Jakarta, Gotrade News - The S&P 500 wrapped up 2025 with a gain of over 17 percent, marking the third straight year of a bull market driven by AI enthusiasm. However, market leadership is starting to shift—moving away from just chipmakers to the data infrastructure companies powering the tech.

Key Takeaways

- The AI investment focus is broadening to data storage as tech giants pledge massive spending on infrastructure.

- Consumer and retail stocks are under heavy pressure due to tariff uncertainty and inflation under the new administration.

- Beaten-down valuations in the healthcare sector are now being eyed by strategic investors for potential acquisitions in 2026.

Read also: UBS: 10 Multibagger Stocks for 2026 Amid US Retail Momentum

Data Infrastructure Dominance

The main theme this year is the broadening of the AI trade to companies building and storing data. Tech giants or "hyperscalers" like Microsoft Corporation, Amazon.com, Inc., Alphabet Inc., and Meta Platforms, Inc. have pledged to spend over $440 billion in the next 12 months to build out AI capabilities.

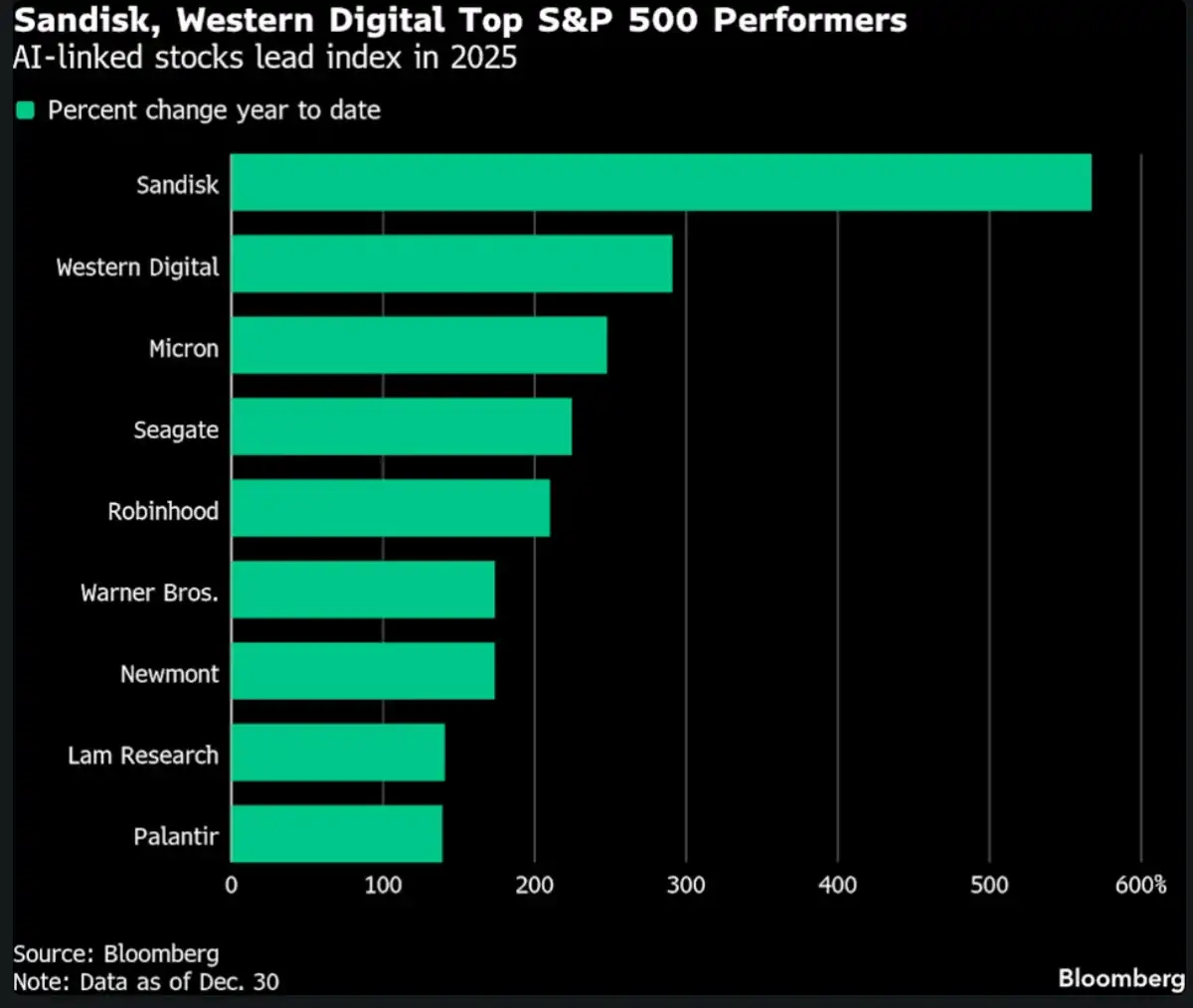

This massive capital flow is benefiting data storage companies like Sandisk, Western Digital Corporation, and Seagate Technology Holdings plc, which were three of the top four performers in the S&P 500. Additionally, new index additions like Robinhood Markets, Inc. and Carvana Co. also posted triple-digit gains.

