Suncor Energy Inc. (NYSE: SU) remains one of the cleanest long-term plays on structural oil scarcity and Canadian oil sands economics:

- Q3 2025 net earnings: C$1.62B vs C$1.13B in Q2, despite only ~US$1/bbl higher WTI.

- Record production: Upstream output hit ~870k bpd, +8% QoQ, proving Suncor can grow volumes profitably even in a “meh” oil tape.

- 9M 2025: Revenue C$39.6B (-4% YoY), net income C$4.44B vs C$5.2B last year, with ~11% net margin. Strong given softer crude prices.

- Balance sheet: Long-term debt cut by C$737M to C$8.61B; interest expense just ~1.2% of revenue.

- Capital returns: ~42M shares repurchased YTD + dividend yield ~3.7–4.0%.

- Valuation: Fwd P/E ~13.5x, a discount to many global majors given Suncor’s long-life reserve base.

The author of the source article is raising his buy target to $40, expecting SU to eventually reclaim and surpass its 2008 all-time high (~$70) as the next oil upcycle unfolds.

Rating: BUY. Core long-term energy holding for investors who want volume durability, buybacks and income.

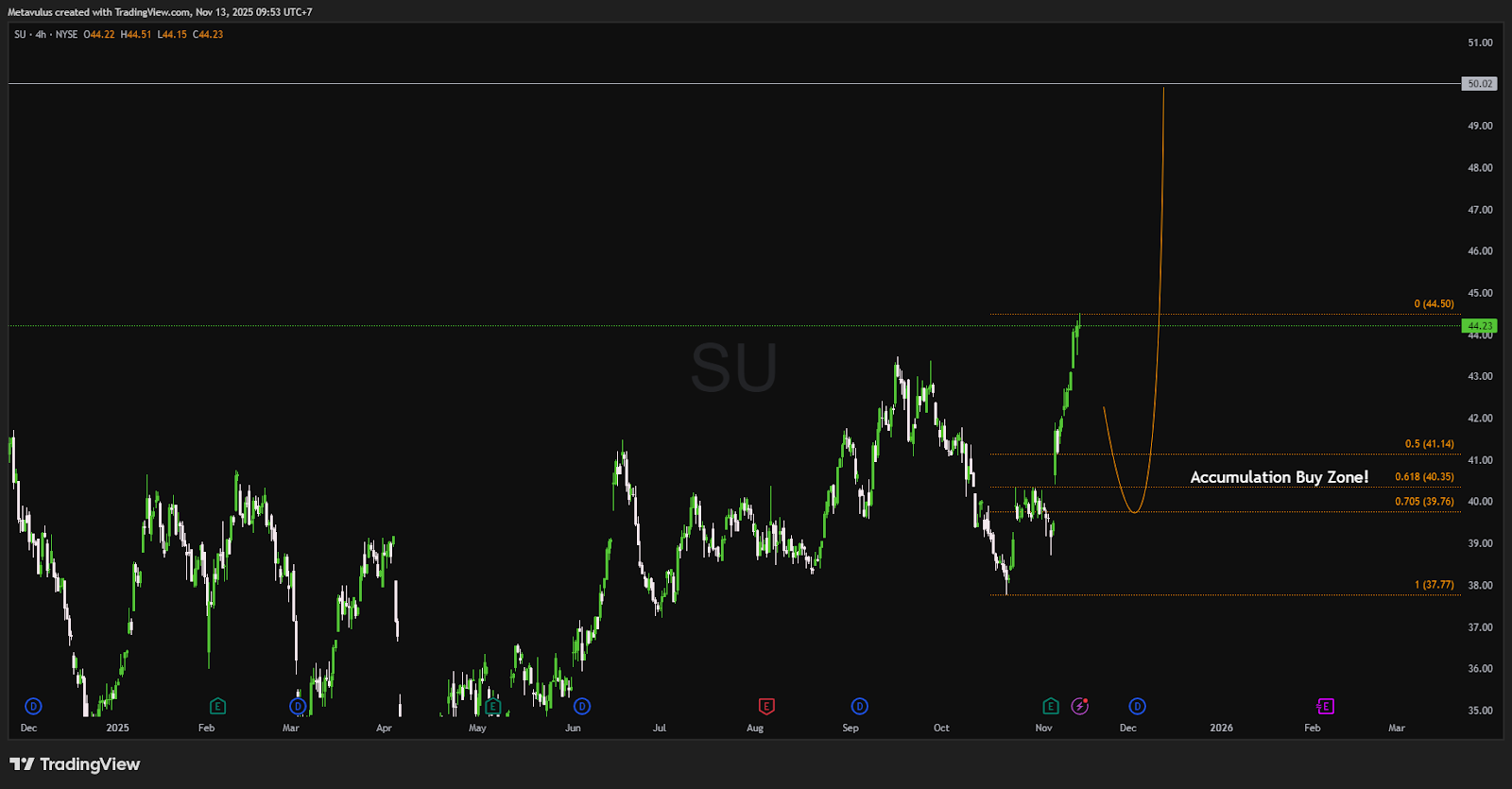

Technical Analysis

- Current Price: ~$44.23

- Local High / Resistance: ~$44.50 (Fib 0)

- Accumulation Zone:

- $41.14 – $39.76 (Fib 0.5 – 0.705)

- Deeper support at $37.77 (Fib 1.0)

- Invalidation: Weekly close < $37.77 (breaks higher-low structure)

- Upside Targets:

- TP1: Retest / break of $44.50

- TP2: $50.02 (Fib extension / measured-move target)

Recent price action = vertical squeeze from high-30s to mid-40s, pushing SU into short-term overbought.

