Jakarta, Gotrade News - The rivalry between Alphabet Inc. and Amazon.com, Inc. in the cloud computing sector is getting hotter as we approach 2026.

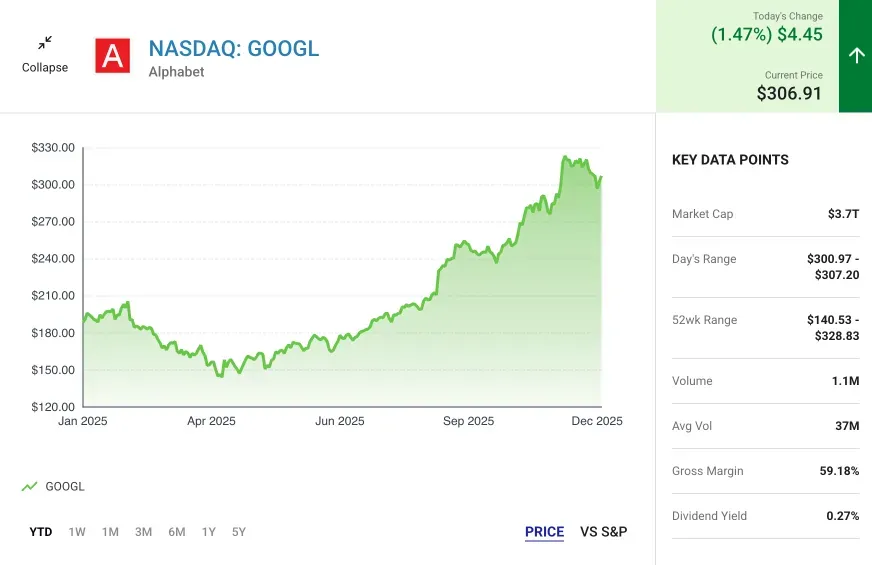

According to analysis from The Motley Fool, Alphabet's stock was the clear MVP in 2025, skyrocketing nearly 60 percent.

However, the market dynamics are predicted to flip next year as both tech giants adjust their strategies.

Key Takeaways

- Alphabet successfully flipped the script in 2025, thanks to the hype around its Gemini AI model and TPU chips.

- Amazon is predicted to take the lead in 2026, driven by accelerating AWS revenue and an attractive valuation.

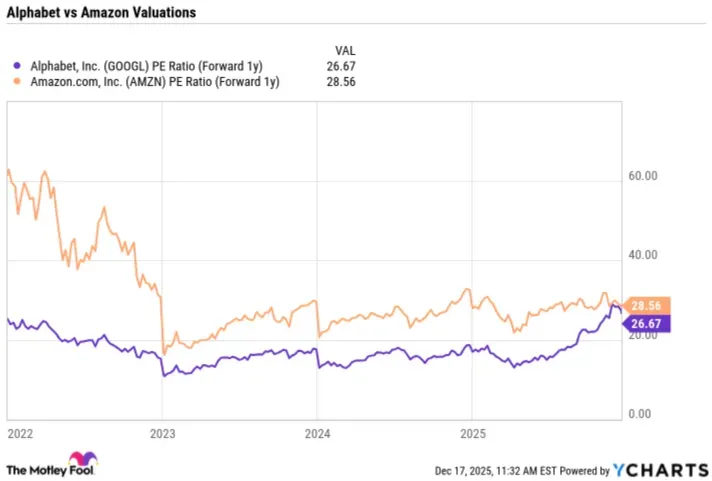

- Both companies boast P/E ratios under 30x, making them solid investment options.

Alphabet's success this year was largely fueled by a shift in investor sentiment, viewing it as a top-tier winner in Artificial Intelligence (AI).

The Motley Fool notes that the Gemini language model and AI integration into its search engine have been the main catalysts for the company's revenue growth.

Alphabet's structural advantage is getting stronger with the development of its seventh-generation Tensor Processing Units (TPU) for internal workloads.

Reports from The Motley Fool mention that Anthropic has even committed to buying these chips—a deal worth $21 billion next year.

Amazon's Potential Comeback

On the flip side, Amazon's stock performance lagged a bit due to AWS growth trailing behind competitors like Microsoft Azure.

That said, AWS revenue has started to pick up the pace, hitting 20 percent growth in the last quarter as capital expenditure budgets increased.

Amazon is now strengthening its position with a new data center for Anthropic powered by their custom Trainium chips. Plus, the company's e-commerce business is showing high efficiency thanks to robotics investments and a surge in high-margin ad revenue.

Valuation and Future Outlook

Analysts predict Amazon's stock has a solid chance to outperform the market in 2026 since its valuation is still lower than other retail giants.

As concluded by The Motley Fool, the acceleration of AWS revenue and the traction of Trainium chips could be a total game-changer for market perception.

Reference:

- The Motley Fool, Alphabet vs. Amazon: Which Stock Will Outperform in 2026?. Accessed on December 22, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.