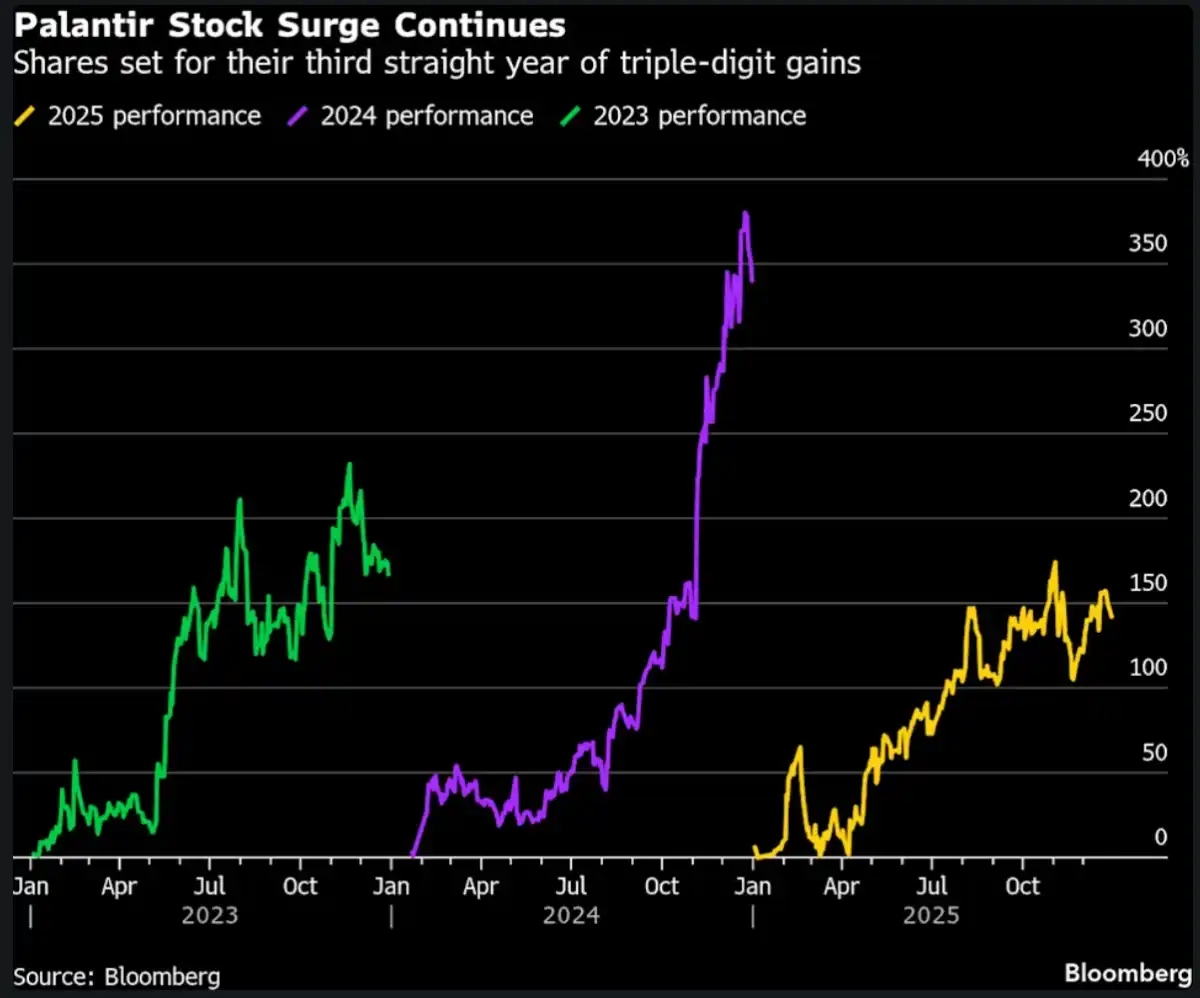

On the flip side, Palantir Technologies Inc. continued its winning streak with triple-digit gains for the third year in a row, thanks to strong buy-in from retail traders. However, Palantir’s valuation is getting pretty pricey with a price-to-earnings (P/E) ratio above 180x, making it one of the most expensive stocks in the index.

