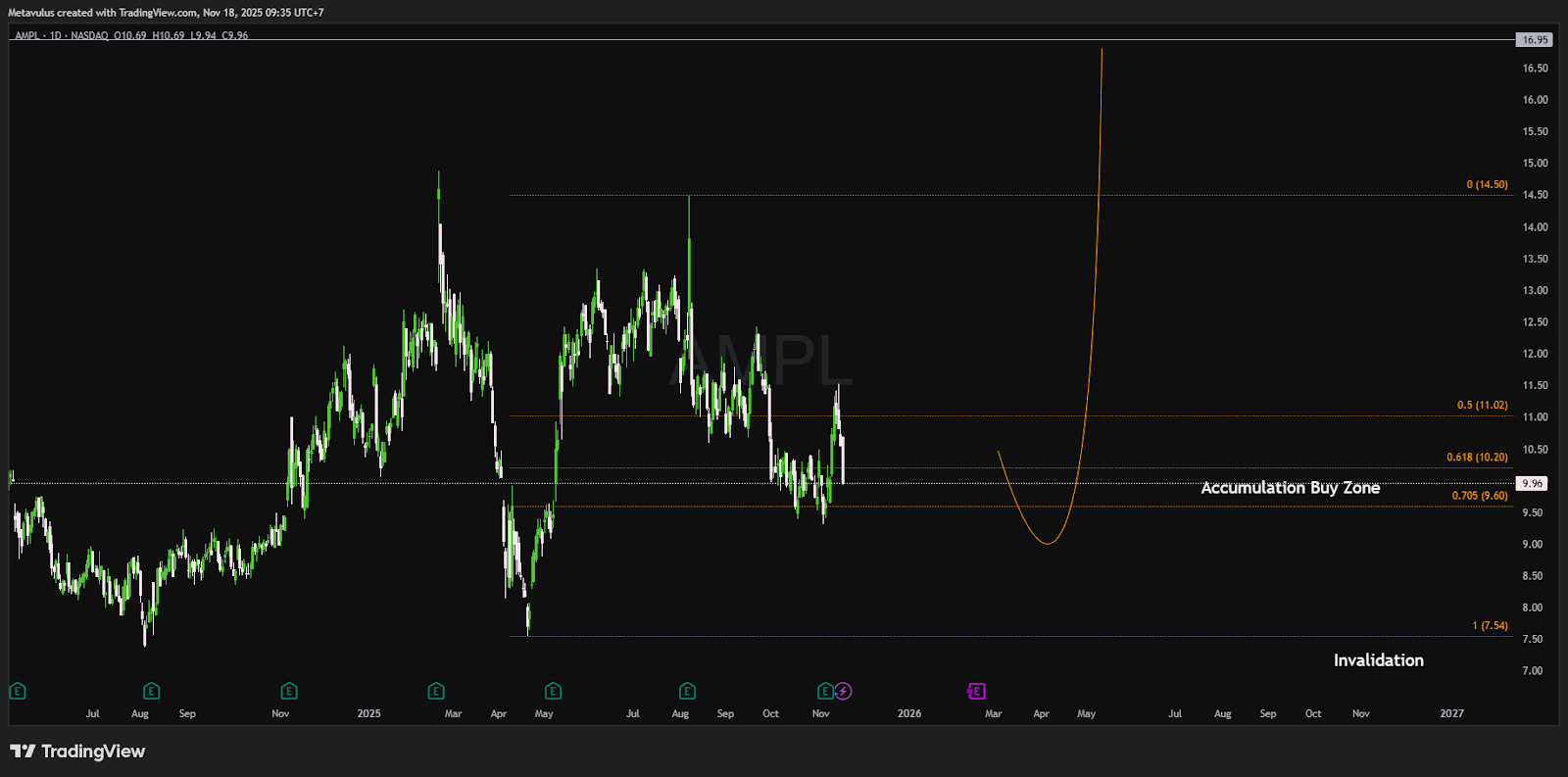

Technical Analysis

- Current Price: ~US$9.96

- Key Fibonacci & Structure Levels (from last big swing)

- Fib 0.0 (major upside ref): US$14.50

- Fib 0.5: US$11.02

- Fib 0.618: US$10.20

- Fib 0.705: US$9.60

- Fib 1.0: US$7.54

- Accumulation Buy Zone:

- US$10.20 – 9.60 (0.618–0.705 Fib band on your chart, labelled Accumulation Buy Zone)

- Resistance / Targets:

- US$11.0–11.5 (0.5 Fib / first supply)

- US$14.0–14.5 (Fib 0.0 / prior high zone)

- Extension target on the chart: ~US$16.95

- Invalidation:

Weekly close below US$7.54 → structure broken; treat as failed turnaround and wait for a new base.

Read:

AMPL has already sold off hard and is now oscillating around the 0.618–0.705 retracement band, a classic spot where smart money accumulates if the fundamental story is improving.

As long as price holds above US$9.60 (ideally well above US$7.54), the risk/reward skew favors rotation back towards US$11–14, and in a full rerating scenario, US$16+.

Trading Setup

DCA Plan (Investor Focus, 12–24 Month Horizon)

Using your buy zone and fibs:

- 40% size at US$10.20–9.90

- 35% size at US$9.90–9.60 (bottom of Accumulation Zone)

- 25% size “last bid” at US$8.30–7.80 (just above fib 1.0 / structural support)

Full-flush average cost if all fills hit: roughly US$9.4–9.6.

Risk Management

- Swing / leveraged traders:

- Hard stop or major size reduction on weekly close < US$9.00, hard invalidation if < US$7.54.

