Written by Aries Yuangga

Summary

DoorDash (NASDAQ: DASH) just entered a sharp correction, down ~30% from the peak, even though fundamentals remain extremely strong.

Fundamentals = Accelerating

- GOV (Gross Order Value) grew 25% YoY, second consecutive quarter of acceleration.

- Monetization improving → net revenue margin up to 13.8%.

- Adjusted EBITDA +41% YoY → TTM FCF hits $1.99B.

- Deliveroo acquisition boosts scale by ~10–11% → DASH becomes the largest global delivery platform.

Sentiment = Misplaced

- Restaurant stocks are crashing (CMG, CAVA), but DASH demand remains fully intact.

- Younger consumers spending less? Yes, but on-demand convenience is now habit, not luxury.

- JPMorgan + Lyft partnerships + DashPass ecosystem protect GOV from macro softness.

Valuation dropped → creates a huge opportunity

DASH now trades at EV/FY26E EBITDA ~20.6x → same as UBER, despite faster growth and better unit economics.

📌 Rating: STRONG BUY

This is the best accumulation opportunity since 2023.

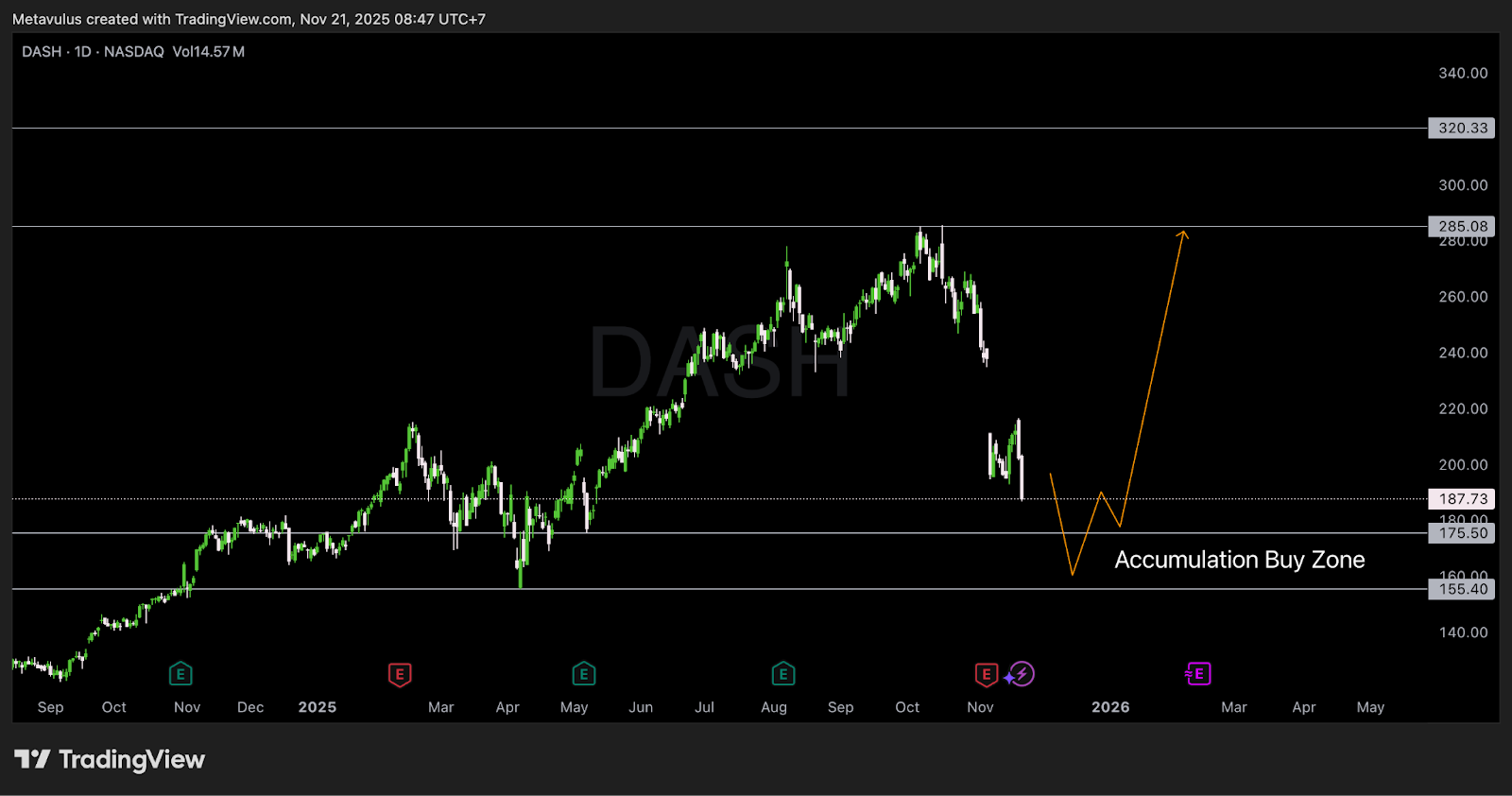

Technical Analysis

Current Price: ~US$187.73

Key Levels

Resistance

- 285.08 → main rebound target (supply zone)