M&A sentiment was also a major driver, seen in Warner Bros. Discovery shares soaring nearly 175 percent amidst takeover speculation. A fierce battle is unfolding between Paramount and Netflix, Inc. as they jockey to strengthen their offers to acquire the media giant.

Consumer Sector Under Pressure

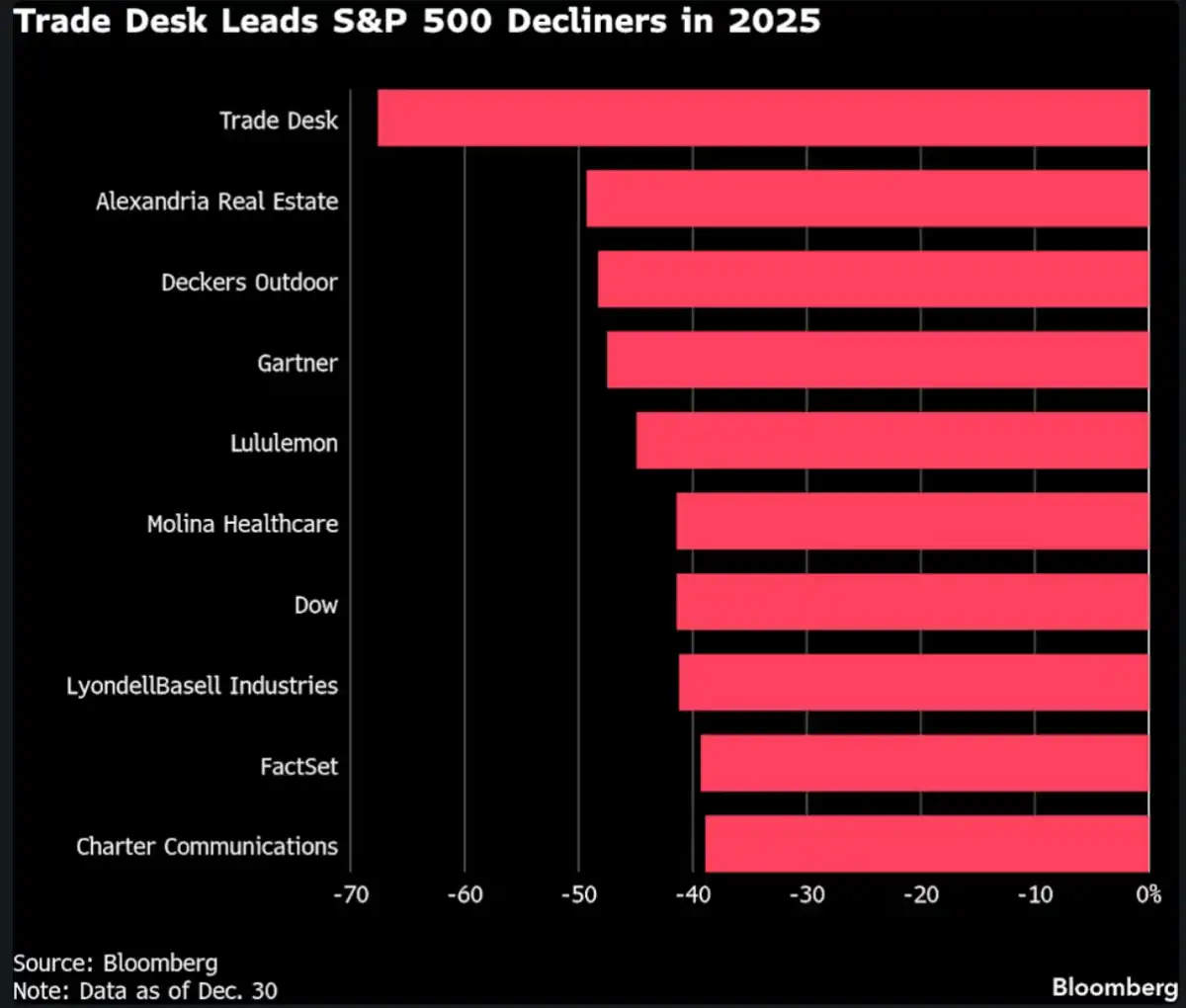

Conversely, economic uncertainty from President Donald Trump's tariff policies hammered consumer stocks. The Trade Desk, Inc. was the worst performer in the index with a drop of nearly 70 percent, followed by Coinbase Global, Inc. which also took a hit.