Base case: mean-reverting pullback toward $41–40, form a higher low in the accumulation zone, then trend continuation toward $50+ if oil cooperates.

Trading Setup

DCA Plan (Swing / Position):

- 40% size at $41.5–41.0

- 40% size at $41.0–39.8

- 20% “last resort” bids at $38.5–38.0 (near Fib 1.0 front-run)

Stop Loss:

- Swing: Weekly close < $37.77

- Long-term investor: use fundamental stop (e.g., oil sub-$50 for extended period + negative policy shock) rather than tight technicals.

Take Profit (TP):

- TP1: $44.50 (partial, de-risk, move stop to breakeven)

- TP2: $50.02, trail stops if macro/oil stays strong (room toward mid-50s on extended cycle).

Income Overlay:

- Sell cash-secured puts at $40–38 (30–60 DTE) to get paid while waiting for pullbacks.

Once assigned, sell covered calls $50–55 against core position to enhance yield on rangebound periods.

Investment Thesis: Why Suncor Works for the Next Oil Regime

1. Structural Supply Constraints + Long-Life Oil Sands

- Global crude (not total liquids) production has essentially flat-lined since 2018, only retaking the prior peak with OPEC+ hikes.

- Many non-OPEC sources (marginal shale, deepwater) need >US$70/bbl to justify new projects, while discoveries lag annual production.

- Canada’s oil sands are one of the few scalable, politically stable sources of incremental long-term supply.

- Suncor’s upstream reserve life is longer than many majors (Shell, Chevron), allowing output growth and high visibility without expensive exploration M&A.

In a world where barrels are harder to grow, tonnes of in-ground, low-decline reserves become the moat. Suncor has them.

2. Strong Execution in a “Not Great” Oil Year

- Despite oil prices not being spectacular, Suncor:

- Hit record production (870k bpd)

- Delivered ~11% net margin

- Grew quarterly earnings QoQ with WTI basically flat.

- 9M earnings down vs 2024 is mostly price, not operational weakness. At current prices, SU still throws off serious cash.

This shows SU can earn through the cycle and doesn’t need extreme oil prices to stay profitable.

3. Balance Sheet De-Risking + Capital Returns

- Long-term debt reduced to C$8.61B, interest only 1.2% of revenue, far away from any solvency issues.

- ~42M shares repurchased in 9M 2025 provide a structural tailwind to per-share growth.

- Dividend ~3.7–4% while debt trends lower = attractive total-return profile if you’re patient.

4. Asymmetric Upside to Oil Normalization / Spike

- Author expects oil will need to average above US$70/bbl long term to incentivize new marginal projects.

- When the next cycle pushes prices higher (whether from inventory draws, geopolitics, or under-investment catching up), high-operating-leverage names with reserves and low financing cost should outperform.

- SU’s CEO and management are leaning into this via:

- Steady production growth

- Buybacks at still-reasonable multiples

- Discipline on debt.

If oil simply revisits sustained $80+, SU’s current earnings power + buybacks could justify prices above the 2008 ATH (~$70) over the next 1–3 years.

Valuation & Return Scenarios

At ~$44, SU screens as:

- Market Cap: ~$53B

- Fwd P/E: ~13.5x

- Dividend Yield: ~3.7–4.0%

Rough scenario sketch (3–5 year view, not precise modeling):

- Base Case: Oil averages $70–80, SU grows modest volumes, continues buybacks + modest dividend hikes.

- EPS grows mid-single to high-single digits; multiple stays 12–14x → mid-50s stock.

- Bull Case: Oil structurally tighter ($80–90), Canada remains key growth source, tax headwinds manageable.

- EPS growth double-digit, modest multiple expansion to 14–16x as cycle optimism builds → $60–70+ plus dividends.

- Bear Case: Demand destruction, prolonged $50–60 oil, Canada hikes taxes hard.

- EPS down, multiple compresses to 9–10x → mid-30s; dividend cushions but total return muted.

Risk/reward still skews up, especially when you’re being paid ~4% to wait.

Key Risks

- Macro / Oil Price: Deep or prolonged recession, demand destruction, or high OPEC spare capacity can keep oil suppressed.

- Policy / Tax in Canada: Federal + provincial deficits raise the risk of windfall or sector-specific tax hikes on oil sands.

- Environmental / Regulatory: Stricter emissions standards or cap-and-trade costs could reduce returns on future projects.

- ESG & Capital Access: Long-term pressure from ESG mandates may limit investor base, although that also keeps supply constrained (double-edged sword).

Conclusion

Suncor is basically a high-quality call option on long-life Canadian oil sands, but with:

- Real cash flows today,

- A solid balance sheet,

- Ongoing buybacks, and

- A ~4% dividend while you wait for the next oil upcycle.

For investors building a core energy sleeve, SU deserves a top-tier spot: it combines reserve depth, operational resilience, and shareholder yields at a reasonable valuation.

Verdict: BUY. Accumulate on pullbacks into $41–40, target $50 near-term and keep bigger upside in mind if oil breaks higher.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.