- 320.33 → major resistance & long-term target

Accumulation Buy Zone

As plotted on your chart:

- 175.50 → top of accumulation zone

- 155.40 → bottom of zone (ideal capitulation flush)

This zone aligns with:

- Historical April–May support

- Strong demand structure

- Potential swing failure pattern (SFP) if we get a wick flush

Invalidation

- Weekly close < 152 = bullish structure breaks → wait for a new base.

Trading Setup

DCA Plan (Long-Term Investors)

| Zone | Allocation |

|---|---|

| 187–175 | 40% |

| 175–160 | 40% |

| 160–155 | 20% |

Average cost (full-fill): ≈165–172

Swing Trading Setup

- Entry 1: 175–178

- Entry 2: 160–165

- Stop: Weekly close <150

- TP1: 230

- TP2: 285

- Stretch Target: 320+

Why the Thesis Works (Pillars)

DoorDash ≠ Restaurants, It’s Delivery Infrastructure

Restaurant comps crash (CMG, CAVA) ≠ Delivery demand crash.

GOV growth shows strength:

- Q1: 20%

- Q2: 23%

- Q3: 25% (accelerating)

Restaurant sector:

- Chipotle comps: 0.3%

- CAVA: severe slowdown

- Macro: weaker consumer

🚀 Yet DASH remains insulated because:

- Consumers cut dine-in first, not delivery

- Strong promo ecosystem

- JPMorgan credit cards & Lyft partnership feeding DashPass retention

Deliveroo Acquisition = Scale Supercharger

- Adds +$2.7B GOV in one quarter

- Makes DASH the #1 global delivery platform

- Integration unlocks large EBITDA expansion through:

- European overhead cuts

- Unified operations for Wolt + DoorDash + Deliveroo

- Cross-platform logistic leverage

CEO Tony Xu confirms:

👉 Deliveroo is healthier than expected

👉 Huge margin expansion potential

DoorDash Is Becoming a Free Cash Flow Machine

- TTM FCF: $1.99B

- Revenue margin: 13.8%

- EBITDA margin: 21.9% of revenue (expanding)

- 2026E EBITDA: $3.93B

And about the controversial investment cycle:

- “Several hundred million” in 2026 = small vs $2B annual FCF

- Many initiatives (e.g., DoorDash for Business) already boost revenue instantly

This is a profitable compounder, not a speculative tech story.

Valuation Reset = Pure Opportunity

At ~$202:

- Market cap: $87.2B

- EV: ~$81.0B

2026 estimates:

- Revenue: $17.8B

- EBITDA: $3.93B

→ EV/EBITDA ≈ 20.6x

Against peers:

| Company | EV/EBITDA | Growth | Position |

|---|---|---|---|

| Uber Delivery | ~20x | Slower | #2 globally |

| DoorDash | 20.6x | Faster | #1 globally |

Conclusion: The stock is mispriced, not overvalued.

Valuation & Scenarios

Base Case (12–18 months)

- GOV growth stays 20–25%

- Deliveroo integration boosts margins

- Market re-rates delivery sector

🎯 Price Target: 250–285

Bull Case (2026–2027)

- DoorDash for Business becomes a new hyper-growth engine

- Deliveroo + Wolt synergy bigger than expected

- Multi-region dominance strengthens

🎯 Price Target: 310–330

Bear Case

- Consumer weakness worsens

- Promo costs rise

- Regulatory pressure on delivery fees

📉 Downside floor: 155–160 = exactly your accumulation zone.

Risks

- Weakening consumer spending → lower frequency

- Fee caps from regulators

- 2026 investment cycle compressing near-term margins

- Deliveroo integration risk

None of these break the long-term thesis, they only slow compounding.

Conclusion

DoorDash is experiencing a rare disconnect:

Fundamentals: Strengthening

Stock Price: Dumped -30%

Restaurant sector weakness is dragging DASH sentiment lower, but the business itself is accelerating:

- GOV growth rising

- Revenue margins improving

- EBITDA expanding

- FCF compounding

- Deliveroo boosting scale

This is a textbook buy-the-dip moment for a high-growth, high-FCF compounder.

⭐ Verdict: STRONG BUY

⭐ Buy Zone: 175.50 – 155.40

⭐ Targets: 285 → 320

⭐ 3–5 Year Outlook: Multi-bagger potential

Disclaimer: Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.