Retail stocks like Deckers Outdoor Corporation and Lululemon Athletica Inc. plunged significantly after years of growth. Similar pressure was felt in the consumer staples sector, where companies like The Clorox Company, Lamb Weston Holdings, Inc., Campbell Soup Company, and Chipotle Mexican Grill, Inc. landed on the list of the 20 worst performers.

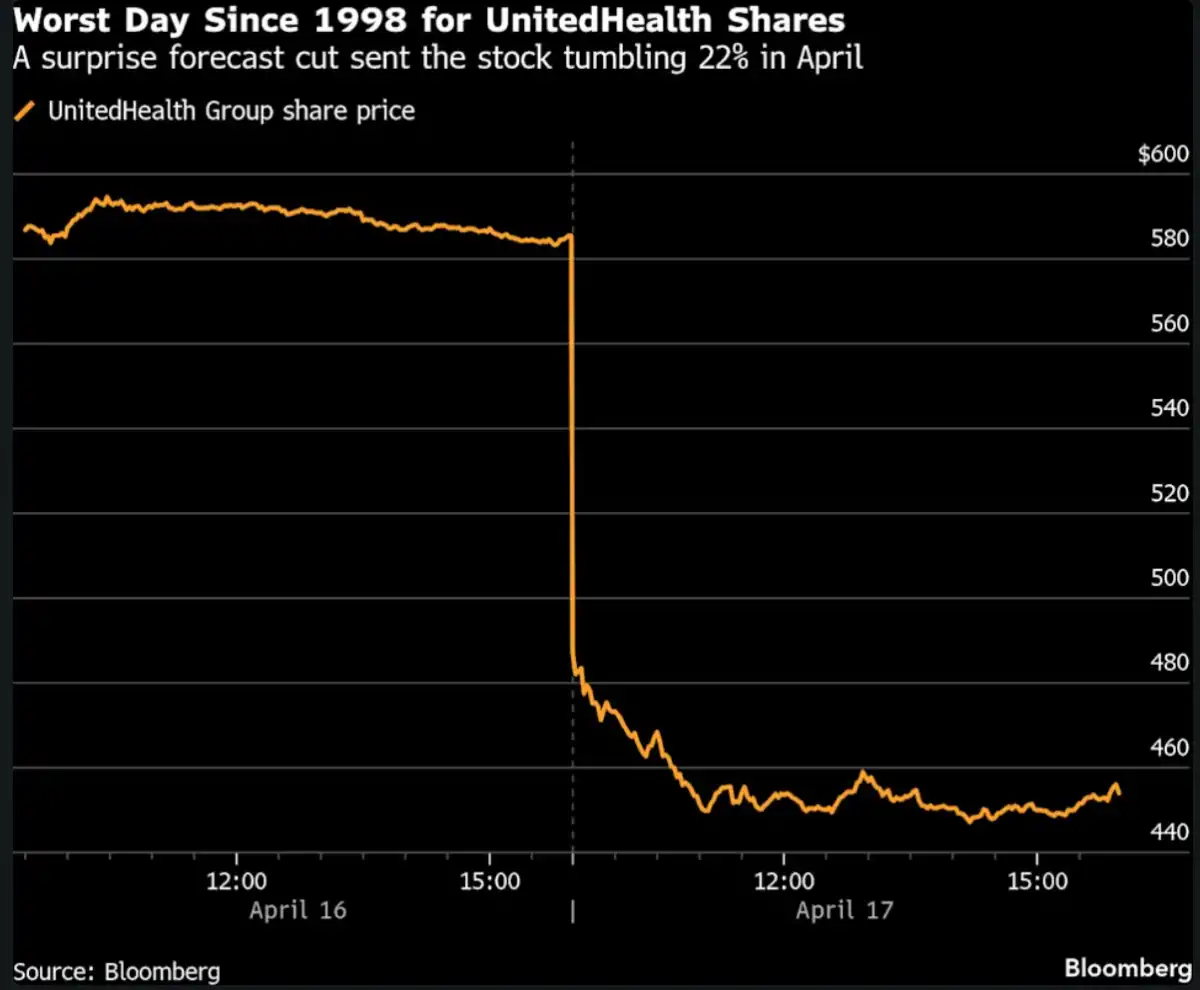

Policy uncertainty also weighed on the managed care sector, with UnitedHealth Group Incorporated and Centene Corporation losing over 30 percent of their value. However, fund manager Michael Burry sees this valuation drop as a potential opportunity, predicting attractive acquisition targets in this sector in 2026 if prices stay this cheap.

Read also: US Economy 2025: High GDP Growth, but Cracks are Showing

Reference:

- Bloomberg, These Stocks Are the Market’s Biggest Winners and Losers in 2025. Diakses pada 2 Januari 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.