- Long-term investors:

- Use a thesis-based stop, not a tight price stop. Thesis breaks if:

- Growth re-slows to low-single digits or negative,

- Net retention and RPO roll over materially, or

- Competitive position clearly deteriorates (large churn to rivals, failure to keep up with AI-driven product analytics).

- Use a thesis-based stop, not a tight price stop. Thesis breaks if:

Take-Profit Levels

- TP1: US$11.0–11.5

- De-risk 20–30% of position, move stop to breakeven.

- TP2: US$14.0–14.5

- Legacy resistance + fib 0.0; good place to harvest another 30–40%.

- Stretch Target: US$16–17

- If fundamentals keep improving and the market re-rates AMPL toward ~4.5x+ FY26 sales.

Options / Income Ideas (for advanced traders)

- Sell cash-secured puts around US$10 or US$9 (30–45 DTE) to get paid for potentially owning shares in the buy zone.

- If assigned, run covered calls at US$14–16 to monetize volatility while waiting for a re-rating

Why the Thesis Works (Pillars)

1️⃣ Turnaround in Growth & Customer Commitments

- Q3’25 revenue +18% YoY, a 4-pt acceleration vs Q2’s +14% in a tough SaaS macro.

- Net-new ARR US$12M, ARR +16% YoY to US$347M.

- RPO +37% YoY to US$392M; current RPO +22% YoY, long-term RPO almost +78% YoY.

- Average contract duration extended from 19 → ~22 months.

These are not the numbers of a dying tool, they’re the numbers of a company rebuilding momentum with larger, longer-term enterprise contracts.

2️⃣ Valuation: Broken-IPO Optics, Healthy Business

At ~US$10:

- EV ≈ US$1.12B (US$1.39B mkt cap, US$267M cash, zero debt).

- FY25 revenue guide ≈ US$341M → 3.3x EV/FY25 sales.

- FY26 Street ≈ US$390.7M → 2.9x EV/FY26 sales.

Peers with similar low/mid-teens growth often trade at 4.5–6x sales. If AMPL just gets to 4.5x FY26 (one turn below Salesforce):

EV ≈ US$1.8B → mkt cap ≈ US$2.0B → ~40–50% upside from here.

You are effectively paying a “no-confidence” multiple for a company whose metrics (RPO, ARR, net retention) say confidence is actually recovering.

3️⃣ Competitive Position in Product Analytics

- AMPL lives in product analytics / digital optimization: helping teams map user journeys, funnels, and retention to ship better features.

- It competes with Mixpanel, Heap, GA4 and others, but:

- Enterprise segment is growing: 653 customers >US$100k ARR, +19 net new in Q3, +15% YoY.

- Long-term RPO surge suggests large, multi-year commitments, not “cheap swap” tooling.

- AI wave = more apps, more experiments, more A/B tests → more need to measure product behaviour. AMPL is positioned as a specialist in that analytics layer.

4️⃣ Financial Discipline & Balance Sheet Strength

- Pro-forma operating margin in Q3 ~0.6% (down YoY as they re-lean into growth).

- Yet FCF is positive: US$13.3M (4.9% margin) in the first 9 months of FY25, slightly improving YoY.

- Balance sheet: >US$250M net cash, zero debt.

AMPL can afford to prioritize growth and enterprise GTM without jeopardizing solvency or resorting to punitive dilutive financing.

Valuation & Scenarios (High-Level)

Assumptions (rough):

- FY25–26 revenue growth ≈ 14–16%, then gradually moderates.

- Long-term FCF margin can reach 15–20% if scale and efficiency continue.

Base Case (3–5 Years)

- Revenue keeps compounding mid-teens; margins trend to low-teens.

- Market re-rates AMPL from ~3x → ~4.5x FY26–27 sales as the turnaround is “obvious”.

- Total return from current levels: ~40–70% over 3–4 years → mid-teens CAGR.

Bull Case

- Growth sustains high-teens as AI app wave drives more demand.

- Net retention rises into 107–110%+, RPO growth stays strong, AMPL becomes a “must-have” analytics layer narrative.

- Market puts AMPL on 5.5–6x sales with improving margins.

- Multi-bagger potential over 5 years (2–3x from today).

Bear Case

- Competition intensifies, growth slips back to high-single digits.

- RPO and contract duration flatten; AMPL loses share to cheaper/ bundled alternatives.

- Market keeps multiple depressed around 2–3x sales. Stock chops sideways or drifts lower.

Even in the bear case, strong net cash and positive FCF limit true downside risk versus more leveraged SaaS names.

Key Risks

- Competitive Crowd: Product analytics is a busy space; if Mixpanel, Heap, GA4, or new AI-native tools out-execute, AMPL’s growth can re-slow.

- Macro & IT Budgets: Renewed SaaS derating or tighter marketing/product budgets could delay re-rating and compress multiples again

- Execution: Pushing upmarket to enterprise requires consistent GTM discipline. Missteps could hurt win-rates and retention.

- Valuation Overhang: The memory of the US$80 IPO peak may psychologically cap how aggressive some funds are willing to be, even as fundamentals improve.

Conclusion

Amplitude is not the hyper-growth rocket of 2021 anymore, but that’s exactly why the risk/reward is attractive now:

- Growth has stabilized and is re-accelerating.

- Backlog and contract duration are improving sharply.

- Balance sheet is clean, FCF is positive, and valuation is cheap vs peers.

If you believe:

- AI will create more digital products,

- Those products will need better measurement of user behaviour, and

- AMPL can remain one of the go-to analytics platforms for serious product teams,

…then buying here around US$10 while the market is still ignoring the turnaround is a rational, asymmetric bet.

Verdict: BUY. Accumulate in the US$10.20–9.60 zone, look for a 2026 re-rating towards US$14–17, and think in multi-year terms, not multi-week swings.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.